US prospects for LNG bunkering uncertain

LNG-fueled ships still account for only a fraction of the US and global fleets, and it may take several decades for significant benefits of LNG-powered vessels to be realized. It is also possible that alternative ship fuels, including biofuels, electric engines, and hybrid engines, will become more economically viable in coming years. Given the uncertainty surrounding LNG as a ship fuel, it is hard to predict the potential benefits or costs LNG bunkering may provide to the US.

The combination of growing LNG supplies and new requirements for less polluting fuels in the maritime shipping industry has heightened interest in LNG as a maritime fuel. In 2008, the International Maritime Organization (IMO) announced a timeline to reduce the maximum sulfur content in vessel fuels to 0.5% by Jan. 1, 2020. Annex VI of the International Convention for the Prevention of Pollution from Ships requires vessels to either use fuels containing less than 0.5% sulfur or install exhaust-cleaning scrubbers to limit a vessel’s airborne emissions of sulfur oxides to an equivalent level.

An option for vessel operators to meet the IMO 2020 standards is to install LNG-fueled engines, which emit only trace amounts of sulfur. Adopting LNG engines requires more investment than installing scrubbers, but LNG-fueled engines may offset their capital costs with operating cost advantages over conventional fuels. Savings would depend on the price spread between LNG and fuel oil. Recent trends suggest that LNG may be cheaper in the long run than conventional fuels.

Early adoption of LNG bunkering is occurring in Europe where the European Union required a core network of ports to provide LNG bunkering by 2030. LNG bunkering is also advancing in Asia, led by Singapore, the world’s largest bunkering port. Asian countries, together with Australia and the UAE, have about 10 coastal ports offering LNG bunkering, with another 15 projects in development.

LNG bunkering in the US currently takes place in Jacksonville, Fla., and Port Fourchon, La., with a third site under development in Tacoma, Wash. Bunkering of LNG-fueled cruise ships using barges also is planned for Port Canaveral, Fla. The relative locations of other US ports and operating LNG terminals suggest that LNG bunkering could be within reach of every port along the eastern seaboard and shores of the Gulf of Mexico.

On the west coast, the ports of Los Angeles and Long Beach, Calif., are near the Costa Azul LNG terminal in Ensenada, Mexico. Seattle and Tacoma are adjacent to the proposed Tacoma LNG project. Since 2015, Jones Act coastal ship operators have taken steps to transition their fleets to use cleaner burning fuels, including LNG. Shippers of dry goods to Alaska, Hawaii, and Puerto Rico have taken delivery or have ordered LNG-fueled and LNG-capable vessels from US shipyards in Philadelphia, Pa., and Brownsville, Tex. Harvey Gulf International Marine operates five LNG-powered offshore supply vessels built in Gulfport, Miss.

Depending on LNG conversions, the global LNG bunker fuel market could grow to several billion dollars by 2030. If US LNG producers were to supply a significant share of this market—on the strength of comparatively low LNG production costs—LNG bunkering could increase demand for US natural gas production, transportation, and liquefaction. While vessel conversion to LNG fuel may increase demand for US-produced natural gas, however, it partially could be offset by reduced demand for US-produced crude oil or refined products. Furthermore, while LNG can reduce direct emissions from vessels, fugitive emissions and environmental impacts from natural gas production and transportation could reduce overall emissions benefits.

The overarching consideration about LNG bunkering in the US is uncertainty about how the global shipping fleet will adapt to the IMO sulfur standards over time. This uncertainty complicates decisions related to both private investment and public policy.

This article discusses impending IMO standards limiting the maximum sulfur content in shipping fuels, the market conditions in which LNG may compete to become a common bunker fuel for vessel operators, and the current status of LNG bunkering globally.

US IMO obligations

The International Convention for the Prevention of Pollution from Ships (MARPOL) is implemented in the US through the Act to Prevent Pollution from Ships. The US effectively ratified MARPOL Annex VI in 2008 when President George W. Bush signed the Maritime Pollution Prevention Act. The act requires that the US Coast Guard and the Environmental Protection Agency (EPA) jointly enforce Annex VI emissions standards. MARPOL’s Annex VI requirements are codified at 40 CFR §1043. They apply to US-flagged ships everywhere and to foreign-flagged ships operating in US waters.

