Low oil prices during January triggered one of North Dakota's two possible state oil tax reductions while state officials closely monitored the state's rig count and production rates.

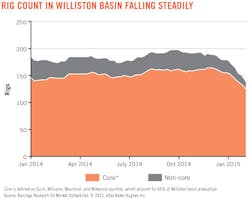

The North Dakota Department of Mineral Resources keeps a running rig count by county. As of Feb. 26, DMR's rig list reported 121 rigs actively drilling in the Bakken area of which 115 were in four counties: Dunn, McKenzie, Mountrail, and Williams.

The 121 total was below an estimated 130 rigs that Lynn Helms, DMR director, has estimated is the total rig count needed to sustain Bakken production at over 1.2 million b/d, a level reached in late 2014.

Some operators postponed completions to avoid high initial production costs given low commodity prices while others slowed completions while working to satisfy North Dakota gas-flaring reduction targets, Helms said.

The rig count in the Williston basin fell rapidly in response to dropping oil prices, Helms said.

Meanwhile, North Dakota state oil taxes have thresholds tied to oil prices to encourage ongoing production during commodity downturns.

Lower rate triggered

The state has two types of oil tax: a 5% gross production tax and a 6.5% extraction tax. The tax rates are subject to change when oil prices drop below certain levels. The state outlines what it calls a small trigger and a larger trigger.

The small trigger allows for a reduction in the extraction tax for new horizontal wells drilled in the month after the previous month oil price averaged less than $57.50/bbl for West Texas Intermediate.

On Feb. 1, new wells received a drop in the extraction tax rate from 6.5% to 2%. State Tax Commissioner Ryan Rauschenberger noted the trigger comes with conditions.

It's limited to the first 75,000 bbl of oil produced from a new well or the first $4.5 million of gross value oil produced from that well. The trigger's duration is 18 months maximum. The trigger comes off after a month averaging $57.50/bbl or more.

"This does sunset June 30 if the legislature does not take any action," Raushenberger said. "Under current law, the small tax trigger would be in place February through June and applies to new wells drilled during that time."

Completion dates determine whether a particular well gets the incentive or not. The well must be completed to be eligible.

"It is an incentive to have wells completed sooner rather than later," Rauschenberger said. There is an overall trigger--a large trigger--that starts after a 5-month period during which WTI stays at or below $55.09/bbl.

When the 5-month threshold is met, the trigger would be applied to all wells for the first 24 months of production. It applies to existing wells in production along with new wells brought on stream during its duration.

"The overall trigger is 24 months of full exemption of the extraction tax for all production based on a well-by-well basis, then after that it goes up to 4%," said Raushenberger. "If you had a well drilled 3 months before the trigger kicked in, you'd still have 21 months left of the full exemption of the extraction tax."

In order for the large trigger to be lifted, WTI prices must average more than $55.09/bbl for 5 consecutive months. If both triggers were implemented for their entirety, North Dakota could lose an estimated $100 million/month in tax revenues, Raushenberger said.

In early February, Helms said oil prices appeared to be recovering. "We've seen renewed confidence that the large trigger is likely not going to hit," he said.