Seismic events pause Bowland shale fracturing

Bob Harrison

Lloyd’s Register

London

Tamara Oueidat

PetroVision Energy Services

London

Gioia Falcone

University of Glasgow

Glasgow

Reoccurring seismic events drew attention to the Bowland shale as an emerging UK shale gas play. Operators paused hydraulic fracturing three times in late 2018 after UK government officials lifted a moratorium on hydraulic fracturing, imposed in 2011. Fracturing resumed in October 2018 under close supervision, but minor induced seismic events had again paused fracturing as of December pending more investigation.

Shale gas could be a new domestic energy source in the UK, providing energy security and boosting the economy. Detailed information on the play, still in its exploration and appraisal stages, remains scarce.

Four companies are at the forefront of Bowland drilling and hydraulic fracturing activities: IGas Energy, Ineos Shale, Third Energy, and Cuadrilla Resources. The Bowland play, which stretches across northern England, is a Middle Carboniferous organic-rich deep marine shale, interbedded with shallow water limestones and sandstones.

Estimated resource studies suggest development potential, but without production history, analysts and investors rely upon analogs, usually comparisons with US and Canadian shales, to forecast Bowland recovery.

Wide variations in shale reservoirs, however, create uncertainty regarding analog comparisons of unconventional plays. Analog selection can be subjective, particularly when using reference data from distant US plays for UK shales.1

Geologic parameters considered in analog selection include pressure, temperature, and reservoir rock and fluid properties. But recovery forecasts cannot underestimate factors influencing near urban operational constraints, especially in the UK and other countries with high land use.

This article presents a workflow that addresses these considerations to forecast potential Bowland shale recovery.

Shale activities, England

IGas began evaluating two Nottingham sites—Springs Road and Tinker Lane—in late 2018 following government permission in 2017 to drill, targeting the Gainsborough trough in the East Midlands area.

Ineos shot 3D seismic covering 250 sq km in the same East Midlands area, having acquired interests in onshore petroleum exploration and development licenses (PEDLs) from Total and Engie during 2017.

Farther north in Yorkshire, Third Energy obtained initial planning permission to fracture its Kirby Misperton-8 well after fulfilling all 13 technical requirements stipulated in section 4A of the UK Petroleum Act 1998. But final consent has yet to be granted as the company has not finalized project financing, which prompted a financial resilience review by the Oil & Gas Authority and the Infrastructure and Projects Authority.

Cuadrilla recently resumed fracturing after regulators lifted a temporary suspension of operations, triggered by seismic events. But fracturing was put on pause again in December.

Environmental groups and local residents strongly oppose fracturing in the UK, which has seen protests and operational disruptions at the well sites of Cuadrilla and IGas.

UK horizontal wells

Following numerous mitigation studies and talks with residents, environmental groups, and regulators, privately owned Cuadrilla drilled the UK’s first horizontal shale gas well at its exploration site in Lancashire in April 2018 followed by a second well in July 2018.

A vertical pilot well was drilled through the Upper and Lower Bowland shales to acquire data to locate these two horizontal wells. The first horizontal well was drilled in the Lower Bowland shale to 7,545 ft and extends laterally 2,625 ft. The second horizontal well was drilled through the Upper Bowland shale to 6,890 ft and extends laterally 2,460 ft.

The first horizontal well’s completion included 45 stages at a rate of 1 stage/day for 10 days, then 4 stages/day. This contrasts with US drilling where crews finish 20 stages/day.

In October 2018, Cuadrilla injected the first well with less than 50% of the water normally used in fracturing, but induced seismic events temporarily halted fracturing.

Cuadrilla plans to gradually increase fracturing fluid volumes under internal company supervision. Meanwhile, the government, media, and the public are closely monitoring operations.

UK regulators rejected Cuadrilla’s request to relax the government’s induced-seismic-activity threshold that triggers a halt in fracturing. The company suggested gas exploration would be stifled, but news reports said elected officials believed a rule change could amount to political suicide.2 In November 2018, Cuadrilla announced gas and fracturing water had reached the surface at the Preston New Road site.

Upon completion of fracturining, Cuadrilla plans flow tests on the two wells for 6 months before connecting them to the gas grid during 2019. The company hopes the wells, once fully tested, will demonstrate the Bowland shale can be tapped without compromising safety.

