OGJ Newsletter

GENERAL INTERESTQuick Takes

UT: Recoverable gas from future US shale wells on rise

A new analysis of the nation’s major shale gas plays shows 20% more natural gas can be technically recovered from future wells compared with an estimate made 5 years ago. Researchers primarily attributed the increase to new drilling practices.

The analysis by the University of Texas at Austin’s Bureau of Economic Geology examined production capabilities and estimated total gas in the Barnett, Fayetteville, Haynesville, and Marcellus plays. The study updated 2011-13 findings.

Svetlana Ikonnikova, the principal investigator of the study and a research scientist at the bureau, noted that developments in drilling technologies, market conditions, cost structures, and improvement in geological characterization prompted the updated assessment.

“Five years ago, we hardly thought of multilayer or stacked well drilling, or of quadrupling lateral well length,” she said. The team used 3D modeling and advanced data analytics to enhance the understanding of geologic reservoir characterization, individual well decline and recovery analysis, individual well geology and engineering improvements that increase productivity, and economically recoverable resource assessment.

Researchers found future wells in the four shale gas plays can technically recover about 780 tcf of gas in addition to 110 tcf already recovered by wells drilled by Dec. 31, 2017. The previous study found 650 tcf of technically recoverable gas.

Based on US gas consumption of 27 tcf in 2017, the new estimate suggests the addition of about 5 years of US consumption.

The projected increase comes largely from new drilling practices that increase recovery, reduce per-unit cost, and allow companies to continue drilling even during periods of low oil or natural gas prices.

New methods include stacked drilling, drilling wells closer together, and horizontal wells that can run for about 2 miles.

EIA: US crude, NGL output broke records in November

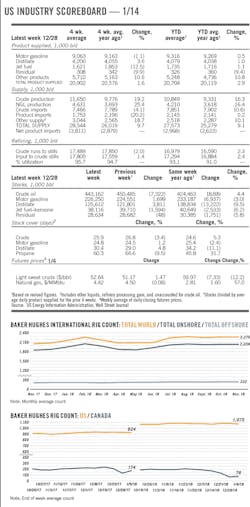

US crude oil and natural gas liquids production broke records in November and the first 11 months of this year, the US Energy Information Administration reported. November’s total US crude production averaged nearly 11.7 million b/d, 15.7% higher than a year earlier, as NGL production for the month climbed 11.2% to an average of almost 4.6 million b/d during the same period, EIA said.

Reported total US crude production through Nov. 30 averaged more than 10.8 million b/d in 2018, 16.4% more than the monthly average of almost 9.3 million b/d for the comparable 2017 period, according to figures from EIA’s December 2018 Monthly Energy Review. Average monthly NGL production through November of more than 4.3 million b/d was almost 14.8% more than average monthly NGL production in 2017’s first 11 months, it said.

EIA’s figures confirmed findings in the November Monthly Statistical Report, which the American Petroleum Institute released a day earlier.

US oil production averaged a record 11.6 million b/d as NGL production also broke a record at an average 4.8 million b/d. Crude oil exports also hit a record high at 2.4 million b/d during the month and US petroleum net imports fell to their lowest monthly level in more than 50 years at 2.2 million b/d, it added.

“Robust American energy production has solidified the United States’ position as the world’s No. 1 oil producer; this has enhanced our energy security, economy, and benefitted consumers at home and aboard,” API Chief Economist Dean Foreman said at the time. “Importantly, record NGL production of 4.8 million b/d in November also made the US gas industry the world’s No. 4 oil producer, narrowly edging out Iraq.

“To continue this success in 2019 and beyond, the industry needs policies to foster access to resources, investment in domestic and export infrastructure, a level playing field through cogent energy policies, and trustful international trade relations,” he said.

DNO hands over operatorship of Oman Block 8

DNO ASA subsidiary DNO Oman Block 8 Ltd. has relinquished operatorship and participation in Oman Block 8 to the Oman’s Ministry of Oil and Gas and state-owned Oman Oil Co. Exploration & Production LLC (OOCEP).

