Lagging pipelines create US gulf light sweet crude glut

Trisha Curtis

Matt Calderon

Ben Montalbano

Lucian Pugliaresi

Energy Policy Research Foundation Inc.

Washington

North American pipeline capacity did not adapt quickly enough to rapidly growing crude oil production, resulting in supply bottlenecks. Now that a build-out is under way, a glut of light sweet crude will likely emerge on the US Gulf Coast.

Constraints, both commercial and regulatory, in building out new pipeline infrastructure and expanding existing infrastructure contributed to steep price discounts for Canadian, Bakken, and other North American crude oil. Rail now offers producers the ability to select the markets into which they will sell without requiring a long-term destination commitment.

Initial production uncertainty in these new shale-tight oil formations may have helped slow large-scale pipeline development. Pipelines typically require a high degree of confidence that shipping can be sustained long enough and at high enough volumes to amortize infrastructure over 20 years. The scale and speed with which tight-shale oil development occurred, combined with growth from the Canadian oil sands, made it difficult for many companies to make this determination.

New pipeline projects face uncertainty in obtaining construction permits. Not only are the state and federal regulatory structure and approval processes for greenfield pipeline projects cumbersome, shippers increasingly hesitate to commit large volumes into a single market for a long time. Refineries may also be less willing to commit to pipeline volumes as they work to adapt to new crude oil slates with varying discounts.

While crude by rail has proven to be a flexible and relatively cost-effective option to move oil to market, the continued reliance and expanded use of rail also stems from limited pipeline infrastructure and changing market dynamics. The original incentive to move crude by rail started in North Dakota at the beginning of the Bakken oil boom when the region was short on pipeline capacity and experiencing rapid production growth. EOG Resources Inc. spearheaded the Stanley rail terminal project to move its oil directly to St. James, La., avoiding steep pricing discounts and gaining some control over transportation of its production.

Rail allowed companies like EOG to move crude oil to more favorable coastal markets and receive Brent pricing instead of discounted Clearbrook or Cushing prices. While rail shipments are more costly than pipeline, there is room to pay for them when the West Texas Intermediate-Brent discount is $10-20/bbl.

The growth in rail terminal capacity and rail's wide footprint have created spare pipeline capacity to move Bakken crude out of North Dakota. New pipeline capacity has come online but has been largely built along existing routes and to existing markets. Producers may wish to allocate some, but not all, of their production to these existing markets while maintaining the flexibility to move a portion of their production via rail to different markets where they can achieve higher netbacks.

More than 760,000 b/d, or 71%, of Williston basin production is leaving North Dakota by rail. This number dipped slightly as the WTI-Brent spread narrowed, but the spread between North Dakota light sweet and Brent was still wide enough to warrant prudent crude-by-rail shipments.

The cost to ship crude by rail varies from railroad to railroad, shipper to shipper, and deal to deal. However, EPRINC estimates that the cost to move crude oil from North Dakota to the East Coast or West Coast is $10-15/bbl. This relatively high price has combined with narrowing price spreads and an over-build of loading terminals to cool the rail market. Crude-by-rail shipments, however, are likely to remain between 500,000 and 800,000 b/d because of the need to move crude oil efficiently and shippers' desire for diversification and flexibility.

Regardless of price spreads, spare pipeline capacity out of North Dakota is likely to remain. The middle of the US is saturated with light sweet crude and the Gulf Coast is quickly becoming saturated as well. Producers are choosing to put large volumes of crude into tank cars rather than use existing pipelines that serve saturated markets.

The East Coast and West Coast are both disconnected from major crude oil pipelines, the systems out of North Dakota offering producers little incentive to commit barrels. Enbridge Inc.'s system, for instance, can send Bakken crude oil north and east into the Line 65 portion of its mainline. But this material then settles in Clearbrook, Minn., a market that typically discounts Bakken crude oil and is sensitive to regional refinery maintenance, pipeline maintenance, and Canadian supply disruptions.

