Oilex group counterclaims East Timor PSC relinquishment

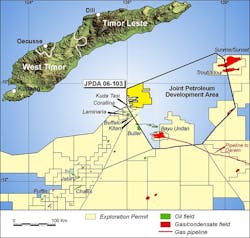

An international joint venture led by Oilex Ltd., Perth, has made a counterclaim to the International Chamber of Commerce (ICC) in Singapore regarding arbitration proceedings brought against it in October 2018 by East Timor’s Autoridade Nacional Do Petroleo E Minerais (ANPM) regarding relinquishment of a production-sharing contract for former Joint Petroleum Development Area (JPDA) 06-103 in the Timor Sea.

Oilex said it has submitted what is known as the respondents first memorial to the ICC in which the JV has lodged a counterclaim against ANPM for $23.3 million in damages arising from the wrongful termination of the PSC.

The dispute has its roots back in November 2006 when the Oilex JV entered the PSC which then had an effective start date of January 2007 with Oilex as operator.

In July 2013, Oilex submitted a request to the ANPM to terminate the PSC by mutual agreement in accordance with the terms of the PSC and without penalty or claim. Oilex and its partners felt there was ongoing uncertainty about the security of the PSC because of the maritime boundary dispute between East Timor and Australia.

ANPM is the body responsible for managing and regulating petroleum activities in the East Timor region.

In May 2015 ANPM issued a notice of intention to terminate the PSC and subsequently in July 2015 issued a notice of termination and demand for payment of $17 million. This sum reflected ANPM’s estimate of the cost of exploration activities not undertaken in 2013 as well as some local content obligations set out in the PSC. More recently ANPM has sought to amend its claim to $22.26 million.

In October 2018, ANPM submitted a request for arbitration to the ICC relating to matters associated with the termination of the PSC by ANPM.

In responding to the arbitration this week, the Oilex JV maintained it has made significant over-expenditure in executing the PSC work program. It also said the ANPM failed to properly assess and award credit for the additional expenditure when terminating the PSC. The JV said it considers there is no penalty payment applicable and the parties had made many unsuccessful attempts to settle the matter in dispute prior to the issuance of arbitration proceedings.

The JV partners in the dispute are operator Oilex (JPDA 06-103) Ltd. with 10% interest, Pan Pacific Petroleum (JPDA 06-103) Pty. Ltd. 15%, Japan Energy E&P JPDA Pty. Ltd. 15%, GSPC (JPDA) Ltd. 20%, Videocon JPDA 06-103 Ltd. 20%, and Bharat PetroResources JPDA Ltd. 20%.

The matter has been complicated internally for the JV in that Videocon parent company Videocon Industries Ltd. is subject to corporate insolvency proceedings and is trading under the supervision of an insolvency professional. In addition, a notice of default has been issued against both Videocon JPDA 06-103 and GSPC (JPDA) for their failure to pay the joint venture cash calls.

Joe Solomon, Oilex managing director, said it was disappointing that the ANPM has elected to pursue arbitration. “The $23.3-million counterclaim further supports our view that the [JV] has previously, and will continue to act in good faith, with previous offers to settle the matter being generous.”

The arbitration hearing in Singapore is scheduled to begin in February 2020.