Unconventional drilling requires managing transportation logistics

Rick Carr

David Wedemeyer

Deloitte Consulting LLP

Houston

Sam Pearson

Deloitte Consulting LLP

Minneapolis

Advancements in drilling for unconventional resources have greatly changed the development of shale into a long-term, viable source of hydrocarbons in North America.

Natural gas production from shale grew from 2% in 2001 to 23% in 2010, and analysts predict that it will account for nearly 49% of domestic gas production in 2035.1 Analysts also predict that production will increase by an estimated 375% in oil and liquid-rich shale plays like Marcellus and Eagle Ford from 2011 to 2016.2

This surge in shale development significantly increases the transportation and logistics requirements at the well site. This article explores the impact of these requirements on safety, cost, and productivity concerns for oil and gas operators and the opportunities for operators to take an active approach to managing transportation and to drive greater value for the company.

Operational demands of unconventional drilling

One such unconventional drilling method used to extract shale gas is known as hydraulic fracturing.

This process drives varied transportation and logistics requirements:

• Each hydraulic fracturing stage pumps about 300,000 gal of water and up to 200 tons of sand down a well.

• 20-40% of the fluids and solids used in hydraulic fracturing flow back to the surface as hazardous waste and require transportation to other wellsites or treatment and-or disposal sites.

• Wellsites are in both remote locations and outside of developed communities with differing road and pipeline infrastructure.

Effect on transportation demands

One by-product of shale development is that it increases an operator's dependency on transportation.

Throughout the well life cycle, E&Ps must hire third-party transportation carriers daily to provide materials and services. These include everything from waste, sand, and chemical hauls to deliveries of drill pipe, living quarters for field personnel, and rigs. The breakdown of the number of loads by transportation category delivered throughout the life cycle of four wells drilled on one pad can be greatly varied (Fig. 1).

As an example, a typical development in the Marcellus region can result in 20,000 to 30,000 truckload movements per rig per year. Compound these requirements by the fact that there are a total of 138 rigs operating in Marcellus and it becomes easy to understand how transportation is such a concern. Similarly, an estimated 270 rigs are now active in the Eagle Ford, and capacity constraints are becoming a concern.3

It is easy to see how this rapid growth can lead to safety, cost, and productivity impacts for operators.

Safety and community effects

The proximity of local communities to each development varies greatly, but the effects of oil and gas exploration can be felt nonetheless.

In the Marcellus shale play, wellsites are within miles of the center of several small towns where daily life is directly affected by the movement of materials and services. This can expose operators to additional safety risks that were not anticipated. Operators should understand the effect that spills, traffic, noise, and accidents from the trucks that support their operations have on these communities, but they should also ensure that local communities receive benefits from the drilling activity.

Cost effects

Many of the unconventional plays possess a limited number of transportation carriers and lack the infrastructure needed to meet the demands of the industry; thus, transportation carriers can demand premium prices to guarantee the availability of crews, equipment, and trucks needed for daily operations.

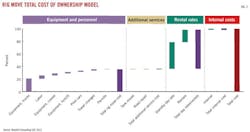

Fig. 2 highlights the total costs throughout the life cycle of four wells drilled on one pad by transportation category. Historically, transportation costs were a smaller portion of well development costs that could be managed directly in the field. As the transportation demands have grown, the costs have increased.

The combined effect from the lack of coordination, limited infrastructure, and premium rates puts further pressure on an operator's margins, which are already being squeezed by low gas prices.

Productivity and efficiency effects

In unconventional drilling, the name of the game is safely drilling and completing as many wells as possible in the shortest amount of time.

Every minute of downtime at the wellsite translates to lost production and increased costs to due to rig, equipment, and personnel costs. Inefficiencies in transportation can directly affect finding and development costs, time to complete the well, and the ability to meet exit rates.

As an example, more than 60% of the total costs on a location rig move are due to the daily rental rates for the rig and its personnel, resulting in an average amount of $30,000/day lost that the rig is not active (Fig. 3). Operators must ensure that third-party transportation carriers not only possess the proper personnel, equipment, and trucks but that they have the right capacity at the right time, which is extremely difficult considering that the exact timing is often a moving target.

Paradigm shift

Traditionally, oil and gas operators have lacked a central focus on transportation and logistics for onshore operations, often pushing the coordination to service providers or the field.

Given the change in operational demands, operators should consider a more focused approach to wellsite logistics. This proactive approach will address safety, cost, and productivity issues by formalizing the management of transportation and logistics activities associated with their wellsites.

Operators can start by focusing on three identified areas that can provide a key differentiator in driving well delivery (see Fig. 4 for an overview).

Transportation management

Stronger relationships with fewer carriers

When acquiring the services of transportation carriers, the drilling foremen at the wellsite are typically price takers as they source the delivery of equipment and services through recommendations or personal preference.

At best, foremen might solicit bids from three transportation carriers, but they often choose a vendor without negotiating or exploring other competitive rates. This method of third-party sourcing may not be the most efficient use of capital and does not cultivate strategic relationships.

A formal sourcing and category management program should be considered for managing these relationships. By focusing on rationalizing their preferred transportation carrier base, negotiating and signing them to contracts, and ensuring that field personnel adhere to the program, operators may obtain important savings.

For example, an operator may achieve 10-20% savings and 5-10% savings in the rig-move and fluid-haul transportation categories, respectively.4 Operators can also use these relationships to drive greater efficiencies and manage tightening supply in unconventional areas.

