Global capacity growth reverses; Asian, Mideast refineries progress

Warren R. True

Chief Technology Editor-LNG/Gas Processing

Leena Koottungal

Survey Editor/News Writer

World crude oil distillation capacity has contracted slightly in 2011 after growing slowly in 2010 (OGJ, Dec. 6, 2010, p. 50), according to the latest OGJ Refinery Survey.

The closings and rationalizations that dominated Western European and North American refineries in 2010 have continued in 2011. Sales of plants and mergers of companies are the most prominent activities in the two developed regions, as the account below details.

Much of the capacity decline has been in countries of the Organization for Economic Cooperation and Development, where the global recession since 2008 has hit the hardest. That's been especially true this year as US and European debt crises have rattled Western European and North American financial markets.

Although Western Europe lost a net of only two refineries so far this year, total capacity for its plants has fallen by more than 225,000 b/cd. North America has seen a drop of four refineries but only a loss of 55,000 b/cd in capacity.

Asian refineries on the other hand have added nearly 44,000 b/cd and Middle Eastern refineries, more than 32,000 b/cd.

While OGJ data show no new refineries starting up so far this year in Asia, several new ones are in various stages of planning or construction. And several others in the region are expanding. The same bustling of new capacity and upgrades is evident among Middle East refineries.

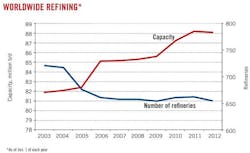

For 2011, OGJ's survey shows total global capacity at slightly more than 88 million b/cd in 655 refineries.

Both figures represent contractions for the first time in nearly 10 years. Capacity has fallen by 175,000 b/d from 88.23 million b/cd for 2010; the number of refineries by seven. For 2009, global capacity stood at 87.2 million b/cd for 661 refineries; for 2008, 85.6 million b/cd for 655 refineries.

Fig. 1 shows the trends in operating refineries and worldwide capacity.

Largest refining companies

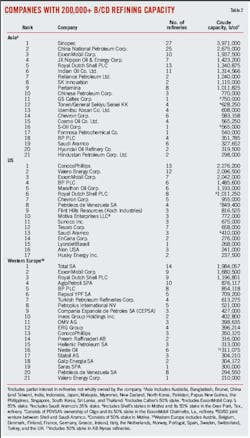

Table 1 lists the top 25 refining companies that own most worldwide capacity. Table 2 lists companies whose plants total more than 200,000 b/cd of capacity in Asia, the US, and Western Europe. Capacities from Tables 1 and 2 include partial interests in refineries that the companies do not wholly own.

Major changes of position in Table 1 since Jan. 1, 2011, involve Valero, which moved up on the strength of adding 160,000 b/cd in capacity, as did SK Innovation, which added 298,000 b/cd. Dropping in rank and capacity were ConocoPhillips (–210,000 b/cd), Chevron Corp. (–196,000 b/cd), and Sunoco Inc. (–150,000 b/cd). Most of these changes are detailed in the discussion below of regional activity.

Other changes in capacity that appear in Tables 1 and 2 are due to adjustments in declared capacity.

In Table 2, for Asia, Pertamina and SK Innovation (formerly SK Corp.) have switched positions and Hyundai Oil Refinery Co. has dropped to 20, having given up 270,000 b/cd in nameplate crude oil capacity. For the US, Valero and ExxonMobil Corp. have switched positions from 2010, Sunoco has moved to 11 from No. 9, and EnCana Corp. moved up to 14 from No. 17. And in Western Europe, ConocoPhillips dropped, to No. 13 from No. 8.

Table 3 lists the world's largest refineries with a minimum capacity of 400,000 b/cd. OGJ data show only that Marathon Petroleum Co. LLC moved from No. 17 to No. 13 on the list during 2011. Table 4 lists regional process capabilities as of Jan. 1, 2011.

Regional developments

Capacity growth this year has occurred almost entirely in Asia and the Middle East, as the regions continued adding new capacity and expanding existing refineries to meet anticipated markets in their own regions as well as developing markets in each other's regions.

On the other hand, North America (mainly the US) and Western Europe have witnessed corporate mergers, restructurings, and a few refinery closings.

Asia

By far the biggest story for Asian refiners this year was the 9.0-magnitude earthquake and consequent tsunami that struck eastern Japan on Mar. 11. Damage to the country's nuclear power plants, shutting down all of them, and to its refineries sent ripples through both the refining and LNG industries in the region and worldwide.

A report by FACTS Global Energy stated that "At one point, as many as six refineries halted operations, suspending approximately 1.4 million b/d of refining capacity, or about a third of Japanese total capacity" (OGJ, Apr. 18, 2011, p. 24).

