Study questions predrill risks associated with stratigraphic traps

Stratigraphic traps made headlines in 2017 with the discovery of an estimated 1 billion boe of recoverable resources in the Stabroek block offshore Guyana within the Payara, Snoek, and Turbot discoveries. The Turbot-1 discovery well was an ExxonMobil-operated joint venture's (JV) fifth exploration test of the Liza play following the giant 2015 frontier Liza-1 discovery. Liza-1 encountered more than 90 m of net pay in Late Cretaceous deepwater turbidite sandstones in a stratigraphic trap. The JV had already discovered almost 2 billion boe of recoverable resources at Liza where a final investment decision (FID) has been taken on the first phase of field development.

On the other side of the Atlantic, however, recent stratigraphic trap exploration has been less fruitful, with unsuccessful wells in Senegal, Cote D'Ivoire, and Guinea chasing the same play concept of Late Cretaceous turbidite sandstones.

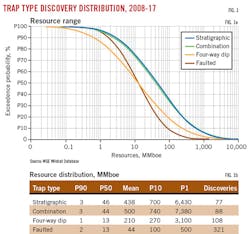

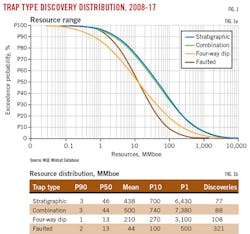

Despite their large resource potential (Fig. 1) and a low average finding cost (drilling cost only) of $0.90/boe, only 22% of global exploration wells targeted stratigraphic traps in conventional plays during 2017. This figure is 19% for the entire period from 2008-17, with little variation year-on-year.

Predrill risks

Stratigraphic traps are perceived to have higher predrill geological risk than other structural trap types like anticlinal structures and tilted fault blocks. Some companies even add an extra geological risk factor to stratigraphic traps by default.

Westwood Global Energy Group has looked at 270 completed exploration wells targeting stratigraphic traps in clastic reservoirs from 2008 to 2017 to investigate the higher risk perception and examine industry performance in its search for stratigraphic traps.

Stratigraphic trap formation

The stratigraphic traps considered in the study are formed by reservoir sand pinch-outs encased in sealing claystones or mudstones. Traps are often created around the time the sands are deposited. Combination traps in clastic reservoirs involve a combination of sand pinch-out with folding, faulting, or both. This usually requires structural deformation post-deposition of the reservoir sands.

There is a wide spectrum between the rarer pure stratigraphic trap and a combination trap, and sometimes little difference between the two. For this study, a trap is designated stratigraphic when the stratigraphic component of the trap is the most important for the accumulation of hydrocarbons. Carbonate reef build-ups can also form significant stratigraphic traps but are not included in this analysis.

Only six basins in the world have had more than 10 stratigraphic traps drilled since 2008. Almost 25% of the exploration wells targeting stratigraphic traps have been drilled in the North Sea basin, followed by the Africa Equatorial Margin including Sierra Leone-Liberia, Ivorian and Tano basins, the Ruvuma basin off Mozambique and Tanzania, the Carnarvon basin in Australia, and the Sergipe-Alagoas basin offshore Brazil. Fewer than 10 stratigraphic traps have been tested in the Suriname-Guyana Basin to date, but the play is emerging rapidly.

Stratigraphic traps in clastic sediments can be formed in all depositional environments where processes result in lateral lithology changes from sands to nonreservoir facies. They can also occur in different tectonic settings. The major focus of stratigraphic trap exploration in the 2008-17 period has been the Cretaceous and Tertiary deepwater turbidite complexes in passive margin settings.Discoveries

Most hydrocarbons discovered in stratigraphic traps have been in Late Cretaceous and Oligocene reservoirs (Fig. 2). The Late Cretaceous plays are dominated by oil, with a large proportion of estimated discovered resources (>3 billion boe) in the Suriname-Guyana basin. An estimated 1.5 billion boe of recoverable oil and gas have been discovered in Late Cretaceous stratigraphic traps in the Sergipe-Alagoas basin. An estimated 37 tcf of gas have been discovered in Oligocene stratigraphic traps, dominated by the gas discoveries of the Ruvuma basin.

More than 15 billion boe of oil and gas resources have been found in stratigraphic traps since 2008. The range of discovery size is wide, with a mean of almost 440 MMboe (Fig. 1). This range is comparable to combination traps, which have a mean resource of 500 MMboe and finding cost of $0.60/boe.

Faulted traps

Faulted traps represent 50% of all exploration prospects drilled during the study period and have a narrow resource range with a mean resource of 44 MMboe, 10 times smaller than stratigraphic traps. The faulted traps finding cost of $2.20/boe is more than double the finding cost of stratigraphic traps.

Resource distributions reflect that most large fault blocks have already been drilled and that the larger remaining accumulations are stratigraphic or have a stratigraphic component in their trapping mechanism.

Success rates

Westwood's study looked at both the technical success rate (TSR), which is the number of hydrocarbon discoveries divided by the number of exploration wells, and the commercial success rate (CSR), which considers the number of commercial discoveries only.

