Permian Basin

CRUDE, CONDENSATE OUTPUT REFUSE TO DECLINE; AVERAGE WELL CONFIGURATION, PRODUCTIVITY CONTINUE TO GROW

ARTEM ABRAMOV, RYSTAD ENERGY

AMONG THE KEY tight oil plays in the US, those in the Permian Basin have received particular market attention in recent months. Not only do crude and condensate output from these plays refuse to decline, but average well configuration and productivity continue to grow. This is due to a shift towards the most productive areas of the Basin, together with more economical well completion characteristics.

Looking at the horizontal wells in the Midland and Delaware Basins brought on-line in 2012-2016, Figure 1 summarizes the evolution of average proppant use and lateral length per well. Both these metrics increased considerably over that last four years and the average lateral length in the Permian Midland has already exceeded 8,000 ft. However, average proppant use grew more rapidly leading to an increased completion intensity. Back in 2012, approximately 900 and 500 lbs of proppant per feet were pumped in the Midland and Delaware, respectively, whereas in Q1 2016 1,400 and 1,500 lbs per feet were observed, respectively.

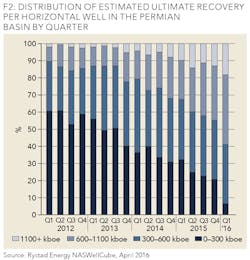

A natural consequence of boosted well configuration and full-scale development of the Wolfcamp and Bone Spring formations resulted in increased well productivity. Figure 2 shows the distribution of estimated ultimate recovery (EUR) for horizontal wells in the Permian Basin, quarter-by-quarter. Less than 15% of the wells exhibited EURs above 600 thousand boe in 2012-2013. However, what used to be outstanding well performance in those years has become standard by 2015-2016 as the share of such wells reached 50-60%. Simultaneously, only 10-20% of the current wells demonstrate EURs below 300 thousand boe, while in 2012-2013 the share of such wells was above 50%.

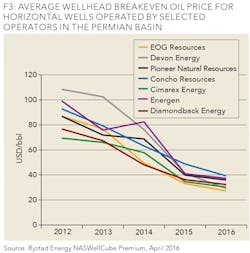

Together with a significant unit price reduction, productivity improvements imposed a downward pressure on the wellhead breakeven prices in the tight oil plays of the Permian Basin. Thus, current drilling of dedicated Permian operators remains commercial in the low oil price environment. Figure 3 demonstrates the average wellhead breakeven price for selected operators in the Permian Basin for different years. In 2016, a typical well of the selected companies is commercial at an oil price below 40 USD/bbl. It is worth mentioning that EOG Resources has managed to achieve exceptional well results in Permian Delaware - an area that was not considered its core area of activity before 2015. EOG's latest wells are among the company's premium drilling inventory and exhibit a breakeven price of around 27 USD/bbl. The second best commerciality is demonstrated by Devon Energy's wells in 2016, which target the Bone Spring formation, with a breakeven price of around 29 USD/bbl. However, the company decided to drop its last rig in the Permian Delaware after drilling only four operated wells in 2016. This confirms the scarce availability of financing, which has become a dominant factor in deciding whether or not to continue drilling-even in highly economical plays. Nowadays, operators are forced to abandon activity even in some of their best and still commercial plays.

ABOUT THE AUTHOR

Artem Abramov is a senior analyst at Rystad Energy with main responsibilities in analyzing upstream E&P data from governmental sources along with empirical research of well production profiles. Artem is the product manager for the NASWellCube, Rystad Energy's NAM Shale well database. He holds an MSc in Financial Economics from BI Norwegian Business School and a BSc in Applied Mathematics with the Major in Statistics from the Novosibirsk State University, Russia.