Emission Control Areas

In addition to its global sulfur standards, MARPOL Annex VI provides for establishment of Emissions Control Areas (ECAs), waters close to coastlines where more stringent emissions controls may be imposed. The North American ECA limits the sulfur content of bunker fuel to 0.1% of total fuel weight, an even lower bar than that set by the IMO 2020 standards. This standard is enforced by Coast Guard and EPA in waters up to 200 miles from shore. Currently, most ships operating in the North American ECA meet the emissions requirements by switching to low-sulfur fuels once they enter ECA waters. The European Union also has an ECA with a 0.1% limit on sulfur in bunker fuels,1 and the Chinese government is considering putting the same standard in place.2

Emissions control options

The IMO 2020 emissions requirement applies to vessels of 400 gross tons and more, estimated to cover about 110,000 vessels worldwide. Analysts indicate, however, that many of the smaller vessels in this group already burn low-sulfur fuel. Accounting for these smaller vessels, one estimate is that about 55,000 vessels currently burn high-sulfur fuel.3 Ship owners have two main options for meeting the emission requirements with existing engines: burn low-sulfur conventional fuel (or biofuels) or install scrubbers to clean their exhaust gases. Alternatively, ship owners may opt to install new LNG-fueled engines to comply with the IMO standard.

• Low-Sulfur Fuel Oils. The simplest option for vessel owners to comply with the IMO sulfur standards, and the one that appears most popular, is switching to low-sulfur fuel oils (LSFO) or distillate fuels. Although switching to low-sulfur fuels would increase fuel costs compared to conventional, high-sulfur fuels, it would require little or no upfront capital cost and would allow ocean carriers to use existing infrastructure to bunker ships at ports.

• Scrubbers. Retrofitting a scrubber on an existing engine can cost several million dollars before factoring in the lost revenue from taking the ship out of service for a month for the installation. Therefore, while using a scrubber will allow a ship to continue using (currently) cheaper high-sulfur fuel, it may take years to recover the initial investment. For example, one industry study estimates that, in the case of a typical tanker, a scrubber installation could cost $4.2 million with a payback time of about 4.8 years.4 Furthermore, scrubbers installed to capture sulfur emissions might have to be further refitted or replaced to comply with any future IMO standards for greenhouse gas (GHG) emissions.

• LNG-Fueled Engines. Another option for ship owners to comply with the IMO 2020 sulfur standards is to switch to engines that burn LNG. LNG-fueled vessels emit only trace amounts of sulfur oxides in their exhaust gases—well below even the 0.1% fuel-equivalent threshold in some of the ECA zones—so they would be fully compliant with the IMO standards. As a secondary benefit, using LNG as an engine fuel also would reduce particulate matter (PM) emissions relative to both high- and low-sulfur marine fuel oils.5 Furthermore, LNG vessels have the potential to emit less CO2 than vessels running on conventional, petroleum-based fuels. However, LNG vessels could result in more fugitive emissions of methane, another GHG, because methane is the primary component of natural gas.

Installing an LNG-fueled engine can add around $5 million to the cost of a new ship.6 Retrofitting existing ships is less desirable because of the extra space required for the larger fuel tanks (new ships can be designed with the larger fuel tanks).

Fuel costs

Recent energy sector trends suggest that LNG may be cheaper in the long-run than petroleum-based, low-sulfur fuels. The price movements of these two fuel types, however, are correlated to some extent. Many existing long-term LNG contracts link LNG prices to oil prices (although such contract terms are on the decline), even in the spot market.

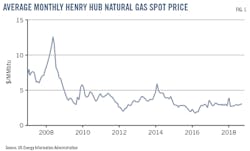

Starting in 2008, shale natural gas production dramatically decreased gas prices in the US. Natural gas spot prices at the Henry Hub—the largest US trading hub for natural gas—averaged around $3/MMbtu in 2018, about a quarter of the peak in average price a decade before, just before the shale gas boom (Fig. 1).7

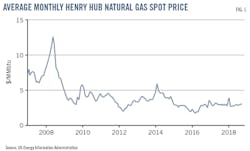

Fig. 2 compares spot prices in the Japan LNG market—the highest-priced LNG market—to spot prices for two common petroleum-based bunker fuels, low-sulfur gas oil and high-sulfur fuel oil (HSFO). Over the last 5 years, Japan LNG generally has been cheaper than low-sulfur fuel and more expensive than high-sulfur fuel on an energy-equivalent basis (per MMbtu). Japan LNG and high-sulfur fuel prices, however, converged in 2018. Spot prices for LNG deliveries to Japan fell below $6/MMbtu in 2016 from a high above $16/MMbtu in 2013. Likewise, low-sulfur gas oil prices have doubled, and HSFO prices have tripled, since 2016.

