Cairn Energy aligns interests in India

Scotland’s Cairn Energy PLC has occupied a niche in the Indian oil and gas community and is beginning to reap the rewards of its successful exploration program.

Production and cash flow from the company’s Ravva field off eastern India and Sangu field off Bangladesh helped to fund subsequent exploration elsewhere in India. Cairn began drilling in western India in 2000, discovering the Lakshmi and Gauri gas fields in Gujarat, followed by drilling in Rajasthan in 2002.

Several years of wildcat drilling are now paying off for the company with extraordinary exploration successes in Rajasthan, including the billion bbl Mangala field.

Cairn recently increased its acreage position with five new blocks awarded under the New Exploration Licensing Policy (NELP) Round V and signed in September 2005 (Fig. 1). The licenses include the Saurashtra basin shallow water block off Gujarat and four onshore blocks: in the Krishna-Godavari basin; in western Rajasthan; in the Vindhyan basin of eastern Rajasthan; and in the Ganga Valley, adjacent to Nepal (OGJ, Jan. 16, 2005, p. 49).

Projects

Discovering petroleum and setting up a production infrastructure are very different propositions. M.K. Bhatta, Cairn’s chief engineer for the Lakshmi field notes that “It doesn’t matter how much gas you have-if you can’t bring it to market, it’s useless.”

Mike Watts, Cairn’s director of exploration, points out that Cairn has been able to fast-track projects in India due to alignment with the central government. In the past decade, the government has created and empowered a strong and effective Directorate General of Hydrocarbons (DGH), and there is a more efficient process for gaining approvals and clearances. This process is facilitated by an open-door policy at the DGH and the Ministry of Petroleum and Natural Gas (MOPNG).

Cairn also benefits from increased cooperation and knowledge sharing with state-run Oil and Natural Gas Co. (ONGC) and from the ability to market its gas directly.

Cairn’s Cambay basin asset manager Santosh Chandra points to the offshore basin as an example of a fast-track development. The company shot seismic in January-March 2000 and began drilling Apr. 22 with a jack up rig from ONGC. The company made the Lakshmi-1 discovery in May 2000, and the Lakshmi and Gauri gas fields became the fastest offshore development in India and the first to be ISO 14001 certified.

Gross production at Cairn’s fields in South Asia at the endn of 2005 were:

• Ravva-64,300 boe/d; India.

• Gujarat-16,750 boe/d; India.

• Sangu-24,650 boe/d; Bangladesh.

Ravva

The Ravva fields lie off Andhra Pradesh state in East India’s Krishna-Godavari (KG) basin. Cairn holds a shallow water block picked up in the small fields round in 1993; the production-sharing contract was signed in 1994, and the reserves were estimated at 300 million boe in late 2005.

There are now eight Cairn/ONGC platforms on the shallow Ravva field. In November 2005, Ravva oil production averaged 50,001 boe/d and gas production averaged 79.8 MMcfd, down 1% from 50,466 boe/d and down 12% from 90.7 MMcfd in January 2005.

Cairn also partners with ONGC in deepwater block KG-DWN-98/2. Cairn sold 90% of the deepwater acreage and operatorship to ONGC along with a 10% production interest in Gujarat in March 2005 in exchange for $135 million plus a 30% interest in Block CB-ONN-2001/1, in the onshore Cambay basin in Gujarat.

Cairn and ONGC have discovered more than 100 million boe in the deepwater KG-DWN-98/2 block to date, including a large gas discovery at the “D” well in August 2005, and say the block potentially holds 700 million boe of “unrisked” (no reservoir risk factors yet assigned) reserves. The JV plans to drill three to six more deepwater wells, beginning with a Padmavati appraisal well at the end of 2005, followed by the “U” prospect in 2006.

The 98/2 area is flanked to the north by ONGC’s 2004 discovery of about 1 tcf, Gujarat State Petroleum Corp.’s reported 20 tcf discovery (June 2005), and Reliance Industries’s 5-14 tcf discoveries (2002-03).

South Gujarat

Cairn has developed several producing properties in Cambay basin lease block CB/OS-2, off southern Gujarat, west India. There are two platforms in the Lakshmi field (A, B), connected by a 36 km, 24-in. pipeline to the onshore Suvali gas processing terminal, commissioned in December 2004 (Fig. 2). A 5-km pipeline connects the GA platform over the Gauri gas field with the Lakshmi-A platform.

