Exploration in Egypt, Ecuador, Russia, and Mongolia pushes boundaries

Oil and gas companies are exploring in disparate parts of the world to add more reserves to fulfill growing world energy demand. Egypt intensified oil and gas exploration efforts in the Mediterranean and Red Sea while Ecuador recently opened more onshore blocks to international investors.

Tharwa Petroleum Co. of Egypt partnered with Eni SPA of Italy to spud their first exploratory well at Noor offshore gas field along the North Sinai coast in late September. Eni is exploring in about 25 countries to find more reserves, Eni Chief Executive Officer Claudio Descalzi said.

Descalzi believes Eni can add oil and natural gas reserves through disciplined exploration spending at lower cost than it can through acquiring producing properties. He estimates 400-500 million bbl has been added to Eni’s reserves in 6 years at about $2/bbl.

Meanwhile, various Latin American governments have revised oil and gas investment incentives. Colombia used tax credits to attract more exploration while Mexico and Argentina sought to attract investment in onshore conventional plays, Wood Mackenzie Ltd. analysts report.

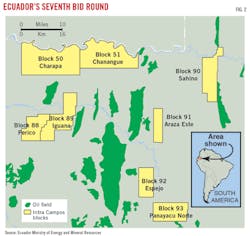

In September, Ecuador launched its 2018 Intracampos Round for eight onshore blocks in the oil-prone northwestern Oriente basin. Ecuador Presidential Decree No. 449, dated July 12, changed the structure of investments from service contracts to a new petroleum sharing contract.

International companies actively explored in Ecuador during in the late 1980s and early 1990s, but they had scaled back, saying earlier effects failed to meet expectations.

In Russia, Gazprom OAO has steadily replenished its annual production volumes and built up its reserves through exploration. The gas giant is accelerating exploration around the Yamal Peninsula and Russia’s Far East.

Mongolia begin issuing oil and gas licenses in 1992 but interest by exploration companies has been low. A UK company is actively exploring in Mongolia.

Egypt

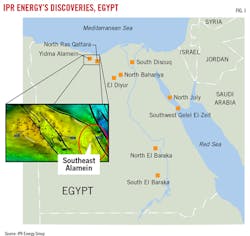

Companies other than Tharwa and Eni also are exploring in Egypt. IPR Energy Group Inc. (IPR) of Irving, Tex., in August discovered a field in the Alamein lease of Egypt’s Western Desert. IPR is executing a large drilling program and workovers covering the Western Desert, Nile Delta, and Gulf of Suez offshore Egypt.

In the Western Desert, the Southeast Alamein-1X (SEAL-1X) exploration well encountered 97 ft of pay from Razzak sand, Basal Middle and Upper Bahariya sands, and Abu Roash G dolomite (Fig 1). Testing and evaluation of various zones are under way.

IPR drilled two new production wells in Alamein field (A-42, AL44), bringing another 580 bbl of oil on stream.

Exploration well AL45X discovered Dahab sand, extending IPR’s knowledge of channel sands. Initial tests exceeded 850 b/d of naturally flowing 30° API gravity crude.

The independent’s horizontal well NEAL-19H targets the Upper A-R G Dolomite of the Northeast Alamein (NEAL) field in the Western Desert.

In the North Ras Qattara (NRQ) concession in the Western Desert, IPR’s exploration well NRQ-12X discovered oil, which tested 1,458 b/d from the Lower Bahariya formation. Two appraisal wells, NRQ 255-18 and NRQ-9-7, brought an additional 820 b/d.

Exploration well Ibn Yunis-1X found gas in the South Disouq concession of the Nile Delta. It flowed 26.9 MMcfd on test.

IPR said appraisal well, SD-4X flowed 28.7 MMcfd on test from the Abu El Maadi (AEM) formation. The SD-3X discovery showed hydrocarbons in both AEM and Kafr El Sheikh (KES) formations. Gas flowed 16 MMcfd on test from AEM.

The independent plans a seismic survey covering 170 sq km in the concession’s southern territory.

IPR has focused on Egypt since 1993. It also has gas production in Pakistan and some mineral rights ownership in the Permian basin of Texas. The company acquired offshore Egyptian holdings through its 2003 acquisition of Devon Energy International’s Gulf of Suez assets.

Separately in Egypt, Eni announced an August gas discovery on the Faramid South prospect in the East Obayed concession, 30 km northwest of the Melehia concession. Both concessions are in Egypt’s Western Desert where Eni is working to develop gas reserves.

The Faramid South well, which reached its 17,000 ft target, flowed 25 MMscfd, confirming the East Obayed.

Through its joint-venture operating company with Egyptian General Petroleum Corp. (Agiba), Eni currently produces 55,000 boed from the Western Desert. Agiba owns 100% of East Obayed concession.

Ecuador

The Ministry of Energy and Non-renewable Resources in Ecuador announced a licensing round for eight blocks onshore Ecuador (Fig. 2). Ecuador officials say they designed the round to attract international investors based on production sharing contracts (PSCs) and updated tax, fiscal, and legal terms.

Northwest Oriente basin reservoirs involve the Cretaceous Hollin and Napo formations, which comprise successions of sand-rich fluvial and deltaic deposits, WoodMac reports. The blocks are near existing pipelines and other infrastructure.

Ecuador officials talked with oil and gas executives in Houston on Sept. 25 during a road show on the licensing round. Carlos Perez, Ecuador’s Minister of Energy and Non-Renewable Natural Resources, told reporters he anticipates the round could attract $1 billion in investment.

