Crude prices rebound June 19 in the New York market with the front-month contract recouping to the penny its loss from the previous session on investors’ hopes policy makers at the Federal Reserve Bank will do something to stimulate the sagging US economy.

“The Standard & Poor’s 500 Index rose 1%, and energy helped lead the charge with the EPX [SIG Oil Exploration & Production Index] and OSX [Oil Service Index] rising 2.3% and 2.1%, respectively,” said analysts in the Houston office of Raymond James & Associates Inc. “Crude was up 0.9%, in line with the broader market while gas trimmed some of [the June 18] gains, falling 3.4% as traders took some profits off the table.”

Olivier Jakob at Petromatrix in Zug, Switzerland, said, “Macro traders of the liquidity theme have been buying assets over the last few days in the hope of another liquidity intervention from [Fed Chairman Ben] Bernanke. The problem for the Fed is the real US economy is starting to get the benefit of lower oil prices, and that will do greater good for US disposable income than another round of the Fed bidding up all assets.”

James Zhang at Standard New York Securities Inc., the Standard Bank Group, reported, “The oil market was mixed yesterday with West Texas Intermediate staying in a range-bound pattern, while Brent continued to decline.” Gasoline was weaker in the New York market, but gas oil and heating oil were strong, pushing the gas oil-Brent spread above $17/bbl for the August futures contracts.

“The current overhang of sweet crude cargoes from West Africa as well as from the North Sea has pushed the Brent structure into contango for the first 6 months,” said Zhang. US supply of sweet crude “in the form of shale oil also put pressure on sweet crude prices,” he said. “In fact, the Brent crude premium over Dubai, the typical sour crude benchmark, fell to near $2/bbl, the narrowest in 20 months. In the options market, implied volatility softened further.”

In Mexico, the 2-day Group of 20 Economic Summit closed with no discernible progress, although President Barack Obama told the media that European leaders displayed a “heightened sense of urgency” over the economic crisis.

However, Jakob said, “Europe is not a nation, and its problems cannot be solved in a G-20 meeting.” He noted the German Zentrum für Europäische Wirtschaftsforschung (ZEW), or Centre for European Economic Research, reported the worst monthly decline in public economic sentiment in 13 years. “The European economic crisis is far from over,” he said.

Iran

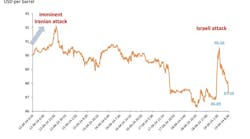

The 2-day Moscow meeting of Iranian officials with representatives from the US, China, Russia, France, Britain, and Germany collapsed in deadlock. However, additional meetings “for nothing will probably continue all year as the US president cannot afford an agreement before the US elections, and he cannot afford either a call for an attack on Iran,” said Jakob. “Hence both sanctions and diplomatic negotiations will have to continue until after the US elections.”

Zhang noted reports the China Petroleum & Chemical Corp. (Sinopec) has asked Iran to deliver its crude, with European insurers set to stop insuring any Iranian cargoes. “For now, the market has ignored this completely partly due to the apparent short-term over-supply. With European refining margins fairly robust, the sentiment could change quickly when the cargo overhang is cleared,” he said.

Analysts at Barclays Capital Commodity Research said, “Lack of progress in Moscow makes it increasingly likely that the European Union oil embargo and the US Central Bank sanctions will be implemented as planned. Moreover, if the diplomatic track remains stalled or is deemed dead, we believe that calls for military action will mount.

Despite the failure of the Iranian talks so far, oil markets have taken little notice. Consensus estimates point to a reduction of Iranian output of just 300,000 b/d to 3.2-3.3 million b/d, since the end of last year, which has been more than made up for by high Saudi output and resurgent Libyan production. Shipping consultancies point to a much larger cut of around 800,000 b/d. The true extent of the loss of Iranian output remains unknown, although anecdotal evidence suggests that Iranian offshore and onshore storage is rising.”

Barclays analysts said, “After July 1, all of the 700,000-800,000 b/d of EU imports of Iranian crude are likely to cease. As of now, India, Japan, and South Korea, large buyers of Iranian crude, have been exempt from US sanctions, but they have already reduced imports from Iran by 20-30%. China remains the notable exception and continues to import from Iran, a trend that we expect to continue.”

They expect implementation of full sanctions could ultimately lead to a cut of some 1 million b/d in Iranian crude supplies. However, the loss could be higher depending on the effect on shipping insurance. The call on crude from the Organization of Petroleum Exporting Countries in the second half of this year is expected to be 1-1.5 million b/d more than in the first half—“essentially the level that OPEC is currently producing,” said Barclays analysts. “Given the lack of spare capacity in the market, the loss of 1 million b/d of Iranian imports could arguably bring actual OPEC production substantially below the call on its crude, resulting in larger inventory draws than markets currently expect.”

US inventories

The Energy Information Administration reported commercial US inventories of crude increased 2.9 million bbl to 387.3 million bbl in the week ended June 15, opposite Wall Street’s consensus for a 1.3 million bbl reduction.

Gasoline stocks rose 900,000 bbl to 202.7 million bbl, a little short of analysts’ expectations of a 1 million bbl gain. Both finished gasoline and blending components inventories increased. Distillate fuel inventories were up 1.2 million bbl to 121.1 million bbl in the same period, compared with projections for a 1 million bbl addition.

Imports of crude into the US increased 328,000 b/d to 9.4 million b/d last week. In the 4 weeks through June 15, crude imports averaged 9.1 million b/d, up 168,000 b/d from the comparable period last year. Gasoline imports last week averaged 988,000 b/d while distillate fuel imports averaged 67,000 b/d.

However, the input of crude into US refineries declined 12,000 b/d to 15.6 million b/d last week with units operating at 91.9% of capacity. Gasoline production decreased to 9 million b/d. Distillate fuel production dipped to 4.7 million b/d.

Energy prices

The July contract for benchmark US light, sweet crudes on June 19 regained the 76¢ it lost in the previous session, back to a closing price of $84.03/bbl on the New York Mercantile Exchange. The August contract more than made up its prior loss, gaining 75¢ to $84.35/bbl. On the US spot market, WTI at Cushing, Okla., kept step with the front-month futures contract, up 76¢ to $84.03/bbl.

Heating oil for July delivery recouped some of its loss, up 1.74¢ to $2.64/gal on NYMEX. Reformulated stock for oxygenate blending for the same month continued to decline, however. It was down 1.94¢ and also closed at $2.64/gal.

The July natural gas contract dropped 9¢ to $2.55 MMbtu on NYMEX, reducing its previous escalation. On the US spot market, gas at Henry Hub, La., jumped 13.5¢ to $2.59/MMbtu.

In London, the August IPE contract for North Sea Brent continued its decline, down 29¢ to $95.76/bbl. Gas oil for July regained $3.50 to $845/tonne.

The average price for OPEC’s basket of 12 benchmark crudes fell $1.30 to $93.73/bbl.

Contact Sam Fletcher at [email protected]