Industry, government work to reduce UKCS drilling costs

UK Continental Shelf (UKCS) costs have doubled since 2004, contributing to record-low drilling activity while operators and government collaborate to find ways to keep the basin competitive despite an ongoing oil-price slump.

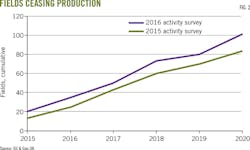

These efforts have targeted a 50% cut in core drilling costs. Factors contributing to escalating expenses include rising rig costs, dropping operational efficiency, tightening industry standards, and growing technical complexity involved in accessing smaller reserves.

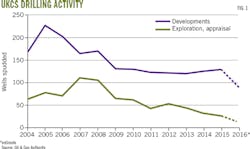

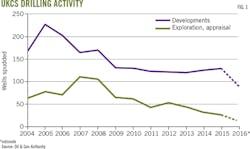

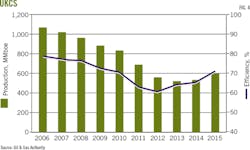

UKCS statistics showed 19 development wells drilled during first-quarter 2016, the lowest level in decades. Exploration drilling ebbed to its lowest level since the 1970s (Fig. 1). The number of fields ceasing production continues to climb (Fig. 2).

UK petroleum law since 1998 has required the maximization of economic recovery from oil and gas. A formal strategy called Maximizing Economic Recovery (MER UK) calls for government and industry to jointly find ways to improve efficiency and reduce UKCS operational costs.

MER UK covers exploration, asset stewardship including production efficiency and improved oil recovery, regional development, infrastructure, technology including enhanced oil recovery, and decommissioning.

Updated energy law, effective in 2016, transferred various petroleum-related functions from the UK Secretary of State to the UK Oil & Gas Authority (OGA), which has wide-ranging responsibilities and authorizations.

The Technology Leadership Board (TLB), one of several MER UK Forum Boards representing industry, the OGA, and government, works to help restore competitiveness to the North Sea basin. TLB has five priorities: small pools, well-cost reduction, asset integrity, digital technologies and data, and decommissioning.

Katy Heidenreich, Oil & Gas UK operations optimization manager, is part of the TLB's well-cost reduction work group. She reports "significant progress" among operators and service providers in optimizing well designs, raising technology awareness, and deploying operational improvements.

The TLB work group estimates a 50% reduction in core-drilling costs could unlock more than 5 billion boe of reserves during the next decade. Technology yet to be developed could unlock another 11.5-22 billion boe of potential resources after 2022.

"There is the potential for delivering estimated well-construction capital expenditure savings equivalent to more than 40 wells per year by 2020," said Heidenreich.

Industry must sustainably implement cost-reduction practices and efficiency gains to "futureproof'' the basin's competitiveness with other basins, said Heidenreich.

She sees savings coming from industry's ongoing efforts at improving collaboration, technology, and drilling efficiency (Fig. 3).

Operators and contractors have direct influence over certain well-construction costs, she told a Society of Petroleum Engineers Aberdeen chapter dinner meeting in September 2016, listing options that include:

• Using rigs for shorter durations.

• Standardizing and simplifying rig designs.

• Reducing operational uncertainty.

• Accelerating adoption of new technology.

Oil & Gas UK scheduled various workshops in which operators and contractors discussed ways to collaborate on improving operational efficiencies and implementing new and emerging technologies.

Efficiency task force

Oil & Gas UK members publicly share best-operating practices and its Efficiency Task Force (ETF) encourages cooperation between companies. The association's web site features a Rapid Efficiency Exchange on which companies report both individual and collective efficiency-related achievements.

BP PLC reduced drilling time by 24 days per 10,000 ft drilled during the appraisal of a possible third phase of development on Clair field, west of Shetland, compared with similar drilling programs. Rig time dropped to 39 days from 53 days.

The major attributed its increased efficiency to new technologies, lessons learned from previous drilling exercises, and focused performance management.

Technology alone saved an average 4 days of drilling per well, according to BP. The company also completed a dual-zone well test with a single run instead of two runs, saving at least 14 days.

BP's overall approach to well operations in the appraisal of Clair reduced drilling time enough that an additional sixth well was drilled within the original 5-well schedule.

Nexen Petroleum UK Ltd. saved about £30,000 ($37,535)/well intervention by using a different type of valve than the one routinely used.

