Israeli outreach aims to further exploration, development

Tayvis Dunnahoe

Exploration Editor

After more than 60 years with almost no hydrocarbon development, Israel now finds itself with burgeoning oil and gas resources. The country has established its first Energy Mission in Houston to coordinate participation of both US and other international companies in its growing energy sector. The mission, opened in mid-2017, combines two Israeli ministries, Energy and Economy.

“Ten years ago, Israel imported 100% of its energy resources,” said Shay Luvshis, enegy and economic consul for Israel. “As of this year, we are meeting our own demand and exporting to other countries.”

Energy demand, supply

“Three years ago, 50% of our electric consumption was comprised of coal,” Luvshis said. By 2017, the country had reduced this number to 25% of total consumption. Luvshis added that the country hopes to reduce coal consumption by half again in 2022 and to phase it out entirely by 2026.

The country is also betting big on transportation by abandoning the import of gasoline and diesel-powered automobiles by 2030, allowing only electric, hydrogen, and compressed natural gas vehicles. “We are actively transferring manufacturing and power generation plants to natural gas from fuel oil, but transportation is the sector showing the largest improvement through the next decade,” Luvshis said.

Natural gas currently supplies more than 70% of Israel’s electricity demand. Luvshis said the country’s goal is 85% with the remaining 15% to be met by renewables.

Natural gas development

Israel has been home to some of the largest gas discoveries in the Mediterranean in recent years. “All of these discoveries have strategic outcomes for the country,” Luvshis said.

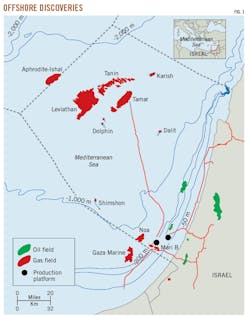

The Delek Group took a final investment decision for Stage 1A of the Leviathan field in March 2017 (OGJ Online, Feb. 23, 2017). The development plan has a proposed budget of $3.75 billion with 12-billion cu m/year peak production (Fig. 1).

The roughly 30,000-ton fixed platform is being constructed by Kiewit Offshore Services in Ingleside, Tex. First steel was cut in February 2017 and Luvshis said the structure is 40% complete. The platform is expected to sail in early 2019 with first production slated for yearend. It will be installed in 86 m of water.

Exporting gas

In February, Noble Energy Inc. signed agreements to sell 2.25 tcf (64 billion cu m) of natural gas each from Leviathan and Tamar deepwater gas fields off Israel to an industrial consortium in Egypt (OGJ Online, Feb. 19, 2018). Even though Egypt has its own giant gas field, the Zohr discovery, its energy consumption is growing rapidly. Both contracts have 10-year terms.

“This $15-billion deal has long lasting political benefits,” Luvshis said, citing the anticipated stability gained by linking Egypt and Israel under long term supply contracts.

Israel has been exporting gas to Jordan since 2017, a deal totaling $10-12 billion.

While these export contracts are new for Israel in relation to its natural resources, the country is home to hundreds of leading multinational technology companies like Apple and Google. Luvshis, however, differentiated between the existence of a research and development center and investment in hydrocarbon infrastructure. “Technology companies can easily decide to move to Ireland and Germany, often within a short window of time,” Luvshis said. “When you have a producing well, a pipeline, or an LNG plant tied to a long-term contract, these arrangements are not as easy to modify.” Oil and gas agreements, while dependent on international relations, can often ensure cooperation between governments over decades, Luvshis noted.

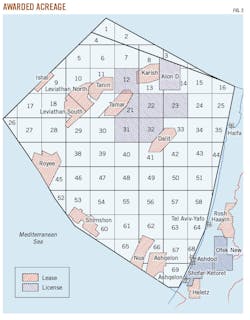

Israel has also signed a memorandum of understanding with four countries to export gas to western Europe. Energy ministers of Cyprus, Greece, Israel, and Italy, with the endorsement of the European Union. The consortium has set a target completion date of 2025 for the Eastern Mediterranean (EastMed) natural gas pipeline between Israel and Italy, through Cypress and Greece (OGJ Online, Dec. 8, 2017) (Fig. 2). The pipeline would carry 12-16 billion cu m/year of gas from Leviathan field off Israel and Aphrodite field off Cyprus. Both fields are in deep water (OGJ Online, Mar. 14, 2017). Discussion of this pipeline remains in its early stages, but holds promise for Israel and Cyprus offshore development.

Yet-to-find resources

Part of Israel’s energy mission is to increase participation in the country’s upcoming bid rounds.

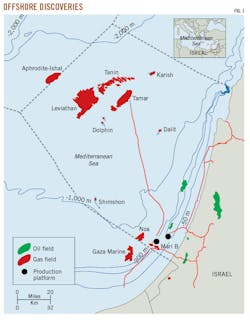

The country’s first bid round last year offered 24 blocks and closed in November 2017. The ministry will offer an additional blocks near yearend 2018 (Fig. 3). ONGC Videsh Ltd. (OVL) and partners received exploratory rights to Block 32 off Israel during Round 1 (OGJ Online, Jan. 8, 2018).

Energean Oil & Gas submitted the round’s only other bids and was awarded exploration rights to Blocks 12, 21, 22, 23, and 31 (OGJ Online, Dec. 14, 2017). The blocks are near Energean’s Karish and Tanin developments on which it will install a floating production, storage, and offloading (FPSO) vessel 90 km offshore (OGJ Online, Jun. 20, 2017). The FPSO will hold 400 MMcfd of gas, and Energean expects to start production from Karish in 2021 after spending $1.3-1.5 billion. Any new discoveries from its current exploration blocks will be produced as tie-backs to Karish.

Noble, Delek, and Energean comprise the major exploration companies with history in Israel. ONGC is the newest entrant, and more are expected if Israel’s outreach goes as planned.

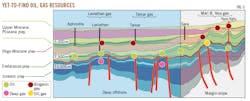

Excluding current discoveries, Israel has P50 reserves of 6.6 billion bbl of oil mostly in Jurassic and Creteceous reservoirs that include an additional 17 tcf of yet-to-find natural gas. Israel’s offshore also contains a probable 58 tcf of natural gas in Tertiary reservoirs (Fig. 4).

Miocene carbonate in the Zohr field indicates that other hydrocarbon plays and giant traps may still be found in the Levant basin offshore Israel.