OGJ Newsletter

GENERAL INTEREST — Quick Takes

Noble to buy Clayton Williams in $2.7-billion deal

The boards of Noble Energy Inc., Houston, and Clayton Williams Energy Inc., Midland, Tex., have unanimously approved a definitive agreement under which Noble Energy will pay $2.7 billion in cash and stock to acquire Clayton Williams.

The combined company, said Noble Energy Chairman, Pres., and Chief Executive Officer David L. Stover, will create the industry's second-largest Southern Delaware basin acreage position and provide more than 4,200 drilling locations on 120,000 net acres, with more than 2 billion boe in net unrisked resource.

"This transaction brings all the key elements we value: excellent rock quality, a large contiguous acreage position adjacent to our own, and robust midstream opportunities, reinforcing the Delaware basin as a long-term value and growth driver for Noble Energy," Stover said.

Other deal highlights include:

• 71,000 highly contiguous net acres in the core of the Southern Delaware basin in Reeves and Ward counties in Texas, directly adjacent to Noble Energy's existing 47,200 net acres. In addition, there are an additional 100,000 net acres in other areas of the Permian basin.

• 80% average working interest in the Southern Delaware position, with more than 95% of the acreage operated.

• 2,400 Delaware basin gross drilling locations identified, targeting the Upper and Lower Wolfcamp A zones, along with the Wolfcamp B and C. The average lateral length of the future locations is 8,000 ft.

• Total estimated net unrisked resource potential on the acreage of over 1 billion boe in the Wolfcamp zones, with significant upside potential in other zones.

• Existing midstream Delaware basin assets include more than 300 miles of oil, natural gas, and produced water gathering pipelines (more than 100 miles for each product).

Closing is expected in this year's second quarter and is subject to customary regulatory approvals, approval by the holders of a majority of Clayton Williams common stock, and certain other conditions.

NZOG takes control of Cue Energy Resources

New Zealand Oil & Gas Ltd. (NZOG) has now taken full control of Cue Energy Resources Ltd. after having launched a hostile takeover the Melbourne-based Cue nearly 2 years ago (OGJ Online, Mar. 27, 2015).

NZOG has now lifted its stake to a majority 50.01% interest from the 48.1% it obtained at the end of its 2015 takeover attempt.

NZOG originally made the bid for Cue at 10¢ (Aus.)/share after buying 19.99% of the company in 2014 from Todd Energy and picking up further shares from Zeta Resources Ltd. The offer closed in March 2015.

NZOG said at the time that it would carry out a strategic review of Cue, including whether it should remain a listed company.

This week NZOG announced it had acquired 13,514,462 shares in Cue in the current financial year to move to the controlling 50.01% shareholding. Total cost of the acquisition was $1.124 million (Aus.).

Cue has production from an interest in the Maari field off Taranaki in New Zealand as well as from the Sampang PSC in East Java, Indonesia. Its exploration portfolio includes the significant Ironbark prospect in the offshore Carnarvon basin, Western Australia, and some leads in Indonesia.

Norman becomes UK energy minister

Jesse Norman has been named UK parliamentary undersecretary of state, minister for industry and energy, a position that includes regulation of oil and natural gas.

The Tory member of Parliament represents Hereford and South Herefordshire.

He replaces Baroness Neville-Rolfe, who became commercial secretary to the Treasury last month.

Exploration & Development — Quick Takes

ConocoPhillips Alaska makes oil discovery in NPR-A

ConocoPhillips Alaska Inc. reported making an oil discovery in the Greater Mooses Tooth (GMT) Unit in the northeast section of the National Petroleum Reserve-Alaska (NPR-A). The Willow discovery wells, Tinmiaq 2 and 6, were drilled in early 2016 and encountered 72 ft and 42 ft of net pay, respectively, in the Brookian Nanushuk formation. ConocoPhillips has a 78% working interest in the discovery; Anadarko Petroleum Corp. holds the remaining interest.

