European, Russian refineries address 2020 reduced-sulfur bunker rules

Ken Cowell

Tim Bennett

Ramin Lakani

Muse, Stancil & Co.

London

The confirmed reduction in sulfur content for marine bunker fuel to 0.5 wt % by Jan. 1, 2020, from a current 3.5 wt % by the International Maritime Organization (IMO)—the United Nations agency that administers the International Convention for the Prevention of Pollution from Ships (MARPOL), which oversees prevention of pollution of the marine environment by ships—will hugely impact the refining industry’s ability to supply the required volume of low-sulfur fuel oil (LSFO) and dispose of surplus high-sulfur fuel oil (HSFO) that will only be saleable as marine bunker fuel to ships that have flue-gas scrubbers.

While this change will affect refining operations globally, the new IMO regulations will acutely impact European and Russian refineries, which have large surpluses of HSFO that will need to be placed elsewhere in the market. If these refineries don’t find a new outlet for their HSFO and cannot effectively blend or convert it, their future economic viability will become questionable.

Part 1 of this two-part article examined challenges faced by European and Russian refineries and began a discussion of potential mitigation plans under consideration ahead of the 2020 deadline (OGJ, July 2, 2018, p. 52).

This article’s conclusion, presented here, addresses potential mitigation plans for both the refining and shipping industries.

Larger refiners have already invested in upgrading facilities and are hopeful to make reasonable margins from processing their own residue streams and buying HSFO and converting it to lighter products, while US Gulf Coast (USGC) refineries that can buy HSFO as incremental coker feedstock could benefit from the price differentials and import low-cost HSFO from Europe. Russian refineries, however, will continue facing difficulties due to their dependence on Urals as a crude source.

The shipping industry is likely to pursue multiple solutions, including changing to LNG as fuel, although this will have a minor impact on volumes in the short term. A large portion of ships are likely to switch to LSFO or low-sulfur marine gas oil (MGO) initially, with considerable increase in their fuel bills, while a small but increasing percentage will install scrubbers to enable burning lower-cost HSFO.

The scrubber manufacturers have been operating at full capacity during the past couple of years and are likely to increase their business in the coming years. The number of ships that will have scrubbers installed by January 2020, however, is limited.

Interdependent industries

Since the refining industry relies on the shipping industry as an outlet for a large portion of its HSFO product, and the shipping industry relies on the supply of heavy fuel oil (HFO) and MGO from refineries, the dynamics between these two industries and how they react to the IMO changes will influence supply and demand for HSFO.

As electricity generators switch from HSFO to natural gas, the importance of the bunker fuel market will only increase for refiners. Therefore, this article addresses the following key points:

• Refineries need to find a way to dispose of current HSFO production. The obvious solution is to blend high-sulfur residues with low-sulfur distillates to meet the 0.5 wt % limit, but this route poses problems of its own. Another solution would be to process these residues further (e.g., using a coker), but this requires large capital investments.

• Some refineries may switch to lower-sulfur crudes to meet the fuel oil sulfur limits. Most Russian refineries, however, are constrained to use Urals crude and will not have an option to switch to sweeter crudes. Furthermore, the price of sweet crudes is likely to rise, thereby affecting refinery economics.

• The IMO change is global, which will affect an estimated 70,000 existing ships. Shipowners must decide whether to: switch from HSFO to LSFO or MGO, change to LNG fuel, or install exhaust-gas emission cleaners (scrubbers). Each of these options present difficulties and opportunities.

• While distillate or distillate-based, LSFO is likely to be the most sought-after fuel choice for ships, there are questions regarding the price, availability, and compatibility of such blends. A number of large bunker-fuel marketing companies have warned about the potential inability of new blends to meet the quality required for ship engines.

HSFO disposal problem

Global HFO production recently has averaged about 400 million tonnes/year, with almost half of that production currently consumed as marine bunker fuel.

The IMO regulation reducing the maximum sulfur content in marine bunker fuel to 0.5 wt % will be applied globally, while inside emission control areas (ECAs) such as the North Sea or Baltic Sea, this limit is already reduced to 0.1 wt %. The regulation change, however, will pose a particular problem for European and Russian refiners because of the relatively high yield of HFO they produce compared to the refining sectors of other developed countries and the high proportion of production currently consumed as marine bunker fuel.

