Iran seeks field revitalization, new development

Vahid Dokhani

Yu Technologies Inc.

Tulsa, Okla.

Zahra Minagar

Oklahoma State University

Stillwater, Okla.

The National Iranian Oil Co. (NIOC) aims to boost production by 1 million b/d from green fields. In the absence of production data, the only viable method to estimate a field's production potential is reservoir modeling, which is time-consuming. Analysts prefer an early estimate of the production potential of newly discovered or undeveloped fields for future planning or preliminary production design. In the case of Iran, such an estimate would also be helpful to exploration companies.

Iran's proven reserves at end-2014 measured 1,201.4 tcf, 18.2% of the global total. Iran's 157.8 billion bbl of proven oil reserves are the fourth largest worldwide.1 International sanctions against Iran hindered investment by major operating companies in the country's oil and gas fields. The US and EU lifted sanctions on Iran in January 2016.

Production of newly discovered fields remains problematic in many regions. More than 90% of new offshore discoveries in the past 10 years have been oil fields. The high cost of drilling and completing offshore wells makes gas fields less attractive to investors. A successful discovery well, depending on the size of the field, often requires additional wells to delineate the resource and collect data about productive formations within the reservoir. Production from a new field can often take up to 5 years to start.

This article investigates the ultimate production potential of Iran's oil and gas fields with a focus on the current state of Iran's oil and gas industry and the country's proposed petroleum contract framework.

New opportunity

Exploration companies are looking at new investment opportunities in Iran's oil and gas fields now that sanctions have been lifted.

Many independent oil companies viewed Iran's current buy-back framework as higher risk than alternatives presented in other Middle Eastern countries.

The new Iran Petroleum Contract (IPC) was announced during the Tehran Summit in November 2015. According to NIOC, the draft of the IPC has already been shared with some of the major petroleum companies for review and feedback.2 The major objectives of the new contract are to attract foreign investment, encourage the rapid development of shared oil and gas fields, increase production levels through improved oil recovery (IOR) and enhanced oil recovery (EOR) methods, and promote the transfer of technology through partnerships and training. NIOC is offering 24 project packages containing 50 field development plans under the new contract, including 30 undeveloped fields. It has also introduced 18 new blocks for exploration and development.2

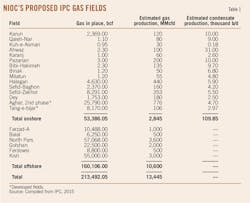

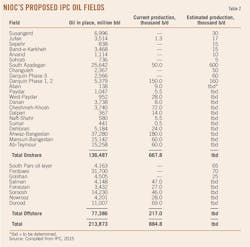

Table 1 lists the gas fields proposed by NIOC for the IPC, holding 213 tcf of gas-in-place. Iran's gas production is about 16.7 bcfd.1 Total gas production is expected to increase by 13.4 bcfd, an 80% jump, by virtue of the IPC. Iran has the largest gas network in the Middle East, its more than 22,000 km of high-pressure pipelines giving it the potential to become a regional gas hub.

More than 70% of Iran's oil production comes from fields greater than 50 years old. To compensate for an 8-10% decline rate due to natural depletion, the country needs major investment.3 Iran's Petroleum Minister last year announced that Iran needs to attract $180 billion to revive its oil, gas, and petrochemical industries by 2020. NIOC expects to increase crude oil production to 5.7 million b/d from redevelopment projects within 3-5 years.

The initial oil-in-place volume of the IPC-proposed oil fields, mainly located onshore, exceeds 210 billion bbl (Table 2). Most of these fields are developed, producing a combined 884,800 b/d. But the NIOC report does not declare the production potential of the developed fields, which must be determined by the contractors. NIOC is urging operators to evaluate the possibility of using enhanced oil recovery methods such as gas lift, downhole pump, or hydraulic fracturing to optimize production.

Oil production

This article draws a correlation between production potential and ultimate reserves in some of Iran's developed oil and gas fields, referencing three independent studies of oil and gas fields in other regions published in Oil & Gas Journal by Rafael Sandrea. In 2006, the study "Early new field production estimation could assist in quantifying supply trends," (OGJ, May 22, 2006, p. 30) showed the relationship between ultimate recovery and peak production in mature fields. In 2009, Sandrea published "New tool determines reserves of mature oil and gas fields" (OGJ, Mar. 23, 2009, p. 33) and "Equation aids early estimation of gas field production potential" (OGJ, May 22, 2009, p. 34). These articles combined provide a substantial tool to reasonably predict oil and gas reserves in Iran's aging fields.

The plateau production level is defined as 85% of the maximum production value of a given field and is associated with a period of flat production.4 Previous studies have shown a strong correlation between ultimate recoverable reserves (K) and the maximum production potential of oil or gas fields (qmax) (see equation), where α and β are constants to be determined through curve fitting of the model with available data from previously developed fields. The units for K and q are millions and thousands of b/d of oil, respectively. Knowing the reserves and the annual production potential of a field, one can also obtain field depletion rate.4

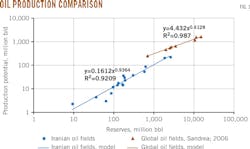

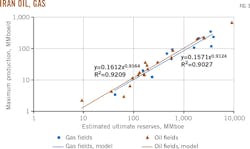

Sandrea's first study analyzed the production history of eight oil fields having reliable production histories. The fields' oil reserves ranged from 0.7 to 15 billion bbl (OGJ, May 22, 2006, p. 30). The coefficients α and β were obtained by plotting the maximum production vs. the estimated ultimate reserves of the fields (Fig. 1). The correlation coefficient (R2) is above 0.987, and the average difference between the model prediction and the actual data is 5%.

