SDX Energy pursues Egypt, Morocco development in 2018

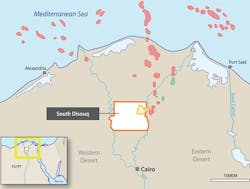

SDX Energy Inc. anticipates spudding the Ibn Yunus-1X exploration well at South Disouq, Egypt, in mid-March. The operator signed a contract with Sino-Tharwa Drilling Co. for the ST-6 rig, which includes agreement for four additional firm wells. The rig is on location in Egypt’s Western Desert completing drilling for a separate operator and is expected to be released this month.

Egypt development

SDX expects a 30-40 day drilling window targeting the Abu Madi conventional gas interval discovered in April 2017 in the SD-1X well, which tested 25.8 MMcfd and 43 b/d of condensate on a 48/64-in. choke (OGJ Online, Sept. 21, 2017). The Abu Maadi formation is at 7,100 ft. Once drilling is completed at Ibn Yunus-1X, the rig will move to the SD-1X discovery to drill two appraisal wells and then on to drill SDX’s Kelvin-1X exploration prospect.

The Ibn Yunus-1X and Kelvin-1X wells are targeting up to 150 bcf of gas and, if successful, SDX plans to tie back to the SD-1X processing facility.

The South Disouq concession covers 1,275 sq km in the Nile Delta and is estimated to contain 1.3 tcf of P10 resources. Located within the Abu Madi-Baltim trend, the area consists of 10 discoveries totaling 6.3 tcf of gas and 100 million bbl of liquids.

SDX has an operated 55% equity position after it completed a farm-out of the acreage to IPR in February 2015 for the remaining 45% (OGJ Online, June 5, 2017).

The operator has also spudded the Rabul 5 development well in Egypt’s West Gharib concession. The first of two development wells planned for the field this year, SDX is targeting oil bearing intervals in both the Bakr and Yusr formations. These intervals were previously discovered in the company’s Rabul 1 and 2 wells. Operations for Rabul 5 are expected to take about 30 days.

Morocco pursuit

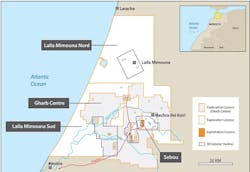

In addition to the North West Gemsa, Meseda, and South Disouq concessions in Egypt, SDX is active in Morocco in the Lalla Mimouna, Sebou, Gharb Center concessions. The company’s nine-well Moroccan drilling campaign commenced in September 2017 and has had several successful discoveries.

After a slight delay on its Sebou permit KSS-2 development well after the rig’s top drive failed, SDX completing drilling to 1,293 m. The well encountered a net 8 m of high-quality reservoir in the Gaddari and Guebbas formations with an average porosity of 30%. Despite the positive implications, the formations showed low gas saturation and have been deemed noncommercial.

SDX has taken the dry hole in stride, citing that four wells have produced commercial discoveries. The KSS-2 well was on the upthrown side of the main bounding fault in the Ksiri area, which appears to have isolated the KSS-2 well from the source rock. The forthcoming SAH-2 well will target the downthrown side, drilling a similar structure to the company’s previous successes.

SDX said it would plug and abandon the KSS-2, which is the sixth well of its nine-well campaign.

SDX Pres. and Chief Executive Officer Paul Welch said the stepout was an attempt to use directional drilling to prove up a new concept and potential new volumes of gas. “Whilst KSS-2 was not successful, our belief is that this result proves that the main bounding fault provides a good seal.” He added that further confidence is held for the final three wells in the basin.

The ONZ-7 well on the Sebou permit was completed and tested on Feb. 6, achieving an average flow rate of 10 MMcfd on 48/64-in. choke. The maximum flowrate during the test was 15.34 MMcfd, which was “highest achieved to date in the basin,” Welch said. SDX has said its gross production target is 8-10 MMcfd in Morocco by yearend.

The Sebou concession is in the Rharb basin and was acquired by SDX in January 2017. Most of the block is covered by 2D and 3D seismic, and 17 wells drilled to date have resulted in 14 discoveries.

Production is from the Miocene-age Hoot and Guebbas formations, and the gas is a consistent, low-impurity Methane composition across fields and units. Average production is 5.1 MMcfd.

SDX received a renewal of its Sebou exploration permit in second-quarter 2017 for 8 years after the operator committed to drill three exploration wells in the first 4 years.

In a recent presentation, Welch attributed the company’s 2018 activity as the “year of development,” referring to how the company is applying its Egypt operational lessons to its Moroccan exploration and development.

Continued exploration

SDX previously announced a two-well exploration program in the fourth-quarter 2017 to fulfill commitments in the Lalla Mimouna Nord and Sud permits ahead of its renewal decision for the license in March, but the company was granted a 4-month extension through July.

The Gharb Center could hold more than 20 bcf of unrisked natural gas, SDX said. The company drilled its ELQ-1 well to a total depth of 1,484 m, encountering 22.6 net m of reservoir interval and 2 m of marginal net gas pay in the Hoot formation. The operator ultimately determined the intervals were noncommercial and plugged the well.

The results were attributed to the ELQ-1 being the company’s sole well in the recent nine-well campaign to be targeted using legacy low-resolution 3D data. The first three wells in the campaign yielded discoveries and were based on high-resolution 3D seismic data SDX acquired during the early phase of its Moroccan operations.

As a result, the operator will be shooting new seismic in the Gharb Center concession in this year’s second quarter. According to SDX, the new survey will double the area covered by high-resolution 3D data. The company asserts that it remains on track to achieve its target of increasing gas sales volumes in Morocco by up to 50%.

Contact Tayvis Dunnahoe at [email protected].