Potential shipowner solutions

In general, shipowners have three main options to meet the requirements of the 2020 IMO bunker-fuel sulfur emission regulations:

• Fit flue-gas scrubbers to remove sulfur oxides while continuing to burn HSFO.

• Switch to using LNG as a marine fuel.

• Buy 0.5% LSFO or MGO distillate fuel.

Shipping industry experts estimate that about one third of the global fleet could be fitted with scrubbers by 2030. Clearly the number of vessels with scrubbers by January 2020 will be relatively small, estimated by some shipping experts at 3,000-4,000 (less than 10% of all ships), limiting the size of the market for HSFO bunkers to a small portion of the current marine bunker-fuel volume.

A switch to LNG as marine fuel allows a vessel to comply with the new regulations but reduces demand for liquid bunker fuels and, therefore, does little to help refiners. The uptake of LNG as marine bunker fuel, however, is likely to continue to be gradual because of the need to develop LNG bunkering infrastructure and the issues around retrofitting existing vessels. We believe that LNG will be more practical for new-build vessels and those ships that have a fixed route (e.g., cruise liners that visit specific ports rather than a cargo ship that could have multiple destinations in a year).

We believe that most existing vessels will look to comply with the IMO regulation from January 2020 by switching to LSFO or MGO with a sulfur content of 0.5 wt % or less. This presents the European and Russian refining industries with two problems: producing sufficient 0.5 wt % marine fuel oil to meet the shipping market demand in European and FSU ports and disposing of HSFO currently sold as marine bunker fuel.

Installation of shipboard flue-gas scrubbers

Flue-gas scrubbing has been used for onshore power station effluent treatment for decades but is a relatively new technology application shipboard, with only an estimated 1,500 systems installed worldwide. Most of these installations are retrofits (vs. new-build applications) and most are on either vessels that spend much of the time in ECA regions or passenger cruise ships. As well as controlling sulfur emissions, flue-gas scrubbers eliminate 80-90% of soot and unburned liquid hydrocarbon emissions, a major plus for passenger-carrying vessels.

Early flue-gas scrubber installations were costly and constrained by available space and engineering issues. There is increasing evidence from scrubber constructors that the technology’s cost, size, weight, and installation time and complexity is decreasing. These improvements support recent estimates that there will be 3,000-4,000 scrubber systems installed by the time specification changes are implemented on Jan. 1, 2020.

The United Nations Conference on Trade and Development (UNCTAD) Review of Maritime Transport for 2017 sets the global shipping fleet of vessels with > 100 dwt displacement at approximately 93,000 vessels, but the number likely to be directly affected by IMO regulation changes is estimated to be 70,000.

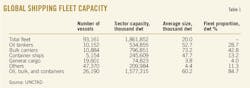

Table 1 shows the UNCTAD assessment of the global marine fleet by type, number, and size.

In understanding the implications for the bunker fuel market, the core vessels by type are oil tankers, bulk carriers, and containers vessels: about 26,000 vessels making up 28% of the fleet by number but 85% by tonnage. Table 1’s “others” category includes cruise ships and chemical tankers.

The number of current vessels that will be equipped with scrubbers and the rate of installation will depend on multiple factors. Recent profitability within the shipping industry has been poor, with low charter rates and overcapacity weighing heavily on returns, leaving little free cash for capital investments. Scrubber costs typically range $2-6 million per retrofit, depending on size and complexity of each specific installation. With this capital-cost range, payback times at current price differentials between HSFO and MGO of $150-$250/tonne are in the range of 2-4 years, with post-2020 payback times potentially dropping to about 1-2 years due to the likely increase in HSFO-MGO price differentials. If a shipowner does not already have time slots booked with a scrubber manufacturer and a shipyard, however, installation by 2020 is unlikely. The scrubber manufacturing industry claims that as the industry matures and designs are better optimized, new installation costs will be 40-50% less than retrofits, further reducing payback times.

In assessing the potential medium-term market for bunker fuels, we considered various factors. The issue of willingness to comply with the new regulations will be a major driver for the industry post-2020, particularly for the core vessel types: tankers, bulkers, and container vessels. Although policing of compliance remains unclear, larger charterers will be unwilling to risk reputational damage by being associated with the use of ships burning noncompliant fuel. Vessel owners-operators who fail to burn compliant fuel will become marginalized, and those that do not install scrubbers will become uncompetitive. We believe that the industry will move to a position where all major vessels will be fully compliant with the new regulations within 2-3 years from January 2020.

