Oil Price Fluctuations

The impact on major oil-exporting countries in the Middle East

SANJAY KUMAR KAR AND YASH PATHAK, RAJIV GANDHI INSTITUTE OF PETROLEUM TECHNOLOGY, JAIS, INDIA

Oil is the second largest contributor to global primary energy consumption and BP's Statistical Energy Outlook suggests that it will continue to play a similar role until 2035. It is fair to argue that oil remains one of the biggest drivers of the global economy. Therefore, crude oil demand-supply dynamics critically influence price - a concern for global investors and importing and exporting countries. History presents numerous instances of crude oil price fluctuations. Whenever such fluctuations occurred, both oil rich and oil deficient countries faced challenges. Further, price fluctuations had far reaching consequences beyond demand-supply dynamics.

This article discusses factors responsible for oil price fluctuations and covers the impact of such fluctuations on GDP, export, trade balance, and budgetary expenditure of selected countries in the Middle-East. Further, the authors highlight strategic actions taken by the concerned countries to counter the adverse impact of fluctuating oil price. Finally, the authors recommend some strategic measures to minimize negative impact of such fluctuations in the future.

Major factors behind crude oil price fluctuations

Crude oil is one of the most widely traded commodities in the world, and its price is exposed to many variables. Some of the major contributors to oil price fluctuations include:

Demand-Supply dynamics: During 2010-2014, a spike in oil price could be attributed to many factors, including a supply crunch from the conventional oil fields. A rise in price resulted in higher earnings for upstream companies and investors. Consequently, the surplus funds were used to develop unconventional sources like shale and tight oil. Successful exploration and commercial production of unconventional sources pushed the price of conventional oil downward. A price trend of OPEC crude basket from 2007-2017 is shown in Figure 1.Impact on Middle East

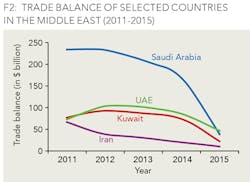

Oil prices fell over 57% from June 2014 - January 2015, resulting in lower revenue for oil exporting nations. Economies in the Middle East, which depend heavily on oil export, were exposed to sustained revenue loss, resulting in severe budget pressures. In the process, trade balance of countries like Saudi Arabia, Kuwait, UAE, and Iran started to crumble (See Figure 2).

Saudi Arabia

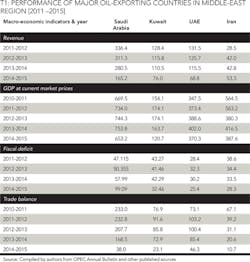

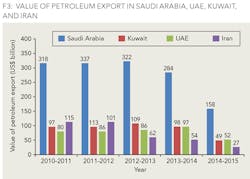

Saudi Arabia is the world's largest exporter of crude oil and other petroleum liquids. Saudi Arabia's oil exports account for about 89% of the country's total revenue. During 2011-15, a decline in global oil prices pulled down the value Saudi Arabia's petroleum exports, leading to budgetary pressure. Obviously, falling revenue adversely impacted social programs, projects, and support extended to other countries. The recent revival of oil prices is likely to improve net import realization, resulting in the strengthening of financial conditions of the country.

Falling crude price negatively affected the fiscal deficit, which widened to $99 billion in 2014-15 from $47 billion in 2011-12. Saudi Arabia did well in 2016 to bring the fiscal deficit down to 297 billion Saudi riyals ($79.2 billion). Total revenues of Saudi Arabia declined to approximately $165 billion in 2014-15 from $336 in 2011-12, a loss of nearly $171 billion. The International Monetary Fund (IMF) forecasts the deficit to narrow from 13% of GDP in 2016 to 9.6% in 2017. If this happens, the government would consider it a significant achievement. To manage the fiscal deficit, the government should continue to cut down on subsidies and infrastructure investment. Cutting down energy and water subsidies leads to a rise in the cost of living. Saudi Arabia faces multiple challenges which include increasing non-oil revenue, enhancing GDP growth, and protecting falling per capita GDP which has fallen from $23,594 in 2011 to $20,813 in 2015.

OPEC's agreement to cut production from January 1, 2017, calls on Saudi Arabia to bring down its production from 10544 thousand b/d to 10058 thousand b/d, a 4.83% reduction. Hence, there is a possibility that the IMF's projected fiscal consolidation of Saudi Arabia is going to be tough. On the other hand, the rising oil price may assist Saudi Arabia in its fiscal management.

