Study evaluates refiners' options to meet 2020 bunker fuel sulfur rules

Tayseer Abdel-Halim

Matthew Yu

Chevron Lummus Global

Richmond, Calif

Refiners need to modify their product slate to conform to increasingly strict environmental regulations as efforts to reduce atmospheric emissions have extended to fuel oil burned at sea.

In October 2008, the International Maritime Organization (IMO)-the United Nations agency responsible for the safety, security, and environmental stewardship of international shipping-adopted new, geographically based standards to limit exhaust emissions from engines that power ocean-going vessels. These standards require ships operating in areas with air-quality problems-designated as Emission Control Areas (ECAs)-to meet even tighter emission limits. While portions of the new standards have been gradually phased in over the last several years, final regulations are slated to take effect in 2020, putting refiners with relatively large production of residual fuel oil at risk for adverse impacts to profitability.

To comply with these stricter regulations, the shipping industry is considering either burning IMO-compliant fuels or retrofitting ships with an exhaust-gas scrubber or an LNG fuel system. All three options have serious operational and economic detriments that impact refiners exposed to bunker fuel markets.

This article presents refiners with several commercially proven bottom-of-the-barrel processes that enhance earning potential in the face of these new bunker fuel requirements, including a detailed techno-economic analysis to compare the different processes.

New specifications, options

Current specifications for bunker fuels-in effect since January 2012-limit sulfur globally to 3.5 wt %. With the global specification slated to drop to 0.5 wt % in 2020, however, the impending regulations will threaten the profitability of refiners which produce a relatively large proportion of residual fuel oil.1

Since 2015, ships operating in ECAs have been required to use fuels with a maximum sulfur level of 0.1 wt %, reduced from 1.0 wt % in 2010. Table 1 summarizes the historic and proposed fuel sulfur standards and anticipated start dates for ECA and global fuel sulfur limits.

While these emission reductions theoretically can be achieved by installing onboard flue-gas desulfurization, this technology has been commercially proven only in land-based industrial applications and is unlikely to be commercially accepted in a ship-based setting in the foreseeable future. Issues surrounding use of this technology-including the discharge of treated wastewater-must be resolved, making the number of ships that would be retrofitted for it unclear. It is more likely that ships will be retrofitted to burn low-sulfur diesel fuel while operating in ECAs.

Refiners that serve the bunker fuel market have started considering future options.

Refiners' options

The options available to refiners producing high-sulfur fuel oil (HSFO) are limited and include:

• Continuing business as usual. Profitability of HSFO will become less attractive as prices decline. While a change to lower-sulfur crude is possible, higher pricing for these crudes typically makes this a costly option.

• Investing to reduce the sulfur content of produced fuel oil to continue serving the bunker fuel market. Investments in process options should be carefully evaluated based on differentials in pricing of low-sulfur fuel oil (LSFO) vs. HSFO.

• Exiting the fuel oil market completely. Many refiners are considering implementation of bottom-of-the-barrel upgraders to produce more low-sulfur distillates, including marine diesel.

The changes outlined by IMO will have repercussions for many refiners, particularly in the Asia Pacific region where much of the world's bunker fuel is produced. Refiners will need to consider available investment options to remain profitable as the market for HSFO is eliminated.

Desulfurization of atmospheric or vacuum residues remains the predominant technology available for producing 0.5 wt % LSFO from residues and is widely used throughout the Asia Pacific region. Proper integration of atmospheric or vacuum residue desulfurization into an existing refinery can offer additional processing benefits that can improve return on investment. Using this technology to produce LSFO with less than 0.1 wt % sulfur to comply with proposed regulations for ECA compliant fuels, however, will be difficult and impractical.

Refiners seeking to exit the fuel oil market are considering several available bottom-of-the-barrel technology options.

Technology overview

In addition to traditional bottom-of-the-barrel technologies such as atmospheric residue desulfurization and delayed coking, Chevron Lummus Global (CLG) developed the LC-FINING technology platform-consisting of LC-FINING, LC-MAX, and LC-SLURRY technologies-for improved residue conversion and selectivity towards high-value distillate products.

Some of the major benefits of CLG's technology platform include:

• Ebullated catalyst beds developing minimal pressure-drop buildup.

• Recycle pump at the bottom of the reactor creating nearly isothermal reactor conditions.

• High-level conversion to distillate products.

• High onstream factor.

The technology platform has been further enhanced by recent features:

• Integrated hydrotreating simplifies the fractionation and production of finished clean products.

• Integrated two-stage hydrocracking maximizes the amount of high-value distillates produced from the unit, including selective cracking to produce Euro V diesel.

• An interstage separator in the reaction section considerably increases conversion and per-train capacity by reducing the vapor superficial velocity and gas hold-up in the reaction section.

Continuing advancements

To address the IMO regulations taking effect January 2020, CLG recently patented a new process focused on producing finished LSFO.

LC-LSFO is an enhancement to the LC-FINING technology platform that produces low-sulfur bunker fuel from unconverted residue oil. LC-LSFO applies the process technology developed for LC-SLURRY to unconverted residue vacuum tower bottoms (VTB) and atmospheric tower bottoms (ATB). The processed VTB-ATB is then treated in a fixed-bed reactor with CLG's hydrotreating catalyst.