The original lease was signed June 30, 1998, under a joint venture between Cairn Energy India Pty. Ltd. (45% exploration, 30% production interest); ONGC (10% exploration, 40% development interest); and Tata Petrodyne Ltd. (TPL) (45% exploration, 30% development interest). The original area was 3,315.1 sq km and exploratory drilling took place in two phases, the first in May 2000 followed by a second from October 2000 to February 2001. After transactions with TPL and ONGC, Cairn settled with 60% exploration, 40% production interest. TPL retained 15% exploration, 10% production; and ONGC retained 25% exploration, 50% production interest.

Lakshmi was discovered in May 2000, completed in October 2002, and began production in November 2002. The Gauri and Ambe fields were discovered in January 2001. Production from Gauri began in April 2004. The Ambe field may be developed in synergy with the adjacent North Tapti gas field.

The exploration phase ended June 29, 2005, and the current development area is 403.5 sq km, about 12% of the original area of the block.

In November 2005, combined gas production from the Lakshmi and Gauri gas fields was 113 MMcfd. Total production in 2004 was 7,375 boe/d, down from 10,802 boe/d in 2003. Gas is sold to BG’s Maharaja Gas Co. and the Gujarat Gas Co.

Some oil (condensate, API 60º, no sulfur) was also found at Gauri (GA-3 well) and production began in October 2005. It flows commingled through the 24-in. line to the Suvali terminal at about 1,000 bo/d. (3,000 bo/d is the maximum that the gas terminal can handle.)

Oil sands were also tagged in several of the Lakshmi wells, and the JV was studying the commerciality and economics of the Lakshmi oil at the end of 2005. The potential oil recovery at Lakshmi will be partly construed based on the depletion performance of the GA-3 well.

Cairn plans future exploration in the Cambay basin, where it holds licenses for the CB-ONN-2001/1 block and the CB-ONN-2002/1 onshore blocks. ONGC and Cairn discovered the onshore CB-X gas field on the CB-ONN-2001/1 block in February 2004 and have proposed a development plan.

The Cambay basin is a major Indian hydrocarbon province initially established by ONGC. After the drilling of more than 4,000 wells, about 100 fields have been discovered. UK analysts Wood Mackenzie estimate Cambay basin reserves at 2.1 billion bbl oil and 3.4 tcf natural gas. Overall production is about 120,000 bo/d and 240 MMcfd.

Rajasthan

Cairn’s interest in Rajasthan began in 1997 with a 10% stake in Royal Dutch/Shell’s block, and the ability to reach 40% by carrying Shell through $60 million in exploration. In 1999, Shell drilled the Guda-1 well and interpreted the logs as not showing oil, which Mike Watts saw differently.

Cairn renegotiated with Shell and drilled one more well to reach 50% interest. The Guda-2 well flowed 2,000 bo/d and the company’s future was launched. Cairn gave Shell operatorship of the joint Bangladesh properties and Cairn assumed operatorship in Rajasthan.

In 2002, Cairn bought out Shell’s remaining interest for $7.25 million and negotiated a 3-year extension on the Rajasthan lease, set to expire in May 2002. The company’s strategy became “drill ‘til you drop,” Watts says.

Cairn began a multiwell drilling program in 2002, shot seismic, and drilled about 80 exploration wells on the Rajasthan lease through the May 2005 extension. Initial drilling focused on the southern and central parts of the original RJ-ON-90/1 lease area, which covered 6,688 sq km (5,000 acres) in the Thar Desert, now dubbed the “desert of discovery.”

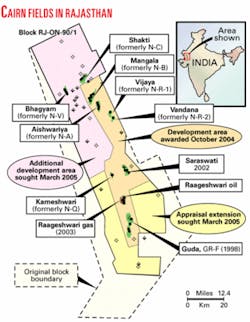

In 2004, Cairn began drilling in the northern part of the block and almost immediately made several major oil discoveries. The company relinquished part of the original lease when the 1,858 sq km development area was awarded in October 2004 (Fig. 3).

With the 3-year extension due to expire in May 2005, Cairn proposed a 1,141 sq km northwest extension to the established development area in March 2005, in order to include the Bhagyam (API 21-30º) and Shakti (API 15-19º) discoveries, as well as an additional appraisal area extension. In June 2005, the DGH granted an 18-month extension to appraise 2,884 sq km in the northern half of the original block (OGJ Online, June 15, 2005).

In March 2005, Cairn also requested an 18-month extension to better explore 1,935 sq km in the southern half of the block, surrounding the Kameshwari, Raageshwari, and Guda discoveries. This was granted in August 2005.

Cairn carries 100% of the exploration costs in the block and had more than $400 million invested in Rajasthan through November 2005. ONGC has the right to back in to 30% of the production.