Although fuel prices as shown in Fig. 2 indicate favorable economics for LNG versus low-sulfur fuel, if prices for HSFO collapse as some expect after the 2020 IMO regulations enter force, it is possible that LNG could lose its price advantage over residual fuel oils. Likewise, the price spread between low-sulfur gasoil and HSFO would increase, incentivizing more carriers to install scrubbers to capitalize on the savings in fuel costs by continuing to burn high-sulfur fuel. An additional complication is the variability of LNG prices by region. Many shipping lines are global operators seeking low-priced fuel worldwide, but unlike the global oil market, natural gas markets are regional. Because the price of LNG can vary significantly by region, the relative economics of LNG versus other bunker fuels would also vary by region.

LNG bunkering overseas

Early adoption of LNG bunkering occurred in Europe, where the first sulfur ECAs were created in 2006 and 2007. Through Directive 2014/94/EU, the European Union required that a core network of marine ports be able to provide LNG bunkering by December 2025 and that a core network of inland ports provide LNG bunkering by 2030.8 This mandate has been promoted, in part, with European Commission funds to support LNG bunkering infrastructure development.9 In addition, the European Maritime Safety Agency published regulatory guidance for LNG bunkering in 2018.10 More than 40 European coastal ports have operating LNG bunkering capability, primarily at locations on the North Sea and Baltic Sea, and in Spain, France, and Turkey. These include major port cities such as Rotterdam, Barcelona, Marseilles, and London. Another 50 LNG bunkering sites at European ports are in development.11

LNG bunkering is also advancing in Asia, led by Singapore, the world’s largest bunkering port. Singapore has agreed to provide $4.5 million to subsidize the construction of two LNG bunkering vessels.12 The Port of Singapore plans to source imported LNG at the adjacent Jurong Island LNG terminal, loading it into bunkering vessels for ship-to-ship fueling in port. Singapore also has signed a memorandum of understanding with 10 other partners—including a Japanese Ministry and the Chinese Port of Ningbo-Zhoushan—to create a focus group aimed at promoting the adoption of LNG bunkering at ports around the world.13 In Japan, one consortium is implementing plans to begin vessel-to-vessel LNG bunkering at the Port of Keihin in Tokyo Bay by 2020.14 Japan’s Nippon Yusen Kaisha (NYK) Line, a large ship-owner, recently announced an agreement with three Japanese utilities to add LNG bunkering to ports in Western Japan.15 Asian countries, together with Australia and the UAE, have around 10 coastal ports offering LNG bunkering, with another 15 projects in development.11

US LNG bunkering

LNG bunkering in the US takes place in two locations—Jacksonville, Fla., and Port Fourchon, La.—with a third bunkering site under development in Tacoma, Wash. LNG bunkering in these ports serves the relatively small US-flag domestic market. Bunkering of LNG-fueled cruise ships also is planned for Port Canaveral, Fla. Ports in North America, however, have significant potential to expand US LNG bunkering capability.

• Jacksonville, Fla. Jacksonville is the largest LNG bunkering-capable US port. One bunkering operation at the port, developed by JAX LNG, began truck-to-ship refueling services in 2016 for two LNG-capable container ships. The LNG comes from a liquefaction plant in Macon, Ga.16

In August 2018, upon delivery of the Clean Jacksonville bunker barge, the site began to replace truck-to-ship bunkering with ship-to-ship bunkering. The barge will be supplied by LNG from a new, small-scale liquefaction plant JAX LNG is building at the port.

A second bunkering operaetion at Jacksonville’s port, operated by Eagle LNG, provides LNG sourced from a liquefaction plant in West Jacksonville. Eagle LNG also is building on-site liquefaction and vessel bunkering infrastructure in another part of the port, expected to begin service in 2019. Taken together, the JAX LNG and Eagle LNG facilities are expected to establish Jacksonville as a significant LNG-bunkering site with the ability to serve not only the domestic fleet but larger international vessels as well.