CLG's LC-LSFO pilot unit has operated using 27 different feeds in more than 30 different operating conditions, improving on the already high-conversion LC-FINING process, with the last unconverted barrels converted to low-sulfur bunker fuel or used as feedstock to an RFCC unit.

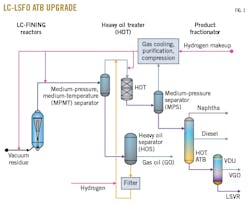

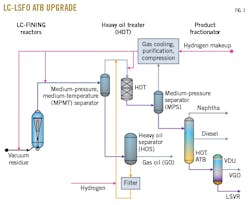

Figs. 1-2 show flow schemes for ATB and VTB upgrading, respectively.

This article examines the potential economic benefit of various modified refinery configurations incorporating these technologies in a typical 350,000-b/d Asia Pacific refinery.

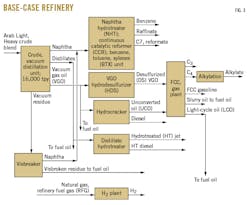

A 50-50 blend of Arabian Light and Arabian Heavy crudes was assumed for all cases in the accompanying economic analysis. These crudes were selected because they are processed throughout the world but especially in the Asia Pacific region, where a large portion of the world's bunker fuel oil is produced.

Fig. 3 shows the base-case configuration for a refinery equipped with a visbreaker.

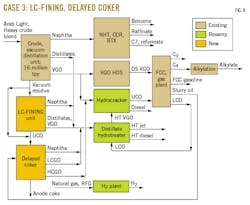

The authors evaluated six modified refinery configurations and the benefits associated with each of these variations (see accompanying box). In each case, the existing visbreaker unit was replaced with one or more bottom-of-the-barrel technology options.

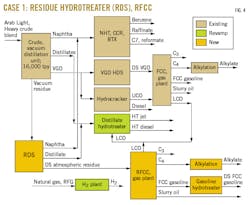

Figs. 4-9 show simplified block-flow diagrams of the six modified refinery configurations.

Economic evaluation

Platts data from 2015 provide the price basis for economic analysis, together with CLG's internal projections for LSFO and HSFO pricing following the IMO sulfur reduction to maximum 0.5 wt %.

Assumptions used to develop these economic estimates included:

• Project life, 15 years.

• Interest rate, 8%.

• Inflation, 2%/year.

• Investment escalation, 2%.

• Initial feed inventory, 5 days.

• Owner's costs, 10% of total investment cost (TIC).

• Contractor risk-profit, 5% of TIC.

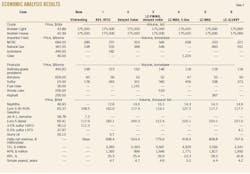

Table 2 summarizes results of this evaluation, including assumed crude and product prices.

Alongside providing a payout period of 5 years or less, the cases deliver large improvements in refinery margins while eliminating the refiner's exposure to the dwindling HSFO market. The optimal option for any refiner will be based on a variety of factors such as initial cost, natural gas availability, and environmental factors.

The delayed coker configuration (Case 2) requires the least amount of investment but also provides the smallest revenue increase over the base case. A similar payout period can be realized with the higher-cost investment options of RDS with RFCC (Case 1) and LC-FINING with delayed coker (Case 3). Cases 1 and 3 have notably higher net present values (NPV) and similar internal rates of return (IRR) as compared with Case 2.

LC-MAX (Case 5) and LC-SLURRY (Case 6) options report the most favorable economics of the cases evaluated with similar investment requirements as Case 1 and Case 3. While LC-MAX with E-Gas (Case 4) is the most capitally intensive option and has the longest payback period, it may be a desirable option if natural gas prices are high or availability is scarce.

Fig. 10 shows a comparison of the different configurations based on each respective configuration's potential to create value. (Capital efficiency hurdle is the ratio of NPV-to-capital expenditure at present value.)

While an individual operator will undoubtedly have its own minimum hurdle by which it evaluates different prospective projects, CLG's pilot studies show that both LC-SLURRY and LC-MAX technologies have the potential to more than double the returns generated by using a single technology configuration (e.g. delayed coking).

References

1. "Ships face lower sulphur fuel requirements in emission control areas from 1 January 2015," International Maritime Organization, Briefing: 44, December 23, 2014.

The authors

Tayseer Abdel-Halim ([email protected]) is vice-president of Chevron Global Technology Services Co. Before joining Chevron, he served as director of heavy oil at KBR Inc. Abdel-Halim has more than 46 years' experience in heavy oil, hydrogen production, and corporate planning. He holds an MS (1975) in chemical (refining) engineering from the University of Tulsa.

Matthew Yu ([email protected]) is a technical service engineer for Advanced Refining Technologies (ART), a joint venture between Chevron Corp. and W.R. Grace & Co., where he supports clients using ART's premium atmospheric residue desulfurization catalyst technology. He previously worked as a process design engineer for both Chevron Lummus Global and Chevron's refinery in Richmond, Calif. Yu holds a BS (2010) in chemical engineering from the University of California at Davis.