Implement focused safety standards

As mentioned, the increase in transportation activities from unconventional drilling often leads to an increase in the number of transportation incidents, which have both direct and indirect costs to an operator and its stakeholders.

The effects compound when considering the trend towards third-party subcontracting. In one play, for instance, a transportation carrier dispatched close to 400 trucks while only owning 20% of that fleet. The other 80% of the transportation carrier base consisted mostly of small truck operations that varied in terms of operational sophistication and safety training standards.4

Oil and gas operators can show their commitment to transportation safety performance by implementing a formalized transportation safety program. Furthermore, operators can include contract language that specifies the number of owned and operated trucks a transportation carrier must use and also outline the safety metrics that must be met.

To monitor and enforce safety standards, operators can require transportation carriers to undergo periodic safety audits, participate in performance improvement initiatives, and forfeit business in the event these standards are not met. These terms can help decrease the number and severity of incidents and show the operator's commitment to safe and responsible operations.

Field and performance management

Establish field logistics management

Some transportation categories such as rig moves, sand hauls, and fluid hauls are high-touch, high-spend, and process-intensive.

For instance, a rig move might involve the movement of 50-60 loads of heavy, large equipment over a 10-mile distance within a 6-day period while fluid hauls involve the constant movement of more than 200 loads of fresh and produced water each day.5 These categories command a high percentage of the wellsite budget and carry considerable safety and legal risks.

Implementing a formalized field coordination program can help manage field logistics and reduce delivery risk. Operators can design and implement local execution positions that directly oversee all phases of the transportation life cycle for these high-risk categories.

Field coordinators should consider outlining defined processes, standard operating procedures, and metrics to drive safe and efficient logistics. They can also assist with improving the relationships with the local transportation carrier base. These effects drive both cost and efficiency benefits.

For example, one operator achieved costs savings of 5% on rig moves while also decreasing cycle time by up to 40% through implementing a rig move field coordinator program.4

Set performance targets and report progress

One key challenge for operators is to understand where performance issues are because they often do not have defined metrics and processes for tracking and reporting performance. Transportation and logistics is an area that often lacks any formalized reporting.

Operators should establish transportation focused performance metrics in key areas and review performance regularly. Performance metrics can help asset managers to track the overall performance, cost implications, and safety-specific performance of carriers, monitor risk areas in delivery, and drive continuous improvement.

These metrics should apply to each facet of the organization: third party suppliers, field coordinators, and central coordination. They should also be built in a manner that makes them specific and actionable. Fig. 5 provides a list of possible key performance indicators.

Centralized coordination

Centralize transportation coordination

Most drilling foremen do not coordinate with other wellsites in the development program when managing the logistics associated with the close to 4,000 loads of equipment and services delivered.6

This lack of coordination may lead to an increase in the number of last minute orders, known as "hot shots," and in the number of noncontracted carriers used. In addition, operators lose the opportunity to achieve tangible savings through backhaul and improvement opportunities.

As an operator progresses the development of its transportation and logistics function, the use of centralized coordination centers to manage the dispatch of low-touch, highly transactional transportation categories, such as waste and rental hauls, can drive increased levels of value to the operation.

A centralized coordination center can help an operator gain visibility into transportation movements within a play, leverage deliveries of equipment to multiple wellsites, and take advantage of backhaul opportunities. In addition, these centers can increase the accountability of drilling foremen, providing visibility into the number and names of carriers used for transportation activities and encouraging drilling foremen to better forecast their wellsite needs.

Technology-enabled logistics management

Simply using manual processes to dispatch transportation activities could create process inefficiencies and increased costs as an organization increases its development program.

An operator might need to employ as much as twice the level of staff to manage orders and hire additional resources to manage data and performance. In addition, an operator may find it more difficult to possess real time visibility into ongoing transportation activities.

An operator can improve the performance of the logistics function and the coordination center and drive real savings through implementing a transportation management system (TMS). Lower staff levels will be required as the productivity of coordinators increases through automated planning and reporting processes. The TMS can also drive improved controls, ease data collection and performance reporting, and improve communication with carriers. Lastly, a TMS can serve as the source for improved reporting of performance information to manage the function.

The proliferation of unconventional drilling changes the dynamics of operations for oil and gas operators in multiple ways. Where transportation was once a limited requirement that could be handled by field personnel, it is now an important piece of the supply chain that demands a focused and calculated approach and can provide a key differentiator in wellsite performance.

Operators can achieve transportation excellence by sourcing categories, setting safety standards for third-party suppliers, and developing new logistics field management positions and centralized coordination centers enabled with TMS software. By building an active transportation function, operators can achieve savings; build stronger relationships with carriers; improve performance; and demonstrate their commitment to safety and their communities while showing accountability.

References

1. US Department of Energy, Energy Information Administration, Annual Energy Outlook 2012.

2. Bloomberg, "US shale oil output to reduce imports, Purvin & Gertz says," June 2011.

3. Smith Bits rig count as of Apr. 7, 2012.

4. Source: Deloitte engagement.

5. Source: Deloitte proprietary Wellsite Logistics Model.

6. Source: Deloitte proprietary Wellsite Logistics Model. Figure reflects total loads for four wells drilled on one pad.

The authors

More Oil & Gas Journal Current Issue Articles

More Oil & Gas Journal Archives Issue Articles

View Oil and Gas Articles on PennEnergy.com