Operators favor completions, production over drilling

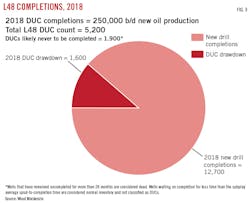

The US Lower 48 (L48) average rig count is expected to grow only moderately in 2018 while operators focus primarily on completions and production management rather than drilling. Companies plan to partially draw down the drilled but uncompleted (DUC) well inventory, Wood Mackenzie Ltd. forecast in a short-term supply outlook.

US L48 crude oil production is set to grow by 1.2 million b/d during 2018, but 2019 is poised for lower oil prices and slowing rig activity with production growth forecast to average 860,000 b/d. WoodMac forecasts 2019 average production of 9.23 million b/d.

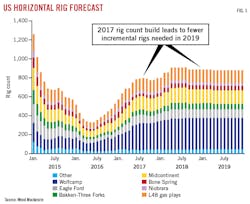

Rig count growth accelerated during 2017, but WoodMac analysts expect slower average growth in 2018-19. After adding 150 horizontal rigs in 2017, US operators report less need for additional rigs because existing ones continue completing wells.

WoodMac forecasts 50 new horizontal rigs will be added in 2018. Analysts say the rig count could be higher if 2018 light, sweet crude oil prices average above $60/bbl on the New York Mercantile Exchange (NYMEX).

Separately, Barclays forecast the US rig count will increase steadily throughout 2018 to average 925 rigs compared with a 2017 average of 850 rigs (OGJ, Mar. 5, 2018, p. 20).

The rig count typically rises with higher oil prices. As of early April, WoodMac forecast the US benchmark will average $64.55/bbl in 2018 and $55.86/bbl in 2019.

NYMEX crude rose above $65/bbl in late March, which analysts attributed to Middle East tensions and optimism that major producing nations will extend an existing production-cut agreement into 2019.

The Organization of the Petroleum Exporting Countries (OPEC) and 10 non-OPEC producers, including Russia, have been holding back crude output by around 1.8 million b/d, or nearly 2% of global supply, since Jan. 1, 2017. The agreement is set to expire on Dec. 31, 2018.

Brent crude oil is expected to average $63/bbl for 2018 and US light, sweet crude about $59/bbl, said a Wall Street Journal (WSJ) poll of 15 investment banks in late March. Both estimates were $1 higher than the poll’s February forecast. Banks surveyed expect Brent will fall to around $61/bbl in 2019 and average about $62/bbl in 2020.

US rig count

Baker Hughes reported 995 working rigs for the week ended Mar. 23, noting the total US rig count had increased seven times in 9 weeks. The rig count for the same week last year was 809.

The US rig count has risen rapidly across unconventional plays since hitting a record low of 404 working units in May 2016.

Rigs directed towards oil totaled 804 for the week ended Mar 23, still well below the 1,609-rig peak of October 2014. The oil rig count rose eight times in 9 weeks for the period ended Mar. 23.

Baker Hughes said the natural gas rig count was 190 for the week ended Mar. 23, having increased six times in 9 weeks. The number of rigs drilling for gas was above the year-ago tally of 155. Gas-directed rigs remain well below the all-time high of 1,606 from late summer 2008.

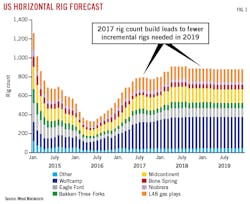

Barclays and WoodMac analysts both believe the Permian basin will receive most of the additional rigs in 2018. The basin is distinguished by low breakevens, scale, and flexibility.

WoodMac expects the Permian will account for over 80% of new L48 crude oil production year-on-year by Dec. 31. Wolfcamp production alone is forecast to average 1.7 million b/d in 2018 and 2.3 million b/d in 2019. The table shows Permian production for horizontal wells is anticipated to nearly double by yearend 2019 from yearend 2018.

Of L48 regions, only the Midcontinent will compete with the Wolfcamp in terms of year-on-year percent growth. Average Midcontinent production grew by over 75% in 2017-18 but operators plan to add fewer new rigs during 2018-19, WoodMac said.