To make up for the loss in Japanese refining capacity in the aftermath of the disaster, some refiners planned to increase crude runs, FACTS noted.

Brazil's Petroleo Brasileiro SA (Petrobras) reportedly increased production at its 100,000-b/d Nansei Sekiyu Nishihara refinery in Okinawa by 24%. Production there was 46,000 b/d before the earthquake.

JX also reportedly planned to increase operating rates at its Okayama and Oita refineries by 30,000 b/d. And Cosmo Oil reportedly planned to increase runs at its three other undamaged refineries in Sakai (100,000 b/d), Sakaide (110,000 b/d), and Yokkaichi (125,000 b/d).

A further 160,000 b/d of capacity was to be permanently be removed this year at Fuji Oil's Sodegaura and Toa Oil's Keihin plants.

In April, Reuters reported that Cosmo Oil's 220,000 b/d Chiba refinery, damaged by the quake, would be out of commission for some time. Cosmo Oil gave no schedule for the refinery's operations. JX Holdings, on the other hand, had plans for its 252,500-b/d Kashima refinery to restart by summer.

In early May, JX Nippon Oil & Energy Corp. resumed shipments of oil products from its Sendai refinery. The refinery's sendout capacity of gasoline, kerosine, and other products was at about 15,700 b/d, about half its output before the quake, said another report.

Refining operations remained offline at JX Nippon's Sendai plant, however, and products were being shipped from existing inventory. The company's refining at Sendai was badly damaged during the earthquake and not expected to resume operations until the middle of next year.

In China in early 2011, Aramco Overseas Co. BV and PetroChina Co. Ltd. agreed to develop jointly a 200,000-b/d grassroots refinery in Yunnan Province in far southwestern China.

About the same time, PetroChina raised crude oil processing capacity in its Jilin refinery by a third, to 200,000 b/d. The expansion is part of PetroChina's preparation to receive Russian crude oil via the newly built China-Russian crude pipeline, reportedly to supply 300,000 b/d for 20 years.

The pipeline, connected to Russia's East Siberian Pacific Ocean pipeline (ESPO), was set to pump 60,800 b/d of crude in November and 70,600 b/d in this month to China (OGJ, Feb. 7, 2011, p. 110).

PetroChina has also upgraded its 200,000-b/d Liaoyang refinery in Liaoning Province as the main processor of Russian crude.

In May, China National Petroleum Corp. and Russian state-owned Rosneft announced plans to begin building late this year a $5 billion, 260,000-b/d crude oil refinery in Tianjin. Operations would begin in 2015. The Oriental Refinery, Xinhua Agency reported, would be able to process 13 million tonnes/year (tpy) of crude oil.

In Tianjin, China Petroleum & Chemicals Corp. (Sinopec) already operates a 10-million-tpy refinery, which has ethylene production capacity of 1 million tpy, and is building a crude oil storage depot.

In June, China's National Development and Reform Commission approved construction by PetroChina of a 400,000-b/d refinery in Taizhou, in eastern Zhejiang province.

PetroChina will be joined by Royal Dutch Shell PLC and Qatar Petroleum to invest about $12.4 billion; the refinery will include a 1.2 million tpy ethylene plant.

A unit of PetroChina will hold 51% of the venture, while Shell and Qatar Petroleum will each own 24.5%.

In June, Sinopec, Asia's top refiner, announced plans to build a new 32-million-tpy refining complex in the eastern province of Jiangsu. The proposed project, to be based in the new Xuwei area near the coastal town of Lianyungang, is to cost more than $15.45 billion.

Local media reported that Sinopec planned to build the mega-complex in two phases, with the first having a refining capacity of 12 million tpy as well as a production capacity of 1 million tpy of p-xylene. Construction of the proposed project is to start in 2013 with the plant operating by 2016.

In September, Kuwait Petroleum Corp. and Sinopec revealed plans to build a $9-billion oil refinery in Guangdong province capable of handling 300,000 b/d. The refinery will also produce 1 million tpy of ethylene, according to the Xinhua news agency. Construction could start early next year.

In Vietnam at mid-year, Reuters reported that Petrolimex, Hanoi, planned to expand into oil refining from its fuel distribution business and was seeking investors to build Vietnam's first pipeline to China. Petrolimex said it planned to invest $4.4-4.8 billion to build a 200,000-b/d refinery complex in the central province of Khanh Hoa.

The Nam Van Phong complex would produce gasoline, diesel, jet fuel, kerosine, LPG, and petrochemicals. It would be one of five new refineries planned in Vietnam. The prospectus, according to the news service, also said the firm had discussed a $212-million project with China's PetroChina Co. Ltd. to build a 140-mile pipeline to take Chinese refined products to Vietnam.