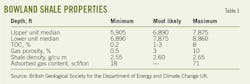

Table 1 shows the different characteristics between the Upper Bowland and the Lower Bowland.

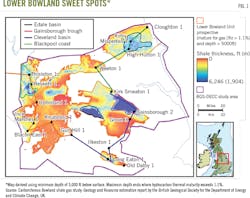

The shale is naturally highly fractured, having been initially deeply buried and then subsequently uplifted. Estimates vary regarding its commercial producibility. A British Geological Survey (BGS) study in 2013, used a volumetric approach to provide in-place resource estimates shown in Table 2, with 80% present in the Lower Bowland Shale.

A study done for the US Energy Information Administration estimated resources at unrisked gas in-place of 632 tscf with a potential recovery factor of almost 20%.3 Other recovery estimates suggest a range of 5-25%. A 10% recovery factor is considered by many to be the most realistic.4

Table 2 shows probabilistic estimates of gas initially in place for the Upper and Lower units of the Bowland shale from Monte Carlo simulation.

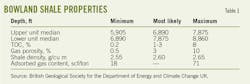

Fig. 1 shows Bowland shale sweet spots having total organic content (TOC) greater than 2%, with thermal maturity (Ro) greater than 1.1, and the gas-generation window below 5,000 ft.

Four regions of thicker shale, believed to have higher production potential, are drilling targets: Edale basin, Gainsborough trough, Cleveland basin, and the Blackpool coast.

A BGS report for the Department of Energy and Climate Change UK (DECC) suggested that the Conasauga shale is analogous to the Bowland shale based on age and structural complexity.5

The Cambrian Conasauga shale in Saint Clair County, Alabama, has an estimated 625 tscf of gas in place, 80% free, but its development has not lived up to expectations.6

The Conasauga shale is structurally complex, deformed by large folds and faults, making it difficult to drill. Several blow outs indicated high-pressure accumulations. The Big Canoe Creek field, for example, was abandoned after producing 187 MMscf of gas, rather than the forecast 1 bscf.7

UK shale gas potential dims if the Conasauga shale is the only analog considered. Other US shale plays might be more appropriate analogs for the Bowland shale.

When considering a potential analog, researchers compare key parameters, both graphically and numerically, to rank which developed shale gas plays are most analogous to the target play. Multiple data sources are investigated for each play to avoid inconsistencies caused by regional differences, dates of data retrieval, or different operational techniques.

It is important to establish a relationship between two formations that extends beyond the static and descriptive reservoir characteristics. Properties that define the development and operations of different plays are compared to assess the analogy’s appropriateness.

Table 3 shows geologic attributes and parameters that were used for analog selection. Authors modified the screening criteria of previous researchers.8

Analysts invariably turn to US and Canadian shales, the world’s most developed unconventional gas formations, when looking for analogs. Constraints should be placed on analog selection, however, so parameters that control production potential and recovery from the analog are equal to or lower than the corresponding values of the target play.9

The study considered 11 shale gas plays:

• Barnett (Texas)

• Woodford (Oklahoma)

• Marcellus (West Virginia, Pennsylvania, New York, Ohio)

• Utica and Point Pleasant (West Virginia, Pennsylvania, New York, Ohio)

• Haynesville (Texas, Louisiana, Arkansas)

• Bossier (Texas, Louisiana)

• Eagle Ford (Texas)

• Fayetteville (Arkansas)

• Montney (Alberta, British Columbia)

• Muskwa (Alberta, British Columbia)

• Conasauga (Alabama)

Authors used radar plots to identify and reject poor analog candidates by showing the poor degree of similarity between quantitative parameters. They rejected six shale plays, leaving the Barnett, Montney, Utica, Marcellus, Fayetteville, and Woodford for additional consideration.

Fig. 2 shows the Marcellus shale has the closest match with the Bowland while the Eagle Ford shale had the poorest correlation from the list of potential analogs.

Authors then compared remaining potential analog candidates with the Bowland shale using minimum, most likely, and maximum values of the key parameters in triangular distributions to encompass the reported range of values.

The overlap between the parameter distributions of the target play and those of the potential analog provides a comfort factor (CF) ranging from 0 to 1, with 0 being completely dissimilar and 1 being exactly alike. The CF weighted average helps determine the best analog for the Bowland.

