In its September Short-Term Energy Outlook the US Energy Information Administration forecasts Brent crude oil prices to average $74/bbl and West Texas Intermediate crude oil prices to average more than $67/bbl in 2019. Both forecasts are $3/bbl higher than the forecast from the August STEO.

The higher price forecast reflects a lower forecast for global oil supply in 2019 based on lower expected production from the US, Canada, and the Organization of Petroleum Exporting Countries (non-crude liquids). The lower production forecast is only partially offset by lower forecast oil demand for next year.

EIA forecasts total global liquid fuels inventories to decrease by 400,000 b/d in 2018 compared with 2017. This is followed by an increase of 100,000 b/d in 2019, which is 200,000 b/d lower than previously forecast.

This outlook of relatively stable inventory levels during the forecast period contributes to a forecast of monthly average Brent crude oil prices remaining relatively stable, between $72/bbl and $76/bbl, from September 2018 through the end of 2019.

Global oil market in August

Crude oil prices broadly fell in early August, due to large declines in some emerging market currencies and increased concerns about global economic growth and its potential impact on oil demand.

However, oil prices rose in the second half of August following reports of reduced purchases of Iranian crude oil ahead of the US’s reinstituting sanctions on Iran in November.

Third-party ship tracking data indicate that several countries may have already reduced purchases of Iranian crude oil, and August estimates of waterborne crude oil exports from Iran to be 19% lower than the average during first 7 months of 2018. EIA estimates that Iranian crude oil production declined 200,000 b/d from July to August.

Other supply developments likely contributed to a pull of oil inventories and higher oil prices. These include an anticipated delay until September for restarting some Canadian production after July’s oil sands outage and the shutdown of some offshore crude oil platforms because of tropical storm activity in the US Gulf of Mexico.

EIA estimates that global petroleum inventories declined by almost 400,000 b/d in August—the seventh consecutive month of net inventory withdrawals.

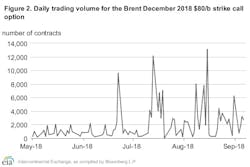

“Hedging activity in the crude oil options market were apparent, suggesting several market participants purchased financial protection in anticipation of an increase in crude oil prices ahead of the November implementation of Iranian sanctions,” EIA said. Call options for the December 2018 Brent crude oil futures contract with a strike price of $80/bbl have been one of the most actively traded out-of-the-money contracts in recent months.

US highlights

Crude oil prices in the Permian region of Texas and New Mexico traded at wide differentials to those on the Gulf Coast in August. The WTI-Midland differential to Magellan East Houston reached a low of -$23.95/bbl on Sept. 4 before settling at -$22.45/bbl on Sept. 6.

The wide differential between Permian region prices and the Houston prices is the result of constrained pipeline capacity, which has caused producers without pipeline space to ship crude oil using more costly modes of transportation, such as trucks. In addition to this capacity constraint, the differential in August could have been exacerbated by a fire near a storage tank that feeds the Basin Pipeline, which extends from the Permian to Cushing, Okla., which disrupted an estimated 50,000 b/d of flow, more than 10% of the pipeline’s total capacity.

EIA’s August Drilling Productivity Report estimates that crude oil production in the Permian region will increase to 3.4 million b/d in September. Current estimates of available regional refinery intake and pipeline takeaway capacity is about 3.6 million b/d. Even though crude oil takeaway infrastructure constraints could contribute to wide price discounts for Permian crude oil through third-quarter 2019, which would moderate production growth compared with an unconstrained scenario.

EIA still expects Permian crude oil production to drive total US production growth next year. According to EIA, many producers in the region claim they can operate profitably with prices in the mid-$50/bbl level, and they might use higher cost transportation options to move crude oil to the US Gulf Coast or other regions. Some producers with a geographically diverse portfolio of upstream properties could also redirect capital to other areas or decide to reduce completion activity until the transportation constraints ease.

EIA estimates that US crude oil production averaged 10.9 million b/d in August, up by 120,000 b/d from June. US crude oil production will average 10.7 million b/d in 2018, up from 9.4 million b/d in 2017.

EIA forecast that US crude oil production will average 11.5 million b/d in 2019, which is 200,000 b/d lower than forecast in the August STEO. The lower production reflects more severe constraints in Permian region pipeline takeaway capacity than previously expected. The lower forecast is also the result of a reevaluation of projects in the US Gulf of Mexico. EIA now expects production in that region to proceed at a slightly slower pace than previously assumed.

US natural gas

EIA estimates US dry natural gas production was 82.2 bcfd in August, up 0.7 bcfd from July. Dry natural gas production is forecast to average 81 bcfd in 2018, up by 7.4 bcfd from 2017 and establishing a new record high.

EIA expects natural gas production will continue to rise in 2019 to an average of 84.7 bcfd. EIA forecasts that US natural gas inventories will total 3.3 tcf at the end of October. This level would be 13% lower than the 2017 end-of-October level and 14% below the 5-year (2013–17) average for the end of October, while also marking the lowest level for that time of year since 2005.

EIA expects Henry Hub natural gas spot prices to average $2.99/MMbtu in 2018 and $3.12/MMbtu in 2019.