Is OPEC tempting fate-1986 redux-with strong defense of oil prices?

Is OPEC tempting fate by doggedly hewing to its defense of a price target? Could the result be a repeat of the Asian oil demand collapse that undermined oil markets in 1998?

As the Centre for Global Energy Studies notes, global oil demand is beginning to show signs of collapsing as it did 3 years ago.

Given the combined pressures of weakening economy worldwide, a stronger US dollar, and continued high oil prices, the London think tank sees gloom gathering over oil markets and worries about Asia 1998 redux.

The most worrisome sign is the scramble by analysts and agencies to ratchet down their forecasts of demand for the year. The International Energy Agency, citing persistently low industrial output and faltering consumer demand, estimates that global oil demand growth will be limited to less than 500,000 b/d this year, reaching an average total of 76 million b/d for the year. The Paris-based agency trimmed its forecast for oil demand growth in 2001 again this month, paring another 51,000 b/d off its projection to a level of 460,000 b/d; it was the seventh consecutive downward revision to the IEA forecast since it initially projected demand growth of 1.9 million b/d for 2001 last summer.

IEA expects a turnaround in the US economy towards the end of the year to spur a rebound in oil demand growth next year of 780,000 b/d, or a paltry 1%. It also noted that this figure could be higher if oil prices slacken.

That's a might big "if," considering OPEC's recent behavior, as CGES notes:

"In spite of the heavy slide in oil demand growth, OPEC appears determined to defend its price target, and the US government is happy for it do so, because it wants to stimulate domestic oil production."

That last point is arguable, because the Bush administration also worries about the possiblity of a full-blown US economic recession-a situation that doomed the reelection chances of the president's father in 1992.

Still, as CGES points out, OPEC now is more willing to act quickly to prevent oil prices from falling than it is to stop them from rising. That point was certainly driven home this week, when the group managed to work up another 1 million b/d cut without even a meeting-the quota cuts were agreed upon largely by telephone and fax. And the group hinted at the possibility of still another cut in the weeks to come, perhaps even ahead of its next regularly scheduled ministerial meeting in Vienna on Sept. 26.

Defending prices

It's easy to understand why OPEC is so determined to keep the price of its basket of crudes at $25/bbl or above.

CGES notes that changes in the OPEC nations' gross revenues from oil production closely track changes in oil prices. When prices fall, revenues decline proportionately. The same is true on the upside. When OPEC's gross revenues fell 21% in the first quarter of this year from fourth quarter 2000, this percentage drop was greater than that for the decline in the basket price because OPEC's output also fell, by 3%, in the first quarter vs. fourth quarter 2001. On the other hand, the rate of revenue growth outstripped the size of the rise in prices in the second and third quarters of last year because OPEC was able to boost production.

"Having experienced a sharp drop in revenues in first quarter 2001, OPEC will try to make sure that this will not be repeated," CGES said.

Demand slump

The decline in oil prices this quarter has stemmed in part from a jump in US product stocks of 800,000 b/d in the second quarter-as refiners were spurred on by the margins high gasoline prices and lower crude prices were delivering as well as by the fear of another series of regional supply shortfalls in the US.

The other key contributing factor was a slowdown in Asian crude buying.

"The crucial question is when, or if, Asian refiners will start buying again," CGES said. "The answer could make the difference between 600,000 b/d of incremental oil demand in 2001 and no growth at all."

CGES says it has not yet written off Asia as a market factor, contending that oil buying from that region will pick up again. If that incremental demand does, in fact, materialize, then oil prices should stay within OPEC's $22-28/bbl price band target even without the Sept. 1 cut. But the cut apparently was needed to sustain that OPEC marker basket at $25/bbl, and the price rally this week in response to the OPEC announcement approached that target.

CGES wonders if OPEC's price concerns might not be somewhat misplaced. It contends that the market will remain vulnerable to winter price spikes because industry stocks worldwide remain relatively low-albeit higher than last year's levels-and stock cover will fall as winter approaches.

"Furthermore, speculators' huge net short positions will be quickly reversed as soon as the market shows any sign of recovery, exaggerating any rebound in prices," CGES said.

OPEC activism

So how long will OPEC keep up its activist market role?

Energy Security Analysis Inc.'s Sarah Emerson contends that OPEC will continue to take an active role in oil markets for the next 2 years as its struggles to keep oil prices within its targeted band.

"The lower end of the $22-28/bbl band for the OPEC basket may end up a price floor that OPEC will have to work hard to defend.," she says.

The difficulty OPEC faces is mainly in the growth of supply from non-OPEC countries.

Emerson notes that crude oil production in the former Soviet Union over the next 5 years-and especially within the next 2 years-will grow by 200,000 b/d/year, or about half of all non-OPEC growth.

At the same time, oil prices will continue to be extremely volatile, given OPEC activism, uncertainty over Iraqi supplies, continuing segmentation of downstream markets, and the strengthening ties between physical and financial markets.

"So, from time to time, crude oil prices will be very strong," Emerson said. "Even so, gains in OPEC's productive capacity and continued growth in non-OPEC production will mean that there's plenty of oil."

Accordingly, she sees global supply and demand balancing at a price closer to $20/bbl (WTI) than to $30/bbl.

But with non-OPEC output continuing to grow, that means OPEC-mainly Saudi Arabia-will find itself increasingly acting as swing supplier for the market.

"OPEC should not draw comfort from the fact that the world does not seem to need more of its oil," CGES said. "Its pursuit of higher prices to boost revenues may work very well in the short term, but in the longer term, the organization will pay the price of lower oil demand growth and higher non-OPEC output.

"OPEC may find it needs ever-higher oil prices to maintain revenues, as it is forced to repeatedly cut output in the face of a shrinking market for its oil."

Remember the last time OPEC-mainly Saudi Arabia-saw its market share dwindle to an unacceptable level even as oil prices stayed high? It happened at the end of 1985. And we all know what happened after that.

OGJ Hotline Market Pulse

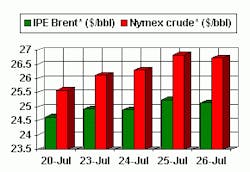

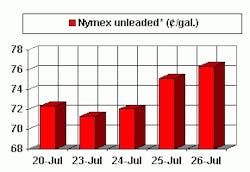

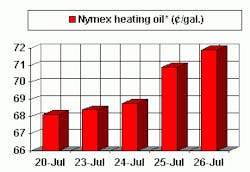

Latest Prices as of July 27, 2001

null

null

Nymex unleaded

null

Nymex heating oil

null

IPE Gas oil

null

Nymex natural gas

null

NOTE: Because of holidays, lack of data availability, or rescheduling of chart publication, prices shown may not always reflect the immediate preceding 5 days.

*Futures price, next month delivery. #Spot price.