Vietnam currently has one major refinery, the 130,500-b/d Dung Quat complex (OGJ Online, Aug. 13, 2010). Only a few weeks ago, media sources for Vietnam reported that construction of the $7.5 billion, 200,800-b/d Nghi Son oil refinery—which would be Vietnam's second—was to be delayed until first-quarter 2012. The plant will process sour Kuwaiti crude oil, according to French oil services group Technip SA (OGJ, July 25, 2011, p. 22).

Nghi Son is to be owned by Petrovietnam, Kuwait Petroleum International, Japan's Idemitsu Kosan Co., and Mitsui Chemicals Inc. Construction will take 3-4 years. Reports said Technip, Japan's JGC Corp., and Spain's Tecnicas Reunidas are building the refinery in northern Thanh Hoa province, 134 miles south of Hanoi.

In India late in 2010, Hindustan Petroleum Corp., India's third-largest state refiner, announced plans to build a $6.6 billion refinery near Mumbai to raise the company's overall refining capacity to about 40 million tpy over 10 years, according to local media.

The new refinery, planned for western India about 186 miles south of Mumbai, would initially be able to process 9 million tpy of crude, which may be expanded to 18 million tpy.

In April, Hindustan Petroleum placed into service a 28,000-b/d fluid catalytic cracking unit at its 132,000-b/d Mumbai refinery alongside a 20,000-b/d FCCU already in place (OGJ Online, Apr. 1, 2010).

In first-quarter 2011, India's largest refiner Indian Oil Corp. dedicated a large naphtha cracker at its 300,000-b/d Panipat refinery and petrochemical complex in Haryana north of New Delhi. The cracker receives feedstock from Panipat and Indian Oil's 300,000-b/d refinery in Koyali, Gujarat, and 175,000-b/d refinery in Mathura, near Panipat.

Essar Oil Ltd, according to media reports earlier this year, would next year complete Phase 1 of an ongoing expansion at its Vadinar oil refinery.

The refinery, according to Essar statements, was operating at more than its 10.5 million tpy nameplate capacity, reaching throughput of 14.76 million tonnes in 2010-11. The Phase 1 expansion will raise its refining capacity to 18 million tpy.

Completion of Phase 1 will also enhance complexity at the refinery to 11.8 from 6.1. This will allow the plant to increase its proportion of heavy and ultra-heavy crude, produce a higher portion of middle and light distillates, and improve gross refining margin.

A joint venture of Hindustan Petroleum and Mittal Energy Investment Pte. Ltd., Singapore, completed earlier this year a 180,000-b/d grassroots refinery at Bhatinda, in the northern Indian state of Punjab.

Construction was nearing completion on a 630-mile, 28-30-in. pipeline to carry crude to the refinery from Mundra on the coast of the state of Gujarat. The project includes a crude oil terminal and single-point mooring with a 10.5-mile, 48-in. pipeline in the Gulf of Kutch at Mundra.

Each major partner holds a 49% interest in refinery operator Hindustan Mittal Energy Ltd., based in Noida, near New Delhi. Indian financial institutions hold the other 2%.

Indian Oil announced in September it was considering spending $1.87 billion to expand capacity to 18 million tpy at the Koyali refinery in Gujarat. Construction would take 36-40 months. The refinery near Ahmedabad is the second largest of 10 Indian Oil owns with total refining capacity of 64.7 million tpy.

Indian Oil's refining capacity will near 80 million tpy when its 15-million-tpy Paradip unit in Orissa comes on stream in early 2013. According to the company, the Paradip refinery will produce for domestic consumption 5.97 million tpy of diesel, 3.4 million tpy of motor gasoline, 1.45 million tpy of kerosine, 536,000 tpy of LPG, 124,000 tpy of naphtha, and 335,000 tpy of sulfur.

In Thailand in April 2011, Thai Oil Co. Ltd. let a contract to a Foster Wheeler AG subsidiary for an upgrade of its 193,000-b/d refinery at Sriracha.

The Foster Wheeler unit is handling basic design engineering and engineering, procurement, and construction management of a project that will enable the refinery to run higher-sulfur crudes, convert fuel oil into lighter products, and lower emissions of sulfur oxides.

The firm will apply deep-cut vacuum technology and install sour-gas handling, including sulfur recovery and tail-gas treatment. It also will expand hydrogen production capacity, now about 28.8 MMcfd via steam reforming of methane, by installing pressure-swing adsorption.

In South Korea, early in 2011, GS Caltex, Seoul, announced it would add upgrading capacity at its 760,000-b/cd refining complex at Yeosu. It planned to spend $978.6 million to add 53,000 b/d of vacuum gas oil fluid catalytic cracking capacity and 24,000 b/d of gasoline hydrodesulfurization capacity.

