Western Gas aiming for 2024 for start of Equus gas production

Western Gas Corp. Pty. Ltd. (WGC), Perth, reported that its Equus gas project offshore Western Australia is on track for coming on stream in 2024. The estimate follows completion of an “upstream-to-LNG development plan” and the commencement of project financing and partnering.

WGC Executive Director Andrew Leibovitch said the engineering and design process undertaken by development partners McDermott and Baker Hughes had delivered a globally competitive, midscale LNG development plan for the Equus fields.

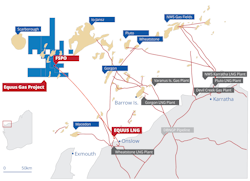

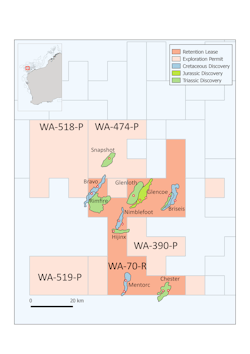

The development will eventually tap 10 discoveries spread across exploration permit WA-474-P and retention licence WA-70-R located between Woodside’s Scarborough gas field and ExxonMobil Corp.’s Io-Jansz field on the outer North West Shelf.

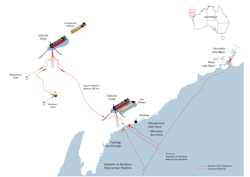

The first phase comprises three production wells connecting the Nimblefoot and Mentorc fields via a subsea network to a floating production, storage, and offloading vessel, a 160-km dry gas export pipeline to a nearshore, a 2 million-tonne/year floating LNG (FLNG) plant, and an onshore pipeline connection to supply gas into the Dampier-to-Bunbury natural gas trunkline.

Processing on the FPSO will include gas dehydration, gas compression, and stripping of condensate for direct export.

Engineering and design work will now focus on development proposals for the subsea installations, the FPSO, pipeline, and FLNG work packages.

WGC has appointed Goldman Sachs as the company’s financial adviser in connection with its partnering process. Leibovitch said Equus is at the stage of development where the introduction of an experienced and financially capable partner can help progress the project to start of gas production in 2024 and realize the value of the greater Equus area.

At the moment WGC has 100% ownership of the Equus project.

Some $1.5 billion has already been spent at Equus since 2007 on exploration, appraisal, and development stuides. This includes 17 exploration wells, 4 appraisals wells, 5 dynamic well tests, 9,100 sq km of 3D seismic as well as a completion of front-end engineering and design studies.

Independent assessment by Gaffney Clines & Associates has estimated the 10 fields contain 2C resources of 2 tcf of gas and 42 million bbl of condensate. The 1C estimate is 1.34 tcf of gas and 26.6 million bbl of condensate while the 3C estimate is 3.2 tcf of gas and 68.4 million bbl of condensate.

WGC also has potential for a further 9 tcf of gas in the exploration portfolio that includes prospects in surrounding permits WA-519-P, WA-390-P, and WA-518-P.

The 10 discovered fields are Nimblefoot, Rimfire, Bravo, Glenloth, Glencoe, Briseis, Hijinx, Mentorc, and Chester in WA-70-R and Snapshot in WA-474-P.

The fields are in the Carnarvon basin 200 km northwest of Onslow in 1,000-1,200 m of water.

They were discovered by Hess Corp. between 2008 and 2012. WGC bought the Equus package in 2017.