Researchers shortened the list of analog plays for the Bowland shale to two: the Marcellus has the highest CF value followed by the Fayetteville.

Others have suggested choosing multiple analogs rather than just one to give some measure of variability,10 but the Marcellus was the closest match.11

As the Bowland shale formation has no production history, the authors used information on Marcellus production to generate a type curve to model the estimated ultimate recovery (EUR) per well.

Average EUR values/1,000 ft of lateral drilled came from presentations made by Marcellus shale operators: Antero Resources Corp. of Denver, Blue Ridge Mountain Resources of Irving, Tex., Chesapeake Energy Corp. of Oklahoma City, CNX Energy Corp. of Pittsburgh, Pa., and Eclipse Resources Corp. of State College, Pa.

A wide range of recovery underlines the highly variable nature of unconventional plays. Any EUR values quoted in cubic feet equivalent (bscfe) were converted to bscf at the wellhead.

Empirical models have shown positive correlation between well length and shale gas EUR,10 so the trend can be used to scale Marcellus EUR to assumed Bowland shale lateral length of 500 m (1,640 ft).4

The resulting Bowland shale EUR per well were low, 0.33-1.64 bscf, reflecting the conservative lateral lengths.

UK operational constraints

Any future development will face the obstacles of operating in a densely populated region with traffic congestion and nearby national parks.

Escalating demands on land use will continue to pose difficulties. The Institute of Directors, a London organization for business leaders, estimates a single well pad hosting 10 horizontal wells would require 11 trucks accessing the site every day for the first 2 years of drilling and completion activity.4

Such concerns have led to studies that estimate the likely physical footprint of well pads, if UK shale gas developments proceed, will be constrained by the environment’s carrying capacity resulting in limited resource recovery.12

One study calculated the UK conventional well site footprint to be 2.5 acres (1 hectare), the area per well 5,823 ft, and access road length 755 ft. To assess disruption to existing infrastructure, the researchers placed well pads of the average footprint, with recommended setbacks, randomly into the licensed blocks covering the Bowland shale, showing a 33% probability of interacting with immovable infrastructure. That probability rose to 73% if a 500-ft setback was used, and 91% for a 2,000-ft setback.

The minimum setbacks from current UK production are 70 ft from non-residential and 150 ft from residential property, with mean setbacks of 1,080 ft and 1,465 ft, respectively. When surface and subsurface footprints were considered, the mean land-carrying capacity within the licensed blocks was 26%, which would affect potential recovery of shale gas resources.

The study conservatively assumed a baseline well pad of 1 hectare with a single well drilled from it to a lateral distance of 1,640 ft (500 m). Researchers acknowledged that up to 6 horizontal sections could be drilled from each well.

UK operators might consider well pads covering 2 hectares to accommodate 20 wells or more, although residents and environmental groups may oppose well pads that large.

In comparison, Marcellus operators, who experience far fewer access constraints than UK operators, typically drill 7,000-10,000-ft laterals spaced 750 ft apart. Each pad contains at least 6 wells. The Bowland shale’s EUR could be constrained by land-carrying capacity. Nearly 130 blocks already licensed in northern England feature the Bowland shale. If all were developed assuming the average carrying capacity of 26 well pads per 100 sq km (due to access restrictions), there would be 3,302 well pads.12

UK operators suggest each well pad could accommodate 10 wells,13 which implies 33,020 Bowland shale horizontal wells.

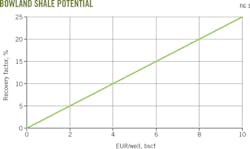

Fig. 3 shows the potential recovery factory for the Bowland shale as a function of EUR per well at an assumed EUR/1,000 ft lateral length of a typical development well as 1,329 tscf estimated gas in place.

References

1. Lee, J., “Oil and gas reserve evaluations,” International Association of Exhibitions and Events (IAEE) conference, Houston, June 17, 2014.

2. Vaughan, A., “Fracking firm boss says it didn’t expect to cause such serious quakes,” The Guardian, Nov. 11, 2018.

3. Kuuskraa, V., Stevens, S., and Moohe, K., “World Shale Gas and Shale Oil Resource Assessment Technically Recoverable Shale Gas and Shale Oil Resources: An Assessment of 137 Shale Formations in 41 Countries outside the United States,” Report prepared for US Energy Information Administration (EIA) by Advanced Resources International Inc., June 2013.

