OFFSHORE BONDS— Conclusion: Risk-adjusted methods update supplemental bonding calculations

Risk-adjusted methods provide alternative approaches for calculating supplemental bonding requirements for operators in the Gulf of Mexico.

Currently the US Mineral Management Service is assessing the need to update the formula for calculating bonding requirements that have been in place since the early 1990s.

This concluding part of a two-part series summarizes several proposed alternative calculation methods to determine adequate supplemental bonding levels. The first part (OGJ, Sept. 7, 2009, p. 37) provided an overview of the supplemental bonding industry in the gulf.

Supplemental bonding

Supplemental bonding protects the government from incurring costs associated with offshore lease abandonment. The MMS requires operators to post a supplemental bond if at least one record titleholder of the lease does not satisfy a minimum threshold financial capacity.

MMS has been using an empirically derived formula (Table 1) for computing end-of-lease liability. The formula has worked successfully but because the bonding formula is calibrated to projects performed in the early 1990s, there is an obvious need to update the formula to reflect current operating costs and technology.

A recent study presented updated risk-adjusted bonding levels and discussed the guidelines and tradeoffs in formula development.1

The present article summarizes these risk-adjusted alternatives.

Background

The US government sells the right to explore for hydrocarbons and develop tracks on the Outer Continental Shelf at periodic sealed-bid auctions. The bidding variable at these auctions is a cash payment, or bonus that the winning bidder must pay to the government before the lease becomes effective.

Operators buy the right to extract natural resources on federal lands subject to royalty and rental payments, a commitment to operate in an environmentally sound manner, and to remove facilities when the lease can no longer produce commercially.

The MMS is the primary federal agency responsible for ensuring that operators develop resources and maintain facilities in a safe and environmentally sound manner. Once production facilities reach the end of their useful lives, MMS has the obligation to ensure that decommissioning operations protect the safety of workers and environmental integrity, in accordance with federal regulations.2

From the operator's point of view, decommissioning represents a future cost to be incurred, while from the government's perspective, decommissioning represents a risk of noncompliance and potential financial liability.

The government requires operators to post a general bond on all leases based on the amount of activity on a lease to ensure compliance with rent, royalties, environmental damage, and clean-up activities not related to oil spills, abandonment, and site-clearance.

When the cost to meet lease obligations exceeds the amount of a general bond and the lessee cannot demonstrate the financial capability to meet these obligations, the regulations require a supplemental bond.

The accompanying box provides a definition of financial capacity.

Recently, the MMS issued NTL No. 2008-N07 to update and clarify the procedures and criteria used to determine when a supplemental bond is required to cover potential decommissioning liability.3

Financial strength, reliability

Federal regulations require a supplemental bond on a lease, right-of-use easement, or right-of-way, unless the government determines that at least one record title owner or holder of the RUE or ROW meets the following conditions that demonstrate financial strength and reliability:

1. Provides an independently audited calculation of net worth equal to or greater than $65 million, in accordance with US Generally Accepted Accounting Principles (US GAAP) or the International Financial Reporting Standards (IFRS).

2. Has a cumulative decommissioning liability of less than or equal to 50% of the most recent and independently audited calculation of net worth.

3. Demonstrates reliability as evidenced by:

- Number of years of successful operations and production of oil and gas in the OCS or in the onshore oil and gas industry.

- Credit rating, trade references, and verified published sources.

- A record of compliance with current and previous governing laws, regulations, and lease terms.

- Other factors that indicate financial strength or reliability.

Source: NTL No. 2008-N074. Produces fluid hydrocarbons in excess of an average of 20,000 boe/d from OCS leases for which the lessee owns a record title interest.

5. Meets the criteria set forth in Table 1 by providing independently audited financial statements in accordance with US GAAP or the IFRS.

The MMS considers all lessees and operating-rights interest owners on a lease to be jointly and severally liable for all lease obligations. A company that sells its interest remains liable for decommissioning if the current owners do not comply with the terms of the lease.

If a property has current or previous working interest owners who are not financially capable of performing their decommissioning obligations or if a property does not have any previous owners,the property will be put up for sale. If the property is of marginal value or decommissioning liability is greater than the expected value of production, it is unlikely that a buyer for the property will be found.

Decommissioning commitments nonetheless have to be fulfilled, which creates a potential problem because MMS is neither funded nor authorized to incur these obligations. If the cost of decommissioning is greater than the supplemental bond on the lease, the lessee has the obligation to pay the difference.

In the case of default, the US government, as the party of last resort, would have the obligation to pay the difference.

Each producing lease in the OCS has a different level of decommissioning risk to the government. Risk events may be triggered by occurrences specific to a few participants, such as a bankruptcy or blowout, or by events that affect several companies simultaneously, such as hurricane destruction.