• Port Fourchon, La. In 2015, Harvey Gulf International Marine began LNG bunkering operations in the Gulf of Mexico to fuel its small fleet of LNG-powered offshore supply vessels serving offshore oil rigs. Harvey has since built a $25 million bunkering site at its existing terminal in Port Fourchon to store and bunker LNG sourced from liquefaction plants in Alabama and Texas. The operation can provide truck-to-ship bunkering services for LNG-fueled offshore supply vessels, tank barges, and other vessels.17 A Harvey subsidiary has ordered two LNG bunkering barges to enable future ship-to-ship fueling.18

• Tacoma, Wash. Puget Sound Energy has proposed an LNG liquefaction and bunkering site at the Port of Tacoma, Wash. Vessels traveling between Washington and Alaska typically spend the entire journey within the 200-mile North America ECA. Consequently, vessel owners operating along these routes have been interested in LNG as bunker fuel. TOTE Maritime, for example, a ship owner involved in trade between Alaska and the Lower 48 states, has begun the process of retrofitting the engines of two of its container ships to be LNG-compatible.

The proposed Tacoma LNG facility would produce up to 500,000 gpd and would include an 8-million gal. storage tank. The terminal would serve the dual purposes of providing fuel for LNG-powered vessels and providing peak-period natural gas supplies to the local gas utility system.19 Its total construction cost is expected to be $310 million.20 Community and environmental concerns have slowed progress, the project still being under regulatory review.21 Puget Sound Energy originally planned to put the LNG facility into service in late 2019; however, permitting issues appear likely to delay its opening until 2020 or later, if it’s eventually approved.22

• Port Canaveral, Fla. Q-LNG Transport, a company 30% owned by Harvey, has placed orders for two LNG bunkering barges to provide ship-to-ship LNG fueling as well as “ship-to-shore transfers to small scale marine distribution infrastructure in the US Gulf of Mexico and abroad.” Q-LNG’s first barge is expected to provide fuel to new LNG-fueled cruise ships based in Port Canaveral (and, potentially, Miami), while service from its second barge is still uncommitted.23 Initial plans are for the LNG to be sourced from the Elba Island LNG plant near Savannah, Ga.—about 230 nautical miles away—though the company may seek to develop an on-site LNG storage capability in the future.24

Other potential US ports

US LNG bunkering thus far has been limited to serving a handful of vessels in domestic trade and tourism. LNG bunkering for the much larger fleet of foreign-flag ships carrying US imports and exports is still to be developed. As in Europe and Asia, domestic ports near major LNG import or export terminals may serve as anchors for expanded LNG bunkering.

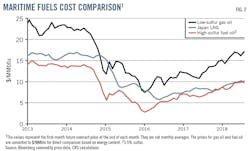

Fig. 3 shows existing LNG terminals and plants in North America. LNG can be liquefied from pipeline natural gas (or imported natural gas) and stored in large quantities at these sites. The LNG can then be bunkered on site or transported to bunkering elsewhere in the region by truck, rail, or barge.

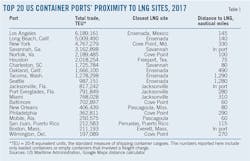

Taking the 230-nautical mile distance between Elba Island and Port Canaveral as a measure of how far away LNG can be sourced and barged economically, it is possible to extrapolate which US ports are within reach of a potential supply of LNG for vessel bunkering. The accompanying table lists the Top 20 US container shipment ports and their proximity to existing LNG plants or terminals. Of these ports, 12 are less than 230 nautical miles from an operating LNG terminal. Distances between LNG terminals and the other east coast ports are not much greater, suggesting that LNG for vessel bunkering could be within reach of every US port along the eastern seaboard and Gulf of Mexico.

On the West Coast, the ports of Los Angeles and Long Beach—the two largest US ports—are relatively close to the Costa Azul LNG import terminal in Ensenada, Mexico. Seattle and Tacoma are far from Ensenada but would be served by the proposed Tacoma LNG bunkering project, if constructed. LNG bunkering for Seattle and Tacoma alternatively could be sourced from an existing LNG port around 100 nautical miles north in Vancouver, BC, which is expanding to provide LNG bunkering services to international carriers. Alaska’s existing LNG export plant is inactive, but could supply LNG bunker fuel in the Pacific Northwest as well.25

Although existing LNG import terminals and export plants in North America could supply LNG for regional bunkering operations, such activities would require additional investment such as LNG transfer infrastructure and bunker barges. Congressional Research Service is not aware of any public announcements among the LNG terminals discussed to develop bunkering operations. But at least one LNG plant owner, Cheniere Energy, which operates in Louisiana and Texas, identifies vessel bunkering as a source of future LNG demand growth worldwide.26

Global LNG supply

World LNG production has been rising rapidly over the last few years, driven by growth in the natural gas sector in new regions, especially Australia and the US. Collectively, LNG supply from new liquefaction projects could exceed projections of demand, which would put downward pressure on LNG prices. While increases in the global supply of LNG do not necessarily translate directly into an increase in LNG available for bunkering, such increases could provide options for LNG bunkering in more ports.