The upgrade will boost production of propylene by 250,000 tpy at the complex to 450,000 tpy. The complex had 61,000 b/d of resid FCC capacity and 181,000 b/d of resid hydrocracking capacity in three units. GS Caltex is a 50-50 partnership of Chevron Corp. and GS Holdings, Seoul.

In July, Shell Australia announced it would cease refining at its 79,000 b/d Clyde refinery in Sydney and convert it and the Gore Bay terminal into a fuel import site before mid-2013.

The move forced Australia to obtain from overseas the 10% of its refined products that Clyde was currently providing. Clyde was producing 75,000 b/d and had been operating for more than a century. About 85% of the crude required to meet the product mix in Australia was imported from Asia in 2008-09 and about 15% from the Middle East (OGJ, May 2, 2011, Newsletter).

And in July, Tajikistan's President Emomali Rahmon launched construction of the country's first refinery, a 2,000-b/d plant in Tursunzoda, about 40 km west of the capital, Dushanbe.

Construction was prompted by supply shortages and price increases after Russia imposed prohibitive tariffs on gasoline exports in May to address its own supply shortages (OGJ Online, July 29, 2011).

Rahmon suggested if funding could be found to increase the refinery's capacity to 10,000 b/d, then 90% of Tajikistan's fuel and lubricants would be met by the new installation. Energy analysts claim the kind of refinery envisioned for Tajikistan can be built in 4-5 months at a cost of $100-150 million and could pay for itself within 8 months under local conditions.

Middle East

As active as Asian refining has been this year and appears to continue growing, industry observers have agreed that growth in capacities of several kinds in the Middle East will outpace those in Asia for the remainder of this decade.

This was the main theme of a report released in October from Deutsche Bank AG (OGJ, Oct. 31, 2011, p. 24).

Nearly 5 million b/d of refining capacity will be built in Middle East countries 2010-18, representing more than 20% of global expansion during the period and boosting regional capacity by nearly 60%, said the report.

Saudi Arabia and Iran plan to raise refining capacity by 1.2 million b/d each through 2018, it said. Other major expansions include nearly 900,000 b/d in Kuwait and 620,000 b/d in the UAE.

The report cautioned, however, that a total of about 1.5 million b/d of the projected refining capacity expansion is to occur in countries where elevated risks might keep plans from being fulfilled: Iraq, Iran, Yemen, and Bahrain.

Of secondary-unit capacities expected to be added in the region, the Deutsche Bank analysis said 40% will be desulfurization and 25% coking. Among the region's major oil producers, total country refining capacity eventually will exceed half of crude oil production capacity in Kuwait, Iran, and Qatar, lowering crude volumes available for export.

In the UAE and Saudi Arabia, refining capacity will remain low relative to growing production capacity. Those five countries—Kuwait, Iran, Qatar, UAE, and Saudi Arabia—account for nearly 25% of global oil production and 85% of Middle Eastern production, said the analysis.

Regional oil demand growth is "far outpacing that of the US and Europe," said the report. Gas oil-diesel accounts for about 30% of Middle Eastern consumption, gasoline about 25%.

Demand for fuel oil, declining elsewhere in the world, remains strong in the Middle East, driven by electric power generation. About 36% of Middle Eastern power generation is fueled by oil, compared with a 7% average worldwide, according to International Energy Agency data cited by the report.

Saudi Arabia is the main reason for the region's heavy use of fuel oil, it said, relying on oil for nearly 60% of its power generation. Of the 20% of Saudi oil demand that applies to power generation, 39% is gas oil, 35% direct-burn crude, and 27% fuel oil.

In December of last year, Saudi Aramco said its planned refinery in the industrial city of Yanbu is slated to start production in 2014, Bloomberg reported. The refinery will process 400,000 b/d of heavy crude to produce diesel and gasoline with byproducts of sulfur and petroleum coke, said the company.

Early this year, Saudi Aramco let a frontend engineering and design (FEED) and project-management contract to KBR for a grassroots refinery in the Jazan area of southern Saudi Arabia. KBR reported crude capacity of the refinery, to be built in conjunction with a marine terminal on the Red Sea, at 400,000 b/d. Aramco earlier had described capacity as 200,000-400,000 b/d.

The refinery will be able to process Arabian crude oils and yield about 75,000 b/d of gasoline, 100,000-160,000 b/d of ultralow-sulfur diesel, and 160,000-220,000 b/d of fuel oil, according to Aramco.

In September, Aramco and France's Total Refinery and Petrochemicals Co. (Satorp) said they expect a new refinery at Jubail in Saudi Arabia to be fully operating in December 2013, according to Reuters.