In defining which vessels will likely be equipped with mitigating hardware, the most important issue will be vessel age.

Table 2 shows simplified age-profile data for the global vessel fleet extracted from the UNCTAD database.

All current vessels less than 10 years old are likely to have scrubbers installed. These ships have sufficient useful life for financing to be arranged, retrofits to be engineered and installed, and payback periods secured. Such installations invariably must be scheduled around drydocking inspections. Muse believes that in the 10-15-year-old range about 10-20% of vessels will be modified, while in the 15-year-old+ range a large portion of vessels are unlikely to be modified, and some of them may be scrapped. To date, the installation of scrubbing technology has typically been cheaper than converting to LNG use, which requires both engine modification and fuel storage changes. Going forward, flue-gas scrubbing will be the favored revamp, except for vessels predominantly sailing in ECAs with ready availability of LNG bunkering installations, such as the Baltic Sea, North Sea, and English Channel.

We have assumed that all new-build tanker, bulker, and container-type vessels will have some form of mitigation technology installed to minimize fuel costs and maintain competitiveness. Of these new builds, we believe 75-80% will burn HSFO utilizing flue-gas scrubbing, while 20-25% will be LNG-fueled. Scrubbers will primarily be used in the tanker and bulker markets where route flexibility is more important, and LNG will primarily be used on container vessels and cruise liners, where point-to-point journeys are more important, and development of LNG bunkering installations is more likely.

Under the assumptions outlined above, by 2030, more than 14,000 of the current major vessels in the tanker, bulker, and container categories would be revamped with flue-gas scrubbing hardware. The global fleet has been increasing capacity by approximately 3% annually, but this has been achieved with no material change in the number of vessels. The vessels scrapped each year have tended to be the older and smaller ships in their categories and have been replaced with larger-capacity new builds. We estimate that some 8,000 new-build vessels are required to maintain the fleet size and capacity, of which 6,000 will be equipped with scrubbers, yielding a total number of scrubber-equipped vessels operating by 2030 of about 20,000 compared with an estimated 3,000-4,000 operating in 2020. These scrubber-equipped vessels in 2020 would have the capacity to absorb about 15% of the current HSFO bunker market—a massive contraction in capacity that will cause major pain in the global refining industry, particularly in Europe and Russia. The potential expansion to 20,000 vessels by 2030 equates to an increase in consumption to some 75% of the current bunker fuel market.

There are, of course, questions regarding the preceding analysis:

• Can shipowners finance such a large number of scrubber installations?

• Is there sufficient industry capacity to handle the required revamps and new-build scrubbers?

• Is the shipping industry ready to operate and maintain a large number of scrubbers?

• Is there sufficient drydocking time and capacity to meet the required needs?

A recent additional uncertainty for future marine fuel quality and consumption is IMO’s announcement on Apr. 13, 2018, that the shipping industry will be committed to a 50% reduction in CO2 emissions by 2050, with policy to be developed in the early 2020s. This announcement, coming before the bunker-fuel sulfur specification change has even been implemented, highlights the continuous environmental pressure on the shipping industry.

Refinery mitigation issues

Part 1 of this article discussed in detail the impact of the IMO bunker-fuel oil specifications on the overall European and Russian refining industries’ fuel oil balances. As the demand for HFO wanes, all European countries, whether inland or coastal, have surplus fuel oil production that is either sold as bunkers in European ports or exported out of the region as fuel oil cargoes.

Much of the surplus Russian fuel oil production is transported into Europe and comingled with European surplus material for export out of the region. This material invariably ends up as bunker fuel in distant markets. About 80% of European HFO exports are high-sulfur with 20% less than 1.0 wt % sulfur. Russian HFO exports are almost entirely high-sulfur material.

The continual decline in European inland fuel oil consumption has not led to a major widening of light and heavy product price differentials. Refinery operating strategies have typically been guided by the ability to find a home for surplus European and Russian fuel oil outside the region, frequently to Asia-Pacific markets, rather than capital investment options for destroying fuel oil. While European and Russian refiners in recent years have made some investment in complex upgraders (e.g., hydrocracking, FCC units), these investments have been minimal.

On the USGC, the abundance of nearby Latin American heavy crude oil has led to the almost universal installation of cokers. But this has never been replicated in Europe or Russia. The forthcoming IMO change to bunker fuel specification closes a large portion of the export option for HSFO, incentivizing fuel-oil destruction investments.

