US Tenth District energy activity accelerated in third quarter

The Federal Reserve Bank of Kansas City’s third-quarter energy survey revealed accelerated growth in energy activity in the Tenth District, while expectations for future activity remained high.

The Kansas City Fed’s quarterly energy survey monitors oil and gas-related firms located or headquartered in the Tenth District, with results based on total firm activity. The district encompasses the western third of Missouri; all of Kansas, Colorado, Nebraska, Oklahoma, and Wyoming; and the northern half of New Mexico.

“Regional energy activity grew faster in the third quarter as prices pushed higher. The profitable price for oil drilling was up slightly from the past few years but still well below current and expected prices.” said Chad Wilkerson, Oklahoma City Branch executive and economist at the Federal Reserve Bank of Kansas City.

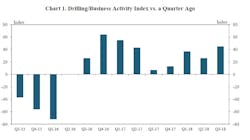

Growth in Tenth District energy activity accelerated in the third quarter, as indicated by firms contacted during Sept. 14-28. The drilling and business activity index jumped to 45 from 26, marking the highest level reached since early 2017.

Other quarterly indexes were mixed, but all indexes remained positive, indicating expansion. The total revenues and employee hours indexes edged lower, and the indexes for employment, wages and benefits, and access to credit also fell slightly. The supplier delivery time and total profits indexes declined.

Year-over-year indexes also were mixed. The year-over-year drilling and business activity index rose to 57 from 41, marking the highest posting in more than a year. The year-over-year access to credit index also increased moderately to 25. The total revenues and capital expenditures indexes grew modestly, while the total profits, employee hours, and wages and benefits indexes edged lower but remained at high levels. The supplier delivery time and employment year-over-year indexes declined slightly.

Expectations for most indexes remained high. The future access to credit index increased to 30 from 6, which was the highest level in survey history. The future total profits index rose to the highest level since late-2016, and the total revenues index also increased modestly. Conversely, the future capital expenditures and wages and benefits indexes dipped slightly from high levels. The expected drilling and business activity index also remained high but declined to 50 from 61. The expected employment and employee hours indexes were somewhat lower, and the future supplier delivery time index fell into negative territory for the first time this year. The oil price expectations index increased considerably, to 48 from 12, while the natural gas price expectations index inched down.

Special questions

Firms this past quarter were asked what oil and gas prices were needed for drilling to be profitable on average across the fields in which they are active. The average oil price needed was $55/bbl, with a range of $35 to $85. This average was up from a range of $51 to $53 since first-quarter 2016.

The average gas price needed was $3.23/MMbtu, with responses ranging from $2.25 to $7. This was also an increase from the last two times the topic was surveyed.

Firms were again asked what they expected oil and gas prices to be in 6 months, 1 year, 2 years, and 5 years. Expected oil prices increased modestly since the last quarter. The average expected West Texas Intermediate prices were $71/bbl, $72/bbl, $73/bbl, and $79/bbl, respectively. Gas price expectations also edged higher. The average expected Henry Hub gas prices were $2.89/MMbtu, $2.92/MMbtu, $3.10/MMbtu, and $3.42/MMbtu, respectively.

Firms also were asked how they anticipated utilizing any excess financial capital over the next 12 months, checking all options that applied. More than 60% of respondents reported excess financial capital would be used to expand business through capital expenditures. Nearly 40% of firms reported they would use excess financial capital to reduce debt. A quarter of firms also will prioritize paying out dividends, and more than 21% reported excess financial capital would be put towards wages and benefits for employees.

Finally, firms were asked about the impact of price differentials between WTI Midland and Cushing on oil production in the Permian basin over the next 6 months. Nearly 38% of respondents had no opinion, and almost 14% reported no impact. More than 44% of firms expected a slightly negative impact on oil production from the price differentials, with less than 4% of firms reporting a significantly negative impact.