Shuttle tankers offer competitive deep US gulf transport choice

Petrobras’ development of Cascade and Chinook fields in the US Gulf of Mexico will use a floating, production, storage, and offloading vessel in the initial phase.

The use of shuttle tankers will provide a competitive alternative to pipeline transport of crude production, even if shuttle tanker use remains generally limited. The development of Cascade and Chinook via FPSO and shuttle tanker is an important first step in establishing this type of facility in the remote, ultradeep waters of the US gulf.

This article analyzes the transportation options of a hypothetical oil discovery in a remote part of the Lower Tertiary play, comparing the costs of shuttle tanker use to paying tariffs through new and existing pipelines.

Background

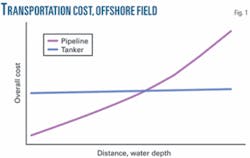

Petrobras’ Lower Tertiary Cascade and Chinook fields are the first US gulf fields to be developed by FPSO. FPSOs are used globally in other deepwater provinces but until recently were prohibited in the US gulf. Their use in frontier environments is sensible, especially from a transportation standpoint. Pipeline costs rise disproportionately as water depths increase, while shuttle tanker costs are insensitive to water depth andto a certain extentdistance.

The shuttle tanker holds a cost advantage vs. pipeline when the full life of the field is considered. The advantage, however, is concentrated in the first half of a field’s life. As production declines, the dedicated status of the shuttle tanker causes unit costs to increase sharply. Sharing the shuttle tanker with another FPSO-developed field would help defray these high late-life costs.

Shuttle tankers hold several other benefits vs. pipelines, not least the lower risk incurred in a frontier area since both the shuttles and the FPSO itself can be redeployed if the development proves disappointing. Other advantages include avoidance of hurricane damage and flow assurance issues, flexibility of destination, and easier maintenance and repair.

Certain barriers, however, exist to the spread of shuttle tanker use in the US gulf. The US Jones Act inflates costs and complicates operations. Stringent rules on gas use also mean gas from remote discoveries might need to be transported by gas pipeline regardless of other factors.

It remains to be seen whether other operators will follow Petrobras in FPSO and shuttle tanker deployment in the US gulf or whether pipeline companies will be convinced to keep building out the pipeline network to the new frontiers.

In 2001, the US Minerals Management Service issued an environmental impact statement approving the concept of FPSO development. This laid the regulatory foundation for its use, after which the MMS announced it would review FPSO-based development plans on a case-by-case basis. Despite this, the first application didn’t occur until 2006, when Petrobras submitted it as the development concept for Cascade and Chinook, using two dedicated shuttle tankers provided by OSG.

There is still, however, no shuttle tanker fleet in the US, meaning initial FPSO developments will need to use dedicated vessels such as these, and taking advantage of the extensive existing pipeline infrastructure in the US gulf will remain an appealing development option.

Ultradeep waters

Discoveries in the Lower Tertiary play and progress toward development in the region have spurred increased drilling in the remote, ultradeep waters of Walker Ridge, Keathley Canyon, and Alaminos Canyon protraction areas. Williams plans to spend $480 million to build oil and gas pipelines to connect the Alaminos Canyon’s Perdido Regional Hub to existing networks in the western gulf. No such plans currently exist for transportation infrastructure in the central gulf from the Lower Tertiary play.

Laying pipelines to discoveries in ultradeep waters (greater than 1,600 m), remote from existing infrastructure, disproportionately increases their cost. Pressure rises and temperatures drop as water depths increase, requiring thicker pipelines that use more steel and potentially more technology to insulate them. The limited number of vessels capable of installing in such water depths increases installation costs.

The cost of a shuttle tanker, by contrast, is largely insensitive to increasing water depth and distance to infrastructure, unless the distances are so great they require two shuttle tankers. Fig. 1 shows the effect of increasing water depth and distance on overall capital and operating costs for pipelines and shuttle tankers. It, however, reflects only the basic cost. It does not reflect fees or returns on investment; nor does it consider the cost differences between an FPSO and any other facility design such as a spar.

In addition to cost considerations, upstream risk remains an important consideration in remote areas of the US gulf as the Lower Tertiary remains a frontier play. A great deal of uncertainty surrounds reservoirs in Lower Tertiary discoveries, both in terms of size and long-term production performance. This uncertainty has undoubtedly played a part in Petrobras’ decision to take a phased approach to developing Cascade and Chinook, with an FPSO and shuttle tankers used in the initial phase. If the reservoir proves disappointing, the FPSO and tankers can be redeployed elsewhere, keeping sunk costs to a minimum.

