WoodMac: Deepwater, tight oil share similar growth themes

Deepwater projects and tight oil plays are two upstream growth areas even though offshore and unconventional often are considered at opposite ends of the development spectrum, a Wood Mackenzie Ltd. researcher said.

Deepwater represents large, expensive, and complex long-cycle projects suited to the majors while tight oil offers flexible short-cycle opportunities typically favored by independents.

Both deepwater projects and tight oil plays have undergone a rapid transformation over the past few years, altering many industry assumptions.

Angus Rodger, director, WoodMac Asia Pacific upstream, said, “In both deepwater and tight oil, costs have come down, while development techniques have improved, allowing vast new reserves to breakeven under $50/bbl.

“Tight oil’s progression from cottage industry to industrialization is primarily a Permian story, but it is still in its early stages,” Rodger said. “It used to be all about price-responsive flexibility and well-by-well economics. Now scale is the key differentiator. New tight oil is industrialized, and that requires more capital and infrastructure, and longer cycle times.”

Meanwhile, deepwater operators also reinvented themselves, cutting costs, cycle-times, and break-evens levels. This has created several advantaged sweet spots, such as Brazil, Guyana, and the Gulf of Mexico.

Convergence

Deepwater is trying to slim down and shorten its investment cycle to offer a viable alternative to tight oil.

Permian basin operators are scaling up capital spend, project footprint, and value extraction. This benefits majors who can use their capital and big project capabilities to lead the next phase of tight oil development.

“There are other similarities too,” Rodger said. “At present, both currently produce around 7.5 million b/d, and each is poised for a sustained period of rising output. Both themes are growing, but tight oil, with its underlying low-cost resource base, is growing faster.”

Permian development strategy is changing. For instance, pad sizes are getting bigger and laterals are getting longer.

“The focus has switched to exploitation, increasing recovery and improving incremental economics,” Roger said. “Engineers discovered that bigger really is better. Experiments proved that well economics improved with more aggressive completions and longer laterals.”

Resetting economics

Rodger said the nature of deepwater development remains the same, but investment economics has changed as has development strategy.

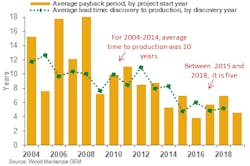

“Simpler projects are quicker–from 2004 to 2014 the average project took 10 years from discovery to come online. From 2015, the time from discovery to first production has halved to 5 years. Leading the way are new low-breakeven developments in the US Gulf of Mexico and Angola,” he said.

“The majors’ longer-term investment horizon also allows them to invest through the cycle in both deepwater and tight oil,” Rodger said. He believes the Permian will be central to driving corporate strategies for players of all sizes. Many US independents will need to scale up to compete as industrialization gathers pace, but not all have the skills and capital to do so.”

A more concentrated, differentiated corporate landscape will start to emerge. A key theme for all will be to focus on advantaged assets. Rationalization will be an especially important strategic theme for those players with large, low-breakeven tight oil and deepwater inventories. Portfolio high-grading will create more opportunity for national oil companies, conventionally focused majors, and internationally focused independents.

These combined trends may force many of the larger US independents to reassess the wisdom of abandoning both deepwater and international portfolio positions.

Rodger said, “Having a diverse inventory of low-breakeven oil opportunities will be key to thriving as the energy transition unfolds—and both tight oil and deepwater have vital roles to play.”

Contact Paula Dittrick at [email protected].

About the Author

Paula Dittrick

Senior Staff Writer

Paula Dittrick has covered oil and gas from Houston for more than 20 years. Starting in May 2007, she developed a health, safety, and environment beat for Oil & Gas Journal. Dittrick is familiar with the industry’s financial aspects. She also monitors issues associated with carbon sequestration and renewable energy.

Dittrick joined OGJ in February 2001. Previously, she worked for Dow Jones and United Press International. She began writing about oil and gas as UPI’s West Texas bureau chief during the 1980s. She earned a Bachelor’s of Science degree in journalism from the University of Nebraska in 1974.