P. 2 ~ Continued - Global capacity growth reverses; Asian, Mideast refineries progress

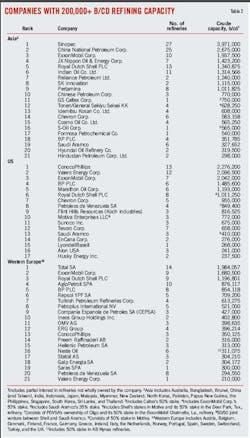

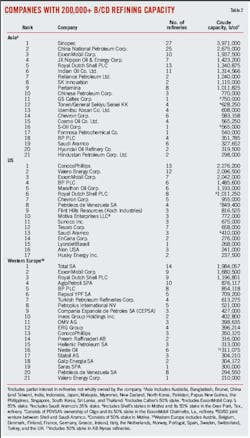

In Table 2, for Asia, Pertamina and SK Innovation (formerly SK Corp.) have switched positions and Hyundai Oil Refinery Co. has dropped to 20, having given up 270,000 b/cd in nameplate crude oil capacity. For the US, Valero and ExxonMobil Corp. have switched positions from 2010, Sunoco has moved to 11 from No. 9, and EnCana Corp. moved up to 14 from No. 17. And in Western Europe, ConocoPhillips dropped, to No. 13 from No. 8.

Table 3 lists the world's largest refineries with a minimum capacity of 400,000 b/cd. OGJ data show only that Marathon Petroleum Co. LLC moved from No. 17 to No. 13 on the list during 2011. Table 4 lists regional process capabilities as of Jan. 1, 2011.

Regional developments

Capacity growth this year has occurred almost entirely in Asia and the Middle East, as the regions continued adding new capacity and expanding existing refineries to meet anticipated markets in their own regions as well as developing markets in each other's regions.

On the other hand, North America (mainly the US) and Western Europe have witnessed corporate mergers, restructurings, and a few refinery closings.

Asia

By far the biggest story for Asian refiners this year was the 9.0-magnitude earthquake and consequent tsunami that struck eastern Japan on Mar. 11. Damage to the country's nuclear power plants, shutting down all of them, and to its refineries sent ripples through both the refining and LNG industries in the region and worldwide.

A report by FACTS Global Energy stated that "At one point, as many as six refineries halted operations, suspending approximately 1.4 million b/d of refining capacity, or about a third of Japanese total capacity" (OGJ, Apr. 18, 2011, p. 24).

To make up for the loss in Japanese refining capacity in the aftermath of the disaster, some refiners planned to increase crude runs, FACTS noted.

Brazil's Petroleo Brasileiro SA (Petrobras) reportedly increased production at its 100,000-b/d Nansei Sekiyu Nishihara refinery in Okinawa by 24%. Production there was 46,000 b/d before the earthquake.

JX also reportedly planned to increase operating rates at its Okayama and Oita refineries by 30,000 b/d. And Cosmo Oil reportedly planned to increase runs at its three other undamaged refineries in Sakai (100,000 b/d), Sakaide (110,000 b/d), and Yokkaichi (125,000 b/d).

A further 160,000 b/d of capacity was to be permanently be removed this year at Fuji Oil's Sodegaura and Toa Oil's Keihin plants.

In April, Reuters reported that Cosmo Oil's 220,000 b/d Chiba refinery, damaged by the quake, would be out of commission for some time. Cosmo Oil gave no schedule for the refinery's operations. JX Holdings, on the other hand, had plans for its 252,500-b/d Kashima refinery to restart by summer.

In early May, JX Nippon Oil & Energy Corp. resumed shipments of oil products from its Sendai refinery. The refinery's sendout capacity of gasoline, kerosine, and other products was at about 15,700 b/d, about half its output before the quake, said another report.

Refining operations remained offline at JX Nippon's Sendai plant, however, and products were being shipped from existing inventory. The company's refining at Sendai was badly damaged during the earthquake and not expected to resume operations until the middle of next year.

Displaying 2/11

View Article as Single page