IHS Markit: US chemical producers pressured by midstream constraints

The surge in production of associated and nonassociated natural gas from US shale gas and tight oil plays, combined with a wave of new petrochemical steam-crackers coming online, has created a major pinch-point for producers and purchasers of those ethane gas molecules. This is due to a lack of adequate NGL fractionation capacity to separate and fractionate the mixed natural gas liquids (Y-grade) stream into purity products, namely ethane, according to a recent market analysis by IHS Markit.

“The US upstream shale gas and tight oil revolution has translated into a petrochemical feedstock bonanza and significant cost advantages for US chemical producers, but a misalignment between ethane purity product supply capacity and demand has driven a tight ethane market and a spike in price,” said Yanyu He, executive director, Asia and Middle East NGLs and global NGL pricing, at IHS Markit, and an author of the IHS Markit Midstream and NGLs Analysis: Ethane—What Went Wrong?

“We expect purity product ethane supply and demand to be tight through 2020, and ethane market price volatility is expected to persist through 2020. The energy industry strives for alignment, but the unconventional upstream industry is much nimbler and more responsive to price signals than the midstream sector. We are now seeing the fallout of underinvestment in midstream infrastructure that occurred during 2014 to 2016, after oil prices cratered and put the brakes on NGL-centric midstream infrastructure build-out,” He said.

He said that US shale gas and tight oil producers have drastically improved their efficiency and can now bring a well into production in a matter of months, while adding capacity at a gas processing plant can take 12-18 months, expanding Y-grade pipelines and purity product NGL fractionation capacity can take up to 3 years, and steam crackers require 4-5 years to bring online from final investment decision to completion.

“From an investment standpoint, you have a months-vs.-years cycle that causes misalignment across the upstream through midstream to downstream value chain,” He said. “Ironically, the increasing efficiency of the US unconventional upstream energy sector has rapidly increased oil, gas, and correspondingly, byproduct Y-grade NGL-production rates. The current production has surpassed the midstream supply chain’s capability to receive, process, produce, and deliver purity product ethane supply to the new US Gulf Coast ethane crackers,” He said.

And there is more demand coming as the industry is in the middle of the first wave of new US ethane cracker-capacity additions built to consume advantaged ethane, IHS Markit said. Several new ethane-based cracker additions on the US Gulf Coast will come online in 2018 and 2019, and correspondingly, demand is outpacing the capability to supply purity ethane.

According to IHS Markit, gas production rates have and will continue to increase during the next several quarters mainly from associated gas derived from tight oil plays, including the Permian basin, the Oklahoma SCOOP and STACK, and the Bakken, and from the Marcellus and Utica gas plays in Appalachia.

He said the midstream industry is largely in the business of serving the needs of upstream producers and operators. The NGL-centric midstream supply chain is rather complex, with several key links. Once gas is produced from the well, it is gathered and then sent to gas-processing plants, which separate the raw gas stream into residue-gas and a raw-NGL mix. The residue-gas is delivered into gas pipelines, while the raw NGL-mix (also called Y-grade) is transported to NGL fractionation facilities, where the natural gas liquids are separated into different purity products, such as ethane, propane, butanes, or pentanes. From this point, the various purity products can be stored and transported to chemical plants, refineries, or to commercial distributors.

The IHS Markit analysis noted three contemporaneous factors behind the rapid price increase: congestion on inter-PADD transport corridors, high Gulf Coast fractionator utilization, and rising demand for ethane from both domestic producers and exports.

The first challenge, He said, is that two of the key PADDs are experiencing extreme congestion, which is restricting the supply of ethane to fractionators and also to petrochemical plants reliant on the ethane as feedstock. The congestion observed on the transportation corridor between PADD II (Midwest) and PADD III (Gulf Coast) significantly widened the NGL-price differentials between Conway, Kansas, and Mont Belvieu, Tex. The Conway vs. Mont Belvieu price differentials had averaged 3-5¢/gal, more or less reflecting the pipeline tariff but, since February, the NGL pipeline-system constraint has resulted in a period of “scarcity pricing,” He said.

The second primary constraint is the NGL-fractionation capacity at Mont Belvieu. “Low oil prices caused upstream producers and operators to halt financial support and spending on midstream infrastructure and, as a result, there was no NGL-fractionation capacity added in the US in 2016 to 2017,” He said. “Upstream financial support and spending has since resumed, and we expect more purity product NGL-fractionation capacity to come online in Mont Belvieu in 2019, but not enough to alleviate market tightness and price volatility. As a result, the Y-grade supply is discounted while the scarcer supply of purity ethane is a premium,” He said.

“In the meantime, US ethane demand has outpaced supply since the end of 2017, putting pressure on the Mont Belvieu ethane inventory,” said Todd Dina, executive director of light olefins at IHS Markit, and a coauthor of the IHS Markit ethane analysis. “Between December 2017 and July 2018, we’ve had three world-scale US Gulf Coast steam-crackers start operations (Dow Chemical, Chevron Phillips Chemical, and ExxonMobil Chemical), with five more crackers coming online next year. All these crackers translate to a massive 52% increase in purity product ethane demand above average levels consumed just 2 years ago. In addition, US ethane exports have been increasing during this period, too,” Dina said.

By mid-2019, IHS Markit said more than 10 million tonnes of ethane steam-cracking capacity will come online. “We expect ethane inventory to tighten until the system sees some relief in mid-2020,” Dina said. “What that means for petrochemical producers is near-term volatility in ethane prices trending toward overall higher ethane feedstock cash-costs, which will further erode steam-cracker profitability.”

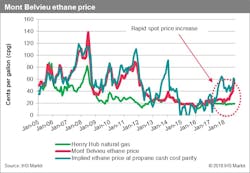

To get some perspective about the magnitude of this rapid rise in the Mont Belvieu ethane spot price, consider that ethane prices historically have mostly been constrained between their floor value, if sold as a component of gas (aka, the thermal value), and a ceiling value roughly defined by cash-cost competition with other feedstocks used in flexible-feed olefins crackers (propane cost is shown in the chart, as an example).

In the years leading up to the shale boom, ethane prices typically remained nearer the cash-cost ceiling value. Following the great recession of 2008-09, the sharply increasing production of NGL’s pushed ethane into an oversupply situation, eventually causing prices to fall to the thermal value, which it where it remained through 2015. The rise of prices off the thermal floor during the years since has been somewhat gradual. By May, however, Mont Belvieu ethane prices began a rapid climb and peaked at nearly 62¢/gal on Sept. 18—almost 250% greater than the average seen in 2017.

The petrochemical producers fortunate to have “flex-feed” crackers able to adapt to alternate feedstocks will pursue those alternatives—with ethane prices being the equalizer, until new Gulf Coast NGL-fractionation capacity additions come online, IHS Markit said. A widening consumption of heavier feedstocks to meet growing ethylene demand will provide a market advantage to flex-feed crackers over ethane-only crackers, according to the analysis. However, incremental steam-cracker coproduction will lower propylene and butadiene prices, providing upward price pressure on ethane as comparative cash-costs rise, Dina said.

Another fallout of rising ethane prices for petrochemical producers is the impact on polyethylene (PE) export margins as ethane supply limits are reached. IHS Markit forecasts that integrated PE producers with PE exports will see a significant margin drop from its near-term peak in July.

“This environment does not change until the fractionators come online in 2020, cracker capacity growth slows, and ethane supply capability once again exceeds demand. Only then does the US ethane advantage return to its full potential,” Dina said.