Estimating potential demand for LNG in the maritime sector is complicated and uncertain. One study of future LNG demand for bunkering projects that LNG-powered vessels in operation and under construction as of June 2018 will require 1.2-3.0 million tonnes/year (tpy) of LNG. The study’s review of several LNG consumption forecasts in the maritime sector shows a consensus projection of 20-30 tpy by 2030.27 This level of demand growth implies an increase in LNG-powered vessel construction from the current rate of around 120 ships/year to between 400 and 600 new builds per year.

If these levels were reached, they could create a significant new market for LNG suppliers. Assuming a Henry Hub spot market price of $4/MMBtu in 2030, the annual market for LNG in shipping could be worth $2.9-5.8 billion, before accounting for liquefaction and transportation charges. Some studies have projected the LNG bunkering market to be even larger and to grow more quickly.28 But key variables—such as the prices of natural gas and crude oil, the number of new vessel orders, and the future costs of emissions technology—are hard to predict with accuracy. Thus, it is not assured that natural gas consumption in the maritime sector will absorb more than a small amount of the global liquefaction in development.

As of October 2018, LNG prices were substantially lower in North America than in Asia, Europe, and South America. Even after adding $1-2/MMBtu to transport the LNG to overseas ports, LNG produced in the US is globally competitive.

If LNG from the new liquefaction capacity coming online can be produced and delivered with similar economics, the cost advantage may create an opportunity for US LNG in bunker supply. There are over 400 petroleum fuel bunkering ports in the world, but 60% of bunkering in recent years has happened in six countries: Singapore, the US, China, the UAE, South Korea, and the Netherlands.29 Of these countries, only the US is a significant LNG producer. Therefore, the US could be a favorable source of LNG for both domestic bunkering and, via export, bunkering at the other major ports.

US opportunities

Depending on adoption in the global fleet, the LNG bunker fuel market could grow to several billion dollars by 2030. If US LNG producers were to supply a significant share of this market—on the strength of comparatively low LNG production costs—LNG bunkering could increase demand for US natural gas production, transportation, and liquefaction.

Opportunities in LNG-related shipbuilding might be more limited, as most of this occurs overseas, with the exception of Jones Act vessels. In the latter case, demand for domestically-constructed LNG bunkering barges could be one significant area of economic growth.

Engineering and construction firms could benefit from opportunities to develop new port infrastructure for LNG storage and transfer. While likely limited in number, such infrastructure could be complex, costing tens or hundreds of millions of dollars to complete.

Although LNG bunkering could present the US with new economic opportunities, it may pose problems as well. Rising demand for LNG in the maritime sector could increase natural gas prices for domestic consumers. In addition to being the world’s largest natural gas producer, as of 2018, the US is also the world’s largest producer of crude oil and the second largest bunkering hub.30 Consequently, while vessel conversion to LNG bunkering may increase demand for US-produced natural gas, it could be partially offset by reduced demand for US-produced crude oil or refined products. Exactly how changing demand in one sector could affect the other is unclear. Furthermore, while LNG can reduce pollutant emissions from vessels, emissions and environmental impacts from increased natural gas production and transportation could increase overall emissions. Much of the net environmental impact depends on practices in the natural gas industry subject to ongoing study and debate. Although new LNG bunkering infrastructure can create jobs, as the Tacoma LNG projects shows, the construction of such sites can be controversial for safety, security, and environmental reasons.

Overarching these considerations is uncertainty about how the global shipping fleet will adapt to the IMO sulfur standards over time. This uncertainty complicates decisions related to both private investment and public policy.