True Cos.' system—including the Belle Fourche, Bridger, and Butte pipeline companies—sends crude oil south into Wyoming, another saturated market. Both Enbridge and True systems (Fig. 1) have been underused as producers move their barrels to rail seeking higher priced markets. Rail will remain a major mode of transportation for North Dakota simply because the current pipeline network cannot move Bakken crude oil to the East or West Coasts where both the refining capacity and demand exist.

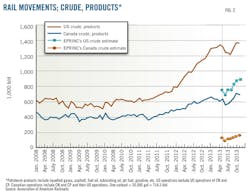

The majority of crude oil moving by rail within the US and Canada is from the Bakken. EPRINC estimates that of the 1.4-million b/d of crude oil and petroleum products moving via rail in the US alone, roughly 900,000 b/d is crude oil. Of the 700,000 b/d of crude oil and petroleum product moving via rail in Canada, about 160,000 b/d is crude oil. Together, 1-million b/d of crude is moving via rail in the US and Canada, 780,000 b/d of which is Bakken crude.

An additional 100,000 b/d is likely moving from other plays within the US (the Niobrara and Anadarko formations). Roughly 160,000 b/d is moving out of Canada to refineries within Canada, along the US East Coast, and increasingly to the Gulf Coast. And roughly 600,000 b/d of ethanol bound for the gasoline supply is also moved via rail.

Canadian railroads have not moved as quickly as US railroads to accommodate growing, discounted production in their backyard. Origin terminals are being planned and rapidly built in Canada, but only a few sites are currently available to unload and process heavy bitumen via rail. The most likely method for shipping bitumen via rail would be heated cars, avoiding diluent or condensate use, each of which add cost. Without the diluent, however, proper unloading of the rail cars requires heating, which in turn requires the necessary infrastructure at the unloading facility.

Economies of scale require unit trains using 100 or more tank cars. Manifest shipments will still occur but will be more costly due to the absence of scale. Realizing the efficiencies of unit trains will require destination terminals with the necessary infrastructure and capacity to unload hundreds of railcars at a time.

Such terminals are being built and crude by rail will become an increasingly important asset for Canadian producers in the future. The lag in infrastructure build-out for heavy oil unloading, however, may see blended bitumen shipped by unit train as a near-term substitute. Rail will become an essential, rather than additional, mode of crude oil shipment should the Keystone XL, Northern Gateway, or Energy East pipeline projects fail to be approved.

The regulatory environment for the transportation of crude oil via rail has, until recently, been relatively benign. Unlike oil pipelines in which tariff structures are regulated by the US Federal Energy Regulatory Commission (FERC), moving crude by rail requires no regulatory pricing approvals. Companies and third parties negotiate prices with the railroad for either short or long-term rates. Individual states regulate terminal build-out. This combined regulatory flexibility is partially responsible for rail's quick adaptation by the oil industry.

The recent accident in Lac Megantic, Que., and subsequent derailments and explosions in the US, however, have changed public perception of safely moving crude oil by rail. US derailments last year resulted in 1.15-million gal (27,000 bbl) of oil spilled, compared with 800,000 gal spilled in total between 1975 and 2012, as shown in US Pipeline and Hazardous Materials Association (PHMSA) data. According to the Association of American Railroads (AAR), 11.5-billion gal travelled by rail last year.

The flammability of Bakken crude oil has been called into question and PHMSA has issued safety alerts to shippers and carriers, emergency responders, and the general public. While investigations are still taking place, Canadian regulators have already changed rail safety requirements. Immediate regulatory changes that require trains to be manned at all times, staffed with at least two crew members, and require more brakes to be engaged along the train when stopped have taken effect. The AAR has implemented similar measures at the request of the US Federal Railroad Administration (FRA).

