SPECIAL REPORT: Drilling on upswing in US as Canada pulls from slump

Oil and gas drilling is on the upswing in the US in 2008, and drilling in Canada is coming back after slumping in 2007.

OGJ looks for the drilling of 7% more wells in the US this year than last and a slight gain in Canada.

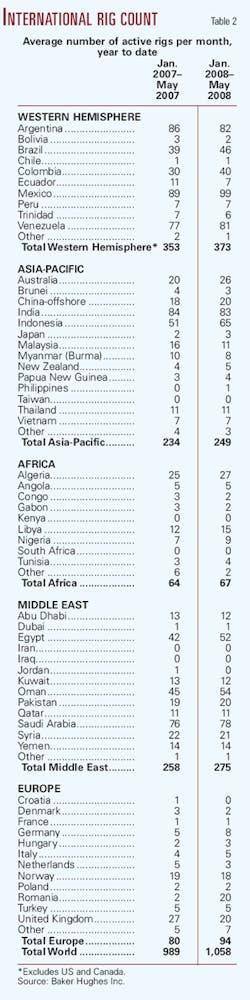

The pace of drilling in the rest of the world is up about 7% from January through May 2008, according to international active rig statistics.

Year over year gains for January through May were posted in all geographic regions: Western Hemisphere excluding the US and Canada, Asia-Pacific, Africa, Middle East, and Europe.

Here are highlights of OGJ’s midyear drilling forecast for 2008:

- Operators will drill 50,475 wells in the US, up from an estimated 47,057 wells drilled in 2007.

- All operators will drill 5,246 exploratory wells of all types, up from an estimated 3,833 last year.

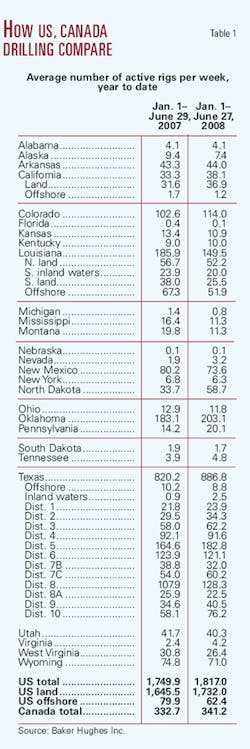

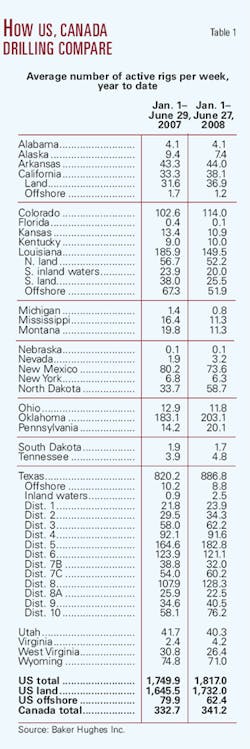

- The Baker Hughes Inc. count of active US rotary rigs will average 1,840 rigs/week this year, up from 1,768 in 2007 and 1,649 in 2006.

- Operators will drill 18,605 wells in western Canada, up from an estimated 18,391 wells in 2007.

World activity

The rest of the world excluding the US and Canada had 1,058 rigs at work at the beginning of June 2008.

That compared with 931 rigs working in all of Texas and 1,886 rigs running in the US at the same time.

Not a single country outside the US and Canada averaged even 100 rigs working in January through May 2008, according to Baker Hughes. The closest was Mexico with 99 active rigs. Indonesia averaged 83, Argentina 82, Venezuela 81, and Saudi Arabia 78.

Algeria was the busiest country in Africa, with 27 rigs running, and in Europe the UK had 20, Romania 20, and Norway 18.

A midyear survey by Lehman Bros. indicated that a 20% increase in world exploration and production spending can be expected in 2008 (OGJ, June 16, 2008, Newsletter). This includes outlays for project costs other than drilling.

The results implied a 15% spending hike in the US, 11% in Canada, and 22% in all other countries this year even after companies overspent their 2007 budgets by $8.5 billion worldwide.

US plays

Shale and other unconventional gas plays were claiming large shares of the drilling in Texas and numerous other states.

East Texas Dists. 5 and 6, with the Jurassic Bossier and Cotton Valley and other gas plays, led the state by averaging more than 300 rigs/week in the first half of 2008 even before the Jurassic Haynesville shale play has a chance to strengthen.

The Texas Railroad Commission issued 355 permits for the drilling of deep Bossier wells to 33 operators in 2007, compared with 291 permits in 2006.

Texas Panhandle counties averaged 75 rigs/week, up from 57 rigs in January through May 2007.

Oklahoma averaged about 200 rigs/week through May compared with 180 a year earlier.

Colorado drilling averaged about 15% higher in the first half of 2008, and the state had more than 100 rigs at work in its far-flung basins. One operator, Williams Cos., Tulsa, was running 26 rigs in the Piceance basin at the end of June.

With the Bakken shale oil play moving eastward, Montana’s rig count fell to 11 rigs/week from 20 rigs/week in 2007 while North Dakota’s averaged 57 rigs/week versus 33. North Dakota added 147 wells producing from the Bakken in 2007, compared with 7 to 15 wells each for the state’s other oil producing formations.

Utah, which had a particularly difficult winter for drilling operations, was down only slightly at 40 rigs/week.

Canadian outlook

Drilling in Canada is showing initial signs of a turnaround from weakness the past few years, especially in gas drilling.

Baker Hughes, which counts only rigs actually making hole, tallied an average 349 rigs in Canada in January through May compared with 346 in the same period of 2007.

The resurgence can be attributed partly to stronger gas and oil prices, partly to operators’ expectations for exploiting newer plays such as Bakken shale oil and shale gas in the Montney, Muskwa, and other formations, and returning to coalbed methane and other gas programs.