Oil tanker freight-rate volatility increases

Rajesh Rana

Beroe Consulting Pvt. Ltd.

Chennai, India

Factors that can either increase demand for tankers or lead to excess supply will clash for the balance of 2016, leading to great fluctuations in oil tanker freight rates. Crude oil prices plummeted in July 2014, leading to job cuts, declining margins, and depleted cash reserves for both upstream operators and their suppliers. Low oil prices, however, initially had the opposite effect on crude tanker rates, which had surged to 8-year highs by December 2015.

The market for crude tankers looked strong through at least 2017 as last year closed. Declining crude prices increased oil trade, with countries like China importing huge quantities to build up their strategic reserves. And with the Organization of Petroleum Exporting Countries (OPEC), North America, and Russia showing no signs of decreasing production, prices are not expected to rise radically over the next 2 years.

But daily rates for benchmark Saudi Arabia-Japan very large crude carrier (VLCC) cargoes crashed almost 50% in January. There was also a slump in Middle East spot cargo availabilities. Both events were in stark contradiction to the expected market trend. This article will examine if the oil-tanker market boom is already over or if the recent decrease in rates is seasonal and the market is still going to be strong.

Assessments

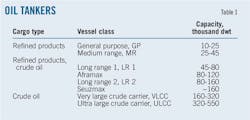

The Average Freight Rate Assessment system is a classification system used by the global crude oil and refining tanker fleet to establish shipping costs, standardize contract terms, and determine the ability of a ship to pass through certain channels and straits.

Classification occurs on a dwt basis, a measure of how much mass a ship is carrying or can safely carry (Table 1). To calculate the barrels of oil that a ship can carry, 90% of the ship's dwt is multiplied using a bbl/tonne conversion factor specific to the type of petroleum product or crude oil being transported.

Historical trend

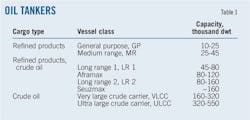

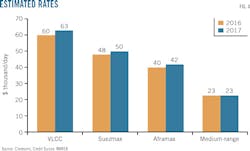

The oil tanker market had been sluggish since the economic downturn of 2008. High crude oil prices had dampened international trade and led to rate stagnation apart from the usual seasonal increase towards the end of each year due to heating oil demand, (Fig. 1).

Tanker rates 2009-13 were well below the long-term average (Table 2). The oil tanker industry suffered huge losses, with day rates often significantly below operating costs.

Revival

Crude production surpluses measured 0.85 million b/d worldwide in 2014 and 1.7 million b/d in 2015, according to the International Energy Agency. North America and OPEC were producing record volumes around January 2015, and with Iran sanctions soon to be lifted crude prices fell even further than had been expected. The lower commodity prices, however, helped spot tanker rates hit 7-year highs of $64,000/day in May 2015.

Improvement in time-charter rates was slow compared to the spot freight rates, getting stronger only towards end-2014. Time-charter prices were then relatively stable for first-quarter 2015. After further crude price declines and spot rate increases, time-charter rates started rising again, reaching $56,250/day their highest level since the start of the financial crisis in 2008.

2015 trends

Lowered crude oil costs improved refinery margins, resulting directly in more oil-products trade. One example was the 22% increase in China's export of oil products in 2015 as compared with 2014 reported by jodidata.org and trademap.org.

Floating storage also has been in increased demand, with commodity trading firms storing oil at sea to earn profits from longer-dated futures contracts. This practice has further reduced available shipping capacity.

Demolition activity has subsided, however, with most fleet operators instead running their vessels at maximum speeds to achieve as much benefit as possible from the increased demand.

Shipping companies ordered 66 new VLCCs in 2015, adding about 35 million dwt to the fleet..

2016 expectations, reality

A 2015 in which the market witnessed the highest freight rates in years and rapid increase in demand prompted expectations that strength in the oil tanker industry would continue in 2016.

• Oil tanker net earnings were expected to increase 5-10% in 2016 compared with 2015.

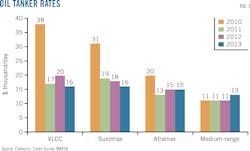

• The existing fleet of crude oil tankers was projected to grow by 4.3% in 2016, with total fleet growth expected to be around 5-6%.

• With VLCC utilization rising to 95% towards end-2015, freight rates were expected rise beyond $100,000/day.

The oil tanker industry expected another profitable year in 2016 and freight rates were expected to remain elevated for most of the year. But following winter's seasonal hike, freight rates started declining. Asian VLCC rates (Persian Gulf-Japan route) dropped 44% in January 2016, losing 11 worldscale points to trade at W53.25. Worldscale prices represent a percentage of the nominal value of shipping the cargo in question. Day rates for Saudi Arabia-Japan VLCC rates fell nearly 50%, reaching $50,955/day in January after briefly reaching the expected $100,000/day mark just one month earlier.