The containment integrity of tank cars moving crude oil has also come into question. Industry responses suggest the current fleet will largely be replaced with approved and updated Department of Transportation (DOT) 111A tank cars during the next 2 years. These updated tank cars have thicker tanks and more robust safety bumpers. Existing tank cars not meeting the new DOT 111A standards could be removed should regulators ban their use. Short-line railroads continue to have problems obtaining sufficient insurance coverage for movement of crude oil and other hazardous chemicals.

Barges

Producers have turned to barging in recent years as a partial solution to infrastructure shortcomings, using both inland waterways and rail-to-barge routes. Eastbound crude oil is railed to Albany, NY, then loaded onto barges and shipped down the Hudson River to East Coast refineries. Westbound crude oil travels by rail to Washington refineries. The potential exists to barge crude oil along the West Coast to refineries in California, but the Jones Act may make the cost of doing so prohibitive. Rail-to-barge terminals have also been developed along inland waterways on the Upper Mississippi River and Illinois River, connecting Minneapolis and Chicago to the Gulf Coast. These rail-to-barge sites primarily transport Bakken crude oil but also move Canadian crude oil railed into US Petroleum Administration for Defense District (PADD) 2.

Fig. 3 shows the increase in barge shipments from the Midwest to the Gulf Coast since 2005, currently 127,000 b/d, up more than 100,000 b/d since 2010.

Given the large volumes of crude oil flowing into the gulf, barge movements also play an important role in moving production to refineries along the Gulf Coast. Barge shipments of crude oil from Corpus Christi, Tex., rose from almost zero in early 2012 to 300,000 b/d by yearend.1 Barging volumes may decrease when pipelines such as Shell's Ho-Ho start taking crude oil from Houston to refineries in St. James, La.

Barging will remain an integral mode of transportation as demand grows to move crude oil along the East and West Coasts but will ultimately be limited by the Jones Act. The Merchant Marine Act of 1920, better known as the Jones Act, requires US flagged, built, and owned vessels to transport goods between US ports. Jones Act-vessels must be owned by a US company, manned by a mostly US crew, and built in the US. The Jones Act requires the crew be at least 75% US citizens and that vessels limit the amount of foreign-sourced materials used in repairs to 10%.

The need to move larger crude oil volumes throughout North America raises the issue of whether exemptions to the Jones Act are needed or whether the Jones Act can be adapted more efficiently so that ships can play a larger role in moving domestic crude oil to refining centers. Jones Act requirements apply to the both tankers and barges and increase the cost of shipping between US ports. The exact premium imposed by the Jones Act is unclear, but it will likely become an issue of discussion as light sweet crude oil continues to make its way to the Gulf Coast and Eagle Ford production breaches 1-million b/d. Estimates place the cost of moving crude on a Jones Act-vessel from the Gulf Coast to the Northeast at $4.00-6.30/bbl.2-3

Pipeline development

The resurgence in rail (and to a lesser extent barge) reflects the desire of producers to maintain flexibility and achieve improved netbacks by having the ongoing choice of shipping to the East Coast, West Coast, or Gulf Coast. It also reflects the slow pace of pipeline build-out. As production rose, pipelines adapted to move new crude oil volumes from the producing regions into the larger existing pipeline network. But delay in major projects such as Keystone XL created market uncertainty about the construction of large-scale greenfield pipelines and inhibited rapid debottlenecking of Canadian and Bakken crude oil in the Midwest. As bottlenecks and chokepoints developed, prices discounted, increasing crude-by-rail's attractiveness. The potential for rail to compete with certain pipeline projects subsequently put the commercial viability of those projects into question.

Obtaining the necessary long-term commitments from shippers to develop a pipeline is difficult now that producers have the option of market diversification and short-term contracts via rail. With rail, producers can shift production volumes to alternative destinations as market conditions change. Greenfield projects to a new market—a pipeline from North Dakota to the East Coast or North Dakota to the West Coast—might attract shippers, but the regulatory and political risk is too great to allow construction.