“Since inception, Block 8 has produced 35 million bbl of oil and 285 bcf of gas, generating the Sultanate of Oman about $1 billion in total revenues,” said DNO Managing Director Bjorn Dale during the handover ceremony.

Offshore Block 8, which contains Bukha and West Bukha fields, produced an average of 4,458 boe/d during 2018.

Effective Jan. 4, with the expiry of the 30-year commercial term of the exploration and production-sharing agreement, Block 8 will be operated by the Musandam Oil & Gas Co., fully owned by OOCEP.

US FERC commissioner McIntyre dies

Kevin J. McIntyre, a member of the US Federal Energy Regulatory Commission who cut short his tenure as chairman for health reasons in October 2018 but remained a member, died on Jan. 2. He was diagnosed and treated for brain cancer in 2017 before US President Donald Trump nominated him to chair the commission.

While chairman, McIntyre led several initiatives, including an inquiry into whether to revise FERC’s pipeline certification process, and an agreement with the US Department of Transportation’s Pipeline and Hazardous Materials Safety Administration to coordinate the siting and safety review of LNG facilities under the commission’s jurisdiction.

Neil Chatterjee, who had succeeded McIntyre as FERC’s chairman, said, “During his tenure at the commission, Kevin exhibited strong leadership and an unmatched knowledge of energy policy and the rule of law.”

FERC noted that before joining the commission, McIntyre co-led the global energy practice at the Jones Day law firm, where he practiced for most of his nearly 30-year legal career. His work for energy clients spanned administrative and appellate litigation, compliance and enforcement matters, and corporate transactions.

Exploration & DevelopmentQuick Takes

India offering 14 blocks in OALP-2

Oil and gas operators may submit bids until Mar. 12 for 14 blocks in India offered under the government’s second round in its Open Acreage Licensing Program (OALP). The Ministry of Petroleum and Natural Gas opened OALP-2 bidding on Jan. 7.

It’s offering nearly 30,000 sq km under revenue-sharing terms introduced in 2016 with its Hydrocarbon Exploration and Licensing Policy, which replaced the New Exploration Licensing Policy. Operators nominated 10 of the blocks newly on offer. The government added four blocks on the basis of data from a seismic program and resource assessment.

Eight of the blocks are onshore, four in the Mahanadi basin in Odisha, two in the Cambay basin in Gujarat, and one each in the Rajasthan basin of Rajasthan and Cauvery basin in Tamil Nadu.

Two offshore blocks each are offered in the Andaman and Kutch basins, and one offshore block each is offered in the Krishna Godavari and Mahanadi basins.

The Directorate General of Hydrocarbons takes bids through an electronic portal and provides bidding instructions. The ministry said it expects to launch a third OALP round, offering 23 onshore and offshore blocks covering about 32,000 sq km, “within the next few weeks.”

After the first OALP round, it signed contracts for 55 blocks covering 59,000 sq km with six operators, all from India.

Gemba-1 success points to new Cooper basin play

Senex Energy Ltd., Brisbane, completed a test at its Gemba-1 wildcat in 100%-owned Cooper basin permit PEL 516 with a stabilized flow rate of 8 MMcfd and raised the potential of a new play in the Permian-age Dullingari group sediments.

The well is on the southwest margin of the Allunga Trough, close to existing infrastructure and about 37 km southwest of the Moomba processing facility in South Australia.

Gemba-1 was designed to evaluate the Patchawarra sands which it did successfully and then went on to intersect gas in the deeper Dullingari sands that the company says represents a potential new gas play.

Following a seven-stage hydraulic fracturing program across the interval 2,360-2,730 m in November, Senex conducted a 7-day flow test and recovered a total of 44 MMcf of gas and 88 bbl of liquids. The gas has a 20% carbon dioxide content.

Preliminary interpretation of the results indicates that the predrill estimate of 15 bcf of ultimate gas recovery may be conservative. The firm will undertake an extended production test across each of the intervals this year to further assess the reservoir, gas deliverability, and ultimate recovery for each zone.

A development plan will then be developed based on the results, with potential for first gas sales from Gemba by yearend.