Aramco and Total are building the $14-billion Jubail plant as part of an effort nearly to double its refining capacity. Although the refinery is designed to process 400,000 b/d, Aramco has committed to supply it with up to 440,000 b/d for 30 years.

Jubail will refine Saudi heavy crude into products ranging from motor gasoline to petroleum coke for domestic and export markets. About 54% of the new plant's output, said the story, will be diesel and jet fuel with an estimated 11.4 million tpy.

Elsewhere in the region in first-quarter of 2011, Abu Dhabi Oil Refining Co. (Takreer) awarded contracts of unspecified amounts for mass-transfer equipment to GTC Technology Korea Co. Ltd., a unit of Houston-based GTC Technology International LP, as part of an expansion of the 350,000-b/d refinery at Ruwais. The project is to be completed in 2013 (OGJ Online, Feb. 9, 2011).

Also in Abu Dhabi, International Petroleum Investment Co. of Abu Dhabi announced in March plans to complete construction by yearend 2016 of a 200,000-b/d refinery at Fujairah, on the UAE's east coast, according to Bloomberg.

The refinery, set to cost about $3 billion, would sit near the outlet of a 1.5 million-b/d oil pipeline running to the coast and set to be completed this year. The pipeline would give access for exports to the Gulf of Oman, allowing shipments to bypass the Strait of Hormuz.

In Oman, the Sohar refinery on the northeast coast is expanding by installing a crude unit and hydrocracker (OGJ Online, Mar. 2, 2011). The 116,000-b/d refinery processes a mixture of Oman Export Blend crude and long resid delivered by pipeline from the 106,000-b/d Mina Al-Fahal refinery near Muscat 165 miles to the southeast.

Oman Refineries & Petrochemical Co. let a $49.8 million contract to CB&I for FEED and project management for the project that will include a 71,500-b/d crude distillation unit, 96,800-b/d vacuum distillation unit, 66,400-b/d hydrocracker, and 42,400-b/d deasphalting unit.

Commissioned in 2006 with an initial capital investment of $1.35 billion, the Sohar refinery features a crude unit with a capacity of 116,400 b/d and a residue FCCU of 75,260 b/d.

Early this year in Iraq came news that the country was to double refining capacity by 2020 to meet domestic needs and allow for exports. Iraq's plans include increasing its oil-processing capacity to 1.5 million b/d by the end of the decade. Production in 2010 was about 530,000 b/d because of damage to refineries.

As part of the capacity increase, Iraq aims to build a 300,000-b/d refinery in southern Iraq that will process crude oil from Nasiriyah oil field for export from a port in the south.

In May, work on the Nassiriyah plant was set to begin.

Iraq's State Company for Oil Projects, part of the Ministry of Oil, had selected UOP LLC to provide reforming, isomerization, fluid catalytic cracking, and selective hydrotreating technologies for the new plant, according to the engineering company. UOP said that Iraqi refining capacity is to more than double by 2017 to 1.6 million b/d and to double again by 2030.

In 2010, the oil ministry reported plans to invest about $20 billion in four refineries. In addition to Nassiriyah, it has let contracts for preliminary work on refineries with capacities of 150,000 b/d each at Karbala, Kirkuk, and Maysan (OGJ, July 5, 2010, p. 36).

In July 2011, Iraq's ministry of oil signed an agreement with Karbala Refinery Corp. Ltd. for construction of a 200,000-b/d refinery in the Karbala region (OGJ, Aug. 8, 2011, Newsletter).

"Karbala Refinery will be located [62 miles] south of Baghdad on a [2.3-sq-mile] plot of land, and will be the most advanced state-of-the-art refinery with almost [a] full conversion rate and with an estimated cost of $6.5 billion," said KRC Chief Executive Officer Dean Michael.

In August, Bloomberg reported that Iraq's oil ministry had signed a preliminary agreement with Egyptian company Al Qalaa to build a 150,000-b/d refinery in the northern city of Mosul.

Crude oil for the plant will come from two nearby fields of Najma and Qaiyarah. Al Qalaa will conduct design studies for 3 years before construction of the refinery.

Kuwait's Oil Minister Mohammad al-Busairy said in June that the country's Supreme Petroleum Council approved construction of the 615,000-b/d Al-Zour refinery (OGJ Online, July 1, 2011). He also said the council approved proposals to upgrade two of Kuwait's three existing refineries—the 466,000-b/d Mina Al-Ahmadi and the 270,000-b/d Mina Abdulla—as part of the $14.5-billion project.

Development of the Al-Zour refinery will come in two phases: During Phase 1, the plant will process 300,000 b/d of crude for domestic consumption; under Phase 2, it will process a further 315,000 b/d of oil.