Some European refineries have responded to this by investing in process equipment to solve the bunker fuel issue at their locations. ExxonMobil Corp invested in a coker-hydrocracker at its Antwerp refinery. Total SA invested in a ROSE-hydrocracker complex at Antwerp and Grupa Lotos SA a coker at its Gdansk refinery. Most refineries in the region, however, either through lack of resources or concerns over the uncertainty of implementation timing, have not committed to large capital-investment solutions. For these refineries, we outline a range of potential mitigation strategies of increasing complexity and applicability that may aid future operations.

• Revise refinery crude slate to reduce HFO production, high-sulfur material. Changing crude slates to process lighter, sweeter crude is a potential solution to the bunker-fuel sulfur content changes, but there is a tendency to oversimplify this process. All current worldwide, low-sulfur crude oil production is fully utilized. The differential between sweet and sour crudes is anticipated to increase by 2020, but the larger price differential will not necessarily increase sweet crude oil availability. In the US within the next 3 years, incremental production of crude from shale formations (light tight oil, LTO) is projected to make around 3 million bbl of sweet crude available. While this will ease pressure on sweet crude availability, the low fuel-oil yield from LTO will not be a major contributor to 0.5-wt % sulfur bunker fuel oil production.

• Reformulate current LSFO production. About 40% of all inland European HFO consumed is produced to a 1.0 wt % sulfur specification, and 20% of all surplus HFO exported from Europe is 1.0 wt % sulfur. For those refineries that are currently running low-sulfur crudes, there will be an incentive to ensure that all inland LSFO is produced right up to 1.0 wt % specification, all exported 1.0 wt % HFO production is similarly sulfur maximized, and the lowest-sulfur content fuel oil components can be made available to blend 0.5 wt %-compliant bunker fuels for local consumption. This may improve refinery margins since 0.5 wt % bunker fuel should sell at a premium to current 1.0 wt % HFO exports, but it would not affect HSFO disposition.

• Reformulate feeds to refinery upgrading units. The feed pool for upgrading units typically is formulated to maximize unit feed rate and volume swell. As a result, lighter, sweeter feedstocks are usually favored. With surplus HSFO likely to be produced from each refinery, there will be an incentive to back out low-sulfur, light feeds to upgraders by segregation or better fractionation in upstream units. Any upgrader capacity deficit would then be made up with incremental high-sulfur heavy material that is currently routed into the fuel oil pool. Any light, sweet material would be directed to the new 0.5 wt % LSFO bunker pool. This would move FCC operations from feed-rate/volume-swell governed limits to regenerator heat removal and flue-gas sulfur limits and hydrocrackers from feed-rate limits to very hard hydrogen limits. These moves would reduce HSFO production and also create a new compliant bunker-fuel pool.

• Change asphalt strategy. Asphalt-producing refineries may have the opportunity to reformulate feed strategy to reduce purchase of very heavy crudes and switch asphalt production to utilize current fuel-grade vacuum residues. While this would reduce HSFO production, it would also affect a limited number of refineries. The expected decline in HSFO price and corresponding reduction in asphalt price will also increase asphalt demand by highway authorities able to execute more road building and repairs within their existing budgets and make asphalt more cost-competitive vs. concrete as a road building material.

• Expand or retrofit current upgrading units, fractionation systems, or install new fuel oil destruction units. Project investment decisions made in 2018 are likely to take 4-5 years to finance, engineer, procure, and schedule, leaving no impact on HFO disposition until 2022-23, at the earliest. Major capital investment is the only solution with the potential to secure a long-term future for a given refinery but depends on the refinery surviving from 2020 to the commissioning of the required investment.

Most of these mitigating actions are not available to many Russian refineries, as they are inland and supplied with Urals crude via pipeline, making it impractical to switch their crude slates to low-sulfur crude. Because of their high-sulfur, single-grade crude slate, they have no flexibility to reformulate fuel oil blends or upgrader unit feed slates to produce compliant bunker fuel. Their only options are to invest in expensive residue upgrading projects (which will not be ready by 2020) or hope they can capture the remaining HSFO demand from vessels with flue-gas scrubbers and suffer the economic impact of much-reduced HSFO prices. Some may face closure or temporary mothballing until increasing shipboard-scrubber installation could lead to a partial recovery in HSFO bunker volumes, and consequently, prices.

At this late stage, some refineries will take the approach that, since there are too many uncertainties, any capital investment is futile and will wait and see how the market develops post January 2020.