Sharjah in 2018 became the latest United Arab Emirates monarchy to offer licensing rounds, seeking international partners for exploration and development. The offer follows licensing rounds by Abu Dhabi and Ras al Khaimah (RAK).

Sharjah’s acreage is more prone to natural gas than oil, although Sharjah National Oil Co. (SNOC) said a “tested oil well” exists outside the licensing round areas.

Envoi Ltd., London, assisted (SNOC) in licensing-round logistics on behalf of Sharjah Petroleum Council National Oil Corp. (SPC) to advance exploration and development in the Thrust Zone trend, featuring naturally fractured carbonate reservoirs.

The emirate will award licenses under 30-year terms with a 10-year extension option. The exploration term is separated into three 2-year periods. Gas production declines and associated power plant fuel shortages contributed to electric outages in Sharjah within the last decade.

Tom Quinn, Wood Mackenzie Ltd. senior research analyst in London, told OGJ, “Sharjah struggles to meet summer peak electricity demand using gas so it has used liquid fuels for power generation.”

SNOC signed a memorandum of understanding with Uniper in 2016 to import LNG into Hamriyah port and supply gas to power plants operated by Sharjah Electricity and Water Authority (SEWA). Uniper of Dusseldorf, Germany, is involved with power generation projects, primarily in Europe and Russia.

Sharjah plans installation of a floating storage and regasification unit (FSRU) outside Hamriyah port. The FSRU tentatively is scheduled to start operating by early 2020. Uniper Technology has invited tenders for the engineering, procurement, and construction contract.

Concession areas

Winning bidders will have access to SNOC’s existing infrastructure, gas-condensate processing plants, and export terminals. SNOC said future production from licensing round acreage can be tied into existing infrastructure to enable early cash flow for international gas producers.

Discoveries can be commercialized rapidly because SNOC is willing to buy new production. Sharjah officials developed new fiscal terms to ensure positive returns for investors. Licensing round documents said, “even small discoveries would be commercial.”

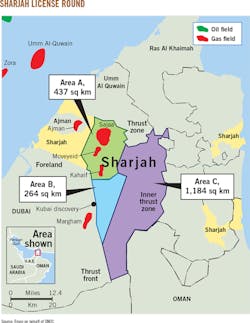

Fig. 1 shows areas Areas A and C in which SNOC offered 75% interest to bidders, along with operatorship. Partners will carry SNOC through exploration and appraisal, recovering costs during development. There are no bonuses on these areas.

SNOC plans to operate Area B, where it plans to drill its first well, and retain 50% interest with no carry. Non-operated interests in Area B are available.

Bids, based on drilling commitments, closed in late 2018 and winning bidders are expected to be announced in 2019. Companies selected to help develop Sharjah’s fields will have access to existing gas and condensate infrastructure as well as SNOC’s export terminals.

SNOC said 3D seismic data covering 850 sq km improved imaging of the fold thrust belt in Areas A and B. Seismic surveys shot in 2016 and processed in 2017 indicated potentially large undrilled prospects, SNOC said.

Some wells previously drilled based on 2D seismic images were drilled off structure or missed the main Cretaceous Thamama carbonate reservoir in the complex geology, according to SNOC.

Quinn suggested IOCs will show the most interest in Area B because it is the most prospective area and is around existing gas fields.

“Area C is part of an unproven play so it will be one for frontier explorers,” Quinn said.

Exploration history

The license-round area dominates central Musandam Peninsula. Amoco Sharjah Oil Co. discovered gas-condensate fields in Sharjah during the 1980s. Amoco Corp. merged with BP PLC in 1998.

Existing fields (Sajaa, Kahaif, and Moveyeid) have a combined resource estimate of more than 5 tcf but are excluded from the licensing round. SNOC took over operatorship of the three fields in 2013 with expiration of BP’s production license.

Sharjah’s oil and gas exploration started in the 1930s. The Mubarek A-1, drilled in 1972, was the first commercial oil discovery. The well encountered oil in the Cretaceous Thamama and Wasia group platform carbonates offshore in the western Foreland basin.

The reservoir is fractured in faults and salt-related structures. Overlying Upper Cretaceous Nahr Umr and Aruma shales seal the Lower Cretaceous carbonates. Mubarek A-1 produced 60,000 b/d in 1994 but had declined to around 6,000 b/d in early 2000.

Offshore Zora field, discovered with the Sharjah-1 well in 1979, flowed 14 MMscfd on test. The well was not appraised until 1999 when the Sharjah-2 well flowed 41 MMscfd and 452 b/d of condensate on test.

Dana Gas, an independent in Sharjah, operates Zora. Dana has said Zora production dropped to 9 MMcfd in 2017 from 15 million cfd in 2016.

Sharjah’s onshore exploration focuses on the Thrust Zone trend. Amoco discovered gas fields using early 2D seismic in the 1970-80s. Most of the prospective Thrust Front was contained within the 2,428 sq km to which Amoco formerly had 100% interest (OGJ, Apr. 19, 1993, p. 17).