Crews had used a shear-seal valve, the size of which required workers to remove a major deck hatch. The logistics involved cost Nexen time and money. It switched to a slimbore shear-seal ball valve that was taller and slimmer than the shear-seal valve.

The alternate valve fit through a much smaller opening, requiring fewer workers to remove a smaller deck plate. They now can lift and place the valve using a wireline mast-tugger, cutting costs by eliminating the need for a platform deck crew and crane driver during placement.

Total SA reported it reduced the time needed to complete planned tasks related to UKCS production operations by 12% over 3 months. A company initiative encouraged workflow changes to improve safety, increase production efficiency, and control costs.

Offshore teams used visualization techniques to accelerate certain operations and maintenance activities. Total reported improved efficiency in numerous tasks, including site checks and meeting work-permit requirements.

Production efficiency

OGA said industry was unlikely to reach its 2016 production efficiency (PE) target of 80%, defining PE as actual production as the percentage of structural maximum production potential. OGA's comment came in November 2016 as it released its 2015 survey of operator-provided PE data (Fig. 4).

UKCS operators reported an average 71% PE, up by 6% from 2014 and marking steady progress from 2012, which marked a PE low of 60%.

"Further focus on efficiency, continuous improvement, and collaboration across the industry is required if the UKCS is to come close to achieving the shared industry and OGA target," OGA said.

Every 1% increase in PE equates to an additional 8.43 million boe of production based on 2015 production volumes, according to OGA.

"Evidence shows a reversal in the declining production potential trend coupled with a sustained decrease in production loss volumes in the UKCS," OGA said. "This has yielded an increase in realized production in 2015, the highest since 2011 and a clear indicator of improved performance."

OGA emphasized the need for maximizing returns on North Sea production efforts.

Survey respondents said 28 of 91 production hubs surpassed the 80% PE target during 2015. Most high performers were in the northern and central North Sea.

Ten of 24 individual oil companies surveyed said they passed the 80% PE target. PE reports varied from a high of 90.9% to a low of 50.3%.

"Increased levels of production in the North Sea are unlikely to be sustained in the medium-to-long term," OGA said. "Against this background of declining production, it is more important than ever to maximize returns."

North Sea decommissioning

Oil & Gas UK issued a report in November 2016 that forecast a gradual rise in oil and gas decommissioning offshore UK and Norway to 2025. The report, based on the Decommissioning Insight 2016 survey, forecast £17.6 billion would be spent on UKCS decommissioning during 2016-25, up from a forecast of £16.9 billion for 2015-24.

Mike Tholen, OIl & Gas UK upstream policy director, notes that decommissioning isn't occurring at the pace that the overall oil market might suggest: "With low oil prices continuing, you might expect decommissioning to be a key focus…, however, we are not witnessing a rush to decommission." Some companies, according to Tholen, deferred stopping production because field life was extended through sustained efficiency improvements while other companies expedited decommissioning to take advantage of lower service costs in the oil-price downturn.

More than 100 platforms are forecast for complete or partial removal from the UK and Norwegian continental shelves by 2025 and some 1,800 wells scheduled to be plugged and abandoned. The central North Sea will account for more than half of the £17.6 billion in anticipated decommissioning expenditures on the UKCS in 10 years, Tholen said.

Decommissioning costs have fallen since the 2015 survey, particularly for well plugging and abandonment.

Industry also is using the oil-price downturn as a time for focusing on cost reductions and efficiency improvements. Companies are working to identify future investment opportunities. "There could still be up to 20 billion bbl of oil and gas to recover from the UKCS," Tholen said.

Oil & Gas UK expected that a more positive production outlook could reduce the average UKCS operating cost to £15/boe by Dec. 31, 2016, from an estimated £17.80/boe in 2014. The 15% reduction during 2014-16 could almost reverse the last 3 years of increased operating costs, the trade association said.

About the Author

Paula Dittrick

Senior Staff Writer

Paula Dittrick has covered oil and gas from Houston for more than 20 years. Starting in May 2007, she developed a health, safety, and environment beat for Oil & Gas Journal. Dittrick is familiar with the industry’s financial aspects. She also monitors issues associated with carbon sequestration and renewable energy.

Dittrick joined OGJ in February 2001. Previously, she worked for Dow Jones and United Press International. She began writing about oil and gas as UPI’s West Texas bureau chief during the 1980s. She earned a Bachelor’s of Science degree in journalism from the University of Nebraska in 1974.