Senex was granted $5.26 million (Aus.) in funding from the South Australian Government through the second round of the PACE Gas Grant Program to progress the Gemba project.

Lundin Norway exploration well comes up dry

Lundin Petroleum AB subsidiary Lundin Norway AS will plug and abandon Silfari exploration well 6307/1-1S in PL830 in the Norwegian Sea. The well was dry.

The main objective of the well was to test the reservoir properties and hydrocarbon potential of the Jurassic and Permian formations in the frontier Froan basin, next to the Froya High in the Norwegian Sea. The well encountered good reservoir sands in the targeted Jurassic formation but with no hydrocarbon indications. In the second target, no reservoir intervals or hydrocarbons were encountered.

This well—the first in the Froan basin area—provided significant data points as to the geology of the basin, which will be analyzed to determine any further prospectivity, the company said. The potential of the undrilled, adjacent Froya High area is unaffected by the Silfari result.

Lundin Norway is operator of PL830 with 40%. Partners are Equinor, Neptune Energy, and Petoro with 20% each.

The well was drilled with the Ocean Rig Leiv Eiriksson semisubmersible drilling rig, which will next drill exploration well 7121/1-2 S on the Pointer-Setter prospect in PL767, southeast of the Alta-Gohta discovery in the southern Barents Sea.

The Pointer-Setter prospect contains two distinct lower Cretaceous sandstone targets with estimated total gross unrisked prospective resources of 312 million boe. Lundin Norway is operator of PL767 with 50%. Partners are INPEX, 40%; and DNO, 10%.

Cairn group begins FEED at SNE field off Senegal

The Cairn Energy-led group offshore Senegal has begun front-end engineering and design (FEED) work for the first phase of the proposed development of the SNE oil field (OGJ Online, Oct. 26, 2018). The work follows the award of the subsea FEED contract to Subsea Integration Alliance, an international partnership between OneSubsea, Schlumberger, and Subsea 7.

Feed work includes activities required to finalize the costs and technical definition for the proposed development leading to a final investment decision that is targeted for mid-2019.

The development concept for SNE involves a stand-alone floating production, storage and offtake vessel with supporting subsea infrastructure. It will be designed to enable SNE development in phases, including options for sending associated gas to shore and for future subsea tie-backs from other reservoirs and fields.

Phase 1 will target an estimated 230 million bbl of oil reserves from the lower, less complex reservoirs and an initial phase in the upper reservoirs. Production will be from 11 wells and there will be 10 water injection wells and two gas injection wells.

The FPSO will have a capacity of 100,000 b/d and the field is expected to be brought on stream in 2022.

The start of FEED follows approval by the Senegalese Minister of Petroleum and Energies for Perth-based JV member Woodside Petroleum Ltd. assuming the role of development operator.

In parallel with FEED, the JV will continue to progress project financing and the environmental and social impact assessment for the project. SNE field was discovered in 2014 and was the first field discovered offshore Senegal.

Drilling & ProductionQuick Takes

BP lets contract for Atlantis Phase 3

BP PLC has let a contract to TechnipFMC to provide integrated engineering, procurement, construction, and installation services for the Atlantis Phase 3 project in the Gulf of Mexico. BP recently approved a $1.3-billion expansion at the field (OGJ Online, Jan. 8, 2019). BP operates Atlantis and holds 56% interest while BHP holds 44% interest. BHP has yet to commit to a final investment decision.

Following FIDs from all partners, TechnipFMC will manufacture, deliver, and install subsea equipment, including subsea tree systems, manifolds, flowline, umbilicals and subsea tree jumpers, pipeline end terminations, subsea distribution and topside control equipment. The contract includes provisional services for tooling and personnel.

Atlantis Phase 3 field, which lies 150 miles south of New Orleans in 2,100 m of water, will be tied back to the existing platform. It is scheduled to come on stream in 2020.

Eni agrees to acquire 70% Oooguruk stake

Eni SPA says its prospective acquisition of a 70% interest in Oooguruk oil field in the Beaufort Sea offshore Alaska will complement work at nearby Nikaitchuq oil field.