4. Taylor, C., Lewis, D., and Byles, D., “Infrastructure for business--getting shale gas working,” report prepared for the Institute of Directors, London, June 2013.

5. Andrews, I., “The Carboniferous Bowland Shale gas study: geology and resource estimation,” report by the British Geological Society for the Department of Energy and Climate Change, UK. December 2013

6. Pashin, J., Kopaska-Merkel, D., Arnold, A., and Thomas, W., “Gigantic, gaseous mushwads in Cambrian shale: Conasauga Formation, southern Appalachians, USA.” International Journal of Coal Geology Vol. 103, December 2012, pp. 70-91.

7. Drozd, R., “Mystery in the Mushwad: the origin of gas in the Big Canoe Creek Field, Saint Clair County, Alabama, USA,” American Association of Petroleum Geologists (AAPG) Eastern Section annual meeting, Indianapolis, Sept. 20-23, 2015.

8. Hodgin, J., and Harrell, R., “The selection, application, and misapplication of reservoir analogs for the estimation of petroleum reserves,” Society of Petroleum Engineers (SPE) Annual Technical Conference and Exhibition, San Antonio, Tex., Sept. 24-27, 2006.

9. Sidle, R., and Lee J., “An update on the use of reservoir analogs for the estimation of oil and gas reserves,” SPE-International Association for Energy Economics Hydrocarbon Economics and Evaluation Symposium, Houston, January 2010.

10. Charpentier, R., and Cook, T., “Variability of oil and gas well productivities for continuous (unconventional) petroleum accumulations,” AAPG Annual Convention and Exhibition, Houston, Apr. 10-13, 2011.

11. Oueidat, T. “Using unconventional play analogues and recovery constraints to estimate the potential recovery from the Bowland Shale,” 2017 report submitted in partial fulfilment of the requirement for the MSc/DIC, Imperial College, London.

12. Clancy, S., Worrall, J., Davies, R., and Gluyas, J. “An assessment of the footprint and carrying capacity of oil and gas well sites: The implications for limiting hydrocarbon reserves.” Science of The Total Environment Journal, Vol. 618, Mar. 15, 2018, pp. 586-594.

13. Regeneris Consulting, “Economic impact of shale gas exploration & production in Lancashire and the UK,” Report prepared for Cuadrilla Resources, September 2011.

The authors

Bob Harrison ([email protected]) is project director and subsurface technical authority with Lloyd’s Register. Previously, he worked for British Gas and Enterprise Oil and then as a freelance consultant. He gained an MS (1982) in petroleum engineering at Imperial College, London. He is a certified Competent Person, past chairman of the Society of Petroleum Evaluation Engineers (SPEE) Europe Chapter, former member of the SPE Oil and Gas Reserve Committee, and a fellow of the Energy Institute.

Tamara Oueidat ([email protected]) is a petroleum engineer at PetroVision Energy Services. Her work includes integrated field development planning, petrophysical analysis, reservoir modelling and simulation, reservoir performance analysis and optimization, and reserves classification. Oueidat holds a BSc (2016) in geology from American University of Beirut, and a MSc (2017) in petroleum engineering from Imperial College London.

Gioia Falcone ([email protected]) is Rankine Chair, professor of energy engineering at the University of Glasgow. Until June 2018, she was professor and head of the Geo-Energy Engineering Centre at Cranfield University. During 2011 through early 2016, she held the Endowed Chair and Professorship in geothermal energy systems at Clausthal University of Technology, Germany, where she also served as director of the Institute of Petroleum Engineering. Falcone is formerly an assistant and then associate professor in petroleum engineering at Texas A&M University, and Chevron Corp. Faculty Fellow. Previously, she worked with Eni-Agip, Enterprise Oil UK, Shell E&P UK, and Total E&P UK, covering offshore and onshore assignments. She holds a Laurea Summa Cum Laude (1998) in environmental-georesources engineering from Sapienza University of Rome, an MSc (1999) in petroleum engineering from Imperial College London, and a PhD (2006) in chemical engineering from Imperial College London.