Rystad Energy: Haynesville shale set to surpass 2011 gas output record

Natural gas production in Louisiana will soon reach record heights thanks to an outstanding resurgence of the Haynesville shale play.

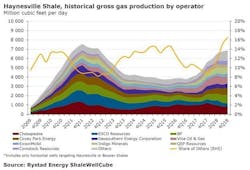

Rystad Energy research shows that the Haynesville shale alone was able to add 1.85 bcfd of gross gas production between fourth-quarter 2016 and fourth-quarter 2017. Another 1.3 bcfd was added last year. Production needs to increase by another 700 MMbcfd to reach new all-time highs.

“We conclude that Haynesville shale’s revival, for the second year in a row, looks sustainable. Supported by its proximity to a new LNG export terminal, gas production will continue to grow, and achieving new all-time high gas production levels should happen within a matter of months,” said Artem Abramov, Rystad Energy partner.

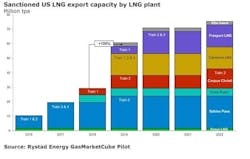

Driven by Louisiana’s Sabine Pass LNG terminal on the Gulf Coast, US LNG exports increased markedly in 2018. Rystad Energy forecasts US LNG production to surpass 40 million tonnes/year in 2019 as liquefaction capacity is set to double, including additions at Freeport, Cameron, Sabine Pass, Corpus Christi, and Elba Island. While currently sanctioned LNG plants will produce about 65 million tpy by 2022, Rystad Energy forecasts production to reach 150 million tpy by 2030.

“The demand for US LNG is driven by the Asian market, where China, India, and emerging markets will account for the largest portion of the growth. Rystad Energy forecasts global LNG demand to reach 560 million tpy by 2030, with Asia accounting for more than 75% of total volumes,” said Sindre Knutsson, Rystad Energy senior analyst.

Prior to the collapse in US gas prices in second-half 2008, the Haynesville shale was one of the world’s most prospective shale gas reservoirs, with the capability to drive growth in US gas production for years. But low gas prices from 2009 to 2011 effectively derailed Haynesville’s growth prospects. After peaking in fourth-quarter 2011, gas production in Louisiana entered a multiyear decline phase, losing nearly 4 bcfd by fourth-quarter 2016.

“Haynesville shale is truly a different play today than it was in the first growth phase,” Abramov said. “Well productivity doubled from 2012 to 2018 measured in initial production rates and current estimated ultimate recovery (EUR). Even when productivity is normalized per perforated lateral foot, we observe 20-40% improvement over the last 6 years.”

Robust well productivity and low development costs for modern completions serviced by the “Big Three” frac services companies—Schlumberger, Halliburton, and BJ Services—are central to the Haynesville renaissance.

“In 2015, Halliburton was able to increase its market share to 40% from 10%. Schlumberger reached a 28% market share in 2018. Combined, Halliburton, Schlumberger, and BJ Services now account for 90% of the Haynesville market,” Abramov said.