The refinery's second phase will eventually replace the distillation input of the country's 200,000-b/d Shuaiba plant, which is Kuwait's oldest and smallest refinery and planned for closure.

In February of this year, Iran was set to inaugurate a major oil refinery–the largest in the Middle East. Shazand refinery in the central town of Arak about 150 miles south Tehran will boost gasoline production by more than 100,000 b/d once in full operation, according to area media.

Shazand initially was to reduce the country's dependence on imported fuel. Its overall production includes gasoline, propane, propylene, diesel fuel, and other products that comply with such international standards as Euro-5.

In August, Qatar's Laffan Refinery Co. Ltd. let a lump sum FEED contract of an undisclosed sum to Technip SA for the Laffan refinery's Phase 2 expansion, which would double the refinery's throughput capacity to 292,000 b/sd. The plant will be fully operational by first-quarter 2016.

The expansion will allow Qatar to meet domestic demand for naphtha, diesel, LPG, and jet fuel while becoming a net exporter of diesel and other refined products, instead of an importer, according to Qatargas, which operates the refinery. The FEED contract work is to be completed by first-quarter 2012; the EPC contract is to be awarded by third-quarter 2012 (OGJ Online, Aug. 19, 2011).

Of importance to the trade in refined products not only for the Middle East but for markets into which refiners in the region sell is the start-up in March in Qatar of the Pearl gas-to-liquids plant operated by Royal Dutch Shell PLC and Qatar Petroleum. In June, the plant in Qatar's Ras Laffan Industrial City sold its first commercial shipment of GTL gas oil (OGJ Online, June 14, 2011).

The sale marked the start of production of GTL products from the plant. In coming months, production was to ramp up from the Pearl GTL project's first train, and the second train was to start up before yearend. The plant is expected to reach full production capacity by mid-2012.

It is the largest energy project ever launched in the Qatar, officials said.

When fully operational, Pearl GTL will produce 1.6 bcfd from North field, which will be processed to deliver 120,000 b/d of condensate, LPG, and ethane, plus an expected 140,000 b/d of GTL products using Shell technology and project management.

Shell operates the Pearl GTL plant under a development and production-sharing agreement with Qatar. The project was launched in July 2006.

Major construction was completed in 2010. On Mar. 23, 2011, gas began flowing to the project from wells 60 km offshore. The gas processing plant began producing condensate, LPG, and sulfur.

Americas

In the US as 2011 began, Marathon Oil Corp. announced it would spin off its downstream business, forming an independent refiner to be named Marathon Petroleum Corp. based in Findlay, Ohio. The parent company, Marathon Oil, remains in Houston.

Refinery locations and capacities to be operated by the spun-off company are Garyville, La., 464,000 b/d; Catlettsburg, Ky., 212,000 b/d; Robinson, Ill., 206,000 b/d; Detroit, 106,000 b/d; Canton, Ohio, 78,000 b/d; and Texas City, Tex., 76,000 b/d.

Crude capacity of the Detroit refinery was being expanded by 15,000 b/d in a project that will increase heavy-oil processing capacity by about 80,000 b/d.

Marathon completed the spinoff on June 30, as planned. (OGJ, July 11, 2011, Newsletter).

Also in July, ConocoPhillips announced plans to separate its upstream and downstream businesses into two standalone, publicly traded corporations via a tax-free spinoff of the refining and marketing business to ConocoPhillips shareholders (OGJ Online, July 14, 2011).

The resulting exploration and production company will focus on oil and gas worldwide, while the downstream company will focus on refining and marketing, primarily in the US although ConocoPhillips has some downstream operations abroad.

In September, ConocoPhillips put up for sale its 185,000 b/d refinery in Trainer, Pa., and associated pipelines and terminals and began immediately to idle the plant and permanently close it in 6 months if it could not sell it.

In yet another corporate move in US refining, HollyFrontier Corp. in July completed the merger of Holly Corp. and Frontier Oil Corp. HollyFrontier has a refining capacity of more than 440,000 b/d across five refineries, says the new company, and serves the Midcontinent, Rocky Mountain, and southwestern refining markets with access to growing regional domestic and Canadian crude oil supplies.

The newly formed company has its headquarters in Dallas and produces light products such as gasoline, diesel fuel, jet fuel, and other specialty products. Through its subsidiaries, HollyFrontier operates a 100,000-b/sd refinery in Artesia, NM, a 125,000-b/sd refinery in Tulsa, a 31,000-b/sd refinery in Woods Cross, Utah, a 135,000-b/sd refinery in El Dorado, Kan., and a 52,000-b/d refinery in Cheyenne, Wyo.

