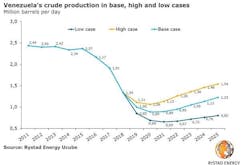

Rystad Energy: Venezuela production could fall below 700,000 b/d by 2020

Venezuela’s oil industry has been in a tailspin in recent years, with the country’s crude oil production falling to just 1.34 million b/d at yearend 2018 from 2.4 million b/d in 2015. This freefall is poised to carry over into 2019, according to energy research and consulting firm Rystad Energy.

In Rystad Energy’s base-case forecast, Venezuelan production drops by another 340,000 b/d year-on-year to 1 million b/d in 2019 and slips even further to 890,000 b/d in 2020.

In the low-case scenario, where the status-quo continues, and Venezuela is unable to offset the effects of US sanctions and secure new financing, the country could see an additional 20% reduction in crude output this year, dropping to about 800,000 b/d before sliding to 680,000 b/d in 2020.

Finally, Rystad Energy’s high-case scenario considers the effects of a regime change in Venezuela, where US sanctions are lifted, and new financing agreements are secured. Here the country can slow the downward trend, with crude production sliding to 1.11 million b/d this year and on to 1.06 million b/d in 2020.

One key factor is that Venezuela relies on imported diluents that are then mixed with the heavy crude produced from the Orinoco belt to make the product marketable. Venezuela currently imports 60,000 b/d naphtha from the US, mainly from state oil company Petroleos de Venezuela SA’s US refining subsidiary Citgo Petroleum Corp.

“Rystad Energy forecasts that some operators in Venezuela will run out of the crucial diluent by March. Without diluent, the current 200,000 b/d of heavy crude exports is at risk,” said Rystad Energy analyst Paola Rodriguez-Masiu.

Rystad Energy also forecasts what could happen in the case of a regime change that leads to the lifting of US sanctions and attracts new financing agreements.

In the short term, production will slow its downward trend. Fields in the Orinoco belt, which are currently operating below capacity, will be relatively easy to rejuvenate. Further production increases become much more complicated as mature fields have reached their natural production decline and sufficient damage has been done to many wells.

In the midterm, arresting production declines and well damage in mature fields—which were the biggest contributors when Venezuelan production stood at more than 2 million b/d—will be a major challenge, both technically and financially. Therefore, to increase production Venezuela will have to further develop fields in the Orinoco belt.

And in the long term, Rystad Energy does not expect to see growth on a massive scale but does see upside potential over time. Venezuela sits on massive proved reserves. The cost structure is relatively low and exploration risk is minimum. Furthermore, the Orinoco belt oil sands are less energy-intensive than the oil sands in Canada given Venezuela’s warmer climate, which means less energy is required to enable the heavy crude to flow.

Finally, demand for heavy oil is to remain high despite potential carbon regulations and International Marine Organization 2020 restrictions on shipping fuel, as complex refineries such as those in the US could still process this type of crude in compliance with environmental regulations.

“This type of heavy crude is abundant in Venezuela and has no associated exploration risk. Further investments to process these reserves could therefore be justified,” Rodriguez-Masiu said.