NPD sees optimism on Norwegian Continental Shelf

Undiscovered recoverable resources on the Norwegian Continental Shelf are an estimated 935 million to 5,420 million standard cu m of oil equivalent (scmoe), the Norwegian Petroleum Directorate estimated last month.

The estimate embraces the entire NCS except for a new area in the northeastern Barents Sea acquired under a recent maritime delimitation treaty between Norway and Russia.

The undiscovered recoverable average volume of 2,980 million scmoe is 410 million higher than the previous NPD estimate in 2011.

From 1966 through April 2013, about 1,430 exploratory wells have been drilled on the NCS, peaking at nearly 50 wells/year in the 1980s, receding to a low of 5 in 2005, and averaging more than 40 wells/year the last 5 years.

Resource growth the past 15 years has been substantially smaller than in the two previous 15-year periods, NPD said, but the last 5 years have been positive with several large discoveries including Johan Sverdrup on the North Sea's Utsira high in 2010.

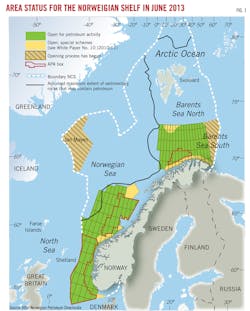

NPD noted that Norway's overall offshore area covers 2.04 million sq km, 6½ times the country's mainland area (Fig. 1). About half of the NCS contains sedimentary rocks that could contain oil and gas.

The full report in seven parts is published on the NPD web site.

Undiscovered resources

The main reason for the rise in its estimate of undiscovered recoverable resources on the NCS is that it included for the first time areas in the Barents Sea southeast and the Jan Mayen area, NPD said.

The largest components of NPD's average NCS estimate of 2,980 million scmoe are the Barents Sea with 960 million scmoe and the North Sea with 850 million scmoe. The Norwegian Sea, Barents Sea southeast, and Jan Mayen have lesser volumes.

Liquids potential is judged to be greatest in the North Sea and gas potential largest in the Barents Sea. In other words, should discoveries be made, gas is most likely to be found in the Barents Sea southeast and oil around Jan Mayen, NPD said.

Uncertainty as to undiscovered resources is greatest in the Barents Sea, where exploration didn't begin until 1980 and the fewest wells have been drilled. Exploration in the North Sea began in the mid-1960s, so uncertainty there is less because more plays have been confirmed by discoveries.

NPD has identified 73 plays on the NCS of which 40 have been confirmed by discoveries. Explorers have confirmed 19 of the 24 plays in the North Sea, 11 of the 22 plays in the Norwegian Sea, and 10 of the 27 plays in the Barents Sea.

Recent exploration

A series of discoveries has resulted from the high level of exploratory activity in recent years.

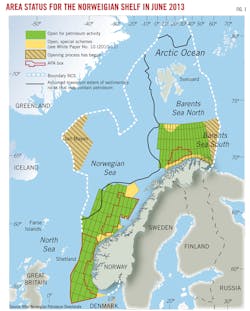

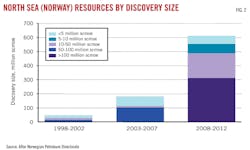

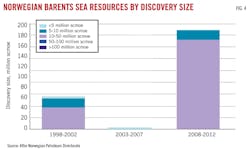

Three of the past 5 years accounted for the largest-ever number of finds on the NCS, NPD noted (Figs. 2-4). A large proportion of these have been made on acreage awarded in the country's four first license rounds.

No discovery has been made on production licenses awarded in the 21st round or the APA 2011 and 2012 rounds since it takes time for drilling decisions to be taken and wells spudded.

The average finding success rate on the NCS has been rising in line with growing knowledge of its geology and with technological advances, NPD said. Technical and commercial finding rates have averaged 55% and 40%, respectively, over the past 15 years.

Not all discoveries will be developed. The NPD has classified some discoveries as unlikely to be produced because they are not expected to prove commercial, even in the long term.

This type of discovery, known as resource category 6, contains resources for which substantial changes in technology, costs, and petroleum prices are required if they are to be brought to commercial production and where such changes are thought to be unlikely.

Resource category 6 contains 108 discoveries, whose resources are not included in the estimate of total recoverable resources on the NCS.

Few examples exist of discoveries placed in this category that have subsequently been developed. However, new nearby discoveries, technological advances, and significant changes in the price and cost picture could change conditions for commercial development.

North, Norwegian seas

Operators have drilled 615 wildcats on the Norwegian side of the North Sea since 1965.

North Sea exploratory activity remains high, and about 100 new production licenses have been awarded during 2011-13.

About 200 wildcats have been drilled in the Norwegian Sea since 1980, but since an upturn in 2008-10 interest has been limited outside areas close to existing fields.

Operators made nine discoveries out of 19 wildcats drilled in 2011-May 2013, but proven volumes in the discoveries have been moderate to small.

The Norwegian Sea deepwater remains a frontier area in relative terms, and only one of the 19 wildcats was drilled outside the existing APA area in deep water in the Voring basin. No deepwater exploratory well is planned in the Norwegian Sea in 2013.

In the deepwater areas, particular work is being done to prepare for seismic surveying beneath the basalt layers adjacent to the More and Voring high and in the westernmost part of the More and Voring basin.

After several years of limited exploratory activity in the More basin in the southern Norwegian Sea, a number of new licenses have been awarded in the south of the basin around Ormen Lange field and in the basalt region farthest to the west, NPD noted.

These licenses were awarded in the 20th and 21st license rounds and in the 2010 APA round. Evaluations under way in a number of them will result in drill or drop decisions within 1-3 years.

Norwegian Barents Sea

Optimism has returned to the Barents Sea after many years of disappointment, and NPD expects 10-14 wells to be drilled in the Barents in 2013.

This revival occurred mainly because of three discoveries made in 2011-12.

They are the Johan Castberg oil find (7220/8-1 Skrugard and 7220/7-1 Havis) and the 7225/3-1 (Norvarg) gas discovery.

About 100 exploratory wells, including some 80 wildcats, have been drilled in the Barents since 1980. The first discovery, 7120/8-1 Askeladd, came in 1981.

More than 30 discoveries have been made in the Barents Sea, though some are not expected to be commercial and are grouped in resource category 6.

Only one field, the Snohvit cluster of eight gas discoveries, has come on stream, although Goliat oil field is under development.

In 2011, Johan Castberg proved gas and oil in Jurassic rocks. As expected, NPD said, the double flat spot seen on seismic proved to represent the gas-oil and oil-water contacts.

The industry is working to find explanations for why the petroleum system functions in this area. Large parts of the Barents Sea have been subject to uplift and erosion, with many of the strata eroded away so that the petroleum has leaked out.

The gas leakage is clearly visible in on seismic, including above the Skrugard structure, but has probably acted there as a form of safety valve. Because the gas leaks out, it does not expand in the reservoir and drive out the oil.

In addition, the source rock lies at a favorable depth for also generating oil and gas today. This means, NPD said, that the traps could be dynamically refilled with petroleum to compensate for the leakage, not unlike the petroleum systems in the North Sea.

NPD recently mapped the Barents Sea southeast area, which could be opened to industry as early as 2013 if the Storting (parliament) gives its consent, said Sissel H. Eriksen, NPD exploration director, in a preface to the report.