Oil markets are focused on the Middle East and whether Israel's missile strike against Iran in the early hours of Apr. 19 is a one-time event or the catalyst for a broader conflict between the two regional powers.

On Apr. 19, Israel retaliated with a missile strike on Iran following an Iranian attack on Israel 6 days prior. Media reports indicate explosions in Iran’s central city of Isfahan. Iranian officials are downplaying the attack's severity and denying any damage on the ground. Reports are that Iranian officials state there are no plans for an immediate retaliation against Israel.

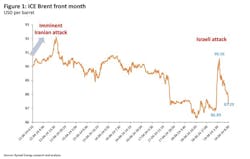

Oil prices reacted rapidly, with Brent crude jumping to $90.6/bbl from $86.7/bbl. Subsequently, prices have decreased to around $87/bbl at the time of writing.

Rystad Energy maintains its position that unless there is a notable escalation in the Middle East, the geopolitical risk premium will stabilize and decrease steadily.

“While it is difficult to assess whether this a temporary blip or the start of a new escalation in conflict between Iran and Israel, the initial market reaction suggests the former is more likely,” said Rystad Energy senior vice-president, Jorge Leon.

However, this scenario does not mean that hostilities and armed attacks between parties come to an end, according to Rystad.

“This would still involve calibrated attacks between parties, as appears to have been the case with Israel’s attack today. The risk, however, is that a miscalculation from any of the parties could rapidly trigger a new escalation in an already volatile region.

“If there is one certainty, it is that geopolitics will play an even bigger role in the oil market in the coming days and weeks. As such, the market can expect significant volatility in the near future,” Rystad said.

Rystad Energy calculates that ‘fair value’ of Brent for the month of April, based purely on supply and demand fundamentals, is slightly below $83/bbl. This means the current geopolitical risk premium is around $5-6/bbl.

“We reiterate that, barring a significant escalation in conflict in the Middle East, we believe that the geopolitical risk premium will stabilize and gradually decrease. There are two reasons for this assertion. The first one is the fact that OPEC+ holds an unprecedent large volumes of spare capacity, at close to 7 million b/d, while the second one is that after a few weeks, in the absence of actual supply disruptions, geopolitical fatigue starts to play a role,” said Leon.

However, Jim Burkhard, vice-president and head of research for oil markets at S&P Global Commodity Insights, remarked: “The Iran-Israel conflict has not impacted the flow of oil in the Middle East, which is why oil price reactions to the recent military escalation have been relatively muted. However, with no sign that hostilities will de-escalate, direct attacks by Iran and Israel are a new and dangerous phase of mutual antagonism that could yet spillover into the oil market.”

Regarding speculation about the Strait of Hormuz being closed rises during times of turbulence in the Middle East, Burkhard said: “In 2011 Iran threatened to close the Strait. On Tuesday the head of Iran’s navy said it could close the Strait. The Strait has never been closed and that is unlikely to happen today or in the future. But it can become more dangerous. Iran also has a long track record of harassing and seizing ships—as it did earlier this month. It is in no country’s interest to see the Strait closed, including China and all the Gulf exporters. However, if the Iranian government felt its existence was at great risk, then extreme actions could take place—including an attempt to close the Strait.”