The two discovery wells, about 4 miles apart, are 28 miles west of the Alpine Central Facility. The Tinmiaq 2 well was tested and established good reservoir deliverability with a sustained 12-hr test rate of 3,200 b/d of 44° gravity oil. Initial technical estimates indicate the discovery could have recoverable resource potential in excess of 300 million bbl of oil, ConocoPhillips said.

Appraisal of the discovery will start this month with the acquisition of 3D seismic. Subject to appraisal results and the choice of development scenario, Willow could produce as much as 100,000 b/d of oil. Initial commercial production could occur as early as 2023, "assuming timely permit approvals and competitive project economics," the company said.

In a follow-up to the Willow discovery, ConocoPhillips and its bidding partner, Anadarko, were successful in December's federal lease sale on the western North Slope, awarded 65 tracts for a total of 594,972 gross acres. ConocoPhillips independently was successful in December's state lease sale on the western North Slope, awarded 74 tracts for a total of 142,280 gross acres.

ExxonMobil unit finds more oil offshore Guyana

Esso Exploration & Production Guyana Ltd. (EEPGL) encountered more than 95 ft of oil-bearing sandstone in its Payara-1 well, which was drilled about 10 miles northwest of the Liza-1 discovery (OGJ Online, May 20, 2015). The well was drilled to 18,080 ft in 6,660 ft of water. This makes ExxonMobil Corp.'s second oil discovery on the Stabroek block. The well was drilled in a new reservoir that was similar in age to that of the original Liza discovery.

In addition to the Payara discovery, the operator's Liza-3 well has identified an additional, deeper reservoir directly below the Liza field, the company said. The new reservoir is estimated to contain 100-150 MMboe.

The operator spudded its Payara well on Nov. 12, 2016, with initial total depth reached on Dec. 2. According to ExxonMobil, two sidetracks have been drilled to evaluate the discovery and a well test is under way.

Liza field is on the 27,000-sq-km Stabroek block, 193 km offshore Guyana with a potential resource estimate of more than 1 billion boe. In December 2016, the operator let contracts to SBM Offshore NV for a floating production, storage, and offloading vessel for Liza field (OGJ Online, Dec. 20, 2016). The project is subject to a final investment decision this year.

EEPGL is operator and holds 45% interest in the block. Partners are Hess Guyana Exploration Ltd. with 30% interest and CNOOC Nexen Petroleum Guyana Ltd. with 25%.

Statoil's Cape Vulture well finds oil, gas near Norne

A year after Norway's Awards in Predefined Areas (APA) 2015 round, Statoil ASA has discovered 20-80 million bbl of recoverable oil with its Cape Vulture well in PL128 offshore Bronnoysund, Norway, in the Norwegian Sea (OGJ Online, Jan., 25, 2016). The well was spudded in early December 2016 in about 380 m of water, Statoil said.

The discovery lies northwest of Statoil's Norne field, and Statoil is considering developing Cape Vulture as a tie-back to the Norne's floating production, storage, and offloading vessel.

Jez Averty, Statoil senior vice-president for exploration, cited the importance of new acreage and the ability to quickly test new opportunities. "Looking at mature areas in new ways may pay off," he said.

Norne field, brought on stream in 1997, was scheduled to be closed in 2014 but Statoil announced a 2030 extension for the field in 2015 citing new discoveries and improved recovery (OGJ Online, Jan. 9, 2015). The field lies 85 km offshore Norway and has produced more than 700 million boe to date.

Statoil is the operator of licenses 128 and 128D with a 64% interest. Partners Petoro and Eni SPA hold 24.5% and 11.5% interest, respectively.

Energean chooses FPSO scheme for Karish, Tanin fields

Energean Oil & Gas SA, Athens, has followed its August 2016 commitment to develop deepwater Karish and Tanin natural gas and condensate fields offshore Israel (OGJ Online, Aug. 19, 2016). It announced a development plan using a floating production, storage, and offloading vessel.

Energean will submit a formal field development plan at midyear, which involves the drilling of 3-4 wells to develop Karish field and 2-3 development wells in Tanin field after Karish field production has come off plateau, the company said.