Kuwait

Kuwait depends primarily on petroleum exports to fuel its economic growth; in fact, petroleum exports had been in the range of 98-64% of revenue during 2011-2015. The nation's revenues fell sharply from $128.4 billion in 2011-12 to $76 billion in 2014-15, primarily due to fall in crude price. During the period under consideration, petroleum export value fell from $97 billion to $49 billion. As a result, the trade balance eroded from about $77 billion in 2011-12 to $23 billion in 2014-15 (see Table 1).

Recent economic conditions prompted Kuwait to take steps to diversify its economic activities. In 2015, the IMF recommended a revamp of the tax structure in Kuwait. From a government-controlled regime to private participation and curtailment of subsidies on kerosene and diesel, serious attention is needed for long-term policy reform.

Of course, the government may not be able to disown the philosophy of a "welfare state," but it should make all efforts to enhance private participation in business and attract foreign investment. The establishment of the Kuwait Direct Investment Promotion Authority (KDIPA), 2013 is a testament to Kuwait's commitment to attract foreign direct investment. Kuwait now allows up to 100% FDI in many sectors excluding those in the negative list. Kuwait's cost competiveness is based on subsidized power and portable water, which may not be the ideal way to evaluate competitiveness. Kuwait must establish competitiveness based on market forces and attract investment to establish supremacy in the region.

United Arab Emirates

Despite UAE having the most diversified economy in the Gulf Co-operation Council (GCC), its economy remains extremely reliant on petroleum exports.

A sharp crude price slide resulted in reduced revenues. UAE revenue fell from $131 billion in 2011 to $68 billion in 2015, an estimated 48% decline (See Figure 3).

In recent times, UAE introduced strong reform measures to manage its fiscal challenges. In August 2015, it cancelled subsidies on petroleum products, and introduced corporate and sales taxes. The IMF recommended introduction of excise for automobile and value added tax (VAT). GCC members agreed to introduce a 5% VAT, which is likely to be implemented by 2018. The UAE Cabinet approved the budget of AED 48.557 billion ($13.22 billion) for fiscal year 2016 with zero deficit. UAE's focus seems to be on the development and social benefits sector, where investment in education and infrastructure receive their due.

Iran

Iran is the second largest economy in the Middle East after Saudi Arabia with GDP of over $387.611 billion in 2015. Iran's economy is far more integrated with energy than any other member of the Gulf region due, primarily, to sanctions that forced Iran to diversify economic activities that then resulted in higher demand for petroleum in the domestic market. Like other oil trading nations, sliding oil prices dented Iran's export revenue realization. As a result, the trade balance of Iran came down from $67 billion in 2014 to $10.7 billion in 2015.

The oil price rebound at the end of 2016 and the lifting of sanctions will have a positive impact on the Iranian economy in the near future.

It is important to note that contribution of non-oil sector to Iran's economy is better than other countries in the Middle East. Being a diversified economy means Iran is relatively less exposed to the external shocks. In order strengthen the economic conditions, Iran initiated multiple reform measures in the areas of subsidy, banking, and taxation. Social justice and public health care are also very important to Iran's progress.

Conclusion

Large price fluctuations, especially the downward price corrections, severely impacted oil exporting nations like Saudi Arabia, UAE, Kuwait, and Iran. Falling crude oil prices put the oil exporting economies under severe financial stress. The oil exporting countries have been forced to rethink revenue generation strategies and adopt austerity measures to curtail public expenditure and carry on fiscal consolidation. Economies under stress tried to initiate policy and tax reforms to improve performance and attract foreign invest to fuel economic growth. In general, these economies have focused on cutting subsidies and enhancing investment in infrastructure. However, the pace of reform is relatively slow, primarily due to strong resistance from the existing system and its users. Now is the time to take reform measures to the next level in order to create balanced and competitive economies.

ABOUT THE AUTHORS

Sanjay Kumar Kar is an associate professor and head of the Department of Management Studies at Rajiv Gandhi Institute of Petroleum Technology (RGIPT) in Jais, India. He has also served as an assistant professor at the School of Petroleum Management, PDPU, Gandhinagar, India and as an academic associate at the Indian Institute of Management in Ahmedabad. He previously served as a visiting scholar at the Graduate School of Business, Chonnam National University, South Korea. He holds a Bachelor of Science degree from Fakir Mohan University and MBA and PhD degrees from Utkal University, Odisha, India.

Yash Pathak is pursuing his graduate studies at the Department of Management Studies, Rajiv Gandhi Institute of Petroleum Technology (RGIPT) in Jais, India and serves as part of RGIPT's Energy Research Group. He holds an Engineering degree from Rajasthan Technical University, Kota, India.