Expanding, retrofitting, reversing, or twinning existing pipeline routes seems to be the preference among midstream companies. These options, however, also carry financial risks because most feed into existing markets. Oneok Partners LP cancelled its Bakken Express pipeline project to move crude oil from the Williston Basin to Cushing because it could not attract the interest of shippers willing to commit sizeable long-term volumes (OGJ Online, Nov. 27, 2012).

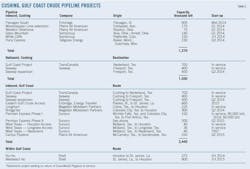

The vast amount of crude oil on the market, however, has created a need for both pipelines and alternative shipping modes. A plethora of pipelines is coming online, under construction, or in the first stages of development. Most of this new pipeline capacity, roughly 7.3-million b/d as estimated by EPRINC, consists of pipeline reversals, expansions, extensions, twinning, repurposing, and retrofitting. Using existing assets and existing rights-of-way saves midstream companies capital and time. Regulatory procedures still exist, but the time from planning to construction is usually shortened by using assets and rights-of-way already in place.

Table 1 lists major pipeline projects since 2012 and highlights the capacity of each project along with its type: i.e., expansion, conversion, twin, etc. Large investments are being made in the midstream. Companies are actively working to move new crude oil volumes to market. But pipeline permitting, development, and construction, coupled with increasingly remote production sources, means alleviating newly found bottlenecks and chokepoints will take time.

As the midstream space works to relieve congestion in Cushing, new constraints arise in the gulf. Without the ability to export crude oil from the gulf, either abroad or to the East Coast (via water shipments), new inbound pipeline capacity together with rising Permian and Eagle Ford production will cause logistical problems on the Gulf Coast. Table 2 breaks down inbound pipeline capacity additions to Cushing and the gulf.

Nearly 3.5-million b/d of new inbound transportation capacity to the Gulf Coast is set to come online between now and 2015. Multiple pipeline projects have already begun flowing oil from the Permian basin to the Gulf Coast, altering the previous flow of Permian crude oil into Cushing. In 2012, only small volumes of Permian basin crude oil moved to the Gulf Coast, while roughly 500,000 b/d was sent into Cushing via pipeline. By yearend-2013, 400,000 b/d of pipeline capacity from West Texas to the Gulf Coast was available. By yearend 2014, pipeline capacity along this route will rise to about 700,000 b/d.

This redirection of oil flow is critical to alleviating the bottleneck in Cushing. Coupled with rising Eagle Ford production, however, another 700,000 b/d of light sweet crude oil delivered onto the Gulf Coast will not only finish backing out all light sweet imports, it will also fundamentally change the gulf's crude flow.

EPRINC projects major pipeline flows into the Houston area will reach more than 3 million b/d by yearend. As Cushing has for the Midcontinent, Houston is becoming a storage hub and terminal center for the Gulf Coast. Rail shipments of Bakken crude oil into St. James, La., will likely cease in the coming months as these refineries become increasingly well supplied with light sweet crude from the Eagle Ford shale and Permian basin.

Planned pipeline capacity additions will help alleviate many existing bottlenecks and inefficiencies in the pipeline network. But congestion and inefficiencies will likely remain. Some projects may not be developed, and none solves the Bakken dilemma, they only exacerbate it.

As infrastructure develops to move Permian basin crude oil to the Gulf Coast, Bakken crude oil will no longer have a home in St. James, La. Production increases from the Eagle Ford alone will be greater than residual capacity available at area refineries. These factors also post a threat to the Eastern Gulf Crude Access project. Bakken crude oil would be left without a home accessible by pipeline and subsequently would continue to move by rail to the East and West Coasts.

Enbridge and Energy Transfer Partners' planned Eastern Gulf Crude Access pipeline from Patoka, Ill., to St. James, La., would bring an additional 660,000 b/d of Bakken crude into the Gulf Coast by mid-2015. With many of the region's refineries, however, having already reached their capacity for processing light sweet crude oil through supplies from the Eagle Ford and elsewhere, they will either have to blend this crude to make a medium barrel or adjust to run even higher quantities of light crude. Either way, this amount of additional light sweet crude oil moving into the gulf, coupled with further increases in Eagle Ford production, will create new bottlenecks and dislocations.