This follows the closing of the acquisition of the assets after Israel's Petroleum Commissioner granted approval (OGJ Online, Dec. 7, 2016). The $148-million deal, plus royalties, is implemented as part of the Israeli government's gas framework. Karish and Tanin fields-discovered in 2013 and 2011, respectively-have 2C gas resources of 2.4 tcf (OGJ Online May 23, 2013; Feb. 7, 2012).

The fields, about 40 km apart in Israel's exclusive economic zone, will supply the Israeli market. Energean intends to start gas production in 2020. Karish and Tanin development is estimated to cost $1.3-1.5 billion over the next few years, the company said.

Energean acquired 47.059% from Noble Energy Mediterranean Ltd. and 26.4705% each from Avner Oil Exploration LP and Delek Drilling LP in August 2016, bringing its interest to 100% for both fields.

drilling & Production — Quick Takes

EIA: Output rise in store for major US onshore regions

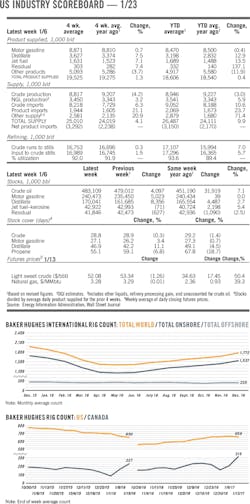

Crude oil output from the seven major US onshore producing regions is expected to rise 41,000 b/d month-over-month in February to 4.748 million b/d, according to data from the US Energy Information Administration.

As with last month's edition of the Drilling Productivity Report, the Permian is forecast to provide the upward lift, adding 53,000 b/d during the month to reach 2.18 million b/d.

The DPR tracks the total number of active drilling rigs, drilling productivity, and estimated changes in production from existing oil and natural gas wells in the Bakken, Eagle Ford, Haynesville, Marcellus, Niobrara, Permian, and Utica.

The Niobrara also is expected to record an increase, gaining 13,000 b/d month-over-month to 426,000 b/d. The Eagle Ford output decline, meanwhile, is seen shrinking to just 3,000, bringing the South Texas region's average oil production to 1.042 million b/d. The Bakken is expected to fall 20,000 b/d to 978,000 b/d.

Overall US natural gas production from the seven regions is expected to increase 330 MMcfd month-over-month in February to 47.969 bcfd. Leading the way is the Marcellus with a 188-MMcfd jump to 18.591 bcfd.

Also expected to see rises in gas output are the Permian, up 103 MMcfd to 7.609 bcfd; Haynesville, up 76 MMcfd to 6.118 bcfd; Niobrara, up 45 MMcfd to 4.477 bcfd; and Utica, up 15 MMcfd to 3.956 bcfd.

The Bakken is projected to drop 5 MMcfd to 1.746 bcfd. The Eagle Ford is seen falling 92 MMcfd to 5.472 bcfd.

Used as an indicator of future oil and gas production, EIA's drilled but uncompleted (DUC) well count for the seven regions in December grew by 167 month-over-month to 5,379. Again carrying the weight for the rest of the regions, the Permian added 137 DUC wells to bring its tally to 1,706.

According to Baker Hughes Inc. data, the Permian has doubled its rig count since May 13 (OGJ Online, Jan. 13, 2017).

Other month-over-month DUC well increases included the Niobrara by 30 to 704, Eagle Ford by 8 to 1,284, Bakken by 5 to 815, and Haynesville by 3 to 154. The Utica dropped by 6 to 99 and the Marcellus by 10 to 617.

CNOOC starts oil production at Penglai 19-9 field

China National Offshore Oil Corp. Ltd. reported startup of oil production from Penglai 19-9 field in the northern Bohai Bay. Two wells are producing 750 b/d.

CNOOC built one wellhead platform and is using existing facilities of the Penglai 19-3 field (OGJ Online, Jan. 11, 2013).

The company has plans for 57 producing wells in the "comprehensive adjustment project" with designed peak production of 13,000 b/d in 2019. Average water depth is 30 m.

