DRILLING MARKET FOCUS: US rig count slumps more rapidly than industry expected

The US rig count fell much more rapidly than most in the oil and gas drilling industry had forecast, and industry executives say they are uncertain when drilling activity might recover.

Baker Hughes Inc. reported a rig count of 975 working rigs for the week ended Apr. 17 compared with 1,743 rigs drilling during the same period a year ago.

The weekly rig count released Apr. 17 marked the first time since Apr. 30, 2003, that fewer than 1,000 rotary rigs were working in the US and its waters. It also marked the lowest weekly rig count since Apr. 2, 2003, when 972 rigs were drilling.

Halliburton Co. Chief Executive Officer Dave Lesar called the drilling decline “unprecedented” and said it’s impossible to say when activity might recover. He believes the downturn came more quickly than in past drilling slump cycles.

Lesar’s comments came Apr. 20 when Halliburton of Houston reported first-quarter 2009 net profit of $378 million compared with $580 million for first-quarter 2008. Rival Weatherford International, based in Switzerland, reported first-quarter net profits of $164.8 million compared with $264.2 million for the same period last year.

Diamond Offshore reported Apr. 15 that three of its shallow-water Gulf of Mexico rigs were idled within 1 month.

Producers shut in gas

Some operators temporarily are shutting in wells. Chesapeake Energy Corp., Okalahoma City, said Apr.16 that it shut in natural gas production by 400 MMcfd. Production cuts primarily involved the Midcontinent and Barnett shale.

Until gas prices strengthen, Chesapeake plans to limit production from most newly completed wells in the Barnett and Fayetteville shales to 2 MMcfd. Production in the Marcellus shale will be limited to 5 MMcfd and Haynesville shale production limited to 10 MMcfd.

Aubrey K. McClendon, Chesapeake’s chief executive officer, blamed soft gas prices on “recession-related reduced demand and abundant US production.” Lower drilling activity and natural reservoir depletion will rebalance the gas market by early 2010, he said.

J. Marshall Adkins, analyst with Raymond James & Associates, said US gas production rates have yet to reflect the plummeting US drilling activity.

“Unfortunately, we still do not believe the US gas supply rollover will come soon enough or be large enough to save the natural gas market from further meltdown in 2009,” Adkins said.

He expects the current slump in drilling rig activity will hit bottom by the end of second quarter.

Having slashed his US rig count forecast for 2009-10 since early February, Adkins said Apr. 20 that he anticipates the US rig count will bottom at around 700 rigs–down from his earlier February forecast of 800.

“The US gas rig count will bottom close to 500 rigs (down nearly 70% from the peak), and year-over-year US gas supply will be down about 6 bcfd by late 2009,” he said.

Natural gas producers recently have been drilling but not completing wells, Adkins said. Based upon his conversations with industry, he estimates that as many as 1,000 wells were drilled but not completed during first quarter.

“This equates to roughly 10-20% of the well count and could delay 10-20% of expected new production,” or up to 1.5 bcfd, he said. Operators delay completions of newly drilled wells because:

- They can save cash and eliminate some well costs.

- They can hold leases by drilling only a vertical well and producing only a small portion of gas vs. drilling a horizontal well

- They are waiting for oil and gas prices to recover before they complete wells.

- Limited take-away capacity has prevented completion and production of wells in some areas, particularly in the Barnett shale recently.

The rig count in shale plays has held up better than the total fleet average, Adkins said, noting that the percentage of active rigs drilling shale plays has moved higher during the past 6 months.

Range Resources Corp., Fort Worth, said its production continues to grow despite a reduced capital program. Range attributes its production growth to the Marcellus shale in Pennsylvania, Nora field in Virginia, and the Barnett shale in North Texas.

Range Resources had 15 rigs operating as of Apr. 16 compared with 33 rigs for the same time last year.

Oil drilling to recover first

Pritchard Capital Partners LLC expects the rig count will bottom at 800-1,000 rigs by June 30, said Pritchard analysts in an Apr. 20 research note. They suggested rigs drilling vertical wells for oil will be among the first to go back to work.

In April, Chesapeake said it had resumed 7,000 b/d of production from previously shut-in oil wells.

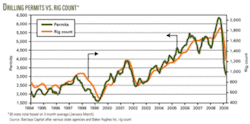

Barclays Capital analysts in New York monitor the number of drilling permits issued by 30 states. They report a “very strong relationship” between drilling permit issuance and US rig count.

In March, the 30 states issued 2,753 drilling permits, down 11.2% from February and adjusted for comparable number of filing days. The decline was broad-based. California was down 99 permits, Montana was down 43 permits, and New Mexico was up 69 permits (see chart).

“We believe the ongoing weakness in aggregate permitting activity points to further erosion in drilling demand during the second quarter,” Barclays analyst James Crandell said.