A lingering issue for oil and gas investors is dispute resolution. Ecuador withdrew from the World Bank arbitration court in 2009. For the latest licensing round, Ecuador’s government agreed to arbitration by Colombian courts if any dispute resolution is needed.

Colombia has established petroleum laws and represents a Latin America perspective, said Noble Pendergrass, WoodMac principal petroleum economist for the Americas.

The PSCs have no cost provisions or royalty, but full production value is placed into a profit-sharing pool. The profit-sharing pool is split between the company and Ecuador’s government based on a percentage involving a production component and a biddable price component.

The production component is calculated using a tier-based system that increases with increased daily production. The biddable component increases as the oil price increases.

Pendergrass said a sovereignty adjustment can be applied to the profit share. Each year, the cumulative cash flows, including all taxes and costs, are calculated for the government and contractor. If the government share is less than 51%, the difference will be added into the government’s profit share the next year.

In addition, Ecuador cancelled its windfall tax. Two production taxes, called Ley 10 and Ley 40, will provide revenues for ecological redevelopment and provincial income. Two income taxes also apply. They are the labor participation tax and the corporate income tax, which together apply at a 36.25% rate to profits.

Russia

Rosneft announced plans to spend almost $2.5 billion in oil exploration in Russia’s Far East and offshore its eastern Arctic during 2017-22.

Gazprom recently outlined its exploration efforts in Russia’s Far East as well as the Nadym-Pur-Taz region, the Yamal Peninsula, the Republic of Sakha (Yakutia), and the Irkutsk Region.

The company reported estimated gas reserves of 35.4 trillion cubic m as of Dec. 31, 2017. The company is reviewing its estimates following adoption of a new Russian Classification of Reserves and Forecast Resources of Oil and Flammable Gases.

Gazprom expects to complete its reserves estimate review by 2021. Meanwhile, it is working to add gas reserve through exploration.

Gazprom drilled two exploratory wells in Kovyktinskoye field in the Irkutsk Region in 2017 and plans to drill more wells in that area (Fig. 3). It acquired 3D seismic surveys covering 2,400 sq km. It also drilled an exploration well in Tas-Yuryakhskoye field last year.

Gazprom drillsexploration wells in Irkutsk Region in ongoing efforts to increase its natural gas reserves (Fig. 3). Photo from Gazprom.

During 2018–21, Gazprom plans 20 exploratory wells and 3D seismic surveys covering 3,800 sq km. In Yakutia, efforts are under way to explore Chayandinskoye, Tas-Yuryakhskoye, Verkhnevilyuchanskoye, Sobolokh-Nedzhelinskoye and Srednetyungskoye fields.

Gazprom executives believe the Nadym-Pur-Taz production region has more resources. Petroleum engineers are studying deposits lying under and above the Cenomanian horizon.

Experts estimate resource potential of the above-Cenomanian deposits in Gazprom’s fields across the Yamal-Nenets Autonomous Area to be 4 trillion cu m. Gazprom continues to explore that area, both onshore and offshore the Yamal Peninsula shelf (Fig. 4).

The Nanhai VIII semisubmersible transited under tow earlier this year from the Port of Murmansk to drill a well at Gazprom’s Rusanovsky license area in the Kara Sea. (Fig. 4). Photo from Gazprom.

Gazprom is developing giant Kharasaveyskoye gas-and-condensate field on the Yamal Peninsula in arctic Russia. Kharasaveyskoye straddles the Kara Sea coast north of Bovanenskovskoye gas-and-condensate field, which will reach design capacity of 115 billion cu m/year of gas with the 2018 launch of a third 5.5-million tonne/year liquefaction train at the Yamal LNG plant.

Gazprom estimates Kharasaveyskoye holds explored and preliminary estimated (C1+C2) reserves of 2 trillion cu m of gas. Initial development will target Cenomanian-Aptian deposits, from which production is scheduled to start in 2023 at an estimated 32 billion cu m/year.

Mongolia

Petro Matad Ltd. plugged and abandoned the Snow Leopard-1 well in the Valley of the Lakes complex’s Taats basin of Block V in Mongolia. Snow Leopard 1 was the first exploration well drilled in the Valley of the Lakes complex, said Petro Matad, which holds 100% interest. It reached 2,930 m MD in granitic basement.

Snow Leopard 1 encountered no sands at the shallower of the two primary targets. No oil or gas shows were observed in the well’s deeper objectives. Snow Leopard-1 operations stopped in September.

“Data and samples gathered during the drilling of the well are now under evaluation to determine the implications of the well results for the surrounding prospectivity,” Petro Matad said in a news release.

“The presence of thick shales and oil and gas shows in the well highlight the potential prospectivity of the Taats basin in which a number of other prospects and leads have been mapped.”

The UK independent moved the rig from Snow Leopard-1 to Wild Horse 1 well where drilling was expected to start by Nov. 1.

The company expected Wild Horse drilling to take 30-45 days to reach a target depth of 2,200 m. The target is the Baatsagaan basin in Petro Matad’s Block IV.

About the Author

Paula Dittrick

Senior Staff Writer

Paula Dittrick has covered oil and gas from Houston for more than 20 years. Starting in May 2007, she developed a health, safety, and environment beat for Oil & Gas Journal. Dittrick is familiar with the industry’s financial aspects. She also monitors issues associated with carbon sequestration and renewable energy.

Dittrick joined OGJ in February 2001. Previously, she worked for Dow Jones and United Press International. She began writing about oil and gas as UPI’s West Texas bureau chief during the 1980s. She earned a Bachelor’s of Science degree in journalism from the University of Nebraska in 1974.