Rising octane demand offers opportunity for US refiners

Sandy Fielden

Morningstar Inc.

Chicago

Largely because of tightening Corporate Average Fuel Efficiency (CAFE) standards enacted by the US Congress in 1975, and regulated by the US Department of Transportation to reduce fossil-fuel consumption, annual average premium-gasoline sales as a percentage of overall gasoline supplied to the US market since 2010 have increased by 10%, or 120,000 b/d. That trend is expected to continue. Improved fuel efficiency to meet CAFE standards is best achieved by higher engine-compression ratios, and auto manufacturers favor using turbochargers to accomplish this.

Turbochargers, however, raise the risk of fuel combustion before sparkplug ignition, or engine knock-a condition mitigated by increasing the octane content of gasoline. Manufacturers of turbocharged vehicles therefore require use of premium gasoline, which has a higher octane rating than regular gasoline.

A delayed reaction to this requirement from US refiners as well as a complex series of tradeoffs in gasoline blending have caused average octane premiums (the price difference between premium and regular gasoline) to almost double since 2010.

This article examines refiners' options to address growing octane demand and the consequences of inaction.

Octane premium

For those driving luxury autos, the widening difference at the pump between premium and regular-gasoline pricing is perhaps a small price to pay for the privilege of sporting a marquee badge on the hood. But the population of premium-gas buyers is growing faster than the stable of luxury cars. By yearend 2016, about 20% of all new vehicles came equipped with a turbocharger, and the US Energy Information Administration projects that share to increase to over 80% of new vehicles by 2025. Increased demand for premium gasoline has widened price differentials at the pump in the past few years.

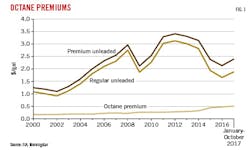

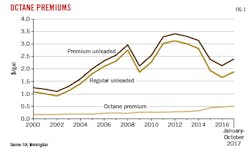

Fig. 1 shows annual average retail prices (excluding taxes) paid to refiners for regular and premium gasoline from 2000 to October 2017 as well as the octane premium (the price differential between premium and regular gasoline grades).

Relatively steady at 17-27¢/gal between 2000-11, the octane premium since then has nearly doubled to an average 51¢/gal between January-October 2017. The higher premium reflects rising octane costs and tighter supplies.

Gasoline blending

Two different methods-research octane number (RON) and motor octane number (MON)-are used to rate gasoline's octane content, which is a measure of gasoline performance when compressed. US gasoline pumps display an average of these two methods: (RON+MON)/2.

Regular gasoline is defined as 87 (RON+MON)/2, while premium gasoline is defined as 91-93 (RON+MON)/2.

Gasoline is a complex mix of components blended to meet a variety of regulatory requirements that differ throughout the country.1 Octane is just one measure that refiners need to juggle, with others such as Reid vapor pressure (RVP, which varies by season and geographic region) and levels of sulfur and benzene dictated by federal regulations. Refineries use complex linear programs to optimize gasoline-blending components produced from primary distillation, downstream catalytic cracking, coking, naphtha reforming, and alkylation processes. External-blending components include corn ethanol added at the distribution terminal to meet renewable fuel standard (RFS) mandates.

Octane components

The principal components used to boost octane include reformate, alkylate, ethanol, and butane, each of which has its benefits and drawbacks.

• Reformate. Refinery catalytic reforming units convert naphtha feedstock into high-octane, high-aromatic reformate with byproducts including hydrogen. Octane content is increased at higher temperatures and with greater catalyst consumption, but costs rise accordingly. Heavy naphtha (containing more aromatic components such as benzene, toluene, and xylene) produces higher-octane reformate. Surging US shale crude production typically produces lighter naphtha components less suited to reforming.

• Alkylate. Alkylation units produce alkylate from isobutane and butylene components typically produced as byproducts of catalytic cracking. Alkylation uses sulfuric or hydrofluoric (HF) acid as a catalyst to produce alkylate, an isoparaffin that has high-octane and low-sulfur and RVP levels. Alkylation units are expensive to build, and their use of acid makes permits for these units difficult to obtain. In fact, the board of California's South Coast Air Quality Management District-the regulatory agency responsible for air-pollution control for all of Orange County as well as portions of Los Angeles, Riverside, and San Bernardino counties-is seeking to ban alkylation altogether because of the risk of an acid cloud.

But alternative approaches to the alkylation process could provide a viable solution for US refiners. Chevron Corp. is converting the existing 4,500-b/d HF alkylation unit at its 53,000-b/d refinery in Salt Lake City, Utah, into the first-ever alkylation unit in the US based on ionic liquids (IL) alkylation technology (OGJ Online, Oct. 4, 2016). Developed by Chevron USA Inc. and now licensed by Honeywell International Inc.'s UOP Isoalky technology uses a less-volatile IL catalyst instead of HF or sulfuric acids as a liquid alkylation catalyst for production of high-octane fuels, which could make permitting for adding alkylation capacity easier if successful.