Cost comparison

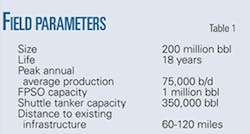

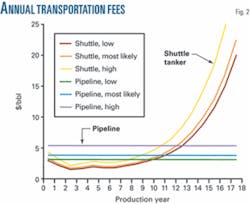

Wood Mackenzie analyzed transportation options of a hypothetical oil discovery in a remote part of the Walker Ridge protraction area. The hypothetical discovery contained 200 million bbl at least 60 miles from the nearest deepwater infrastructure and more than 170 miles from shore. Analysis focused on five different pipeline options at a range of payable fees. Each option uses existing infrastructure, whether tying in to an existing deepwater pipeline or laying pipe to a continental shelf-based platform. Analysis used an assumed cost of building the pipeline(s), and the fees required to earn the pipeline builder a minimal rate of return from the fields feeding the pipeline.

Analysis compared the results of the pipeline options to the estimated cost of a shuttle tanker; basing estimates on one dedicated shuttle tanker for which the field operator paid a set day rate, plus expenses such as fuel, port charges, etc. Day-rate calculation used a range of current global shuttle tanker rates, with an additional 50-100% applied to account for the cost effects of the Jones Act. Analysis disregarded cost differences between an FPSO and any other types of facility design, as well as the possible limit on peak production and deferring of oil revenues made possible as a result of use of only one shuttle tanker.

The shuttle tanker holds a clear cost advantage for the full life of the field, but the advantage changes during the field’s production lifetime. Fig. 2 outlines the fee charged to the operator each year of field life, using the basis of barrels produced. The study assumes the fees charged by the pipeline operator do not change (on a real basis) and the shuttle tanker is assumed to be a dedicated vessel, with the day rate time-charter fee assumed fixed (on a real basis) for the lifetime of the field and paid every day, regardless of whether the vessel is idle or working. The operator would hope, in reality, to share the shuttle tanker with another FPSO development, thereby avoiding this late-life unit cost increase.

At the most likely fee rate, the shuttle tanker maintains its annual cost advantage vs. the pipeline until year 11 of the field’s life, when declining production causes a rapid increase in unit costs. This cost profile depends highly on the field’s production profile. The capacity of the FPSO and shuttle tanker would tend to flatten and extend peak production.

The cost profile described by Fig. 2 would likely render late-life production uneconomic, leading to early abandonment, an act it is unclear whether the MMS would sanction. Writing the shuttle tanker contract with higher day rates early in field life or sharing the shuttle tanker with another FPSO might mitigate this possibility.

Analysis assumed only one shuttle tanker would be employed for a single field. Given assumptions of field size, FPSO and shuttle tanker capacity, and time taken to load, unload, and travel between FPSO and port, one tanker would be sufficient. But Petrobras has contracted two tankers, eroding some of the cost benefit compared to pipelines. Two shuttle tankers, however, would still result in a lower unit cost during the hypothetical field’s first 8 years.

Given Petrobras’ contract for the FPSO is only 5 years long (with a 3-year extension option), it is likely Petrobras’ two shuttle tankers are a lower-cost option than a pipeline. Such a short-lived first development phase also allows the operator to avoid much of the problems of late-life, increasing unit costs.

Tanker advantages

A shuttle tanker operation enjoys a number of advantages compared to a pipeline beyond overall cost benefit in ultradeep water. The specifics of the US gulf, however, change some of the dynamics of this comparison.

- Hurricane. A shuttle tanker, like the FPSO itself, can move out of harm’s way in the event of a hurricane or major storm. Pipeline and facility damage during the 2005 hurricane season led to long production shutdowns, expenditure running into the hundreds of millions of dollars, and some production being lost forever due to destruction of platforms.

- Maintenance. Repairing an ultradeepwater pipeline would be extremely costly in terms of both money and time. The limited number of vessels available that can perform repairs in extreme water depths would leave any repair subject to vessel availability. This could also slow progress on whatever project the vessel is pulled from to perform repair work. Repair or maintenance of a shuttle tanker, by contrast, simply requires dock space.

- Ocean floor. Hills and canyons hundreds of feet high and deep lie on the ocean floor in Walker Ridge, Keathley Canyon, and Alaminos Canyon. Navigating this terrain adds to the cost and complexity of a pipeline.

- Flow assurance. Falling seabed water temperature with increasing distance and water depth force field operators to consider flow assurance issues that might need additional technology to be properly addressed. Solutions might be mechanical (e.g., insulation) or chemical (e.g., hydrate inhibitor). A shuttle tanker does not have any of these issues.

- Flexibility. A shuttle tanker can, in theory, deliver directly to a number of destinations, allowing the operator to take advantage of price differentials or arbitrage opportunities. On the Gulf Coast, however, the shuttle tanker’s draft may limit the number of ports available to it for cargo discharge. The US gulf pipeline network is also so well developed that it offers a number of different delivery options. Most US gulf crude is commingled into a recognized blend (such as Mars or Poseidon) that offers a pricing precedence, while a small cargo from a shuttle tanker of a relatively unknown crude might suffer a price disadvantage in the Gulf Coast market.