References

1. European Maritime Safety Agency, “Sulphur Directive,” http://www.emsa.europa.eu/main/air-pollution/sulphur-directive.html

2. International Bunker Industry Association, “China Announces New Emissions Control Areas (ECAs),” Dec. 20, 2015.

3. Grati, H., “Bunker Fuel in 2020,” IHS Markit, Nov. 7, 2017.

4. Jordan, J. and Hickin, P., “Tackling 2020: The Impact of the IMO and How Shipowners Can Deal With Tighter Sulfur Limits,” Shipping Special Report, Platts, May 2017, p. 5.

5. Thomson, H., Corbett, J.J., Winebrake, J.J., “Natural Gas as a Marine Fuel,” Energy Policy, Vol. 87, December 2015, p. 154.

6. Saul, J. and Chestney, N., “New Fuel Rules Push Shipowners to Go Green with LNG,” Reuters, Aug. 15, 2018.

7. US Energy Information Agency (EIA), “Henry Hub Natural Gas Spot Price,” June 27, 2018.

8. European Union, “Directive 2014/94/EU of the European Parliament and of the Council,” Article 6, Sections 1 and 2, Oct. 22, 2014.

9. LNG World News, “EU Approves Investment in LNG-bunkering Studies Across Europe,” Apr. 25, 2017.

10. European Maritime Safety Agency, “Guidance on LNG Bunkering to Port Authorities and Administrations,” Jan. 31, 2018.

11. DNV GL, “Alternative Fuels Insight,” online mapping system, https://afi.dnvgl.com/

12. LNG World News, “Singapore’s MPA Awards Grant for Two LNG Bunkering Vessels,” June 4, 2018.

13. Maritime and Port Authority of Singapore, “LNG Bunkering (Pilot Programme),” Dec. 4, 2017.

14. Institute of Energy Economics Japan (IEEJ) and Energy Policy Research Foundation Inc. (EPRINC), “The Future of Asian LNG 2018,” October 2018, p. 32.

15. World Maritime News, “NYK, Partners to Explore Commercialization of LNG Bunkering in Western Japan,” Aug. 3, 2018.

16. Corkhill, M., “Jacksonville, the Premier US LNG Bunkering Port, Moves into Higher Gear,” LNG World Shipping, Apr. 17, 2018.

17. Hellenic Shipping News, “Harvey Bankruptcy Put US LNG Bunkering in Focus,” Mar. 14, 2018.

18. Jiang, J., “Harvey Gulf Orders Second LNG Bunkering Vessel at VT Halter,” Asia Shipping Media, Aug. 30, 2018.

19. Ecology and Environment Inc., “Proposed Tacoma Liquified Natural Gas Project: Draft Supplemental Environmental Impact Statement,” prepared for Puget Sound Clean Air Agency, Oct. 8, 2018, p. 1.

20. Nunnally, D., “PSE to Discuss LNG Plans at Nov. 21 Convention Center Event,” News Tribune (Tacoma, Wash.), Nov. 3, 2016.

21. Cockrell, D., “Tacoma and Tideflats’ Future Take Center Stage at LNG Hearing, Council Meeting,” News Tribune, Oct. 31, 2018.

22. Ruud, C., “Tacoma LNG Plant Has ‘Potentially Significant’ Permitting Issues. Opening Could Be Delayed,” News Tribune, May 11, 2018.

23. Corkhill, M., “Q-LNG to Order Second Articulated Tug Barge Bunker Vessel,” LNG World Shipping, Sept. 4, 2018.

24. Berman, D. and Price, W.T., “LNG Cruise Ship Coming to Port Canaveral Fuels Concerns of Some Local Residents,” Florida Today, Sept. 14, 2018.

25. SIGTTO News, “Kenai Calls It a Day,” No. 38, Autumn 2017.

26. Barr, M., “LNG Market Outlook,” Cheniere Energy Inc., presentation to National Association of State Energy Officials annual meeting, Sept. 18, 2017, p. 12.

27. LeFevre, C.N., “A Review of the Demand Prospects for LNG as a Marine Fuel,” The Oxford Institute for Energy Studies, Paper NG 133, June 2018, pp. 17-18.

28. Zion Market Research, “LNG Bunkering Market by Vessel…Comprehensive Analysis and Forecast, 2017-24,” Aug. 1, 2018.

29. Organization of the Petroleum Exporting Countries (OPEC), “World Oil Outlook 2015,” p. 127.

30. US EIA, “The United States is now the Largest Global Crude Oil Producer,” Sept. 12, 2018.