ADNOC, Total sign development deals for offshore concessions

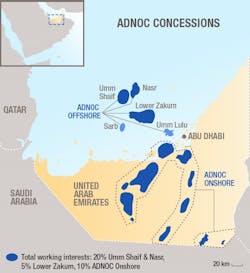

Abu Dhabi National Oil Co. (ADNOC) has signed agreements with Total SA in which the French supermajor will be awarded stakes in two of Abu Dhabi’s new offshore concessions. Under the terms of the agreements, Total has been awarded a 20% interest in the Umm Shaif and Nasr concession and a 5% interest in the Lower Zakum concession.

Total is ADNOC’s largest and one of its longest international partners, active in Abu Dhabi’s oil and gas sector for nearly 80 years.

Total contributed a participation fee of $1.15 billion to enter the Umm Shaif and Nasr concession and a fee of $300 million to enter the Lower Zakum concession. Both concessions are operated by ADNOC subsidiary ADNOC Offshore on behalf of all concession partners.

Both agreements are for 40-year terms.

ADNOC Group Chief Executive Officer Ahmed Al Jaber said, “Total brings deep knowledge and understanding of Abu Dhabi’s offshore oil and gas fields, as well as specialist expertise and technology that will help accelerate the development of the giant Umm Shaif gas cap. ADNOC has recently seen encouraging results from the first gas cap production pilot well at Umm Shaif, which will play an important role in delivering our 2030 smart growth strategy and a sustainable and economic gas supply.”

The Umm Shaif and Nasr concession and the Lower Zakum concession have been created from the former ADMA offshore concession, which Total has been a partner in since 1953. It has been divided into three separate concession areas.

In the Umm Shaif and Nasr concession, Total joins Italy’s Eni, which was recently awarded a 10% stake. Umm Shaif field’s Arab reservoir is characterized by a huge condensates-rich gas cap—one of the largest in the region. “Based on ADNOC’s development and initial piloting activities in the gas cap, the concession partners will further pursue the technical and economic evaluation of the development,” the company said.

The gas cap overlays an oil rim which, in combination with Nasr, has a crude production capacity of 460,000 b/d. ADNOC plans to process 500 MMscfd of gas from Umm Shaif’s gas cap to help meet Abu Dhabi’s growing demand for energy and reduce reliance on imported gas. The condensates, from the gas cap, will be refined to extract higher value products.

In the Lower Zakum concession, Total joins an Indian consortium, led by ONGC Videsh, Japan’s INPEX, as well as Eni as stakeholders. ADNOC is finalizing opportunities, with potential partners, for the remaining 10% of the available 40% stake in the Lower Zakum concession, and for the remaining 10% stake in the Umm Shaif and Nasr concession. ADNOC retains a 60% majority share in both concessions.