Risks, uncertainty

Two primary constraints impede construction of new crude oil transportation in North America: commercial and regulatory risk. Perhaps the most frequently encountered constraint is the commercial risk associated with new pipeline construction. Most pipeline projects are only economically viable when they secure long-term supply commitments from upstream producers. Without such commitments, a pipeline operator cannot be certain the project will generate revenues necessary to justify the costs and time involved to plan, permit, construct, and operate.

The North American petroleum renaissance occurred at a pace that surprised many industry participants and included parts of the US petroleum sector that had either been left for dead (PADD 1 refineries), in decline (the Permian basin and West Texas), or barely existed to begin with (North Dakota). As a result, many upstream producers find it risky to commit to a pipeline project requiring a 20-year contract and locking part of their production into a single market along a fixed route.

If market conditions change, producers with fixed commitments may be unable to adjust fully and could be forced to absorb large economic costs. Given the ongoing evolution of the petroleum renaissance, and in particular crude oil demand among refineries in coastal regions combined with still fledgling shale plays, producers remain hesitant to commit to long-term pipeline projects.

Kinder Morgan cancelled its $2-billion Freedom pipeline conversion from West Texas to California because it lacked sufficient commitments from either crude shippers or crude purchasers (OGJ, Aug. 5, 2013, p. 91). Potential shippers found the short-term flexibility of rail more attractive, given uncertainty in the market and changing price spreads. Refineries, meanwhile, sought to be able to take advantage of potential Bakken crude oil via rail from North Dakota. Neither party was willing to commit to long-term contracts and risk the potential upside offered by more flexible options.

Rail shipments of crude oil have emerged to fill the transportation vacuum created by the lack of new pipeline projects in certain regions. It can be argued that the proliferation of rail, particularly in the Bakken, has prevented construction of some new pipelines. But one must consider whether Bakken production would have reached its current extent without access to coastal refinery regions via rail shipments.

Rail has provided flexibility and options that pipelines cannot. It has done so in a short time. Without rail in the Bakken, producers would still face the risk of locking themselves into a market that becomes undesirable in the future by offering them a lower wellhead value. Commitments to send Bakken crude oil south by pipeline, for instance, would have likely exacerbated existing bottlenecks in Cushing and nearby regions, lowering wellhead values and Bakken investment. It would have also reduced the availability of light sweet crude to refiners in PADD 1, preventing its resurgence.

Not all pipeline projects are hindered by commercial risk. Demand for the proposed Keystone XL pipeline was clear to oil sands producers and Gulf Coast refiners. Canadian oil sands are well matched to the refining complexity of many Gulf Coast refineries, some of which were modified specifically to process Canadian bitumen. With the expected steady increase in Canadian oil sands production, more capacity was going to be needed to send oil from Alberta to the Gulf Coast. Keystone XL was proposed and received commercial backing from producers. The risk to Keystone XL, and several other projects, is regulatory.

The $5.3-billion project has faced numerous obstacles in its quest for a US Presidential Permit over the past 4 years, including a second application, a re-route, and two Environmental Impact Statements (EIS). President Barack Obama has stated that the pipeline will only be approved if it "does not significantly exacerbate the problem of carbon pollution."4 The US Department of State on Jan. 31 issued its final supplemental environmental impact statement on Keystone XL, stating that the project would not have significant environmental effects and clearing the way for a determination of whether it is in the US national interest.

Enbridge's 731-mile Northern Gateway pipeline has been approved by Canada's National Energy Board (NEB), but it still awaits approval from the Canadian Federal government. The NEB approval is already facing multiple appeals in court. The Joint Review Panel, an independent panel appointed by the NEB, completed its public hearing process in June (OGJ Online, Dec. 20, 2013). The $6-billion project faces opposition from environmental groups and First Nations.