It has agreed to acquire the interest from Caelus Natural Resources Alaska LLC and become operator. It now holds 30%.

Oooguruk produces about 10,000 b/d of oil from 25 wells on a gravel island in 1½ m of water 5 km off the North Slope. The field also has 15 gas and water injector wells.

Eni has a 100% working interest in Nikaitchuq oil field, in 3 m of water about 13 km northeast of Oooguruk field. Nikaitchuq produces 18,000 b/d of oil. Its development includes wells drilled directionally from onshore and from an artificial island.

Citing “important operational synergies and optimizations between Oooguruk and Nikaitchuq,” Eni said it plans to drill more production wells in both fields.

Oil flow increases at Iraq’s Halfaya field

Oil production at Halfaya field in southern Iran increased to 370,000 b/d after start-up of a new processing facility, an official of Maysan province told Reuters.

The field, operated by PetroChina, had been producing 270,000 b/d (OGJ Online, Aug. 21, 2014).

The 200,000-b/d processing unit will help production rise to a targeted 470,000 b/d, the official said. Expansion will include a 300-MMscfd of gas plant.

PROCESSINGQuick Takes

Shell wraps Geismar alpha olefins expansion project

Shell Chemical LP has commissioned its $717-million project to increase alpha olefins production at its Geismar, La., chemical manufacturing plant along the Mississippi River, about 20 miles south of Baton Rouge (OGJ Online, June 6, 2017).

Initially started up in December 2018, the 425,000-tonne/year capacity expansion brings total AO production at Geismar to more than 1.3 million tpy, Royal Dutch Shell PLC said.

Part of Shell’s strategy to further integrate its downstream business, the newly commissioned expansion—which makes Geismar the largest AO production site in the world—is supplied with price-advantaged ethylene feedstock from the operator’s nearby Norco, La., and Deer Park, Tex., manufacturing sites, enabling Geismar to respond to market conditions.

The expansion project, which uses Shell’s proprietary Shell higher olefins process (SHOP) technology, included installation of 3,570 tonnes of steel, 18,290 m of concrete, and 85 linear km of pipe, the company said.

Several new pieces of infrastructure also were built as part of the expansion, including a water-cooling tower, a sizable expansion of the site’s rail loading capabilities, and the repurposing of a previously idled tank farm, the operator said.

Hanwha Total lets contract for Daesan complex

Hanwha Total Petrochemicals Co. Ltd., a 50-50 joint venture of Hanwha Group and Total SA, has let a contract to W.R. Grace & Co. to provide technology licensing for a grassroots polypropylene (PP) unit at its Daesan petrochemical complex in Chungnam Province, South Korea, about 145 km from Seoul.

As part of the contract, Grace will license its proprietary UNIPOL PP process technology as well as its CONSISTA catalyst for the 400,000-tonne/year unit, the service provider said.

The PP unit is slated to begin operations in 2021, Grace said.

This newest order follows Hanwha Total Petrochemicals’ December 2018 announcement that it will invest nearly $500 million to expand the polyethylene capacity at the Daesan complex by 60% to 1.1 million tpy by yearend 2020, which will also increase ethylene capacity at the site by 10% to 1.5 million tpy.

Designed to take advantage of competitively priced propane feedstock abundantly available due to the US shale gas revolution, the planned ethylene-PE investments will better position the Daesan complex to capture margins across the propylene-PP value chain as it currently does in the ethylene-PE value chain, as well as allow the complex to meet local demand and supply Asia-Pacific’s fast-growing polymers market.

SemCAMS inks processing deal for Wapiti gas plant

Calgary-based SemCAMS ULC, a subsidiary of SemGroup Corp., Tulsa, has entered a long-term agreement with the Canadian subsidiary of an unidentified international oil and gas company to process sour gas production at its 200-MMcfd gas processing plant now under construction to serve Montney producers in the Wapiti region of the Western Canadian Sedimentary Basin (OGJ Online, Aug. 17, 2016).

The take-or-pay deal secures 70 MMcfd of Montney gas for a 10-year term for the Wapiti gas plant, which is slated for startup in this year’s first quarter and is now 95% contracted.