The largest gem so far is the Mangala field (API 22-29º), discovered in January 2004 in the northern part of the Cairn lease (Fig. 4). Dallas-based auditors DeGolyer and MacNaughton independently verified 1.1 billion bbl in place and recoverable reserves of 256-380 million bbl at Mangala with an additional 100 million bbl possible using enhanced oil recovery techniques. Daily production from Mangala is expected to be 100-110,000 bo/d. “Mangala is our Spindletop,” Watts says, and the field name is derived from the Sanskrit for good opening or beginning, “an auspicious start.”

Nearby Aishwariya field should produce 10-15,000 bo/d (API 29-32º), and Bhagyam field, to the northwest, 20-40,000 bo/d (API 21-30º). DeGolyer and MacNaughton estimated that 380-700 million bbl were recoverable from the three northern fields (M-B-A) combined.

Target production from the three northern fields is 120-150,000 bo/d, with Mangala production expected to begin in late 2007. CEO Bill Gammell noted that development costs will range $3-3.50/bbl.

Mangalore Refinery and Petrochemicals Ltd., an ONGC subsidiary, will take delivery of the Rajasthan crude. Cairn is negotiating the crude oil sales agreement.

CEO Bill Gammell says that the challenge for Cairn in Rajasthan is to monetize its $300-400 million investment. Phase 1 will probably be a pipeline carrying crude oil south; Phase 2 would be for the government to take the Indian crude south and import oil to mix it with; Phase 3 would be building a refinery in Rajasthan. Local politicians have already clamored for an oil refinery at Barmer.

Central, south fields

The central and southern fields in the Rajasthan block include Kameshwari (API 45-52º), Saraswati (API 40-42º), Raageshwari (API 32-38º), Guda (API 38-42º), and Guda-South, which may contribute 3-10,000 bo/d and will be developed independent of the northern fields (Fig. 3).

In a presentation in early December, Mike Watts said that he expected Saraswati (“knowledge, wisdom”) and Raageshwari fields each to produce 1,000-1,500 bo/d and that the cumulative 2-3,000 bo/d production would begin in mid-2006, transported by truck.

Cairn targets 10-20,000 bo/d to be transported by pipeline (potential route to Mundra, as yet unbuilt).

A group of journalists visited the Saraswati-4 well site in November, with Precision Drilling’s 709 super single slant drilling rig on site, the same rig used elsewhere by Niko Resources Ltd. The top section was drilled with potassium and the lower section was being drilled directionally at 36º with synthetic oil-based mud.

Hydraulic fracture equipment had just arrived in the field in mid-November, from Oman (Fig. 5). Cairn planned to frac the Thumbli sands in the Raageshwari-4 and -5 wells. Using four trucks, each capable of pumping 2,000 bbl, Cairn anticipated a pressure of 5-7,000 psi and using about 500,000 lb of proppant.

The company had also experimented with slimhole drilling at Raageshwari, directionally drilling four, 6-in. holes in the field to 4,500 m, using synthetic mud and a polycrystalline diamond compact (PDC) bit.

Cairn contracts two IDECO drilling rigs from Poland’s Oil and Gas Drilling Co. (OGDC) Nafta Pila Ltd., a 1,200-hp triple with a Maritime Hydraulics top-drive, 750-ton hook load capacity, and BOP rated to 10,000 lb; and a 750-hp double drilling rig with a Kelly. The 750-hp rig was brought to India from Poland in Spring 2004 and started drilling the NI field, just east of Bhagyam. This lighter rig spudded the NI-north well in mid-November 2005 (Fig. 6).

Cairn contracts a workover rig from John Energy Ltd., which was testing a well in the Guda field in November. The journalists watched them pull tubes of oil at sunset.

Also that month, the IRI 1200 rig was at work coring the NR-4 sidetrack well using a Hughes 81⁄2-in. coring bit and 11-lb synthetic mud (Fig. 7). The NR-4 field is west of the Vijaya and Vandana fields, and south of Aishwariya (Fig. 3).

More than 1,500 m of core has been taken from the Mangala field, with better than 80% recovery. Much was oil-stained, Watts said. The company also collects sidewall cores, and established a core lab in Jodphur in fourth-quarter 2005, for core storage and analysis.

Managing expectations

Cairn managers say that the company’s activities are aligned with Indian priorities. In early December, CEO Bill Gammell told the World Oil & Gas Assembly in Jaipur, Rajasthan’s capital, that “success in India is always about seeking alignment of interests.”

