Special Report: Midyear Forecast: US, Canada drilling rekindled as gulf faces uncertainty

Drilling onshore in the US and in western Canada is enjoying a brisk uptick from 2009 as US Gulf of Mexico activity succumbs to federal regulatory uncertainty.

Strength in oil prices has led to much more drilling this year than OGJ could predict in the January forecast. Even more drilling could be bolstering the rig count if natural gas prices showed much firmness.

Absent that, many operators, especially those heavily invested in the unconventional gas plays, are attempting to shift drilling rigs to plays prone to oil or natural gas liquids production and away from dry gas areas.

Drilling in the US Gulf of Mexico had shrunk to 17 rigs by June, but operators ran more than double that number of rigs on average in the gulf off Louisiana in the 2010 first half.

Here are highlights of OGJ's midyear drilling forecast for 2010:

• Operators will drill 43,068 wells in the US, up from an estimated 37,062 wells in 2009.

• All operators will drill 1,946 exploratory wells of all types, up from an estimated 1,544 last year.

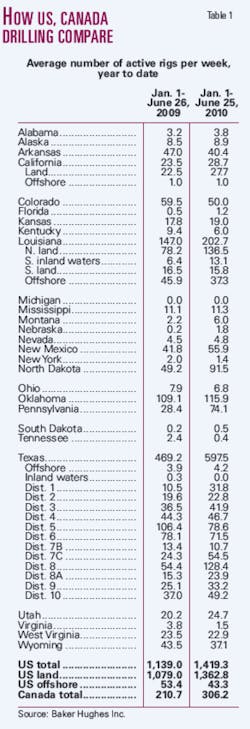

• The Baker Hughes Inc. count of active US rotary rigs will average 1,450 rigs/week this year, up from 1,087 in 2009 and down from 1,867 in 2008.

• Operators will drill 10,785 wells in Canada, up from an estimated 7,974 wells in 2009.

First half results

Rig activity in the US from January through June was 23% busier than in the same period of 2009.

However, operators are not believed to have drilled 23% more wells because of the increasing length of laterals, especially in unconventional gas and liquids plays.

Compared with the first half of 2009, improvements in the rig count were widespread across the US. Operators ran an average 151 rigs in West Texas, up from 70 in 2009, 91 rigs in North Dakota vs. 49, and 74 in Pennsylvania, led by Marcellus shale drilling, vs. 28.

Louisiana operators averaged 203 rigs this year vs. 147 in 2009, with all of the gain coming onshore. North Louisiana, dominated by the Haynesville shale gas-condensate play, fielded 136 rigs vs. 78 last year.

Texas Districts 1 and 2, home of the Eagle Ford shale play, both showed gains. Dist. 1, on the oilier side of the play, tripled to 32 rigs/week in 2010's first half from 11 rigs/week in first-half 2009.

Modestly higher were Oklahoma at 116 vs. 109 and Kansas at 19 vs. 18.

States and areas with dry gas basins didn't fare as well. Arkansas operators ran 40 rigs, down from 47 last year, Colorado 50 compared with 60, Wyoming 37 vs. 44, and the western part of East Texas (Dist. 5) 79 vs. 106.

Impact of gulf ban

OGJ looks for operators to have drilled 190 wells in 2010 off Louisiana, including 144 that we judge were drilled in the first half.

The Baker Hughes Inc. rig count for Louisiana offshore averaged 37 units/week in January through June 2009 and 46 units/week in the same period of 2010. But due to the federal gulf drilling moratorium, the active rig count in the Gulf of Mexico had fallen to 17 units by June 25.

Precise reports weren't available from most operators about the status of the affected rigs.

Federal agencies have said that the gulf drilling moratorium, which they vow to revise after a court held against the initial version, affected 33 rigs.

The Minerals Management Service list of active deepwater rigs dated May 19 showed 35 mobile offshore drilling units in the gulf either drilling or on workover duty. It wasn't clear how many of the units were on workover assignments or whether the moratorium applied to them.

The primary operators of the 35 units were Shell Offshore with seven, Anadarko Petroleum Corp. and Chevron Corp. four each, and ATP Oil & Gas Corp., Eni SPA, Marathon Oil Corp., Noble Energy Inc., and Statoil with two each.

Operating one unit each were BP (Macondo), BHP Billiton, ExxonMobil, Hess Corp., LLOG Exploration, Murphy Oil Corp., Newfield Exploration, Petrobras, Stone Energy, and Walter Oil & Gas Corp.

A list of the other working interest participants in those wells wasn't available at this writing.

Canada's outlook

OGJ's forecast for Canada is close to that of the Petroleum Services Association of Canada, which estimated operators will drill 11,250 wells this year, up 35% from 2009.

Baker Hughes said Canada's rig count averaged 341 in the first half of 2010, up from 211 in the first half of 2009.

IHS Herold looks for a 44% spending hike by Canadian E&P trusts in 2010 compared with a 5% drop in 2009 (OGJ Online, June 15, 2010).

OGJ looks for only 10 wells to be drilled off eastern Canada this year, mostly development drilling in several oil and gas fields.

PSAC's estimate calls for a 31% increase in drilling in Alberta, a 2% decline in British Columbia, and a 47% increase in Saskatchewan. It expects Manitoba drilling to more than double from 2009.

PSAC based its forecast on average prices of $4.25/Mcf for gas and $82/bbl for crude.

More Oil & Gas Journal Current Issue Articles

More Oil & Gas Journal Archives Issue Articles

View Oil and Gas Articles on PennEnergy.com