The existing onshore gas development produces sweet gas and condensate from fractured carbonate discoveries in Cretaceous Thamama pay (see map, OGJ, Nov. 2, 1992: p. 26). The fields are as follows:

• Sajaa field (1980 discovery) has estimated resources of 4.6 tcf of gas and 541 million bbl condensate. Gas columns of 2,600 ft were encountered.

• Moveyeid field (1981 discovery) initially had estimated 363 bcf in gas and 25 million bbl condensate. Gas columns of 1,000 ft were encountered. WoodMac’s Quinn said Moveyeid is depleted and could be used for storage. “It would cost Sharjah billions to fill Moveyeid with enough cushion gas to use it as flexible gas storage,” Quinn said.

• Kahaif field (1991 discovery) has estimated 553 bcf and 19.3 million bbl condensate.

Area A contains all three fields, which are excluded from the licensing round. An undeveloped deeper-pool gas discovery below Sajaa is being offered. That discovery has yet to be appraised.

SNOC owns and operates 53 wells across the three fields linked to two storage and export terminals at Hamriyah. First-year production from these wells has averaged more than 40 MMscfd plus condensate although some wells initially exceeded 10 MMscfd.

WoodMac estimates Sharjah produces around 40 MMcfd of gas and 4,000 b/d of condensate although Quinn said the numbers had not been verified by the emirate or SNOC.

Gas produced from these fields contains hydrogen sulfide (H2S), highest at Kahaif, where an average 500 ppm required installation of a sweetening plant that has additional capacity for H2S from future discoveries.

Ongoing exploration

Since BP left in 2013, RAK Petroleum has explored the Thrust Zone trend. RAK Petroleum PLC took operatorship of a 34 sq km East Sajaa concession in 2008. One well was drilled but did not reach the target Thamama reservoir.

Crescent Petroleum, based in Sharjah, and Russia’s Rosneft Oil Co. also have explored onshore Sharjah.

The Al Owaid-1 well encountered oil in the Cretaceous and produced oil to surface on test. This well now is interpreted to have penetrated the stratigraphy in the previously undrilled Inner Thrust Zone immediately east of the main Thrust Front. It appears to have a different source origin and may be evidence of a separate play although no additional work has been completed to confirm this, Envoi said.

Sharjah’s oil industry previously believed hydrocarbons came from a Jurassic source rock of the Cretaceous play.

Closure of the Tethys Ocean resulted in deposition of Cretaceous passive margin shallow-water carbonates. Transition east to a more distal deposition is represented by the deepwater Hawasina and Sumeini group, found in overthrusts west of the current licensing round.

Sharjah holds additional exploration potential in the shallow Tertiary Pabdeh play, near commercial production from a stratigraphic Eocene closure. Some offshore areas may also have potential. SNOC said future offshore licensing rounds are likely.

Other emirates’ rounds

RAK launched its first petroleum licensing round in April 2018, offering four shallow water blocks and three onshore blocks. The blocks on offer include highly prospective exploration opportunities, an undeveloped oil discovery, and a mature gas condensate redevelopment opportunity, RAK government officials said.

Bids for the licensing round closed in November 2018. A new exploration and production sharing agreement will govern petroleum rights for the round.

“Ras al Khaimah has significant remaining oil and gas potential within its diverse petroleum geology in both the onshore and offshore acreage,” Nishant Dighe, chief executive officer of RAK Gas, said.

Various contracts for Abu Dhabi licenses were signed on the sidelines of the Abu Dhabi International Exhibition & Conference (ADIPEC) in November 2018. Total SA is working with Abu Dhabi National Oil Co. (ADNOC) on unconventional gas development.

Total signed a contract for 40% interest in Ruwais Diyab unconventional gas license, covering 6,000 sq km. ADNOC holds 60% of the project, expected to produce 1 bcfd by 2030.

The Ruwais Diyab contract allows for two exploration and appraisal phases for a period up to 7 years, followed by a 40-year development and production period, Total executives said.

Ruwais Diyab’s unconventional resources are estimated at 14 tcf of gas in place.

Wintershall announced it received a 10% stake in Abu Dhabi’s offshore Ghasha sour gas concession in which Eni already has a 25% stake. ADNOC plans to build a 1.6 bcfd processing plant at Ruwais to handle sour gas.

Since 2012, Wintershall has appraised Abu Dhabi’s Shuwaihat field, but has not yet developed the onshore-offshore field.

Abu Dhabi officials have said development of sour gas resources is part of the UAE’s gas self-sufficiency strategy.

About the Author

Paula Dittrick

Senior Staff Writer

Paula Dittrick has covered oil and gas from Houston for more than 20 years. Starting in May 2007, she developed a health, safety, and environment beat for Oil & Gas Journal. Dittrick is familiar with the industry’s financial aspects. She also monitors issues associated with carbon sequestration and renewable energy.

Dittrick joined OGJ in February 2001. Previously, she worked for Dow Jones and United Press International. She began writing about oil and gas as UPI’s West Texas bureau chief during the 1980s. She earned a Bachelor’s of Science degree in journalism from the University of Nebraska in 1974.