Completions, service costs

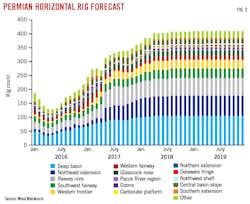

WoodMac expects total L48 horizontal well completions will grow by about 30% in 2018 from 2017. Operators likely will take advantage of higher oil prices by completing more wells to boost revenues.

Fig. 3 shows operators are expected to reduce DUC inventory while also completing newly drilled wells. Operators will continue to drill and maintain some DUC inventory, which WoodMac defines differently from the US Energy Information Administration and others.

WoodMac defines DUCs as wells sitting uncompleted longer than the average lag time between well spud and well completions within a play. Lag time varies by drilling area.

Anadarko Petroleum Corp. expects service costs for its Permian basin operations will increase 10-15% during 2018, while EOG Resources expects its Permian service costs will decrease.

“We’re going to see some natural creep in service costs that will just have to work its way into the system,” Anadarko Petroleum Chief Executive Officer Al Walker told the Scotia Howard Weil conference during late March in New Orleans.

“If oil prices rise higher, that will increase the pressure on [service] prices,” Walker said.

EOG Resources Chief Executive Officer Bill Thomas said he expects Permian service costs will drop 9% this year and EOG’s Eagle Ford service costs will drop 4%.

“We’re really locked in and seeing prices move down,” Thomas told the Scotia Howard Weil conference participants. Houston-based EOG procures its own sand, water, and chemicals for fracturing, helping defray costs. Most producers hire service contractors to provide the materials.

“We don’t need a lot from the service industry except people and equipment to pump,” Thomas said, adding that EOG as of Mar. 27 had contracted for 60% of its anticipated 2018 services.

Deutsche Bank analysts expect US integrated oil companies will experience above-average cash flow growth and improved returns, which they attributed to US shale production growth.

“We estimate that Chevron Corp.’s Permian position can offset declines elsewhere in its portfolio for nearly 60 years,” Deutsche Bank said, adding it believes the Permian assets held by ConocoPhillips Co. and ExxonMobil Corp. can offset declines elsewhere for 15-20 years.

“Through 2020, we see 40-50% growth volumes at Chevron and Exxon driven by growth in their respective liquids-weighted resources,” particularly from the Permian and the Bakken formation, Deutsche Bank said.

WoodMac analysts said increased service expenses plus limited availability of hydraulic fracturing crews could slow Permian completions this year.

Meanwhile, Deutsche Bank said, “An aggressive growth campaign in the Permian is expected to result in increased demand for services and equipment over the medium-term.”

US offshore sluggish

A late-March auction of US Gulf of Mexico (GOM) oil and gas leases attracted limited offers from potential buyers.

The US Interior Department’s Bureau of Ocean Energy Management offered 14,431 tracts across leases totaling 77 million acres. Just 148 of those tracts, covering about 815,000 acres, received bids. The sale yielded winning bids worth $124 million.

Interior Sec. Ryan Zinke had promoted the sale as “a bellwether” of industry demand during comments he made at the CERAWeek by IHS Markit conference in Houston before the lease sale. US President Donald Trump wants to encourage offshore exploration.

“All the extra areas they offered didn’t really translate to a lot of bidding,” said Imran Khan, WoodMac senior manager in Houston. “We’re not saying it was completely dead. Companies were out there picking up bargains, but it’s just not at the old levels.”

Rene Santos, S&P Global Platts senior director for exploration and production and analysis, said oil prices are higher than a year ago but “still a bit low to attract significant activity” in the GOM due to competition from shale.

“Therefore, several operators will likely play it safe and continue to stick to shale development in the near and mid-term…particularly given the fact that potential new Gulf of Mexico projects might not start up for a decade or more in a world that could be seeing much weaker demand growth than today,” Santos said.

About the Author

Paula Dittrick

Senior Staff Writer

Paula Dittrick has covered oil and gas from Houston for more than 20 years. Starting in May 2007, she developed a health, safety, and environment beat for Oil & Gas Journal. Dittrick is familiar with the industry’s financial aspects. She also monitors issues associated with carbon sequestration and renewable energy.

Dittrick joined OGJ in February 2001. Previously, she worked for Dow Jones and United Press International. She began writing about oil and gas as UPI’s West Texas bureau chief during the 1980s. She earned a Bachelor’s of Science degree in journalism from the University of Nebraska in 1974.