Fortunately, the gulf has had a low default rate. During the past 2 decades, only two operators in the gulf have not met their decommissioning obligations, and in both cases, because a previous record titleholder was financially sound, the federal government did not incur any expense.

In recent years, however, as more properties mature and change hands and smaller operators hold larger portfolios of assets, there are concerns about the potential financial risk of decommissioning to the US government.

For all leases in the gulf for which the estimated lease liability exceeds a specified financial commitment for all owners, the operator must post a supplemental bond,

Bonding calculations

Historically, MMS's procedure for determining the value of the bond involves counting the number of unplugged wells and structures on the lease and then applying its formula, referred to as the legacy formula (Table 2).

The MMS adjusts the cost estimates when available information shows that the numbers are inaccurate.

An outline of an alternative approach described in the next section uses risk-adjusted cost estimates for decommissioning.

Baseline level

The approach sets the baseline bonding level for each of the three main stages of decommissioning—well plugging and abandonment, structure removal, and site clearance and verification—at the average historical cost for performing the activity.

The calculation uses the bonding levels for a p-year future time horizon based on data collected from a time no longer than p-years, and vice versa.

For example, if the only cost data available are from a 5-year horizon, then the calculation should use a bonding formula with a future horizon of no longer than 5 years.

Cost estimation assumptions

Plugging and abandonment

• Considers all wellbores on a lease except for permanently plugged and abandoned wells. Wells include producing (active), idle (inactive, shut-in, temporarily abandoned), and service (disposal, injection) wells.

• Makes no distinction between wells based on age, production type (oil, gas, condensate), water depth, completion type (single or multiple), trajectory (vertical, deviated, horizontal), number of sidetracks, or other complexity measures.

• Determines costs based on the application of rig and rigless techniques, platform and lift boat jobs, day rate and turnkey contracts.

• Allows scale economies in wellbore plugging on a multiwell contract.

• Considers only normal operations and not P&A work for hurricane-destroyed structures or wells.

• Considers only surface systems or wells with a surface tree in less than 300-ft water depth. Hybrid wells and wet trees (subsea wells) in water depth greater than 300 ft require a separate assessment.

• Assumes P&A technology remains essentially unchanged during the time horizon under consideration and no significant changes in the regulatory framework during this time.

• Applies a 10%/year cost inflation.

Structure removal

• Assumes employment of conventional technology for all operations and the permitting of all possible disposition options, for instance, complete removal of platforms with all materials transported ashore for recycling or disposal, or reefing of the structures.

• Assumes removal technology remains essentially unchanged during the time horizon under consideration and no significant changes in the regulatory framework.

• Does not consider the impact of environmental mitigation cost; the cost to retain an agent; engineering, planning, permitting, and regulatory compliance; weather and general contingency factors; and abnormal market conditions.

• Considers only normal operations and not structures destroyed by man-made or natural catastrophe.

• Assumes no scale economies occur in operations, such as the grouping of structures in a multistructure removal package.

• Considers only fixed structures in less than 300-ft water depth in the Gulf of Mexico. Structures in water depth greater than 300 ft or residing outside of the gulf require a separate assessment.

• Considers and groups in the same category caissons and well protectors as defined by the MMS as similar structures for the purpose of removal. Fixed platforms comprise a separate category.

• Includes pipeline abandonment in the costs for removal of caissons and well protectors.Removal cost for fixed platforms includes structure preparation and pipeline abandonment.

• Does not inflate cost data.

Site clearance and verification

• Assumes site clearance performed with net trawling under day rate contracts.

• Limits water depth to 300 ft or less.

• Groups structural units and counts them in terms of caissons and all other jacketed structures (well protectors and fixed platforms) to match the clearance area requirements defined by the MMS.

• Does not inflate cost data.

Formula duration

The approach sets bonding requirements at a specific time and it applies to current decommissioning operations as well as future activity. This creates a dilemma when setting bonding levels because costs may inflate and levels set at the current time may not represent future expenditures.

For formula durations that extend across a limited and short time horizon, one would expect this problem to be minimal.

To reduce the level of ambiguity and to encourage a regular review cycle, the recommendation is that the approach specify explicitly the formula duration.

Inflation factor

Cost indices are available for different segments of the oil and gas industry, but offshore decommissioning is a specialized sector without any good proxy measures for cost inflation that we believe are representative of the sector.

Activities that depend on support and construction vessels may require an inflationary adjustment, due to changes in labor rates, fuel, demand requirements, etc. or may be relatively immune to inflationary pressures.

Supply and demand conditions in the gulf determine market rates, and because the uncertainty and magnitude in market rates typically dominates inflation uncertainty, empirical data may not provide clear trends on the occurrence or absence of inflation effects.

