Laredo to maintain flat production with front-loaded 2022 budget, activity

Laredo Petroleum Inc, Tulsa, Okla., expects a total capital expenditure budget in 2022 of $520 million to maintain flat activity levels versus 2021. The budget includes about $20 million for non-operated activity and about $10 million for ESG focused investments, the company said Feb. 22.

Oil production is expected to remain flat with fourth-quarter 2021 levels with expected full-year oil production growth of 24 -34% versus 2021, driven primarily by production acquired in second-half 2021.

With rig and completions crew count flat with 2021, activity and capital levels are front-end loaded with the year’s highest level of investment occurring in first-quarter 2022. The Permian basin-focused company plans to operate three drilling rigs and two completions crews for much of the quarter. Laredo plans to release one drilling rig and one completions crew by the end of the first quarter and operate a constant two drilling rigs and one completions crew for the remainder of the year.

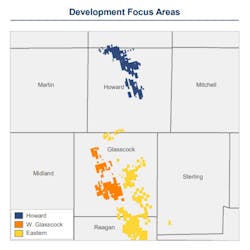

The year’s development plan is focused entirely on oil-weighted Howard County, Tex. inventory. Efficiencies are expected to further improve with 18 15,000-ft wells in the 2022 plan and average lateral length increasing about 18% to 11,800 ft.

The company estimates full-year 2022 production of 82,000-86,000 boe/d with oil production of 39,500-42,500 b/d.

In fourth-quarter 2021, the company produced 41,080 b/d of oil and 85,240 boe/d, an increase of 87% and 3%, respectively, versus fourth-quarter 2020. Oil cut as a percentage of total production was increased to 48% in fourth-quarter 2021 versus 27% in fourth-quarter 2020.

In September 2021, the company agreed to acquire about 20,000 net acres in western Glasscock County, Tex., from Pioneer Natural Resources Co. for $230 million (OGJ Online, Sept. 21, 2021).

The company expects to return cash to shareholders by early 2023.

About the Author

Mikaila Adams

Managing Editor, Content Strategist

Mikaila Adams has 20 years of experience as an editor, most of which has been centered on the oil and gas industry. She enjoyed 12 years focused on the business/finance side of the industry as an editor for Oil & Gas Journal's sister publication, Oil & Gas Financial Journal (OGFJ). After OGFJ ceased publication in 2017, she joined Oil & Gas Journal and was later named Managing Editor - News. Her role has expanded into content strategy. She holds a degree from Texas Tech University.