- Frontier risk. Building a pipeline to remote, ultradeep waters requires an investment of hundreds of millions of dollars, which is then physically static. Pipeline builders typically commit to build a pipeline based on guaranteed throughput from one or more anchor fields that will fill their pipeline until decline sets in and spare capacity opens up. The income from the anchor field usually provides a minimal return, and might only cover the cost of capital.

Incremental returns for the pipeline operator are based on the development of a production hub with a pipeline connection stimulating exploration activity and reducing the economic threshold of other prospects and discoveries in the region. In a frontier play such as the Lower Tertiary, relying on the success of future exploration is very risky. The high cost of construction, however, acts as a barrier to entry for other pipelines, creating suitably high potential rewards in a situation where there may be very few competitive alternatives to a pipeline.

A shuttle tanker-FPSO development carries much lower initial risk, since the shuttle tanker and FPSO can be redeployed elsewhere if the field’s performance is disappointing. They are, however, unlikely to encourage and capture new business from other discoveries, unless these are also FPSO-based developments allowing the shuttle tanker market to reach sufficient critical mass to be run on a fleet basis.

No shuttles

FPSO and shuttle tankers are long-standing development tools in many regionsboth deepwater areas with little infrastructure, such as West Africa and Brazil, and relatively mature areas with existing pipelines, such as the North Seabut have so far not been embraced by US gulf operators.

The US ban on FPSO was founded on environmental concerns. But even the ruling by the MMS to begin considering FPSO applications on a case-by-case basis did not produce a rush of FPSO development plans, largely because the extent of existing infrastructure gave pipelines a cost advantage. An FPSO application will also likely face a large amount of red tape, and possibly the opposition of the general public, making it no coincidence a Brazilian company is the first to develop an FPSO plan.

The Jones Act also continues to act as a barrier to FPSO-based field developments. This legislation dates back to 1920 and was designed to protect American jobs and industry at a time of economic depression. It stipulates any ships plying their trade between US ports must be built in the US, owned and crewed by US nationals and be flagged in the US. An FPSO would qualify as a US port (although the FPSO itself would not be subject to Jones Act regulations).

The Act requires any newbuild shuttle tankers be built in one of a handful of remaining suitable American shipyards, raising implications for both the cost of the tanker and the timescale. Advances in efficiency by Asian shipyards allow them to build a ship for an estimated half the cost of an American yard and in a third of the time.

Conversion of existing Jones Act vessels might be a more cost-effective solution. They, however, are limited in number and their market is already very active. The cost savings in terms of contract day rate (time charter) may not be large, but carrying out a conversion would still be much quicker. Petrobras has chartered from OSG two conversions of newbuild product tankers, which OSG already had on order from the Aker Philadelphia shipyard. Delivery of the first is expected in the first quarter of 2010, with the second following a year later.

Progress on a number of FPSO developments in the US gulf might prompt development of a shuttle tanker fleet such as works in the North Sea, keeping costs low as specialist, third-party tanker operators manage a fleet of vessels for a number of projects and fields.

Natural gas

The economic, environmentally sound, and efficient disposal of any produced natural gas is another key issue surrounding FPSO use. Flaring is not allowed in the US gulf and gas injection is not common since reservoir pressures are high and the gas is too valuable in the US market to reinject into the reservoir. The FPSO can burn some gas as fuel, but this will likely not use up all the gas.

Petrobras plans to install a small gas export line for its Cascade-Chinook development. The economics of this line remain unclear, but it is likely its small size will reduce cost and installation issues. Gas lines also have fewer flow assurance issues than oil lines, again keeping costs down.

The use of compressed natural gas tankers might also be possible inn the future, if the technology can be commercially proven. Since FPSOs do not traditionally have space or technology for gas storage, two CNG tankers might need to alternate, allowing one to always be connected to the FPSO.

The author

Julie Wilson ([email protected]), lead analyst, Gulf of Mexico research, Wood Mackenzie (Houston), leads the research team producing field-by-field analysis of the US Gulf of Mexico deep water, focused on forward-looking project and field economics. Wilson joined Wood Mackenzie in April 1999 as an analyst covering Latin America. She moved to Houston in November 2000 in an upstream consulting role. She then worked in and managed a wide variety of international consulting roles, including gas supply and market analysis, corporate strategies, country entry strategies, and competitor analysis. In August 2006 she rejoined Wood Mackenzie’s research team to focus on the US Gulf of Mexico deep water. Prior to joining Wood Mackenzie, she worked for BP for 8 years in London and Aberdeen in a variety of political, commercial, and financial analysis roles focused on upstream assets. Wilson graduated from Heriot-Watt University with an honors BA in Spanish and French and from University of Strathclyde with an MSc in marketing.