Operator CNOOC has 51% and ConocoPhillips China Inc. has 49%.

CNOOC starts oil production from Enping 23-1 fields

CNOOC Ltd. reported that oil production has started from the Enping 23-1 group of oil fields, which lie in about 90 m of water in the South China Sea's Pearl River Mouth basin.

In addition to fully utilizing the existing facilities of Enping 24-2 oil field, the Enping 23-1 project overall development program (ODP) teamed up with Enping 23-2, Enping 23-7, and Enping 18-1 oil fields for regional joint development.

The main production facilities of Enping 23-1, Enping 23-2, and Enping 23-7 oil fields include one platform and 13 producing wells. There are currently three wells producing 5,600 b/d of crude oil. The project is expected to reach its ODP-designed peak production of 24,800 b/d of crude oil in 2018.

Cairn India reports 7% decline in production

Cairn India Ltd. reported a 7% decline in production in its latest quarter. The company cited a planned maintenance shutdown at its Mangala processing terminal on the Rajasthan block as well as natural declines in production from offshore assets.

Cairn's gross operated production in the third quarter of fiscal year 2017 averaged 181,818 boe/d compared with 196,399 boe/d in the second quarter.

The Rajasthan block averaged 154,272 boe/d in production in the third quarter, down from the 167,699 boe/d that was produced in the second quarter.

For Cairn's 9-month period, production also declined 7%. Declines were partially offset by volume increases from enhanced oil recovery in Mangala and reservoir management elsewhere, Cairn India said.

WoodMac: Asia oil output to fall 1 million b/d by 2020

Asian oil production is declining at a faster rate than other regions worldwide, and China accounts for about half of the anticipated decline, Wood Mackenzie Ltd. said.

"We estimate 2016 production of 7.5 million b/d will fall by over 1 million b/d by 2020," said Angus Rodger, WoodMac's Asia-Pacific upstream research director.

Rodger said the region's output has been falling by about 7%/year since the oil-price slump started in late 2014.

Meanwhile, oil demand is growing in China and India. China reported that imported crude accounted for 64% of the country's demand in 2016.

Asia's biggest oil producers are China, Indonesia, Malaysia, and Thailand. Giant, mature fields in Indonesia, Malaysia, and China will underpin regional production, but these fields require expensive techniques, Rodger said in a video posted on the WoodMac web site.

PROCESSING — Quick Takes

Takreer's Ruwais refinery nearing restart, ADNOC says

Abu Dhabi Oil Refinery Co. (Takreer), the refining arm of state-owned Abu Dhabi National Oil Co. (ADNOC), is preparing to restart about half of its more than 800,000-b/d Ruwais refining complex in the UAE following an early January fire that forced a partial shutdown of operations at the site.

The complex's original East refinery was not affected by the fire, and as a result, has continued to operate without interruption since the Jan. 11 event, the operator said.

While impact of the fire remains marginally limited to the refinery's propylene production, ADNOC said it is taking steps to ensure fulfillment of supply commitments to customers.

A comprehensive assessment and investigation into the cause of the incident is under way, according to a series of posts to the state-run operator's official Twitter account.

Malaysia's Petronas lets technology contract for RAPID

PRPC Polymers Sdn. Bhd., a subsidiary of Petroleum Nasional Bhd.'s (Petronas) majority-owned Petronas Chemicals Group Bhd., has let a contract to LyondellBasell Industries NV to deliver polyethylene process technology for a grassroots unit at Petronas's refinery and petrochemical integrated development (RAPID) project at the Pengerang integrated complex (PIC) in southeastern Johor, Malaysia (OGJ Online, Aug. 11, 2014).

LyondellBasell will provide licensing for its proprietary Hostalen Advanced Cascade Process (Hostalen ACP) technology for production of high-density polyethylene (HDPE) at a 400,000-tonne/year HDPE unit planned for the RAPID complex, LyondellBasell said.

Petronas previously let contracts to LyondellBasell for licensing of its proprietary Spherizone and Spheripol polypropylene process technologies at RAPID, the technology licensor said.

