IEA: Oil market tightens on falling Venezuelan, Iranian exports

The price of Brent crude oil fell close to $70/bbl in early August and is now climbing back to $80/bbl. According to the International Energy Agency’s latest Oil Market Report, two reasons for the swing are that Venezuela’s production decline continues and the market is approaching Nov. 4 when US sanctions against Iran’s oil exports are implemented.

In Venezuela, production fell in August to 1.24 million b/d and, if the recent rate of decline continues, it could be only 1 million b/d by yearend. Evidence provided by tanker tracking data suggests that Iran’s exports have already fallen markedly. If Venezuelan and Iranian exports do continue to fall, markets could tighten and oil prices could rise without offsetting production increases from elsewhere, IEA said.

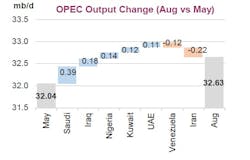

Supply from some countries has risen since the Vienna meetings in June. In August, Saudi Arabia and Iraq combined saw output increase by 160,000 b/d. In Iraq’s case, exports have increased to such an extent that they are greater than Iran’s production, and there is still about 200,000 b/d of shut-in capacity in the north of the country due to the ongoing dispute with the Kurdistan Regional Government.

Based on IEA’s August estimates of production, members of the Organization of Petroleum Exporting Countries are sitting on about 2.7 million b/d of spare production capacity, 60% of which is in Saudi Arabia.

However, “the point about spare capacity is that, having been idle, it is not clear exactly how much, beyond what is widely thought to be ‘easy’ to bring online, will be available to coincide with further falls in Venezuelan exports, and a maximization of Iranian sanctions,” IEA said.

“It is not just a question of volume; refiners used to processing Venezuelan or Iranian crude will compete to find similar-quality barrels to maintain optimal refinery operations. Alternative supplies of lighter crude might not be ideal for this reason. Even before we factor in any further fall in exports from Venezuela or Iran, record global refinery runs are expected to result in a crude stock draw of 500,000 b/d in 2018 fourth quarter. Any draw will be from a basis of relative tightness: in the OECD, stocks at end-July were 50 million bbl below the 5-year average.”

“We are entering a very crucial period for the oil market. The situation in Venezuela could deteriorate even faster, strife could return to Libya, and the 53 days to Nov. 4 will reveal more decisions taken by countries and companies with respect to Iranian oil purchases. It remains to be seen if other producers decide to increase their production. The price range for Brent of $70-80/bbl in place since April could be tested. Things are tightening up,” IEA noted.

Global oil supply

Global supply in August reached a record 100 million b/d as higher output from OPEC offset seasonal declined from non-OPEC. Nevertheless, non-OPEC supply was up 2.6 million b/d year-over-year, led by the US.

Non-OPEC crude supply rose to a 9-month high of 32.63 million b/d in August. A rebound in Libya, near-record Iraqi output, and higher volumes from Nigeria and Saudi Arabia outweighed a substantial reduction in Iran and a further fall in Venezuela.

Brazil was supposed to be one of the big production success stories of 2018, but various problems have stymied growth to the extent that output will rise by only 30,000 b/d this year vs. a first estimate of 260,000 b/d.

The US continues to show stellar performance with total liquids output expected to rise by 1.7 million b/d this year and by another 1.2 million b/d in 2019. However, despite higher prices, companies are not adjusting their production plans, due to infrastructure bottlenecks, and this is unlikely to change any time soon. Even so, growth this year has returned to the extraordinary pace seen in 2014 during the first shale boom.

Libyan production surged back in August to 950,000 b/d, not far below the 1 million b/d level that was achieved for almost a year prior to the recent disturbances. However, the situation is fragile, as evidenced by attacks on National Oil Corp.’s headquarters in the past few days.

Oil demand

IEA’s global oil demand growth estimates for 2018 and 2019 are unchanged. Growth for next year will be 1.5 million b/d following an increase of 1.4 million b/d in 2018.

Global economic growth is still expected to be 3.9% in 2018 and 2019. US growth is accelerating, benefitting from tax reductions and higher federal spending, and some deceleration in Europe and OECD Asia.

However, the economic environment in some emerging markets is deteriorating. While worries about emerging markets are mounting, alongside fears of escalating trade disputes, it is currently difficult to assess whether it will lead to an economic slowdown in the timeframe of IEA’s forecast.

In 2018, signs of weaker demand in some markets have emerged: gasoline demand is stagnant in the US as prices rise; European demand in the period from May to July was consistently below year-ago levels; and demand in Japan is sluggish notwithstanding very high temperatures and will be further impacted by the recent natural disasters.

A possible risk to 2019 forecast lies in some key emerging economies, partly due to currency depreciations vs. the US dollar raising the cost of imported energy. In addition, there is a risk to growth from an escalation of trade disputes.

OECD commercial stocks rose 7.9 million bbl in July to 2,824 million bbl. This rise was less than half the typical level and stocks declined to a 50 million bbl deficit against the 5-year average. Stocks increase in the Americas and Europe but fell modestly in Asia Oceania.