Representative cost

Ideally, to estimate decommissioning cost, one would want to record detailed descriptions of the work activity. In this perfect world, one could easily calculate average costs, and if all operations were reported under well-defined accounting standards, no uncertainty would arise regarding the nature of the assessment and if it is representative of the industry.

In the real world, acquiring cost data that is representative of the industry is a more difficult task due to confidentiality concerns, the lack of industry interest, and the time and resource commitments required.

Example A lease in 75 ft of water has an inventory of 5 producing wells, 18 idle wells, and 3 service wells; 2 caissons, 1 well protector, and 2 fixed platforms. The supplemental bonding required on the lease if no working interest owner meets the minimum financial requirements of the MMS are as follows. First, enumerate the number of wells and structure count by type, and record the water depth of each entity:

Apply Tables 2-5 to determine bonding levels. For the average cost case, Table 2 yields:

The total supplemental bond is $28.39 million for the lease. Table 7 shows the results for the risk-adjusted bonding levels. |

Real world data sets are neither complete nor representative and one must take care to ensure that analysis of the collected data includes the specific characteristics of the operations and operators.

In the real world, bias can result from sample selection problems. Cost statistics closely relate to the sample set and one cannot consider this representative by default. In almost all cases, the analysis needs additional processing.

Data balancing

To normalize or balance the sample data, the proposed approach employs an equal-weighted averaging scheme that first averages according to operator type and then equal-weights the averages by class.

This is based on user preference and the belief that if the federal government performed decommissioning activities in the gulf for any company, independent or major, its cost for services likely would be more similar to those of a major and not those of an independent.

The US government would need the services of a project management firm to manage the logistics and permitting process, would not realize the economics of scale economies, which would increase safety and environmental expenditures above the average costs.

The equal-weight class average attempts to balance the nature of operations with the availability of reliable data. Other balancing schemes are also possible.

Data uncertainty, risk tolerance

The risk-adjusted approach reflects the uncertainty associated with operational and market activity, cost estimation, and the risk tolerance level of the federal government.

One would not expect any of these factors to dominate every situation; therefore, one can view risk adjustment as a means to account for the combination of all data uncertainty and risk tolerance variation.

Risk adjustment

The approach adjusts upward the bonding level from the baseline (average) cost by 1, 2, and 3 standard deviation multiples. There is a trade-off in the selection of the risk adjustment because any increase above average cost will impose a greater financial burden on operators while holding bonding levels at average cost will transfer a greater portion of decommissioning exposure to the government.

Each stage of decommissioning has one of the following four bonding levels:

- Average Cost: C (high risk).

- Risk-adjusted cost I: C + 1SD (moderate risk).

- Risk-adjusted cost II: C + 2SD (low risk).

- Risk-adjusted cost III: C + 3SD (very low risk).

The approach assigns qualitative risk indicators of high, moderate, low, and very low to each category based on the frequency in which actual costs likely will exceed the average costs under normal conditions.

The indicators are subjective and meant to be interpreted in a relative sense. It is difficult to establish quantitatively the correspondence between risk and decommissioning exposure, but by incorporating one or more standard deviation terms, the government likely has less exposure to liabilities arising from inadequate bonding levels.

Average cost represents the base case or the high-risk category. The addition of one or two standard deviation multiples to the base case lowers the risks that the risk-adjusted cost of decommissioning will exceed the posted bonds.

Supplemental bonding tableau

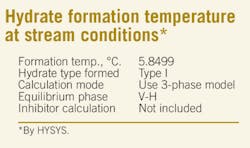

The accompanying box shows the assumptions used in updating the MMS supplemental bonding legacy formula with a risk-adjusted mechanism across each of the main stages of decommissioning.

Table 3 shows the average, no risk-adjustment, and cost of decommissioning, while Tables 4-6 show the three risk-adjusted levels using standard deviation as a proxy for the risk-adjustment factor.

The updated formula maintains the same structure as the legacy formula but is only directly comparable across the P&A category, where since the early 1990s the average well bonding levels have increased roughly sevenfold.

In the structure removal category, bonding levels have increased two to four times above the legacy formula.

The box shows an example calculation with the updated formula, and Table 7 shows the risk-adjusted calculation.

References

1. Kaiser, M.J., and Pulsipher, A.G., A review and update of supplemental bonding requirements in the Gulf of Mexico, US Department of the Interior, Minerals Management Service, TA&R Study No. 600, Herndon, Va., 2008.

2. Oil and Gas and Sulphur Operations in the Outer Continental Shelf—Decommissioning Activities; Final Rule, 30 CFR Parts 250, 256,. 67 (96):35398-35412, 2002.

3. Supplemental Bond Procedures, Notice to Lessees and Operators—NTL No. 2008-N07, Minerals Management Service, Aug. 28, 2008.

The authors

Mark J. Kaiser's biography and photo were published in the first installment of this series (OGJ, Sept. 7, 2009, p. 37).