The new agreement follows SemCAMS’s previous announcement that it will build a separate sour gas plant to serve Montney producers in the Pipestone region of the Western Canadian Sedimentary Basin (OGJ Online, Aug. 11, 2017).

The new 280-MMcfd Pipestone Central plant will be connected to the Wapiti gas plant via the Pipestone pipeline, which is currently under construction and scheduled to begin gathering gas from the Pipestone area in this year’s fourth quarter.

TRANSPORTATIONQuick Takes

Prelude floating LNG project comes on stream

Shell Australia’s Prelude floating LNG (FLNG) project in the Browse basin off northwest Western Australia has started production. The company reported it had opened the subsea wells in the field to enter the project’s start-up and ramp-up phases, the initial stages during which gas and condensate is produced and moved through the giant facility.

Ramp-up will be followed by stabilization of the facility to ensure reliable production of LNG, LPG, and condensate.

The first export cargo of LNG is not expected for several weeks as the company gradually runs through its technical procedures.

Shell said its initial focus is on providing a controlled environment to ensure Prelude will operate reliably and safely.

The 600,000-tonne floating facility, which is the world’s largest FLNG vessel, is 475 km north-northeast of Broome. It is permanently moored and will be on location for 20-25 years.

Nameplate LNG capacity is 3.6 million tonnes/year, along with 1.3 million tpy of condensate and 400,000 tpy of LPG.

Mich. governor seeks pipeline replacement plan review

Michigan’s new governor, Democrat Gretchen Witmer, has asked Atty. Gen. Dana Nessel (D) for a legal opinion of recent legislation to replace Enbridge Inc.’s pipeline in the Mackinac Straits and the new Mackinac Straits Corridor Authority (MSCA) created by her predecessor, Republican Rick Snyder.

Witmer said the review is necessary to resolve any legal uncertainty regarding PA 359, the MSCA, and any actions that it takes. “I pledged to take action on the Line 5 pipeline on day one as governor, and I am holding true to that campaign promise,” she said.

Her request came weeks after the MSCA held its inaugural meeting in St. Ignace, where it approved an agreement with Enbridge Energy LP to build a multiuse utility tunnel that will include a crude oil and products pipeline beneath the waters of the straits between Lakes Michigan and Huron (OGJ Online, Dec. 21, 2018).

In her Jan. 1 letter to Nessel, Witmer questioned six aspects of creating a new authority under Public Act 359 of 2018 to oversee the tunnel’s construction instead of using the Mackinac Bridge Authority, which has been in existence since 1950.

“Resolving any legal uncertainty regarding Act 359, the Corridor Authority, and activities of the Corridor Authority is necessary to assure that we can take all action necessary to protect the Great Lakes, protect our drinking water, and protect Michigan jobs,” she said.

PGNiG inks 20-year deal to export US LNG to Europe

Port Arthur LNG LLC, a subsidiary of Sempra Energy, and Polish Oil & Gas Company (PGNiG) entered into a definitive 20-year sale and purchase agreement for liquefied natural gas (LNG) from the Sempra-led Port Arthur LNG liquefaction-export facility under development in Jefferson County, Tex.

The agreement is for 2 million tonnes a year, or approximately 2.7 billion cu m/year (after regasification)—enough natural gas to meet about 15% of Poland’s daily needs, the company said. Under the agreement, LNG purchases from Port Arthur LNG will be made on a free-on-board basis, with PGNiG responsible for shipping the LNG from the Port Arthur terminal to the final destination. Port Arthur LNG will manage gas pipeline transportation, liquefaction processing and cargo loading, giving PGNiG flexibility in cargo management. PGNiG plans to deliver cargos to domestic customers in Poland or trade LNG on the global market, once operations commence.

The liquefaction-export facility—scheduled to receive final environmental impact statement from the Federal Energy Regulatory Commission in January—is proposed to include two natural gas liquefaction trains capable of processing approximately 11 million tpy of LNG; up to three LNG storage tanks; two marine berths, and associated facilities.