Algeria resets path to oil and gas revenue

Rym Loucif

Gide Loyrette Nouel Algerie

Paris

Algeria plans to amend its hydrocarbon law in a bid to attract foreign investors.

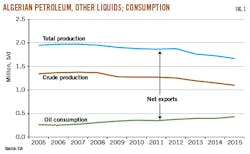

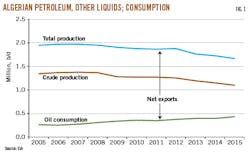

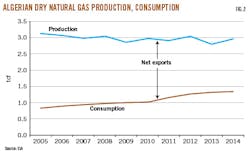

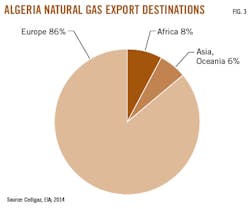

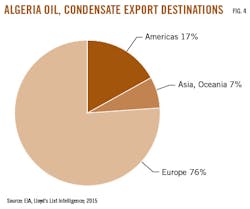

Africa's leading natural gas producer, Algeria exports more than 80% of its gas to Europe (Fig. 1) and ranks among the top three oil producers in the region with the third-largest oil reserves in Africa. Despite these statistics, oil and natural gas production has declined in recent years (Fig. 2 and 3). Adding to this decline, infrastructure projects have been repeatedly delayed and foreign investors have steered away from the country. Algeria's current hydrocarbon law and its fiscal terms have become an obstacle to partnering with international oil companies.

Lower oil and gas revenues reduced Algeria's foreign exchange reserves to $106.29 billion in June 2017 from $178.93 billion in December 2014.

The International Monetary Fund says Algeria's oil and gas revenues provides more than 95% of the country's export earnings and 60% of its budget.

The Algerian government's attempts at revision will begin with a bill in June 2018. Algeria's Ministry of Energy also plans to invest $78 billion in upstream activity through 2021. The question remains whether revisions to the law will be temporary reforms or an overhaul of Algeria's energy strategy.

Past reforms

Algeria's legal and fiscal frameworks for its energy strategy have undergone three major reforms in the past 30 years.

Law No. 86-14 introduced production sharing contracts to Algeria's energy sector. Introduced Aug. 19, 1986, the law was adopted while oil prices were falling. For the first time, foreign exploration partners could receive a share of production in return for technological and financial investments.

The goal of Law 86-14 was to encourage foreign investors to share financial risk while also transferring technological expertise. The period 1986-90 marked an opening of Algerian oil and gas exploration partnerships.

Algeria's state-owned Sonatrach maintained its ownership over exploration, development, and transportation, retaining a minimum 51% interest in all upstream projects.

In April 2005, Algeria introduced Law No. 05-07 to further liberalize its oil and gas sector. The law briefly revoked Sonatrach's majority but was amended in July 2006 by Order No. 06-10, which restored Sonatrach's 51% interest in upstream projects. The 2006 order also introduced retroactive taxation applying to all production sharing contracts executed before Law 05-06.

In February 2013, Law No. 13-01 amended 05-06 by introducing incentives for the development of unconventional oil and gas. The bill established profit-based taxation as opposed to taxes based on total revenue, but falling oil prices since 2014 have rendered this amendment ineffective.

Reform objectives

Reform momentum is growing in Algeria, driven by unsuccessful bid rounds in the country's last five tenders. Algeria awarded four of 31 blocks in its 2014 tender, demonstrating investors' limited interest in undertaking new oil and gas projects in the country. As oil revenues decline and research and exploration slow, Algeria is reviewing its existing hydrocarbon laws and taxation seeking to entice companies to explore new territories. Two-thirds of the country's prospective acreage is under- or unexplored, according to Sonatrach. Drilling density averages 14 exploration wells per 10,000 sq km, with only limited offshore exploration.

Increased production is also needed to meet Algeria's domestic consumption, which has increased to 420,000 bbl in 2017 from 210,000 in 2010.

Reform aspects

The upcoming reform should align with the current energy market, striking a balance in technical and financial risks between Sonatrach and international investors. The new investment framework should incentivize outside participation while simultaneously preserving oil rents. Algeria's reform should also encourage exploration of its vast, untapped shale gas resources in an environmentally sound manner.

Algeria's reform will most likely amend the country's fiscal regime, allowing foreign partners to manage capital projects as opposed to the current law requiring Sonatrach to possess a 51% majority stake in all hydrocarbon projects. The existing tax law, drafted during a high oil-price cycle, should be revised to account for lower oil prices. Algeria charges a 20% royalty on production, and this could be altered to 12.5% and 16.25% subject to special conditions in the new law. Windfall taxes of 15-50%, pending the amount of production also apply, and may be targeted in the new law to encourage outside investment in exploration and development projects.

Administrative procedures must be streamlined as bureaucracy and project postponements can lead to cost overruns for foreign investors.

New energy strategy

Algeria is at a turning point in the face of falling oil prices and the expiration of its LNG export contracts 2018-20. But the country contains shale gas and oil which could fundamentally change its energy markets, but the ministry has no short-term development plans.

Algeria's reform will review the country's energy overall strategy, allowing it to move towards an energy mix dominated by hydrocarbons in the short and medium term and by renewable energy in the long term.

In parallel with developing new oil and gas projects, Algeria will attempt to reduce its dependence on natural gas for generating electricity. A national program for the development of renewable energies was adopted in 2011 and amended in 2015. The program aims to produce more than 4,000 Mw from renewable sources by 2020, expanding this to 22,000 Mw by 2030. Photovoltaic will generate 13,575 Mw and wind 5,010 Mw, the remainder coming from thermosolar, biomass, cogeneration, and geothermal sources.

The program includes an international tender in first-half 2018 to produce 4,050 Mw of solar power, divided into three 1,350 Mw batches.

The author

Rym Loucif ([email protected]) was admitted to the Paris Bar in 2006 and is currently transitioning between law firms. She has worked at Willkie Farr and Gibson Dunn law firms. Her most recent post was in the Algiers office of French law firm Gide Loyrette Nouel. In prior positions she has advised major national oil companies and oil services companies on Algerian oil and gas projects. She completed her studies at University Pantheon-Assas, Paris, and received her Master of Law (2004) with honors in business and tax law. She is also a graduate of King's College, London.