A similar correlation verified the reliability of the proposed model to predict the maximum production of 18 newly developed fields around the world. The average variation between the model prediction and the field data was 17.5%. Some researchers have argued that published values of production potential for newly developed fields often correspond to "name-plate" production capacities and do not reflect the peak production capacity of a given field (OGJ, May 22, 2006, p. 30).

Production model application

The study underlying this article performed a similar analysis, selecting some of Iran's oil fields from the literature.5 In most cases, these fields had more than 40 years of reliable production history. Reservoirs selected for the analysis included only limestone, dolomite, and lime reef rock types with medium to strong aquifer support.

Fig. 1 compares a correlation obtained from selected oil fields in Iran with selected oil fields in Sandrea's 2006 study. Fields in the current study ranged from 93,000 b/d to 224,000 b/d production, with a correlation coefficient above 0.92. Although the slope of the trend line for the Iranian oil fields is higher than that of the 2006 study's fields, the intercept with the vertical access is much lower.

Extrapolation of the correlation obtained for the selected oil fields in the 2006 study may not be appropriate, however, since the proposed correlation over predicts. The peak production potential of Iran's oil fields is also questionable. Lack of investment after Iran's revolution and the Iran-Iraq war are the two main factors that contributed to the selected fields' low performance.

Gas production

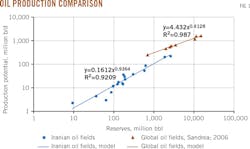

The 2009 study applied the same model to a group of seven mature giant gas fields in the US and UK (OGJ, May 22, 2009, p. 34). Reserves were already determined by decline rate analysis. For gas fields, qmax is expressed in billions of cubic feet/day and K in trillions of cubic feet. Reserves for selected fields ranged from 9 to 920 tcf.

This study took a similar approach for some of Iran's onshore gas fields. Fig. 2 compares the trend of Iran's gas fields with that presented in the 2009 study. The curves show a similar slope, but the intercept of Iran's gas fields with the vertical axis is lower than that of the selected US and UK gas fields. Performance of the gas fields used in the previous study was well-correlated despite having reserves greater than 10 tcf. The pattern for Iran's gas fields is more sporadic.

The global trend suggests a higher production potential for Iran's gas fields. This discrepancy can be attributed to technical or economic difficulties related to gas production in Iran. Maximum production from Iran's gas fields has also been limited by domestic demand's seasonal nature. Although most of country's gas fields were developed after the Iran-Iraq war, limited resources deprived Iran of proper field development.

US sanctions, the lack of investment in field maintenance, and scarcity of rigs also contributed to lower field potential. Ultimate reserves for some of these fields have been revised, signifying uncertainty regarding ultimate recovery. Upward revisions of reserve estimates for the Aghar and Tang-e-bijar fields, proposed recently for inclusion in the IPC, suggest that their maximum production potential (and that of other Iranian fields) has not been fully achieved.

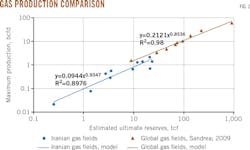

The comparison study from 2009 compiled all the data (a combination of sandstone and carbonate reservoirs in oil and gas fields) into a single plot using barrel-oil equivalents. An intersection between the oil and gas trend lines occurred at 10 billion boe (60 tcf), but the author initially expected to observe a parallel line for oil and gas fields.

In a similar approach, this study selected Iranian oil and gas fields with limestone and dolomite as the main rock type. Contrary to the 2009 study, the trend lines of Iran's oil and gas fields are almost parallel (Fig. 3). The production potential of Iran's oil and gas fields is lower than the global pattern, but the results confirm the intuitive expectation that the trend line for oil and gas fields would be parallel.

Production performance in some of Iran's oil and gas fields reveals a relation between ultimate reserves and production potential. The proposed relations are applicable for oil fields with reserves of 0.1-2.5 billion bbl, and for gas fields with reserves of 0.3-23 tcf. The model presents a quick estimate of the reserves for developed fields in the region. Such estimates provide informative analysis for exploration companies considering the oil and gas fields newly included in the IPC.

References

1. BP PLC, "Statistical Review of World Energy," June 2015 (www.bp.com).

2. NIOC, "Iran Petroleum Contracts," Nov. 29, 2015 (ipc.noic.ir).

3. Nejad, S., "Is Iran worth the risk?" Oil & Gas Financial Journal, December 2015, pp. 42-46.

4. Söderbergh, B., Jakobsson, K., and Aleklett, K., "European Energy Security: An An Analysis of Future Russian Natural Gas Production and Exports," Energy Policy, Vol. 38, No. 12, December 2010, pp. 7,827-43.

5. Dokhani, V. and Delfani, S., "Production Potential of Hydrocarbon Resources," Exploration and Production, Vol. 84, 2011, pp. 45-49.

The authors

Vahid Dokhani ([email protected]) is a technology specialist at YU Technologies Inc., Tulsa, Okla. He has also served as a production engineer for the National Iranian Oil Co. Dokhani holds a PhD (2014) and an MS (2005) from the University of Tulsa and a BS (2002) from the Petroleum University of Technology, Iran, all in petroleum engineering. He is a member of Society of Petroleum Engineers.

Zahra Minager ([email protected]) is a graduate student at Oklahoma State University, Stillwater, Okla. She holds a BS degree in mathematics from Islamic Azad University, Iran.