A subsidiary of HollyFrontier also owns a 34% interest (including general partner) in Holly Energy Partners LP, which in November agreed to acquire pipelines and other logistical properties at HollyFrontier's El Dorado and Cheyenne refineries for $340 million.

At closing, the companies will enter into 15-year throughput agreements with minimum annual revenue commitments by HollyFrontier, from which Holly Energy expects additional revenue of $47 million/year, according to the announcement.

At HollyFrontier's 150,000-b/d El Dorado refinery, the transaction covers storage tanks with 3.7 million bbl of total capacity, a truck-loading rack for oil products, and another rack for propane, and related product pipeline connections.

Properties covered by the deal at the 52,000-b/d Cheyenne refinery include 1.8 million bbl of storage tanks, a products-loading rack, two propane-loading spots, three crude oil lease automatic custody transfer units, and a crude oil receiving pipeline.

In March, Toledo Refining Co. LLC, a wholly owned subsidiary of PBF Holding Co. LLC, completed its $400-million purchase of Sunoco Inc.'s 170,000-b/d refinery in Toledo, Ohio. The high-conversion refinery processes mainly light, sweet crudes from the US Midcontinent and Canada (OGJ, Mar. 7, 2011, Newsletter).

In April, NuStar Energy LP, San Antonio, closed on the purchase of a small San Antonio refinery in a deal linked to the nearby Eagle Ford shale play. NuStar bought the 14,500-b/d refinery from AGE Refining, which entered bankruptcy in February 2010, for $41 million (OGJ, Apr. 25, 2011, Newsletter).

Despite the corporate activity, much of which amounts to lateral shifting with little effect on refining capacity, there are some expansions in progress or planned for US refineries.

In first-quarter 2011, Valero Energy Corp. announced it would expand crude-unit capacity at its McKee refinery in Sunray, Tex., by 25,000 b/cd to increase total capacity to 195,000 b/cd. West Texas Intermediate crude oil from Midland, Tex., will supply the additional oil after the scheduled expansion is completed in 3 years, Valero said.

In March, Tesoro Corp. said it would expand crude capacity at its 58,000-b/d refinery at Mandan, ND, to 68,000 b/d to handle oil from the Bakken shale and elsewhere in the Williston basin. The company expected to invest about $35 million in the expansion.

Processing capacities at the refinery include 25,700 b/d of fluid catalytic cracking and 11,500 b/d of cyclic catalytic reforming. Average throughput over the past 3 years, said the company, has been 52,000 b/d.

In Texas, Motiva Enterprises LLC let a contract to Roberts & Schaefer, a subsidiary of KBR, for construction of a petroleum coker material-handling system in the expansion of its 285,000-b/d refinery at Port Arthur, Tex.

The expansion includes a new single-train crude distillation unit with capacity of 325,000 b/d. Other new units include an 85,000-b/d catalytic reformer with associated isomerization and hydrotreating plants, sulfur recovery, a 75,000-b/d hydrocracker integrated with a new 60,000-b/d diesel hydrotreater, and a 50,000-b/d hydrotreater for feed for the existing catalytic cracker (OGJ Online, Mar. 18, 2009).

When the expansion is complete early in 2012, the refinery will have distillation capacity exceeding 600,000 b/d and become the largest in the US.

Roberts & Schaefer will install, start up, and test the pet coke system and provide on site construction management and technical support for commissioning and testing. It handled engineering and procurement.

Motiva, a 50-50 venture of Shell Oil Co. and Saudi Refining Inc., reported on May 16 that it had completed placement of the expansion project's 375-ft tall delayed coker, which has capacity of 95,000 b/d.

In October, the National Cooperative Refinery Association announced plans to build a new delayed-coking unit at its 85,000-b/d McPherson, Kan., refinery. The $555 million project will replace the existing coker, installed in 1952.

Jim Loving, NCRA president, said the new coker will allow the refinery to run a "greater variety of crude oils…. [this project] is the largest in NCRA's history with a targeted completion in August 2015."

The new delayed-coking unit is not expected to increase production. Its purpose, said the company announcement, is to "squeeze more liquid products (gasoline and diesel) out of the heaviest portion of the crude oil barrel."

Elsewhere in the Americas, early this year, Petroleo Brasileiro SA (Petrobras) signed a contract to build a diesel hydrotreater and hydrogen generation unit at its Alberto Pasqualini refinery (Refap) in Canoas, state of Rio Grande do Sul (OGJ Online, Jan. 13, 2011).

The HDT II unit, said the company, will be able to treat 6,000 cu m/day of low-sulfur (10 ppm) diesel, thereby contributing to compliance with environmental legislation and improving air quality. The UGH II unit will be able to produce 1.25 million cu m/day of hydrogen at 99% purity. The refinery's capacity at the time of the announcement was 200,000 b/d.