The pipeline would ship crude oil to the Pacific coast at Kitmat, BC, from Edmonton, Alta., for export to Asia and the US West Coast. It would also send condensate the reverse direction. First Nations argue against an increase in crude oil tanker traffic along the coast, currently an estimated 79,000 b/d. Enbridge has already spent $500-million on environmental studies and legal fees defending the project.

These two major pipeline projects offer Canadian producers viable outlets to move crude oil to markets where ample demand exists. The delay in both, particularly Keystone XL, has created extensive uncertainty around the ability to build a large-scale greenfield pipeline in the future and the role environmental opposition will play in future infrastructure development. Current opposition to Keystone XL is unique in that rather than targeting the pipeline itself, it is primarily focused on the oil sands that would flow through the pipeline.

Smaller midstream companies have noted a substantial increase in the time it takes to receive infrastructure permits and complete a project. Several factors contribute to these delays. Obtaining the necessary rights-of-way (ROW) can be difficult in regions new to high-volume oil production, such as the Bakken. Landowners experiencing increased oilfield activity on their land and in their communities are becoming less willing to quickly accommodate upstream and midstream companies seeking to lay pipelines on their land.

The number of applications for pipeline projects also has increased since the shale oil boom began. Regulators have more projects to evaluate than they did before. The permitting process, further, is quite complex and often requires coordinating with multiple agencies or states simultaneously.

While the regulatory climate can be cumbersome, new and existing infrastructure projects must be closely regulated to reduce local safety hazards and environmental risks. Pipeline spills and rail accidents in 2013 suggest there is room to improve both regulatory statutes and enforcement. But when actions are taken to impede infrastructure development and serve as a proxy in a campaign against a given energy supply, their results might be both economically and environmentally counterproductive.

Without pipeline shipments of oil sands crude to the gulf, the US will have to continue waterborne tanker imports from countries with fewer shared economic ties and greater political volatility. Rail shipments of Canadian oil sands supplies also will increase and Canadian producers will continue to pursue alternate transportation routes and markets.

References

1. Fielden, Sandy. "We're Jammin' – But Can All Dat' Crude Get Through?—Corpus Christi Terminals." RBN Energy, July 31, 2013.

2. Bussey, John. "Oil and the Ghost of 1920," Wall Street Journal, Aug. 28, 2013.

3. US Energy Information Adminstration, "Additional Information on Jones Act Vessels' Potential Role in Northeast Refinery Closures," May 11, 2012.

4. President Obama remarks on climate change at Georgetown University, June 25, 2013.

The authors

Trisha Curtis ([email protected]) is director of research, upstream and midstream, at the Energy Policy Research Foundation Inc. (EPRINC). Since 2010 her work at EPRINC has focused on evaluating North American potential for increased production from the Western Canadian Sedimentary basin and US unconventional oil production. Curtis earned a BS in economics and a BA in politics (2008) from Regis University, Denver, and an MSc in international political economy (2009) from the London School of Economics.

Matt Calderon ([email protected]) is a research analyst at EPRINC. He has also served as an intern at Arbor Advisors, an investment bank in Silicon Valley. He holds a BS in economics (2012) from Santa Clara University.

Ben Montalbano ([email protected]) is director of research and operations at EPRINC, covering world energy markets and policy developments with a focus on oil, natural gas, and biofuels. Montalbano previously worked for Raymond James and software company Liquid Scenarios. He earned a BS in economics (2008) from the University of Colorado, Boulder.

Lucian (Lou) Pugliaresi is president of the Energy Policy Research Foundation Inc., a not-for-profit organization formed in 1944 that studies energy economics and policy issues with special emphasis on oil, natural gas, and petroleum product markets. Pugliaresi has served in a wide range of government posts, including the National Security Council at the White House (Reagan Administration), Departments of State, Energy, and Interior, as well as the EPA. He graduated from the University of California at Berkeley with a BA in economics (1970).