Canadian firms' earnings bolstered by strong production, prices

With increased production volumes and strong commodity prices, many oil and gas firms based in Canada reported improved third quarter earnings compared with the same period a year earlier.

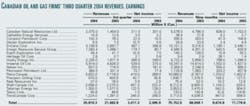

Collectively, the 19 Canadian producers, transporters, and service and supply companies that OGJ sampled earned 37% more during the third quarter on 21% stronger revenues as compared with the same 2003 period.

All results are reported in Canadian dollars, and all companies discussed here are based in Calgary unless otherwise noted.

Husky Energy Inc. reported earnings of $286 million in the third quarter, compared with $249 million in the same quarter of 2003. Husky's crude oil hedge program impaired net earnings in the recent third quarter by $115 million, compared with a $3 million impairment in the third quarter of 2003. Earnings included a net gain on US dollar-denominated debt translation of $55 million, compared with $3 million in the third quarter of last year.

Husky's crude oil and natural gas liquids production for the third quarter increased 3% from a year earlier, while natural gas production increased 20%.

Talisman Energy Inc. reported $122 million in earnings for the quarter ended Sept. 30, down from $128 million a year earlier. Production volumes increased 13% from a year earlier but were down 2% from the second quarter because of planned plant turnarounds for maintenance in western Canada and the North Sea. Talisman's cash flow during the third quarter was $706 million vs. $640 million a year earlier on both higher prices and volumes.

High commodity prices and solid margins drove Nexen Inc.'s third-quarter cash flow and earnings. Higher exploration expense and slightly lower production in Yemen and Canada partially offset those factors.

With slower than expected production growth in the US, compounded by a production shut-in caused by Hurricane Ivan and the maturing of Nexen's Masila oil fields in Yemen, the company revised its 2004 production guidance downward and now expects output to average 243,000-249,000 boe/d. Nexen also reported that its operating costs have increased 27% from 2003. "Assuming oil averages $40/bbl and natural gas averages $5.50/MMbtu for the fourth quarter, we now expect to generate close to $2 billion in cash flow for the year," said Charlie Fischer, Nexen's president and CEO. "We are currently evaluating our options for effectively deploying the surplus cash flow we have generated this year, including further reduction in net debt and value-accretive additions to our production profile," he added.

Imperial Oil Ltd., Toronto, announced net income for the third quarter of a record $539 million, compared with $375 million for the third quarter of 2003. The company attributes the improved results to higher realizations from oil production and stronger margins in its petroleum refining and petrochemicals operations, partly offset by lower margins in petroleum products marketing.

A strengthened Canadian dollar hurt Imperial's earnings by about $55 million in the recent third quarter relative to the third quarter of 2003. Over the first 3 quarters of this year, the negative earnings impact of the higher Canadian dollar as compared with last year was about $200 million.

Also in the first three quarters of 2004, Imperial repurchased more than 9 million of its shares for $580 million. On Sept. 30, the company's cash balance was $933 million, compared with $448 million at the end of 2003.