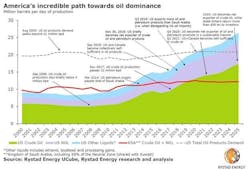

Rystad Energy: US to export more oil, liquids than Saudis by yearend

The US will soon export more oil and liquids than Saudi Arabia, driven by the continued rise in oil production from US shale plays and the increased oil export capacity from the Gulf Coast, according to Rystad Energy.

The US Energy Information Administration reported last week that US exported more crude and petroleum products than it imported.

Granted, US crude oil stocks had risen by 7.1 million bbl in a week, driven by a renewed appetite among US refineries for imported heavy crude oil. However, for the rest of the year, US exports will rise fast with increasingly attractive price spreads, while US demand for imported heavy oil should again diminish, Rystad Energy said.

“The oil market is overly preoccupied with short-term US crude stocks, but the big picture tells a new story. Increasingly profitable shale production and a robust global appetite for light oil and gasoline is poised to bring US to a position of oil dominance in the next few years,” said Rystad Energy senior partner Per Magnus Nysveen.

“The political and economic impact of this shift in global trade has already been dramatic and will be even more pivotal within the next 5 years. The US trade deficit will evaporate, and its foreign debt will be paid quickly thanks to the swift rise of American oil and gas net exports. The tanker shipping industry will see the boom of the millennium, as the excess fossil fuels from America will find plenty of eager buyers in fast-growing Asia.”

Several important milestones are being reached these days. Since September 2018, Canada has been piping enough crude oil across the border to balance the US trade deficit in oil and petroleum products. US crude exports stood at 3.6 million b/d one week ago, which neatly offsets the 3.5 million b/d of seaborne crude oil imports. At the same time, new pipelines are now bringing more oil to Texas and Louisiana’s expanding export hubs.

“This means the US is destined soon to outpace Saudi Arabia when it comes to gross exports of oil and petroleum products,” Nysveen said.

The kingdom currently exports some 7 million b/d of crude oil plus about 2 million b/d of NGLs and petroleum products compared with the US now exporting about 3 million b/d of crude oil and 5 million b/d of NGLs and petroleum products.

Rystad Energy forecasts that US oil production, which increased by about 2 million b/d last year, will rise by close to another 1 million b/d in 2019, even though independent operators are cutting capital spending.

“This year’s lowered pace of oil field activity provides support for global oil balances and crude oil prices. And regardless of the reduced investments being made in the first quarter, we will still see significant production growth in the US towards yearend,” Nysveen said.

Equally important for oil markets is the incredibly quick expansion of infrastructure across Texas to transport and export Permian crude, as well as the expansion of refineries’ distillation capacity for light crudes.