Working to develop an indigenous supply of oil and natural gas is the least costly energy option for the country, reduces the need for pipeline and LNG imports, and brings much-needed oil and gas revenues to the states and the central government.

Cairn employs Indian nationals at all levels in the operations, sponsors students at Indian universities, and brings Indian geoscientists to the UK for cross training. The company also sponsors related geologic research at Leeds and Glasgow universities.

As Cairn discoveries mount, hopes in Rajasthan are rising for an economic boom. David Nisbet, head of Cairn’s communications, told OGJ that the company is investing in the local community but also working hard to manage expectations.

Access to potable water is a primary concern, and the company’s exploratory drilling over the wide lease area has delineated several aquifers. Cairn said that a large shallow aquifer 35 km south of Mangala is saline but would provide sufficient water for drilling operations.

The company is funding water-harvesting projects and supplying pumps and equipment to facilitate access to drinking water and alleviate fears that drilling and production operations will exacerbate the shortage of potable water (OGJ, Nov. 28, 2005, p. 15).

Cairn has also invested in improving local schools, constructing and repairing roads, and negotiated installation of a VHF system in 2004 and cellular-phone network with six to seven towers across the Rajasthan lease area, benefiting local subcontractors as well as facilitating operations. All of the company’s vehicles now have tracking systems. The company has funded a program to plant 6,000 trees in 20 Rajasthan villages, and supports health camps, veterinary camps, and a mobile vet van.

Regional issues

Cairn’s Indian oil is sold at world market price. Cairn’s natural gas is sold under four contracts linked to oil prices but subject to a restrictive composite ceiling price of $3.71/Mscf, reached when Brent is at $24/bbl.

The gas price ceiling in Bangladesh is even more restrictive, pegged at $2.90/Mcf with a floor of $1.71/Mcf. The inability of companies to export Bangladesh gas and the local reluctance to build a much-wanted pipeline from Bangladesh and India’s Assam region to New Delhi are additional sticking points that hinder Bangladesh petroleum development.

With natural gas selling at $14/Mcf in early January, both Indian and Bangladesh price ceilings need to be raised to encourage further reserve development.

Cairn has suffered declining returns from established Indian production, with pre-tax profits decreasing to £29.4 million in 2004 from £69 million in 2003. The company secured an additional $100 million in outside capital to subsidize 2004-05 exploration.

India’s central government recognized that national oil marketing companies “have incurred under-recoveries owing to nonrevision of selling prices in line with the ruling international prices.”1 In 2004-05, this is estimated to be 20,146 crore ($4.5 billion), and for April-June 2005 alone, 9,771 crore.

In recognition, the government increased the retail prices for petrol and diesel on June 21 and Sept. 7, 2005. But upstream national oil companies ONGC, GAIL, and Oil India Ltd. were asked to contribute Rs 3,220/crore for second-quarter 2005 (July-September).

Vedika Bhandarkar, managing director of JPMorgan India Pvt. Ltd., told OGJ in November that India’s current inflation rate of 5-5.5% would probably increase an additional 1.5% if the entire price of market price of petroleum were passed on to the consumer. She said that “the government can’t continue to shield consumers completely.”

Future plans

In addition to exploring its new Ravva, Gujarat, and Rajasthan acreage, Cairn’s plans in southeast Asia will focus on the company’s acreage in northern India, east of Delhi, along India’s Ganga Valley and Nepal’s Terai plain. The company holds three blocks in India: GV-ONN-97/1 (30% interest); GV-ONN-2002/1 (100% interest); and GV-ONN-2005/1 (49% interest), recently acquired under NELP V.

Across the border in Nepal, Cairn holds licenses to blocks 1, 2, 4, 6, and 7; acreage which abuts the Royal ShuklaPhant Wildlife Reserve, the Royal Bardiya Wildlife Reserve, and the Parsa Wildlife Reserve. This area is nearly completely unexplored, although Mike Watts pointed out “Nepal is perfect-a huge area and basin, with oil sheens noted on the Oil River and gas seeps. Cairn expects to drill a well in one of the Indian blocks with similar characterisics bordering Nepal in 2006. There is no drilling yet in Nepal.

Future development of the Bangladesh acreage will probably depend on the government giving companies the right to export gas and sell it at less-restrictive prices.

Cairn was scheduled to present an operational update on Jan. 17 and will announce full-year results on Mar. 14, 2006.✦

Reference

1. Ministry of Petroleum & Natural Gas background material for Economic Editors’ Conference, Nov. 17, 2005, 19 pp.