Heightened competition between owners keen to avoid lengthy waiting periods for vessels heading to the Middle East was the main reason for the decline. At one point more than 10 vessel offers were made on a single eastbound Persian Gulf cargo. The increased competition stemmed from abundant vessel supply, including newly built VLCCs, older tonnage, and ships just out of dry dock. Freight rates remained low in February, with the key Persian Gulf-Japan route assessed at W59.5 early in the month.

Rates started rising again, however, at the start of March. Persian Gulf-Japan prices jumped more than 33% to eclipse 100 worldscale points for the first time since Jan. 8. Spot market rates rose to about $60,000/day, driven in large part by delays in discharging ships in northern China. An increase in short-term VLCC charters also tightened the market.

The future

Improved March vessel demand helped shrink the tanker oversupply. But the industry expects to take delivery of about 130 total VLCCs and Suezmaxes in 2016 and first-half 2017, further depressing freight rates.

With the global oil market flooded, most countries and refineries have been stockpiling crude for future use. Once stockpiling ends and refiners start running down inventories, tanker demand will take a serious hit.

Vessel-demand growth for 2015 was significantly higher than supply growth, one of the primary reasons for high freight costs. The opposite, however, is expected to hold true this year. And the total number of scrapped tankers will not be enough to offest the high number of new tankers entering the market. The rate at which US and Iranian crude exports enter the market will help determine the severity of downward pressure on freight rates.

Strategy

Oil tanker suppliers should be cautious. Entering into a 3-year time charter can shield them against market volatility. Current 3-year charter rates stands at $44,000/day vs. $58,250/day for a 1-year charter. Considering the possibility of both vessel oversupply and decreased demand, rates could go much lower than $44,000/day.

Suppliers with diverse fleets can enter into long-term crude charters on their Suezmax or smaller vessels, and use the VLCCs for 1-year business, taking advantage of any short-term upticks while hedging against risk as well. Similarly suppliers with both crude and product carriers can go into long-term charters on their crude carriers and rely on market conditions for the products fleet. Refined products trade will likely increase as low crude prices improve refining margins.

Bibliography

Avraam, A., "Crude Oil Tanker Market: A Strong Performer in 2015 and its Outlook," PwC Cyprus, http://www.pwc.com.cy/en/articles/2016/tanker-market-a-strong-performer-in-2015-and-its-outlook.html

Baltic and International Marine Council (BIMCO), "Tanker Shipping: Still a Strong Market as Demand Stays High," Jan. 25, 2016.

BIMCO, "Six New VLCCs Marks the Start of a Busy Delivery Year," Feb. 10, 2016.

Catlin, J., "How Will Increasing Iranian Crude Exports Impact The Crude Tanker Market," Seeking Alpha, Jan. 26, 2016.

Christie, N. and Lehane, B., "The Tanker Market is Sending a Big Warning to Oil Bulls," Bloomberg, May 27, 2015.

Disruptive Investor, "Will Strong Spot Tanker Rates Sustain in 2016?" Feb. 21, 2016.

FuelFix, "Oil Tanker Rates Jump to Seven-Year High as Ships Forced to Wait," Bloomberg, Dec. 3, 2015.

Goodridge, S., "Tanker Rates Exhibit Counter-Seasonal Trend," Market Realist, July 29, 2015.

Goodridge, S., "One More Seasonally Strong Month Ahead for Crude Tankers," Market Realist, Dec. 30, 2015.

Goodridge, S., "Is the Crude Tanker Industry Really in Trouble," Market Realist, Jan. 21, 2016.

Hamilton, T.M., "Oil Tanker Sizes Range from General Purpose to Ultra-Large Crude Carriers on AFRA Scale," US Energy Information Administration, Today In Energy, Sept. 16, 2014.

Hargreaves, R., "Oil Tanker Sector Fit for a Fruitful 2016," ValueWalk, Dec. 22, 2015.

Hellenic Shipping News, "Tanker Shipping Rates to Soften from 2016," Drewry, Apr. 12, 2015.

Konig & Cie. GmbH & Co. KG, "Tanker Charter-Rates," April 2016.

Platts Marine, "Dirty Tankers East of Suez Commentary," Mar. 14, 2016.

Poten & Partners, "Reading Tanker Tea Leaves: IEA Paints Lukewarm Outlook for Crude Oil Tankers," Poten Tanker Opinion, Feb. 26, 2016.

Mackay, K., "Teekay Tankers Investor Day," Sept. 30, 2014.

Wang, W., "Marine News," Platts Marine, Mar. 14, 2016.

World Maritime News, "Crude Tanker Market Facing Downturn in Second Half of 2016," Dec. 16, 2015.

World Maritime News, "Crude Oil Tanker Market to Surge in 2016," Jan. 26, 2016.

The author