Independents nurtured Bakken to economic producibility

Shale formations can contain vast stores of hydrocarbons, and it can take industry decades to develop them commercially.

The recent federal estimation of 4.3 billion bbl of undiscovered, technically recoverable oil in the Williston basin Bakken shale pretty much mirror’s the beliefs of newly public Continental Resources Inc., Enid, Okla., the Bakken’s largest oil producing company (see map, OGJ, Apr. 24, 2008, p. 37).

As the Fort Worth basin Barnett shale had a 20-year gestation period to commerciality with Mitchell Energy & Development Corp. in Texas, Continental’s Chairman Harold G. Hamm can trace his company’s foray into the Bakken since the 1980s.

Hamm’s desire to balance his then-private company’s gas dominance with oil discoveries, along with technology advances pioneered in Montana and Dakota fields, placed Continental in the thick of the Bakken evolution.

Bakken attempts

In the 1980s when Continental was rooted in Oklahoma and owned 65% gas assets and field gas prices were newly deregulated, Hamm looked to less-mature Rocky Mountain basins for the potential to make large oil discoveries.

He began working in Bowman County, ND, looking for structures in the Ordovician Red River sandstone formation. He made his first Rocky Mountain region discovery in Montana’s Midfork field in 1989, and in 1995 Continental and Meridian Oil Inc. discovered the large Cedar Hills field in North Dakota.

One Continental geologist mapped the Middle Bakken in the Williston basin in Montana, and Hamm approached companies that had discovered Mustang field in Richland County proposing a pilot waterflood, but they were not interested.

The companies, Headington Oil Co. and Lyco Energy Corp. of Dallas, had completed vertical wells in the Bakken after failed attempts to complete for Red River oil, but the Bakken production wasn’t commercial if a new well were drilled from surface, Hamm said.

Later Lyco aligned with Halliburton Energy Services and began drilling the Bakken horizontally on 320-acre units. Laterals were short and production rates weren’t commercial at first. Eventually fracs were tried, but rates still weren’t commercial.

Commercial step

Then Headington tried fracs in unlined holes and made 800-b/d Bakken wells.

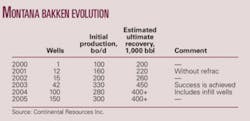

Continental leased 125,000 acres in what became Montana’s Elm Coulee field, largest to date in the Bakken play. Elm Coulee averages 50,000 b/d plus associated gas, and Continental is one of its largest producers with 7,200 b/d.

Elm Coulee is developed on 500 sq miles. Initial spacing was one horizontal well per 1,280-acre unit. Continental then drilled a second well per unit and is now drilling a third well per unit and looking at secondary and tertiary recovery potential.

Hamm took a geological team in 2003 and tasked it with finding the “next Elm Coulee” on the North Dakota side. After a review of cores, the team recommended leasing the crest of the 140-mile Nesson anticline.

Continental leased more than 300,000 acres in North Dakota and later entered a joint venture with ConocoPhillips Co., bringing in rigs as they were released at Cedar Hills. The companies are running 10 rigs now.

Of 66 rigs running in North Dakota, 56-58 are drilling toward the Bakken formation.

The USGS estimate of recoverable oil in the assessment unit that most closely covers Continental’s North Dakota acreage agrees remarkably with Continental’s expectations, Hamm noted.

Of 27 Bakken wells that Continental operated in 2007, the average estimated ultimate recovery is 335,000 bbl. Some won’t make much oil, and others will make 500,000-700,000 bbl, Hamm said.

Learning curves

The Red River B formation was noncommercial when drilled vertically at Cedar Hills field (see map, OGJ, Jan. 15, 1996, p. 21).

Cedar Hills was the first US oil field developed from the start entirely with horizontal wells, Hamm recalled. Continental spaced several townships and drilled mostly 4,000-5,000-ft laterals NE-SW across each square mile, the longest reaching 5,600 ft.

Meridian and Apache Corp. won approvals to drill South Dakota’s first horizontal wells, to Red River in the Buffalo field area in Harding County, in 1989 and 1994.

At the end of 1995, Continental purchased Koch Exploration Co.’s oil and gas properties in Harding County, SD, and Bowman County, ND. The South Dakota properties consisted of three air injection-in situ combustion units in vertically drilled Red River wells in the Buffalo fields.

Continental hiked production modestly by drilling laterals out of 23 of the vertical wells in 2005-06, and has continued to expand lateral drilling in the units.

Another horizontally drilled US formation, the Austin chalk in Texas, had an oil target 40-50 ft thick, but drilling in the Red River involved much higher precision, Hamm noted. There drillers were challenged to keep the sideways-pointing bit in the upper 3-4 ft of a zone that is only 7-10 ft thick.

The Montana Bakken Elm Coulee field, with horizontal drilling and 9,000 psi high pressure fracs and ceramic proppants, has become the 15th largest US onshore oil field.

“Generally, it takes many years and much capital to find out if these shales can be productive. Not all of them are and for the ones that are it can take many years to ‘break the code’ and find out how to drill, treat, and produce them,” Hamm told the Oklahoma Legislature last month. “This is the case of nearly every resource play.”