• Ethanol. Made from US corn supplies, ethanol has a high-octane rating of 113 (RON+MON)/2, making it an attractive gasoline-blending component. In the US, 10% ethanol is already blended into most gasoline to meet RFS mandates. Adding more ethanol to gasoline blends is often the lowest-cost solution to boost octane. Ethanol has a relatively high-RVP level, however, and auto and logistics constraints so far have limited its blending to 10% of gasoline by volume.

Because they don't produce it themselves, refiners dislike ethanol, as it swallows their market share. If they don't blend ethanol into gasoline, refiners must purchase renewable credits (RINs) to comply with RFS mandates. Perceived RIN shortages, however, have markedly increased independent refiners' costs in the past few years.2

• Butane. A gas-liquid byproduct from refining or gas processing, butane is blended into gasoline to boost octane during the winter months. Butane has a very high-RVP level and therefore isn't practical to use during summer months, when higher temperatures increase evaporation rates.

Gasoline production

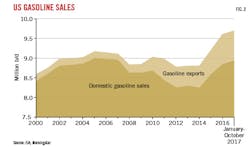

As refiners have wrestled with different options to increase octane during the past 4 years, they've also needed to produce ever-higher volumes of gasoline (Fig. 2). According to EIA statistics, gasoline output dipped in 2006-12 in response to increased ethanol blending under RFS mandates and lower demand following the Great Recession. Since 2012, however, output has increased by more than 1 million b/d to average nearly 10 million b/d in 2016 and 9.9 million b/d in January-October 2017 (reduced by impacts to US Gulf Coast refineries from Hurricane Harvey).

While domestic gasoline demand has increased-particularly since the oil-price crash in late 2014 began lowering pump prices-much of the growth in US gasoline production has been destined for a booming export market.3 Although exports are typically regular-grade gasoline, the combination of increased output and higher domestic demand for premium grades adds to the overall octane-demand crunch.

Slow response

Despite rising octane demand and attractive octane premiums, US refiners have been slow to respond with investment in new capacity. EIA annual refinery capacity reports show that while overall crude processing capacity between 2000-17 increased 14% to 19.8 million b/d, alkylation capacity only increased 10% during the same period. And although refiners increased low-pressure (vs. high-pressure) reforming capability to 71% in 2016 from 59% of capacity in 2000, overall reforming capacity remained static.

In the past 2 years, however, US refiners have proposed several alkylation or related projects, some of which are now in the process of completion. In addition to Chevron's Salt Lake City isoalky prototype unit, these projects include a new 13-million b/d alkylation unit at Valero Energy Corp.'s 235,000-b/d Houston refinery scheduled to be completed in 2019 and Marathon Petroleum Corp.'s $220-million upgrade to the fluid catalytic cracking (FCC) and alkylation units at its 539,000-b/d refinery in Garyville, La., which the operator began in 2016 (OGJ Online, Jan. 23, 2017). Marathon plans a similar $40-million FCC-alkylation project at its 132,000-b/d refinery in Detroit, Mich. Earlier this year, Delek US Holdings Inc. announced a $103-million project to build a 6,000-b/sd alkylation unit at its 74,000-b/sd Krotz Springs, La., refinery to add product flexibility and increase margin potential at the site by 2019 (OGJ Online, Jan. 9, 2018).

A notable exception to recent investment decisions is Marathon's 2015 proposal for subsidiary MarkWest Energy Partners LP to build a standalone alkylation unit in Ohio to upgrade abundant and low-cost gas liquids from the Appalachian basin into alkylate. While this project is still under evaluation, it has disappeared from company presentations.

Import alternative

While US refiners do have the option to import octane-blending components, this isn't happening outside the East Coast region, according to EIA data. In January-October 2017, blending-component imports to US East Coast refineries represented a monthly average of 86% of the US total. This likely is a result of the US East Coast's status as a net importer of refined products since production from local refineries meets only about 30% of regional demand.4 Other US regions import only a fraction of their blending-component needs, suggesting that overseas supplies are too scarce or expensive to be a viable alternative to homegrown gasoline-blending components.

Refiners' problem

The problem for US refiners is that slow investment in new octane capacity encourages alternative solutions. Increasing ethanol blends above 10%, for example, could become a practical necessity to solve the octane gap but would reduce oil refiners' share of the gasoline market, potentially increasing the pain of RIN payments. In the longer term, delays in US refinery investment also likely are to become embroiled in concerns about peak demand for transportation fuels. With a lot of attention now paid to electric vehicles, refiners additionally may find it harder to justify investment in new gasoline-production units during the next decade.

Given today's current octane premium, as well as CAFE standards underwriting higher demand, it makes economic sense for US refiners to invest in new capacity now rather than to stand by and watch alternatives grab market share.

References

1. Fielden, S., "Gasoline Prices Spring Higher as Trump Ponders Deregulation," Morningstar Inc., Mar. 3, 2017.

2. Fielden, S., "Corn Crush and RINS-Tighter Margins for Producing and Blending Ethanol," Morningstar Inc., Sept. 29, 2016.

3. Fielden, S., "Sailing Around the Wall? US Refined Product Exports to Mexico," Morningstar Inc., Nov. 10, 2016.

4. Fielden, S., "East Coast Refineries Recover From Shale Loss," Morningstar Inc., July 3, 2017.