Globally, stratigraphic traps have an average TSR of 49% over the 2008-17 period, comparable to other trap types. The average CSR of stratigraphic traps is only 26%, 10 percentage points lower than the CSR of faulted traps. To understand this difference, the performance of stratigraphic traps needs to be reviewed on a basin and play analogue basis to remove other play element risks that could have a greater impact than the trap type itself.

The Cretaceous turbidite play along the Africa Transform Margin covers basins from Sierra Leone to Benin (Fig. 3). While stratigraphic traps along the margin have had a high TSR of 61%, their CSR is only 11%. Only the Tano basin has delivered commercial volumes so far, with a TSR of 69% and a CSR of 31%.

After the discovery of the Jubilee field in 2007, offshore Ghana, the search for Jubilee look-alikes started, spreading westwards along the Africa Transform Margin. Exploration along this margin focused on Late Cretaceous turbidite slope channel complexes and basin floor fans detached from the up-dip canyon feeder systems.

Sixty-eight post-Jubilee exploration wells have been drilled on the margin, yielding only two development projects, the TEN (Tweneboa, Enyenra, and Ntomme discoveries) cluster development, which came on stream in 2016, and the Sankofa (Sankofa and Gye Nyame discoveries) project that achieved first oil in 2017.

Failure analysis

Failure analyses of dry wells that have sufficient published information indicate that the main causes of failure were lack of sufficient hydrocarbon charge or lack of effective trap and seal. Failure causes for noncommercial discoveries are different than for dry holes because in these cases hydrocarbons are present.

The primary causes of commercial failure are reservoir quality, which is either too thin or displays low porosity and permeability, and trap areal extent, meaning the trap is smaller than predicted. Both result in the gross rock volume of the accumulation being on the low side of predrill expectation.

Another cause of commercial failure in some cases is charge limitation and timing of hydrocarbons migration. These cases are probably the hardest to diagnose with a single exploration well but can result in underfilled traps and, when recognized, impact the understanding of the play.

Understanding failure, success

The high CSR of the Tano basin lies in its structural configuration, defined by the Romanche fracture zone to the South and the St. Paul fracture zone to the North. The Jubilee field JV recognized that the ramp-like geometry of the eastern Tano basin allowed connected turbidite sand systems to pond and that local structure of the South Tano High creates a hydrocarbon migration focal point.1 The Ivorian and Sierra Leone-Liberia margin has a more abrupt morphology, which creates isolated turbidite systems and a lack of well-defined hydrocarbon migration focal points.

Sediment provenance also contributes to differences in CSRs. Tano basin sediments are derived from a more granitic hinterland, delivering cleaner sands, whereas the sediment sources in the Sierra Leone and Liberia areas are dominated by metamorphic rocks, resulting in a lower quality reservoir.

In many cases, the stratigraphic nature of the traps has taken the blame, when other causes are actually responsible for low CSRs and the reduced exploration potential of the whole margin. In areas where turbidite systems can be connected and hydrocarbon migration focal points exist, there is a greater chance of commercial success.

The study also investigated the low commercial success rates of stratigraphic traps in the mature North Sea (22% CSR) and Carnarvon basin (8% CSR) since 2008. Post-well failure analysis conducted by the UK regulator in 2015 concluded that frequent failure of stratigraphic trap tests was due to an over-dependence on geophysical attributes, such as amplitude anomalies or AVO.2 This dependence led to wells being drilled on poorly defined prospects and to overestimated predrill chances of success.

In the Carnarvon basin, only 14 of 115 recorded exploration wells have targeted stratigraphic traps. Although a limited number, all but one of these prospects was reported by companies to be well-defined by seismic attributes, yielding a single commercial discovery. In both basins, the failure of stratigraphic traps is more related to an over-reliance on geophysical tools than the nature of the trapping mechanism.

Stratigraphic traps are not inherently more risky than other trap types. The key is for explorers to recognize whether they have the right tools and processes to explore effectively for commercial discoveries. Making this determination calls for a sound geological model integrating the trap element into the entire petroleum system analysis, reliable geophysical calibration, and the effective use of analogue data.

References

1. Tullow Oil, "Capital Markets Day Presentation," Oct. 1, 2008.

2. Mathieu, C., "Moray Firth - Central North Sea Post Well analysis," UK Oil and Gas Authority, Dec. 8, 2015, pp. 208.

The Authors

Edwige Zanella ([email protected]) is a senior associate at Westwood Global Energy Group, London. She has also served as geologist and exploration manager at Lasmo Plc and Nexen Petroleum UK Ltd. She holds an engineering degree in petroleum geoscience from IFP School, Rueil-Malmaison, France. She is a member of the American Association of Petroleum Geologists (AAPG) and the Petroleum Exploration Society of Great Britain (PESGB).

Jamie Collard ([email protected]) is an analyst at Westwood Global Energy Group. He holds a BS in geology from the University of Bristol and an MS in petroleum geoscience from the University of Manchester. He is a member of AAPG and PESGB.