The International Energy Agency has moderated its global oil demand outlook, according to its October Oil Market Report. IEA now forecasts a growth of 1.3 million b/d for 2018 and 1.4 million b/d for 2019, respectively, a reduction of 110,000 b/d for both years from previous predictions. This is due to a weaker economic outlook, trade concerns, higher oil prices and a revision to Chinese data.

The economic assumptions used in IEA’s forecast have been downgraded following the publication of new outlooks by the OECD and the IMF. The outlook for global economic growth has been revised down, from 3.9% to 3.7% for both 2018 and 2019, following the recent publication of the OECD’s interim outlook. The IMF’s outlook, published in October, has similar numbers.

In Europe, notable revisions were made for France and Germany. The outlook for countries such as Argentina, Brazil, Mexico, South Africa and Turkey were also downgraded. By contrast, Saudi Arabia and Russia have benefited from the upturn in oil prices.

The OECD expects GDP growth in China to remain at 6.5% in 2019, as the impact of trade tensions have, so far, been modest. The IMF was slightly more pessimistic, taking its forecast for China’s growth down to 6.2%. Both organizations noted that global trade growth has slowed and that several developing countries have been severely impacted by a decline in the value of their currency.

Meanwhile, IEA’s oil price assumptions have been revised upwards due to an increase in Brent futures prices.

Oil demand

OECD Americas oil demand is projected to increase by 370,000 b/d in 2018, supported by harsh weather conditions in early 2018 and the start-up of petrochemical projects in the US. However, the strong year-on-year increase in oil prices is slowing gasoline demand.

European oil demand rose above last year levels in July but fell back again in August, heavily influenced by weak German demand.

Non-OECD demand remained robust in July but started to reflect the impact of high oil prices in August. Non-OECD Asian oil demand, supported by China and India, continues to be the main contributor to global growth.

According to IEA, non-OECD demand will increase by 1 million b/d in 2018, led by China and India, which together account for 60% of the global increase.

Global oil supply

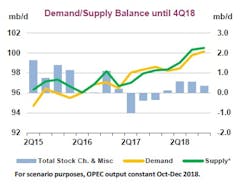

Global oil supply is rising at a relentless pace, even as Venezuelan production deteriorates, and Iranian flows decline ahead of US sanctions.

In September, world oil production was little changed from a month earlier at 100.3 million b/d but was up 2.6 million b/d on a year ago with non-OPEC countries accounting for almost the entire increase.

Non-OPEC oil supply growth has been revised upwards to a record 2.7 million b/d year-over-year in this year’s third quarter after producers ramped up output in response to higher prices and as Vienna Agreement supply cuts were unwound.

In North America, both US and Canadian oil production reached record highs, despite pipeline bottlenecks and discounted crude prices. In the US, recent gains have come not only from prolific onshore LTO plays but also from the Gulf of Mexico, which hit a new record production level in July.

Russian crude and condensate production also rose to a record 11.36 million b/d in September, up 450,000 b/d on a year ago and 390,000 b/d more than in May, just ahead of the revised Vienna Agreement.

IEA’s forecast for non-OPEC supply has been revised upwards by 180,000 b/d for 2018 and 130,000 b/d for 2019 and is now seen rising by 2.2 million b/d and 1.8 million b/d, respectively.

OPEC crude output rose by 100,000 b/d in September to 32.78 million b/d, a single-year high, as Saudi Arabia, Libya, Nigeria, and the UAE more than made up for further losses from Venezuela and Iran. Since May, production from OPEC has risen by 735,000 b/d, with the main gulf producers leading the way, supported by Nigeria and Libya.

Higher production is, however, eroding spare production capacity, which in September was 2.13 million b/d, excluding Iran. Saudi Arabia has signaled that it will pump 200,000 b/d more in October. If final data support this, Saudi spare capacity would be 1.3 million b/d. As a result, overall OPEC spare capacity could fall to less than 2% of global demand. For the record, slightly lower output from OPEC members of the Vienna Agreement saw compliance in September edge up to 121%.

Refining, stocks

According to IEA, refiners are facing increased competition as capacity additions surge between now and yearend 2019. After increasing by 900,000 b/d this year, refinery runs will increase by 1.3 million b/d in 2019, while refined product demand growth is only 1 million b/d.

OECD commercial stocks rose 15.7 million bbl in August to 2.854 billion bbl, their highest level since February, on strong refinery output and LPG restocking. IEA is projections that OECD inventories will have risen by 43 million bbl (470,000 b/d) in the third quarter of 2018, the largest quarterly increase in stocks since first-quarter 2016.