Alongside PIC's six associated installations, the integrated PIC-RAPID will feature a 300,000 b/d refinery equipped to produce Euro 5-quality fuels as well as supply naphtha and LPG feedstock to the petrochemical complex for production of various grades of products, including differentiated and specialty chemicals products (OGJ Online, Sept. 20, 2016).

The entire $27-28-billion development remains on schedule for full startup in early 2019, Petronas said (OGJ Online, June 27, 2016).

Aramco lets contract for Ras Tanura refinery

Saudi Aramco has let a turnkey contract to Tecnicas Reunidas SA, Madrid, to provide engineering, procurement, construction, and commissioning (EPCC) on two packages of a clean-fuels project at Aramco's 550,000-b/d Ras Tanura refinery in Saudi Arabia's Eastern Province, along the Persian Gulf.

As part of Package 1, Tecnicas Reunidas will deliver EPCC services for an isomerization unit, naphtha hydrotreater, and continuous catalytic reformer (including all interconnections, a flare system, and buildings), while Package 2 will cover EPCC services for all associated utilities and off sites for the project, the service provider said.

The clean-fuels plant is scheduled to reach mechanical completion in 48 months, Tecnicas Reunidas said.

A value of the contract was not disclosed.

Aramco has yet to officially confirm further details regarding this second phase of its clean-fuels project at Ras Tanura, a first phase of which the company completed in 2011.

The state-run operator previously awarded Jacobs Engineering Group Inc., Dallas, a contract to deliver front-end engineering design for Phase 2 of the refinery's clean-fuels project in August 2011, according to an Aug. 30, 2011, press release from Jacobs.

TRANSPORTATION — Quick Takes

Inpex lets subsea contract for Ichthys LNG project

Inpex Australia has let a 5-year, subsea and geoscience services contract to Dutch multinational services firm Fugro NV for operations on Inpex's Ichthys natural gas-LNG project in the Browse basin, 220 km offshore Western Australia.

The award includes field operations support, inspection, repair, and maintenance services. There are options to extend.

Inpex has now completed installation of the subsea infrastructure for gas-condensate extraction from Ichthys field with the final 49 km of umbilicals and flying leads laid late last week.

The field is scheduled to be brought on stream in September. It will then ramp up to an expected peak LNG production of 8.9 million tonnes/year alongside 1.6 million tpy of LPG and more than 100,000 b/d of condensate.

The overall facilities comprise offshore processing capacity and condensate storage near the field, an 889-km, 1,050-mm pipeline to Darwin, a 500-Mw combined-cycle power plant, and an onshore LNG plant in Darwin.

ANPR signed for crude-oil vapor pressure idea

US Sec. of Transportation Anthony Foxx has signed an advanced notice of possible rulemaking (ANPR) seeking government, industry, and public contributions on questions about establishing a vapor pressure threshold for transported crude oil.

Such a threshold could help the US Pipeline & Hazardous Materials Safety Administration, which issued the ANPR, and other transportation regulators evaluate its potential benefits within the hazardous materials classification process. Comments will be accepted for 60 days following the ANPR's publication in the Federal Register, where it was sent on Jan 11.

"The American energy landscape is constantly evolving and we need to understand the full scope of safety risks involved with moving energy products in new ways," PHMSA Administrator Marie Therese Dominguez said.

DOT said it has taken more than 30 actions in the past 2 years to improve crude-by-rail safety, including issuing a comprehensive rulemaking package in May 2015 to improve tank car durability, braking and the safe transportation of energy products, and issuing multiple safety advisories.

The department also continues collaborating with the US Department of Energy and Sandia National Laboratories on a study to better understand characteristics of crude oil from the Bakken shale in North Dakota, to determine the best sampling and testing methods for this type of crude, and to better understand how vapor pressure affects transportation safety. Long-term findings of this study will continue to inform PHMSA's rulemaking considerations, DOT said.

The American Petroleum Institute and nine other oil and gas industry and other business trade associations asked PHMSA last summer to clarify its role as a rail tank car safety regulator and the industry's role in recommending and developing new standards.