In Colombia, Ecopetrol SA moved into the second phase of a major upgrade and expansion of its 250,000-b/sd Barrancabermeja refinery in Colombia. The project will raise refining capacity to 300,000 b/sd. It includes a new crude unit, delayed coker, hydrocracker, coker naphtha hydrotreater, and hydrogen and other units. Ecopetrol started up a hydrotreatment complex at the refinery last year (OGJ, Oct. 25, 2010, Newsletter).

Europe

As in North America, much of the refining news for the year in Europe, mainly Western Europe, has been about ownership changes and plant closings.

In the UK in April, Valero Energy Corp. agreed to buy Chevron Corp.'s 220,000-b/d refinery at Pembroke, Wales, for $730 million plus a payment for working capital estimated at $1 billion.

In addition to the refinery, the deal includes ownership interests in four product pipelines and 11 fuel terminals, a 14,000-b/d aviation fuels business, and more than 1,000 Texaco-branded wholesale sites in the UK and Ireland.

The Pembroke refinery yields 44% gasoline, 40% distillates, 11% fuel oil, and 5% other products, Valero said.

Catalytic hydrotreating capacities at Pembroke are 48,300 b/d for cat reformer feed, 60,000 b/d for diesel desulfurization, and 49,500 b/d for FCC naphtha. The refinery also has capacities of 32,500 b/d of HF alkylation, 19,900 b/d of butane isomerization, and 12,000 b/d of pentane-hexane isomerization (OGJ, Apr. 4, 2011, Newsletter).

Near the same time, Royal Dutch Shell PLC agreed to sell its 270,000-b/d Stanlow refinery in the UK to Essar (UK) Oil Ltd., a unit of India's Essar Energy PLC, for $1.3 billion (OGJ, Apr. 4, 2011, Newsletter). Essar offered to buy the refinery, near Ellesmere Port, Cheshire, in February (OGJ Online, Feb. 18, 2011).

Processing capacities at the refinery include 68,000 b/d of fluid catalytic cracking, 27,000 b/d of semiregenerative catalytic reforming, 30,000 b/d of continuous regenerative reforming, 11,000 b/d of HF alkylation, and 5,700 b/d of C4 isomerization.

Essar completed its purchase in mid-year (OGJ, Aug. 8 2011, Newsletter), reporting nameplate capacity of the refinery at 296,000 b/d. It paid $175 million, less adjustments for costs, on completion of the deal and will pay a similar amount plus interest in 1 year. It also paid Shell $916 million for inventories.

Essar described the purchase as a way to gain direct access to the UK products market and expand options for exports of fuels from its 300,000-b/d Vadinar refinery in Gujarat on India's west coast. Expansion projects will boost Vadinar capacity to 375,000 b/d by yearend and to 405,000 b/d by September 2012.

Essar Energy also owns 50% of the 80,000-b/d Kenya Petroleum Refineries Ltd. refinery in Mombasa.

In Germany in August, private Dutch company Hestya Energy BV, Amsterdam agreed to buy the 260,000-b/d Wilhelmshaven refinery on Germany's North Sea coast from ConocoPhillips for an undisclosed amount.

Hestya lists its shareholders as Riverstone Holdings LLC, a private equity firm, and AtlasInvest, a private investment company. The deal includes tank farm and marine terminal.

In Switzerland this autumn, Petroplus Holdings AG, Zug, began to shut down its 60,000-b/d Cressier refinery in Neuchatel. The company attributed the action to the labor strike at the port of Fos Sur Mer, France, which it said was disrupting the supply of crude to the Cressier refinery.

Restart of the refinery was to depend on the outcome of the strike; Petroplus said it was taking steps to continue to supply oil products to its customers.

Petroplus, which operates six refineries in Europe with combined throughput capacity of 752,000 b/d, also said it was closing its 84,800-b/d refinery at Reichstett, France (OGJ Online, Oct. 21, 2010). The company's other refineries are in the UK, Belgium, Germany, and France.

In Eastern Europe earlier this year, Burgasnefteproekt EOOD, OAO Lukoil's engineering subsidiary, let a €70-million contract to Technip for the first phase of a heavy residue hydrocracking complex to be built at the 115,240-b/cd refinery in Burgas, Bulgaria, along the Black Sea. Burgas is Bulgaria's only refinery.

The contract covers detailed engineering and procurement for a 2.5-million-tpy residue hydrocracker based on Axens H-Oil process, as well as amine, sour water stripper, and hydrogen production units.

More Oil & Gas Journal Current Issue Articles

More Oil & Gas Journal Archives Issue Articles

View Oil and Gas Articles on PennEnergy.com