Global capacity growth reverses; Asian, Mideast refineries progress

Warren R. True

Chief Technology Editor-LNG/Gas Processing

Leena Koottungal

Survey Editor/News Writer

World crude oil distillation capacity has contracted slightly in 2011 after growing slowly in 2010 (OGJ, Dec. 6, 2010, p. 50), according to the latest OGJ Refinery Survey.

The closings and rationalizations that dominated Western European and North American refineries in 2010 have continued in 2011. Sales of plants and mergers of companies are the most prominent activities in the two developed regions, as the account below details.

Much of the capacity decline has been in countries of the Organization for Economic Cooperation and Development, where the global recession since 2008 has hit the hardest. That's been especially true this year as US and European debt crises have rattled Western European and North American financial markets.

Although Western Europe lost a net of only two refineries so far this year, total capacity for its plants has fallen by more than 225,000 b/cd. North America has seen a drop of four refineries but only a loss of 55,000 b/cd in capacity.

Asian refineries on the other hand have added nearly 44,000 b/cd and Middle Eastern refineries, more than 32,000 b/cd.

While OGJ data show no new refineries starting up so far this year in Asia, several new ones are in various stages of planning or construction. And several others in the region are expanding. The same bustling of new capacity and upgrades is evident among Middle East refineries.

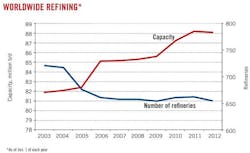

For 2011, OGJ's survey shows total global capacity at slightly more than 88 million b/cd in 655 refineries.

Both figures represent contractions for the first time in nearly 10 years. Capacity has fallen by 175,000 b/d from 88.23 million b/cd for 2010; the number of refineries by seven. For 2009, global capacity stood at 87.2 million b/cd for 661 refineries; for 2008, 85.6 million b/cd for 655 refineries.

Fig. 1 shows the trends in operating refineries and worldwide capacity.

Largest refining companies

Table 1 lists the top 25 refining companies that own most worldwide capacity. Table 2 lists companies whose plants total more than 200,000 b/cd of capacity in Asia, the US, and Western Europe. Capacities from Tables 1 and 2 include partial interests in refineries that the companies do not wholly own.

Major changes of position in Table 1 since Jan. 1, 2011, involve Valero, which moved up on the strength of adding 160,000 b/cd in capacity, as did SK Innovation, which added 298,000 b/cd. Dropping in rank and capacity were ConocoPhillips (–210,000 b/cd), Chevron Corp. (–196,000 b/cd), and Sunoco Inc. (–150,000 b/cd). Most of these changes are detailed in the discussion below of regional activity.

Displaying 1/11 Page 1, 2, 3, 4, 5, 6, 7, 8, 9, 10, 11Next>

View Article as Single page